Investing.co.uk is the leading trading tutorial and investment comparison site for both beginners and experienced traders since 1996. We compare all top brokers and trading products on the market and provide detailed reviews.

Our analysts and experts are regularly cited in the UK and global press for their insights into all things investing. Join all the traders who get their financial education on investing.co.uk.

We have expert reviews of the best trading platforms and brokers in the UK and if you want to trade derivatives like CFDs, or forex and stocks – our tutorials will highlight the best brokers based on criteria like trading costs, customer service and the quality of trading apps.

Top 3 Brokers in the UK

Best UK Brokers and Trading Platforms

Popular Topics

Trading Tutorials

Popular online trading tutorials:

CFDs

Forex

Bitcoin

Stocks

Copy Trading

Day Trading

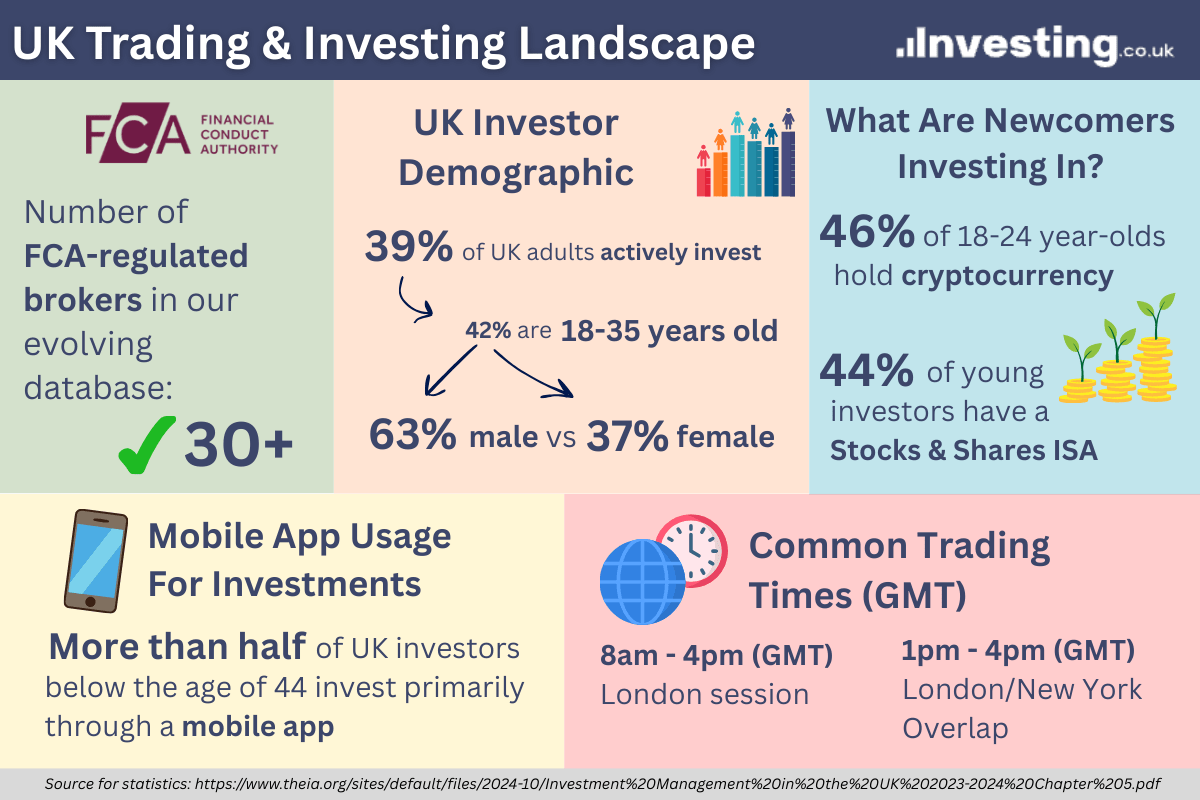

The Role of the FCA

The Financial Conduct Authority (FCA) is the UK’s chief regulator of financial services, including those provided to retail traders.

By choosing an FCA-regulated broker, Brits can expect providers to follow strict rules governing how their funds are handled, as well as a degree of protection from high-risk financial products, though online trading will always pose a significant risk to your capital.

Chief amongst these protections is the Financial Services Compensation Scheme (FSCS):

- Investments & broker failure – If an FCA-authorised broker fails, for example due to financial difficulties, and can’t return your assets, the FSCS provides protection up to £85,000 per person, per brokerage (it doesn’t cover market losses).

- Cash deposits – From 1 December 2025, eligible cash at UK-authorised banks, building societies or credit unions is covered by the FSCS up to £120,000 per person, per banking licence. FCA-regulated brokers are required to hold client money at such banks, either in segregated client accounts or pooled client money accounts, and the FSCS should treat you as the beneficial owner of your share. But the £120,000 limit is shared amongst any other accounts you hold with the same banking group, including personal accounts, so larger total balances may not be fully protected. This makes it worthwhile understanding where your broker holds its bank accounts.

Other retail safeguards include that UK-regulated trading providers must not offer leverage beyond 30x (1:30) your stake, helping to protect against thumping losses, negative balance protection so you can’t lose more than you’ve deposited, and risk warnings for high-risk products like CFDs.