Best MetaTrader 4 (MT4) Brokers In The UK 2026

Whether you’re a seasoned trader or just getting started, choosing the right MetaTrader 4 (MT4) broker can make or break your strategy.

With tight spreads, fast execution, and FCA regulation at the top of your checklist, we’ve done the heavy lifting to spotlight the best MT4 brokers that give UK investors an edge in the markets.

Top MetaTrader 4 Brokers

-

When we evaluated Pepperstone's MT4, execution was extremely swift with spreads starting at 0.1 pips, plus a $7 per lot commission on Razor accounts. The Smart Trader Tools plugin provided real benefits, including sentiment, mini-terminal, and trade management tools. EA automation operated seamlessly, and the mobile version replicated desktop performance in live trades.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Utilising Trade Nation’s MT4 provided the complete charting suite, familiar indicators, and drawing tools. EA automation functioned efficiently; the mobile MT4 was reliable. Although MT4 offers fewer instruments than the TN-Trader platform, copy-trading is available through the "TradeCopier" add-on.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

During testing, Eightcap’s MT4 offered swift execution and spreads starting at 0.0 pips on the Raw account. The commission was $3.50 per side for each standard lot, with an all-in cost of roughly 0.76 pips. The platform supports micro lots and provides smooth EA automation. The mobile MT4 was fast, and Capitalise.ai integration allowed for algorithmic trading without coding.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

When we tested IG’s MT4, execution was stable but a bit slower than their proprietary platform. Spreads averaged 0.6 pips on major pairs without commissions, supporting micro lots and dependable EA automation. Although MT4 did not include IG's exclusive tools, it provided robust mobile functionality and a wide asset range, including CFDs and forex.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

In our tests, FOREX.com's MT4 excelled with quick execution and a comprehensive set of custom indicators. The platform supports micro lots, EAs automation, and mobile trading. Integrated Trading Central and real-time news add-ons ensured seamless strategy testing and analysis.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

In our tests, Vantage's MT4 showed excellent performance, offering spreads as low as 0.0 pips on Raw/ECN and about 1.1 pips on Standard STP, with ECN commissions starting at around $3 per lot side and none for STP. Micro-lot trading and comprehensive EA automation were effective, complemented by robust mobile MT4 functionality.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Best MetaTrader 4 (MT4) Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best MetaTrader 4 (MT4) Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best MetaTrader 4 (MT4) Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ |

Beginners Comparison

Are the Best MetaTrader 4 (MT4) Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best MetaTrader 4 (MT4) Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best MetaTrader 4 (MT4) Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| Tickmill |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Global traders can use accounts in various currencies.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

How Investing.co.uk Chose The Best MT4 Brokers

To compile our list of the best UK brokers that support MT4, we followed a data-driven process:

- Drew on our continually updated database of online brokers operating in or accessible to UK traders.

- Isolated those that offer MT4 on desktop, web, or mobile platforms.

- Ranked these brokers using our in-house scoring system, which combines over 200 quantitative metrics with the real-world insights of our UK-based testers.

How To Pick A MetaTrader 4 Broker

- Tools, add-ons, and education offered by a broker can make a big difference when using MT4. Access to custom indicators, signal services, or advanced dashboards can enhance the platform’s default features, helping you make more informed decisions or automate parts of your strategy. Quality educational resources—like MT4-specific webinars, step-by-step tutorials, or walkthroughs—help you learn how to navigate the platform, place trades, and use features like stop-loss or pending orders correctly. Brokers that actively support beginners with these tools not only reduce your learning curve but also help prevent costly mistakes in live trading.

- Different account types like STP, ECN, and Raw Spread help you manage costs and execution quality. STP accounts typically offer market-based spreads with no dealing desk interference, ideal for beginners seeking simplicity with moderate costs. ECN accounts, on the other hand, connect you directly to liquidity providers with ultra-tight spreads but charge a commission per trade—better suited for scalping or high-volume trading. Raw Spread accounts are often a hybrid, offering institutional pricing with added transparency. Trading conditions such as leverage limits, stop-out levels, and even spreads can vary by account type and platform, so checking how they apply specifically to MT4 helps ensure a smoother live trading experience.

- Costs and fees directly affect your long-term profitability. Spreads—either fixed or variable—can significantly vary between brokers and account types, especially during high volatility, impacting your entry and exit prices. Some MT4 accounts charge commissions per lot traded (familiar with ECN or Raw Spread accounts), which may offer lower spreads but add fixed costs per trade. Swap or overnight fees apply when holding leveraged positions overnight, which can quietly accumulate if you’re a swing trader. Also, be aware of hidden costs like inactivity charges or withdrawal fees—these don’t appear in the trading interface but can affect your overall return, especially on smaller accounts.

- The range of tradable instruments determines the flexibility and diversity of your trading strategy. We’ve found some brokers limit the number of forex pairs, indices, or commodities offered on MT4 compared to their proprietary platforms, which can restrict your market access. For example, if you plan to trade gold or crypto, make sure those assets are supported within MT4—not just listed on the broker’s website. The quality of data feeds also matters: accurate pricing, depth of market (DOM), and real-time tick data help improve trade execution and chart analysis. Choosing a broker with a broad, well-integrated MT4 asset offering ensures you’re not limited as your skills grow.

- Execution quality and infrastructure directly impact how accurately and quickly your trades are filled. High slippage or frequent order rejections—especially during volatile market conditions—can erode profits or lead to unintended losses. For algorithmic trading using Expert Advisors (EAs), access to a VPS (Virtual Private Server) ensures that trades execute with minimal delay, even if your local device is offline. Server location also matters—UK-based traders benefit from brokers with low-latency servers in London or nearby financial hubs, reducing execution lag and improving trade reliability in fast-moving markets.

- Reliable customer service with MT4-specific support is paramount, especially for beginners who may run into setup or technical issues. Whether you’re installing the MT4 platform, configuring EAs, or troubleshooting indicator errors, access to knowledgeable and responsive support can save time and prevent trading disruptions. Brokers that offer 24/5 live chat, clear user guides, and step-by-step onboarding for MT4 reduce the chances of missed trades due to login errors or platform misconfigurations.

When I first started using MT4, I assumed every broker offered the same experience—but I soon realised that factors like execution speed, server stability, and the quality of support in handling fundamental MT4 issues made a significant difference.The platform itself is powerful, but its smooth operation depends on the broker behind it.

What Is MetaTrader 4?

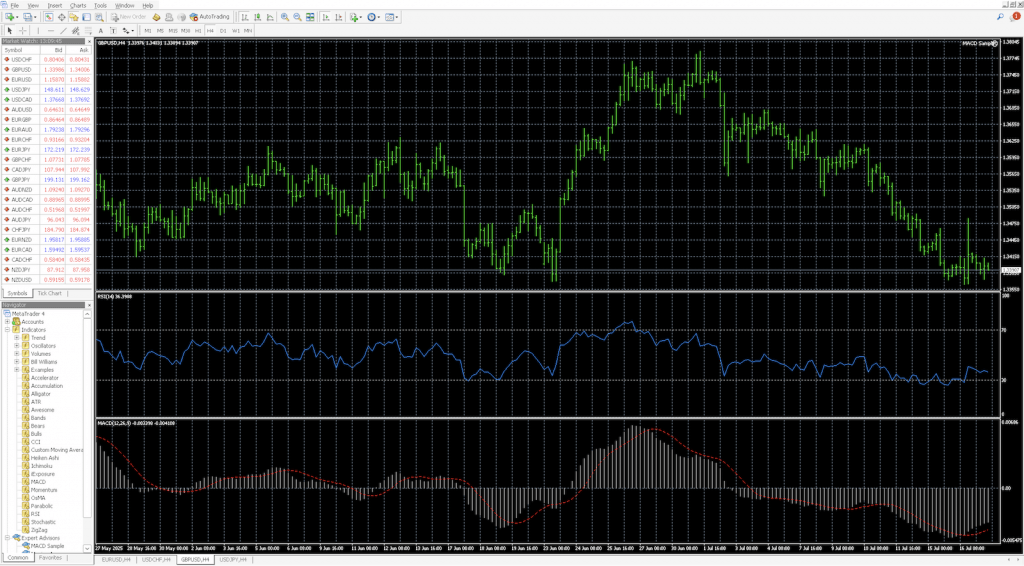

MT4 is a powerful third-party trading platform designed primarily for forex and CFD trading.

It offers real-time price feeds, interactive charts, over 30 built-in indicators, and a suite of drawing tools to help you analyse market movements with precision.

One of MT4’s standout features is its support for automated trading via EAs, which let you program and backtest strategies without manual input—ideal for building discipline and consistency. The platform also supports over 2,000 free custom indicators and scripts, allowing for advanced customisation.

Trusted UK brokers like IG, Pepperstone, and FxPro offer MT4 because of its proven reliability, fast execution, and low system resource usage. For beginner traders, MT4 provides a solid foundation—it’s intuitive enough to get started quickly, yet technical enough to grow with you as your trading skills develop.

MT4 offers solid charting and trading tools, though its interface can feel dated

Pros Of MetaTrader 4

- Lightweight & high-performance execution: MT4 is resource-efficient and runs smoothly even on older hardware, reducing the risk of platform slowdowns during volatile market conditions. Its stable architecture ensures fast order execution and minimal latency, which is essential for time-sensitive strategies like day trading or scalping.

- Advanced charting with custom indicators: MT4 provides multi-timeframe charting, over 30 built-in technical indicators, and supports custom indicators written in MQL4. You can layer multiple indicators, customise parameters, and set visual alerts—ideal for developing, testing, and refining technical trading strategies.

- Automated trading with EAs: Using MT4’s built-in MQL4 scripting language, you can create or import EAs to fully automate trading. These EAs can execute trades based on predefined rules and can be backtested using historical tick data, allowing you to optimise strategies and remove emotional bias from decision-making.

Cons Of MetaTrader 4

- Outdated user interface & ecosystem: MT4’s interface, while functional, hasn’t seen major design updates in years. It lacks some of the modern features, such as drag-and-drop order management, integrated news feeds, or advanced risk management tools, seen in newer platforms we use. Additionally, the MQL4 ecosystem is less actively developed than its successor, MT5, which limits future-proofing for more advanced or diversified trading approaches.

- Limited asset coverage by default: MT4 was initially built for forex trading, so while many brokers now offer CFDs on indices, commodities, and stocks through the platform, asset coverage often depends on broker-side integration. This can limit access to a broader range of markets compared to multi-asset platforms designed with native support for stocks, ETFs, or crypto.

- No native support for two-factor authentication (2FA): Unlike more modern platforms, MT4 lacks built-in two-factor authentication, which means account security is mainly dependent on broker implementation. This can expose you to additional cybersecurity risks, particularly if you use EA scripts or third-party plugins from less trusted sources.

At first, I didn’t pay much attention to account types or trading conditions—I just opened what was available. But over time, I realised that factors such as commission structures, spreads, and stop-out levels directly affected how my trades performed. Understanding how these work on MT4 helped me avoid numerous small, costly mistakes.

Bottom Line

Choosing the best MT4 broker in the UK comes down to more than just FCA regulation or reputation—it’s about how well the broker integrates with the MT4 platform itself.

From execution speed and account types to fees, available instruments, and platform support, each factor can shape your trading experience.

Whether you’re just starting or looking to optimise a strategy with EAs, selecting a broker that offers strong MT4 performance, transparent costs, and responsive support can make a significant difference in your results.