Best Brokers With Trading Tournaments In The UK 2026

Trading tournaments are a niche feature. They give traders a chance to test their skills, compare strategies, and maybe win prizes. But not every broker offers them, and the way tournaments work at each provider can vary a lot from our tests.

We’ve rounded up the biggest trading tournaments in the UK.

Top UK Brokers With Trading Tournaments

-

IronFX's trading tournaments demonstrated significant scale during our tests. Previous events featured prize pools exceeding $1 million, ranking among the most competitive observed. Participation necessitated a funded contest account, with standings determined transparently by profit percentage. It was purely trading performance throughout—no tricks.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

Founded in 2005, FXOpen is a well-regulated broker that has drawn over one million traders. Tailored for active trading, it offers a diverse range of over 700 markets. The platform facilitates high-frequency trading, scalping, and various algorithmic strategies through the use of expert advisors (EAs).

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global) -

The PrimeXBT tournaments are notable for their format: participants trade with virtual funds to win real USDT prizes. Weekly contests can offer prize pools of up to 1,000 USDT, with specific trade count and volume requirements. Transparency is robust; live leaderboards and clear rules under "General Trading Contests T&Cs" ensure clarity.

Instruments Regulator Platforms CFDs, Cryptos, Forex, Indices, Commodities, Futures Own Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:1000 -

Our detailed review of TMGM’s trading competitions highlights clear entry conditions: deposits around $500 and minimum trading requirements ensure eligibility is straightforward. In previous rounds, prize pools surpassed $500,000, offering weekly awards and several performance tiers. Regularly updated leaderboards and a ban on algorithmic hedging ensure genuine fairness and competitiveness.

Instruments Regulator Platforms CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex ASIC, FMA, VFSC MT4, MT5, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:500

Safety Comparison

Compare how safe the Best Brokers With Trading Tournaments In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IronFX | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ | |

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| TMGM | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Trading Tournaments In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| TMGM | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Trading Tournaments In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IronFX | Android, iOS, WebTrader | ✘ | ||

| FXOpen | iOS & Android | ✘ | ||

| PrimeXBT | iOS & Android | ✘ | ||

| TMGM | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Trading Tournaments In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IronFX | ✔ | $100 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots | ||

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| TMGM | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Trading Tournaments In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| TMGM | ✔ | ✘ | 1:500 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Trading Tournaments In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IronFX | |||||||||

| FXOpen | |||||||||

| PrimeXBT | |||||||||

| TMGM |

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- IronFX offers both fixed and floating spread accounts, appealing to novices and seasoned traders alike.

- The broker regularly hosts trading competitions with cash rewards and provides welcome bonuses for new clients.

- Traders gain access to the renowned Trading Central research tool, featuring automated AI analytics and round-the-clock support.

Cons

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

Cons

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- The online platform and app cater to traders, offering advanced charts, a customisable interface, and multiple order options like one-cancels-the-other (OCO).

- In 2025, PrimeXBT significantly expanded its Crypto Futures offerings with over 100 tokens, including AI, NFTs, Metaverse, and Layer 1 & 2 assets.

- Trading fees for crypto futures contracts are quite competitive, with maker fees at 0.01% and taker fees at 0.02%.

Cons

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

Our Take On TMGM

"TMGM excels as a versatile option due to its extensive asset range, varied account types, multiple platforms, and competitive pricing."

Pros

- Caters to new and time-constrained traders by offering copy trading support through HUBx.

- A well-regulated and trustworthy brand with a strong client base.

- Low trading fees feature spreads starting from 1 pip on the classic account. For the raw spread account, enjoy zero spreads paired with a $7 round-turn commission.

Cons

- Shares can be traded exclusively through the IRESS account. They are not accessible via MT4 or MT5 platforms.

- A £30 monthly fee is charged on accounts inactive for six months or with balances under £500.

How Investing.co.uk Chose The Best Brokers For Trading Tournaments

We reviewed a wide range of broker-run trading tournaments, looking closely at entry conditions, prize structures, fairness, and transparency. Our team documented these findings through hands-on checks and user testing, before comparing platforms across key data points.

Finally, we ranked a shortlist of providers by overall ratings to highlight the brokers that deliver the best tournament experience for retail traders in the UK.

What To Look For In A Trading Competition

Types Of Tournaments Offered

Not all tournaments are the same. Some run daily, some weekly, and others just a few times a year. The format can change, too.

- Short-term vs. long-term: Short events test quick decisions. Longer ones allow more planning.

- Free entry vs. paid entry: Some tournaments are free, while others require a buy-in. Free ones are low-risk but often have smaller prizes. Paid ones can offer bigger rewards, but you risk your entry fee.

- Demo account vs. live account: Many brokers run demo-based trading contests, where you trade virtual money but compete for real prizes. Others require live trading with your own funds.

It’s worth checking what mix the broker runs.

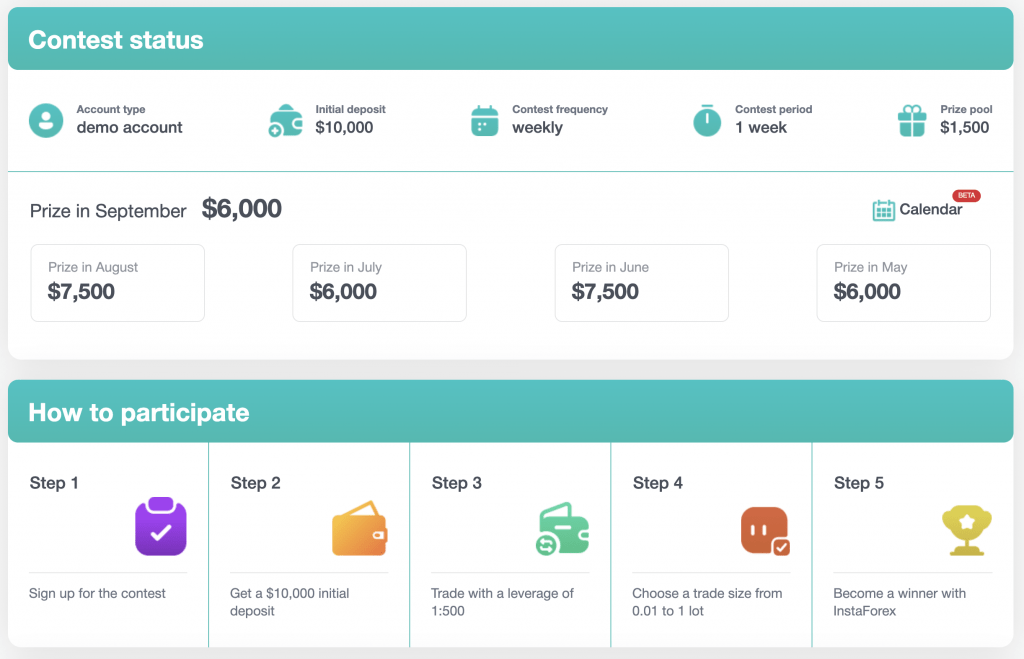

InstaForex’s weekly tournament has a $1,500 prize pool

Entry Rules

Every tournament has entry conditions. Some are simple and just require you to sign up. Others may require you to deposit a certain amount or trade a minimum size.

Key questions to ask:

- Do you need a funded account, or can you enter with a demo?

- Is there a minimum deposit?

- Is the contest open to UK traders?

Make sure you can meet the tournament entry conditions without stretching your budget.

Prize Structure

The prize pool is one of the main draws. But it’s important to see how prizes are awarded.

- Cash vs. credits: Some brokers pay out money, while others give account credits or bonuses you can only use for trading.

- Winner-takes-all vs. split prizes: In some tournaments, only the top trader wins. In others, the top 10 or 20 might share rewards.

- Non-cash rewards: Occasionally, brokers give gadgets or event tickets instead of money.

Check if the rewards feel fair for the effort required.

Ranking System

The way brokers rank players can affect strategy.

- Highest profit: Most tournaments reward whoever grows their account the most in our experience. This often prompts traders to take on high-risk trades.

- Consistency-based: Some contests track win rates or stable returns. These tend to reward steady trading.

- Point systems: A few brokers use custom scoring methods, like giving points for each profitable trade.

Knowing the ranking rules helps you decide if a tournament suits your trading style.

Trading Instruments Allowed

Not every market is open in a tournament. One contest might only cover forex pairs. Another could include indices, stocks, or crypto.

If you have a preferred market, make sure it’s available. Otherwise, you may be forced to trade instruments you don’t normally use.

When I first joined a trading tournament, I didn’t realise they only allowed forex pairs – I usually trade indices.It forced me out of my comfort zone, which was tough but also a good reminder to always check the instruments before signing up.

Level Of Competition

The feel of a tournament depends on who else is playing.

- Open to all: Large contests can have thousands of traders. Competition is high, but they often allow beginners to join.

- Tiered or restricted: Some tournaments are limited to smaller groups, like VIP clients or those with specific account sizes. These can feel less crowded but more competitive.

Think about whether you want to test yourself in a big, open event or a smaller, more intense one.

Entry Costs & Risks

Even if a tournament is free, you still risk time and effort. For paid-entry events, you also risk money.

Check:

- The size of the entry fee.

- The ratio of entry cost to possible reward.

- Whether you’re okay with losing the entry if you don’t win.

Don’t assume all tournaments are worth it. Sometimes the prize pool looks good, but the odds of winning are slim.

Platform & Usability

Since tournaments run on the broker’s platform, ease of use matters.

Ask yourself:

- Is the platform stable during high traffic?

- Is it easy to track your ranking in real time?

- Does the broker show leaderboards clearly, or do you need to wait for results?

A smooth platform can make the experience more enjoyable.

I’ve been in contests where the platform froze right as I was placing trades, and it completely ruined my run.Since then, I have always stuck to brokers with smooth, reliable platforms—it makes all the difference in a timed event.

Transparency

Fair play is a big concern. Look for brokers that are clear about their rules.

- Are the contest rules written out in plain terms?

- Does the broker explain how winners are chosen?

- Can you see the rankings update live, or only after it ends?

Avoid brokers that seem vague about their process.

Frequency Of Events

Some brokers only run a few tournaments per year. Others run them almost every week.

If you like frequent chances, choose a broker with regular contests. But if you only want the occasional challenge, one-off significant events might suit you better.

Support & Communication

During a tournament, questions come up. Maybe you’re not sure how points are counted, or you see a problem with your score.

A broker with responsive support can help clear things up quickly. It’s worth checking if they provide live chat or fast email replies during contests.

Community Feel

Some traders enjoy the social side. A few brokers add forums, chat rooms, or social feeds tied to tournaments. This allows players to share strategies or discuss the event.

If you like that aspect, check if the broker provides it. If you prefer to keep to yourself, this might not matter.

Legal & Regional Limits

Always confirm if the tournament is open to UK traders. Some events exclude the UK because of FCA regulatory limits. Others may only allow UK traders to join demo contests, not real-money ones.

Don’t assume you’re eligible until you read the fine print.

Final Thoughts

Trading tournaments in the UK can be fun, competitive, and sometimes rewarding. But they’re not all alike. The key points are entry rules, prize structure, ranking methods, and whether the contests suit your trading style.

Focus on brokers that make their tournaments clear, fair, and accessible. And never join an event that forces you to risk more than you’re comfortable losing.