Best Funded Trading Accounts In The UK 2026

Funded trading accounts are getting attention in the UK. It can sound like free money, but it isn’t. Every firm sets its own rules. Some are fair, some are strict, and some aren’t worth the cost.

Dig into our selection of the top funded trading accounts in the UK, with insights into what really matters when choosing a provider.

Top Brokers With Funded Trading Accounts

-

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Funded Trading Accounts In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Axi | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Funded Trading Accounts In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Funded Trading Accounts In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Axi | iOS & Android | ✘ |

Beginners Comparison

Are the Best Funded Trading Accounts In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Axi | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Funded Trading Accounts In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Funded Trading Accounts In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Axi |

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

Cons

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

Best Independent Funded Trading Firms

How Investing.co.uk Chose the Best Funded Trading Accounts

We only included trusted funded account providers that clearly outline their profit-sharing rules, scaling plans, and challenge conditions.

Our team reviewed funding terms, withdrawal policies, account transparency, and trader protections, while also considering reputation in the trading community.

Each provider was ultimately ranked using our overall ratings system, which evaluates over 200 factors such as costs, platform stability, support, and fairness of trading conditions.

What Is A Funded Trading Account?

A funded trading account is when a trading firm provides you with money to trade with, rather than you using your own. You start by proving your skills through an evaluation, usually on a demo account. If you pass, the firm gives you access to a live funded account.

You then trade under their rules. If you make a profit, you retain a share, and the firm keeps the rest. If you lose, it’s the firm’s money at risk, not yours—though you may lose your chance at the account if you break rules or hit drawdown limits.

A funded account allows you to handle larger positions without risking your own savings. It can speed up progress if you’re consistent, but strict rules mean one mistake can cost you the account—even if you were making money.

How Funded Trading Accounts Work

Profit Split

A profit split is the percentage of profits you retain. It’s often the first number people check.

- Many firms let traders keep 70% to 90%.

- Some take a larger cut, closer to half.

On the surface, a 90% split sounds great. But look beyond that headline. We’ve found firms that promise a high split often impose stricter rules or charge higher fees. A lower split with more straightforward rules might work out better in practice.

Always consider the entire package, not just the percentage.

Evaluation Process

Most firms don’t hand you capital on day one. You have to pass an evaluation first. This is typically a trial account with strict terms and conditions.

Key things to look for:

- Profit targets: Often around 5–10%.

- Time limits: Some allow 30 days, while others provide 60 days or more.

- Consistency rules: Some want steady profits, not just one big trade.

If you fail, you usually lose the entry fee and may need to pay again to retry. That can get expensive. Therefore, check whether the evaluation rules align with your own trading style.

Trading Rules

Funded accounts come with rules. If you break them, your account will be closed, regardless of how profitable you are. Common ones include:

- Daily loss limits: Maximum you can lose in a single day.

- Overall drawdown: Maximum loss across the account.

- Lot size or leverage caps: Limits on position sizes.

- News restrictions: Some don’t allow trading around major news events.

These rules exist to protect the firm’s capital. But for traders, it can feel restrictive. If the rules don’t fit how you trade, you’ll likely struggle.

Scaling Options

Scaling is when a firm increases your account size if you perform well. It can be appealing if you want to handle larger capital over time.

Example:

- Start with £25,000.

- After three months of consistent profits, move to £50,000.

- Keep building, and accounts can grow even further.

But scaling is not automatic. Each firm sets its own targets, and some are tough to meet. Check if the growth path is realistic.

Fees & Refunds

Most funded accounts charge a fee to enter the evaluation. Costs vary.

- Some accounts cost a few hundred pounds.

- Others can cost much more, especially for larger account sizes.

Some firms refund the fee once you pass the evaluation and go live. Others keep it. Also, be careful with monthly fees. They can drain profits quickly.

Do the maths. The cheapest fee upfront isn’t always the best deal in the long run.

Payout Process

When you make money, you’ll want to withdraw it. Each firm has its own rules on payouts. Look at:

- How often you can withdraw: weekly, bi-weekly, or monthly.

- Minimum payout amounts: Some platforms won’t allow you to withdraw small sums.

- Withdrawal methods: bank transfer, PayPal, or other platforms.

A clear and quick payout process is a good sign. Long waits or confusing rules are red flags.

Market Access

Not every funded account offers the same markets. Some stick to forex. Others allow indices, commodities, or crypto.

If you primarily trade the FTSE or DAX, ensure that these instruments are available. If you trade gold or oil, check they’re included.

Execution speed matters too. Wide spreads or slow fills can eat into profits. Check trading hours as well, especially if you trade outside London sessions.

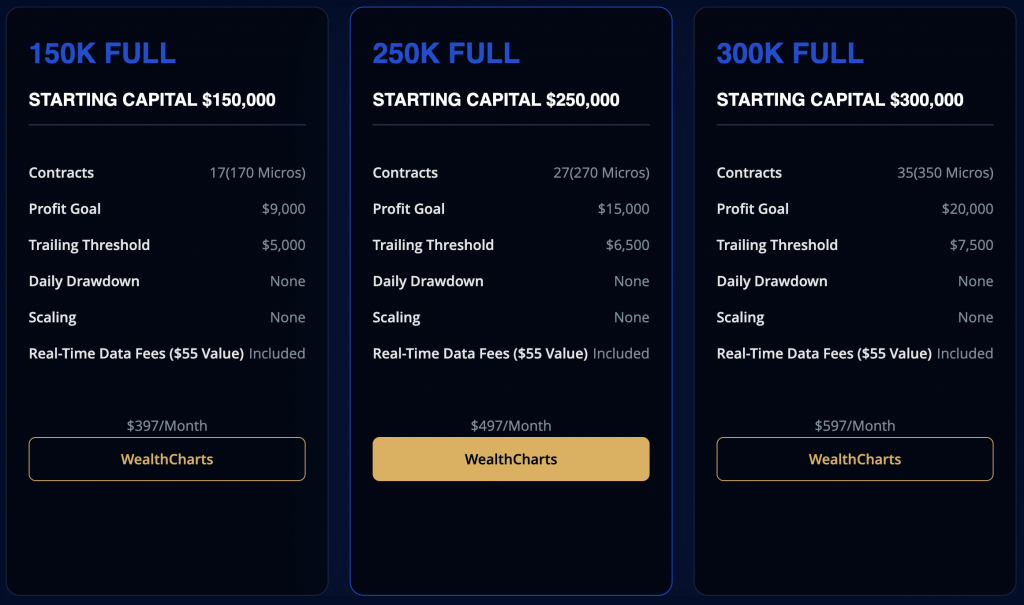

Apex Trader Funding offers up to $300k starting capital

UK-Specific Issues

If you’re based in the UK like me, a few extra points matter.

- Regulation: Funded firms aren’t always brokers. They’re sometimes companies running demo accounts with tracking software. This means you won’t have FCA protection like you would with a regulated broker.

- Currency: Many firms operate in US dollars. Fees, profits, and withdrawals may all be in USD. Be aware of conversion costs.

- Taxes: Profits from funded accounts are typically treated as taxable income. Keep accurate records and be prepared to present them.

Risk To You

One reason people like funded accounts is the idea of ‘trading without personal risk.’ But there is still risk.

- You can lose your upfront fee.

- If you break a rule, you may lose your account.

- Some firms make money from traders failing, not from traders succeeding.

Ask yourself:

- Am I confident I can trade within strict limits?

- Is the fee money I can afford to lose?

- Would I gain more from trading my own small account first?

Funded accounts aren’t shortcuts to easy money. They’re just another way to structure trading.

How To Compare Firms

With so many choices, comparing firms can feel overwhelming. A simple checklist helps:

- Write down the fee.

- Note the evaluation rules.

- Look at daily and overall drawdown.

- Check the profit split.

- Review payout terms.

- Ensure they accommodate your trading style and instruments.

Put all of that side by side. You’ll quickly see which firms are the best fit for you.

Alternatives To Funded Trading Accounts

Becoming a funded trader is very difficult—only the best traders are accepted. However, there are alternative ways to boost your trading funds:

- Brokers with bonuses offer ‘free’ trading credit when you open an account and make a deposit. Trading bonuses can reach £10,000+.

- Brokers with trading tournaments award cash prizes to winning traders. Prize pools can climb to £100,000+.

- Brokers with high leverage, beyond FCA limits, will amplify your buying power and trading results in return for fewer safeguards. Leverage can hit 1:3000.

- Brokers with copy trading allow you to earn additional revenue by attracting investors who copy your trades. You can often charge a commission per winning trade.

Bottom Line

Funded trading accounts can be beneficial for UK traders who want to scale their operations without risking significant personal savings. But the details matter.

Check the profit split, rules, and evaluation process. Consider fees, payouts, and market conditions. Don’t ignore UK-specific points, such as taxes and currency conversions.

The best funded trading account isn’t the one with the highest split or lowest fee. It’s the one where the rules and structure fit how you actually trade.

If you find a firm that matches your style, a funded account can be a good tool. If not, it may cost you money with little reward.