Best Brokers and Trading Platforms UK 2026

We review and list the best UK brokers in 2026 in our large annual test of all the trading platforms that accept British traders. The UK is one of the financial capitals of the world making it a hotspot for online brokers, not all of which are safe to trade with. To find the best online broker for you, see our list of the highest rated and most recommended UK trading platforms below.

Top Rated UK Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Brokers and Trading Platforms UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers and Trading Platforms UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers and Trading Platforms UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers and Trading Platforms UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers and Trading Platforms UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers and Trading Platforms UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

Trading Platforms

The best online brokers in the UK will provide a trading platform that is both easy to use and intuitive. We’ve listed the main options you’ll find on the market below.

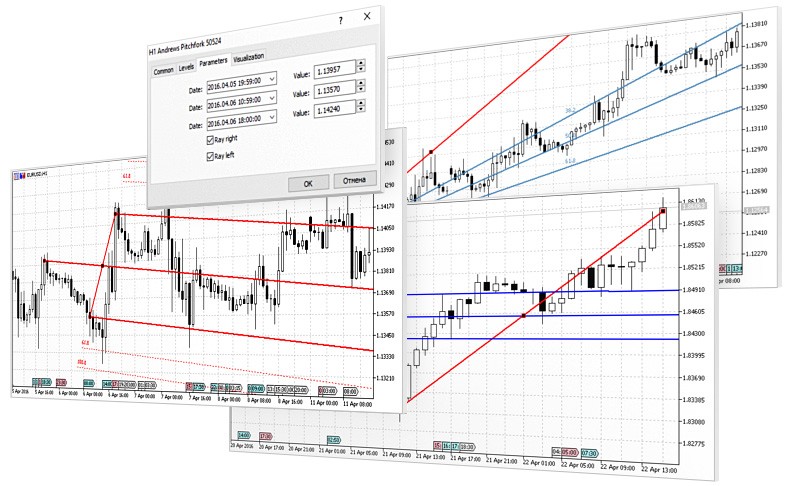

MetaTrader 4 and 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular third-party platforms in the forex world. They were created by the developers MetaQuotes, who’ve been in the online trading market since 2005. There are over 150 online brokers in our list that offer the software, including top names such as Pepperstone, CMC Markets and Avatrade. It is free to download and use, you’ll just need to set up an account with your chosen broker and login with the credentials they provide upon sign up.

MT4 and MT5 are popular for a number of reasons, but there are two stand-out benefits that forex traders love:

- Breadth Of Analytical Tools – MT4 has 30 built-in indicators, 24 analytical objects and 9 time-frame charts. It is designed for traders who love to do their research, making it the top choice for some of the most successful global forex traders. MT5, the most recent software release, goes even further, with 38 indicators, 44 analytical objects and 21 time-frames.

- Customisability – But even better than its built-in tools, MetaTrader platforms are famous for their flexibility. There are 2000 free custom indicators, plus 700 that can be purchased from the Codebase.

Analytical Objects in MetaTrader 5

Proprietary Platforms

A proprietary platform is one that is owned and created by the broker. Sometimes, these can be lacking in the required functionality so online brokers may offer this option alongside MT4 for traders who need access to a variety of tools. However, some of the best online brokers in the UK use proprietary software, which tends to be much more user-friendly and intuitive. They’re ideal for traders that have a certain strategy in mind and require a platform tailored to this.

Top platforms for:

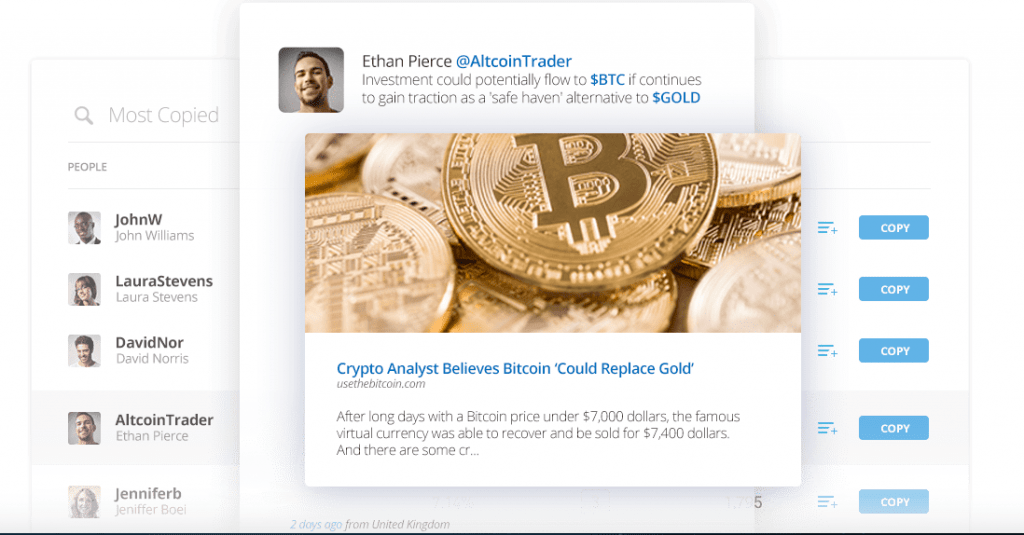

- Social Trading – eToro is a social trading broker that offers its own platform. It’s perfect for those keen to share tips and tricks with their fellow traders. It has a Tipranks Research Tab that allows you to gain insights from the most successful on its books, including those from top institutions. Plus, you can also review other’s trades and choose to copy or ‘mirror’ them if you’re a fan of their strategy.

- Mobile Trading – While MT4 and MT5 do have mobile apps, deep analysis is best completed on your desktop. If you’re looking to trade on the go, there are many top trading apps in the UK offered by online brokers that specialise in making trading simple from a small screen. For example, XTB’s xStation Mobile is great for CFDs, with over 1,500 instruments as well as news and insight available at the touch of a button.

- Asset Variety – For one of the largest selections of assets offered by online brokers in the UK, check out Plus500. It has over 2000 tradable instruments available on its in-house platform and boasts real-time quotes as well as round the clock customer support for all customers.

- Professional Traders – Interactive Brokers is an online broker that is favoured by professional traders. It has an excellent proprietary platform and ECN links to top exchanges that are perfect for day trading. However, high minimum deposit thresholds price some small-time investors out of the market.

eToro’s Copy Trade Function

eToro’s Copy Trade Function

Tools

There is a huge selection of tools out there to help you with your trade analysis, many of the best online brokers in the UK will offer these for free to clients.

News & Insights

Fundamental analysis is the study of economic factors that can influence an asset’s value. Macroeconomic factors, such as the Bank of England’s interest rate, the UK inflation rate and British public policy are all factors. Microeconomic factors include a company’s management, strategy, and P&L. These can all be gleaned by following business news closely. Many of the top online brokers in the UK offer blog posts, opinion insights and news articles as part of their service.

Education

Whether you’re a beginner looking to learn the ropes, or a veteran seeking out the latest strategy, most online forex and stock investors will benefit from access to education. How-to videos and tutorials from a broker are a fantastic way to learn new tips and tricks that may also be relevant to the trading platform you use. Online brokers in the UK that offer this type of resource are a definite advantage.

EAs & Bots

Automated trading is popular among those who prefer a hands-off approach to trading. Therefore, online brokers in the UK that offer access to trading robots (also known as Executive Assistants) are increasingly popular. There are some specialised brokers that offer bots created in-house, but those that provide access to MT4 and MT5 have a much broader selection, as the MetaTrader Codebase hosts thousands that are both free and available to purchase. Always remember to test your bot on a demo account before you trade with real money since there is no guarantee that EAs will be profitable.

Demo Account

A demo account allows you to trade with virtual currency before you take the plunge into the live trading environment. Most online brokers offer this service, which is vital for anyone new to the trading platform. You can use it to practice strategy or trial the features and functionality of the platform.

Fees & Commission

Online discount trading brokers have the cheapest fees of all services in the UK. But there’s a lot of variability depending on the asset traded. We’ve listed the most commonly found fees and what they mean below:

- Spreads – Most online forex brokers charge a fee through ‘spreads’. Spreads are the difference between the buy and sell price of an asset. They’ll either be fixed or variable. Fixed spreads tend to be slightly higher but have the benefit of being constant. Variable spreads change with market volatility.

- Commission – Stocks bought through an exchange are usually charged through commission. Often, this is a fixed amount per trade, e.g £8 or 0.2% of the value. Some online brokers will offer ‘commission-free stocks’, in this case, they usually charge a spread instead.

- Account Fees – Some companies charge just for keeping your account open. While this is rare with online brokers in the UK, it’s one to look out for.

- Rollover Fees – When trading CFDs, rollover fees apply if you keep positions open overnight. Day traders should have no issues, but those looking to invest long term should be aware.

Look out for hidden costs in online brokers offering their services for free. It’s more likely that the asset will be quoted marginally above market rate to cover their running costs. When using online brokers, cost comparison is key to profitability. Check out our online brokers list above for recommendations.

Leverage

The top 10 online brokers in the UK will all offer the opportunity to trade with leverage. Leverage allows you to maximise the results of a trade by multiplying by a chosen factor. For example, if you have a £100 deposit and you trade with leverage 1:5, you can open a position with a value of £500.

All FCA regulated brokers in the UK are limited to what leverage they can provide. They’re capped at between 1:30 and 1:5 depending on the volatility of the asset traded. Forex trading is usually between 1:20 and 1:30, whereas stocks are slightly lower, at around 1:10.

Unregulated online brokers in the UK sometimes offer higher leverage limits. However, we recommend you select a regulated firm as the limits are in place to protect retail traders from undue risk. Leverage amplifies losses as well as profits, so risk management is vital.

Operational Structure

Online brokers operate primarily with one of two trading models: dealing desk or non-dealing desk. A dealing desk broker, or ‘market maker’ creates liquidity on its order book by taking the other side of a trade. For example, if you’re looking to sell Google stocks, but there is no trader on its books willing to buy them, the broker will buy them instead. This ensures that orders are always filled, but it does mean that market makers are trading against you and other clients. If you lose money, they benefit, creating a conflict of interest.

A non-dealing desk broker (or ECN broker) connects to other institutions through an electronic network. This creates a larger order book, making it easier to find another investor willing to take the trade.

Both models are popular with online brokers, and neither is right or wrong. However, some traders prefer to limit the conflict of interest by selecting an ECN broker where possible.

Customer Support

If things don’t go as planned and you need help, an online broker with strong customer support is vital. Look out for a phone number or live chat service, these are key indications that they’ll be on hand when you need them. An email address or ‘contact us’ page is not sufficient. If you ever need it, there’s no doubt you’ll be wishing you’d selected a broker that puts this service as a high priority.

How UK Brokers Are Regulated

In the UK, any firm offering financial services must be regulated by the Financial Conduct Authority (FCA). The FCA was created in 2013 with the aim of managing risk as a result of the 2008 financial crisis. It currently regulates around 51,000 businesses in the UK. FCA regulation is a good indication that the trading broker can be trusted.

The FCA places a number of requirements on online brokers in the UK, which encourages transparency with retail traders. You may not have realised, but the following policies are FCA mandated:

- Risk Disclosure – Online brokers offering CFDs must disclose the percentage of retail traders that lose money with this instrument.

- Negative Balance Protection – When margin trading, it is possible to lose more than your deposit amount since the results of a trade are multiplied. Negative balance protection aims to prevent this by issuing a margin call. All traders regulated by the FCA will provide this.

- Limits On Leverage – As mentioned above, there are limits on how much leverage a broker can offer depending on the volatility of the instrument provided. This is capped at a maximum of 1:30. Online brokers offering higher leverage than this are unregulated and potentially scammers.

- Ban On Excessively Volatile Instruments – In 2020, the FCA banned the sale of crypto-derivatives. Their volatile nature was deemed to cause excessive risk to retail traders. Similarly, following the European Securities and Markets Authority’s (ESMA) temporary ban in 2018, the FCA permanently restricted the sale of binary options in 2019.

- Segregated Funds – If your brokerage fails, you’ll want to know that your trading funds are protected and will be returned to you. The FCA makes it mandatory for online brokers to keep customer funds in a separate account from those used by business operations. This means if their finances are lacking, they can’t use yours to top them up.

- Bonuses – Traders looking for online brokers with the best welcome bonuses should be cautious. The FCA has banned all types of cash bonuses from UK-based online trading brokers, since they entice traders to deposit funds for all the wrong reasons. Sometimes they even have unfair terms and conditions attached to them, like those that restrict profit withdrawal.

Final Word On Online Brokers In The UK

Since online brokers in the UK must be regulated, many will have similar policies. This includes a broker’s leverage limits, provision of negative balance protection and even restricts their instrument list. However, there are a few factors that will vary between firms. Look for online brokers that provide you with an intuitive trading platform with all the functionality you need. Plus, assess their fee structure, educational tools and customer support before taking the plunge.

FAQ

What Are The Best Online Brokers For UK Expats?

Expats can still use online brokers that are registered in the UK as long as the company offers the service to their current jurisdiction. However, be aware that regulatory protections may not apply to your location. Therefore, the best online brokers in the UK can usually be used by expats too, but the tax obligations will vary.

Do Online Brokers In The UK Need To Be Regulated?

Yes. It is mandatory for companies providing financial services in the UK to be regulated by the FCA. Before Brexit, it was sufficient for a broker to be registered with an ESMA approved European authority. This made regulators such as CySEC (Cyprus Securities and Exchange Commission) a commonly referenced industry figurehead. However, since leaving the EU, this no longer applies and online brokers must be regulated by the FCA.

How Can I Find The Best Online Brokers In The UK?

We’ve compiled a list of the top ten online brokers in the UK with a review of each and every one. Check out our UK brokers list and read the article to find the key factors to look for in a broker. This will help you choose the right service for you.

What Are The Best Online Trading Brokers For Beginners?

Beginners should ensure they select a broker that offers a trading platform that is intuitive and easy to use. Many of the charts, graphs and limit orders can be difficult to grasp initially. Before you try and grapple with this, start with the basics. Secondly, online brokers should always offer the opportunity to trial the platform through a demo account. See our list of the best brokers for beginners where we have rated the brokers most suited to beginner traders.

How Do You Start To Buy Stocks Through An Online Broker?

First and foremost, consider which broker offers you the stock you need for a sensible fee. Then, consider how you’ll be trading. For example, if you’re looking to buy stocks for long term investment, a platform isn’t required. However, if you want to make a profit from trading, you’ll need one that provides all the functionality you need. Once you’ve selected your top choice, sign up and follow the broker’s instructions to purchase.

Compare Online Brokers

In the list of UK Online Brokers above, a few key factors are displayed for each firm. But if you are looking for a much more detailed broker comparison we have dedicated pages for that. You can also compare a firm with other online brokers in the individual reviews. Below are some of the most popular comparisons.