Best Trading Simulators In The UK 2026

Looking to sharpen your investing skills without risking a penny? Free trading simulators let you practice in live market conditions using virtual funds—no deposit needed.

We’ve tested the best trading simulators in 2026, ranking them based on available assets, market realism, backtesting tools, and how smoothly they transition to real-money trading.

Top Trading Simulators In The UK

-

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our assessment, IG's demo account provided a $10,000 virtual fund. Execution was dependable with minimal slippage, and real-time market data was accessible. There is no time restriction. Setup required just an email, and users can replenish their virtual funds anytime. The platform is available via MT4, ProRealTime, L2 Dealer, and WebTrader. IG Academy also offered superb educational resources.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

In our tests, Vantage's demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Using Interactive Brokers' demo mirrored the live TWS platform, featuring global market access and advanced order types. Execution speed felt genuine, although fast-moving assets experienced slight slippage. Basic details were needed for setup. With a virtual balance of $1M, paper trading started post-account approval.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our tests, Eightcap's demo account matched actual trading conditions with live pricing and execution. Accessible via MT4, MT5, and TradingView, it offers over 1,000 instruments like forex, indices, commodities, stocks, and crypto. Setup merely required an email, offering a $5,000,000 virtual balance for 30 days, extendable on request. Perfect for both novice and experienced traders seeking realistic practice.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Trading Simulators In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading Simulators In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Trading Simulators In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Best Trading Simulators In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Trading Simulators In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading Simulators In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| IG | |||||||||

| Vantage FX | |||||||||

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Top Independent Trading Simulators In The UK

In addition to the top brokers offering built-in trading simulators, we’ve identified three standout third-party platforms worth exploring:

- TraderSync:TraderSync’s market replay simulator lets you relive past trades with synced journal data, and performed excellently during testing with a superb level of detail.

- Edgewonk: Edgewonk’s trade simulator projects future performance scenarios based on your historical data, helping you assess risk and optimize trading strategies.

- Trademetria: Trademetria’s PnL simulator allows you to run simulations on past trades, offering insights into performance metrics and aiding in short-term strategy development.

How Did Investing.co.uk Choose The Best Trading Simulators In The UK?

We verified that each platform offers a trading simulator or similar mode account accessible to UK users.

We then ranked these providers by their overall ratings following our hands-on testing and structured data capture process, which evaluates factors like usability, features, and FCA regulation.

What Is A Trading Simulator?

A trading simulator is a platform that replicates real market conditions using virtual funds. It lets you practice buying and selling financial instruments, such as stocks, forex, or crypto, without risking your money.

It’s designed to help you build skills, test strategies, and gain confidence before committing to live trading.

A trading simulator isn’t just for beginners—experienced traders, myself included, use them to stress-test strategies under unusual or high-volatility scenarios that rarely occur in live markets. This lets you prepare for unpredictable conditions without financial risk.

Although the terms trading simulator and ‘demo account‘ are often used interchangeably, there are essential differences that you should be aware of.

For UK investors, using both tools in sequence—starting with a simulator and transitioning to a demo—can offer a smart path toward confident, informed trading.

Trading Simulator vs Broker Demo Account

An independent trading simulator is standalone software or a web-based tool not tied to any specific broker.

Its main purpose is education and strategy development. Products like TraderSync, Edgewonk and Trademetria, which we’ve run hands-on tests on, offer a flexible environment for practising across various markets and trading scenarios.

Trading simulators often include features like historical data, market replays, and the ability to simulate different trading conditions, making them ideal for beginners and experienced traders looking to experiment or refine strategies.

Independent simulators often let you replay past market events—like the 2020 crash or 2022 rate hikes—so you can practice responding to real historical volatility. Broker demos rarely offer this, making independent tools better for learning how to trade through extreme conditions.

A broker’s simulator, often provided as a demo account, is designed to replicate the broker’s actual trading environment. It lets you get comfortable with the platform’s layout, tools, pricing structure, and execution speed.

While the range of assets may be more limited than an independent simulator, the data is typically pulled directly from live market feeds, providing a more accurate representation of what to expect when trading with real money.

The key difference lies in intent and flexibility. Independent simulators are neutral and focused on broad learning, while broker simulators are often part of a pathway toward opening a live account.

Many traders use independent simulators to test strategies in a sandbox environment, then switch to a broker demo to prepare for real execution.

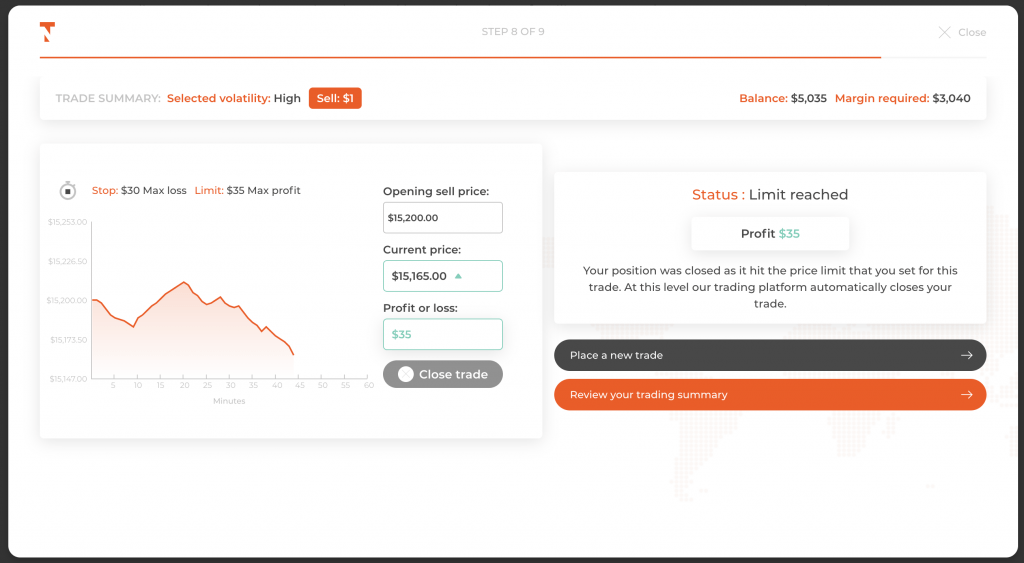

TradeNation’s free simulator offers a user-friendly environment to practice trading

Pros And Cons Of Using A Trading Simulator

Pros

- Trade with virtual money to build skills without risking capital

- Test and improve strategies in various market conditions

- Practice disciplined habits like stop-losses and risk limits

- Get familiar with real market behaviour and UK trading hours

- Build confidence in a safe, no-risk environment before going live

Cons

- Simulators don’t recreate the stress of real money trading

- Order fills are often too perfect, unlike live market execution

- Easy wins can create overconfidence when going live

- Independent simulators may not match your broker’s platform

- Free versions often limit data, markets, or usage time

Key Factors To Consider When Choosing A Trading Simulator

When choosing a trading simulator, you must go beyond surface-level features and focus on what will prepare you for real-world trading.

Here are the key factors to consider, broken down with practical insights tailored to UK assets and investing needs:

Realism Of Market Data And Execution

A good simulator should closely mirror live market conditions. This includes realistic spreads, order execution speed, slippage, and price movements.

Ensure the simulator reflects London Stock Exchange (LSE) trading hours. Simulators with delayed or overly simplified data can give a false sense of confidence that won’t hold up in real markets.

Asset And Market Coverage

Choose a simulator that includes the asset classes you intend to trade. For UK users, this may mean looking for access to domestic equities such as Barclays, BP, and Tesco, as well as major GBP forex pairs like GBP/USD or GBP/EUR.

It’s also essential to ensure the simulator covers key indices such as the FTSE 100 and FTSE 250. If your strategy involves broader diversification, access to UK-listed ETFs or bonds can also be beneficial.

The wider the range of available instruments, the more effective the simulator will be in helping you develop a well-rounded trading approach.

Strategy Testing Tools (Backtesting & Replay)

A quality simulator should allow you to test your strategies against historical data (backtesting) and replay past sessions. This is vital for learning how your trades would have performed during real events, such as the Brexit referendum, Bank of England rate decisions, or UK inflation spikes.

Look for simulators that offer replay features at various speeds so you can analyse your reaction time and decision-making.

When I used TraderSync during testing, what stood out immediately was how detailed the trade journaling is—I could tag each trade by strategy, setup, or mistake. The platform automatically generated performance analytics over time.Uploading trades from my broker was seamless, and seeing visual breakdowns of my win rate by time of day or asset helped me spot patterns I hadn’t noticed before. The simulator mode also lets me replay trades with annotations, which makes reviewing my decisions feel more like coaching than just logging.

Customisation And Risk Management Settings

Simulating different account sizes, leverage ratios, and risk parameters is paramount. UK brokers must comply with FCA leverage caps, especially for retail clients (e.g., 1:30 for major forex pairs), so ensure the simulator lets you reflect realistic constraints.

You should also be able to set stop-loss, take-profit, and trailing stop strategies to train your risk discipline.

User Interface And Learning Curve

An intuitive interface matters. If a simulator is too complex or basic, it may not serve your learning goals. Ideally, the platform should feel similar to what UK brokers like IG, FxPro, or XTB provide.

A clean layout, access to charting tools (such as candlesticks and indicators like RSI or MACD), and easy order entry help mimic the live experience more effectively.

Mobile And Desktop Compatibility

Many traders use mobile platforms during commuting hours to track the overlap between London and New York. A trading simulator with desktop and mobile versions allows you to practice on the go, using the same environment as in real-life trading.

Cost, Access And Time Limits

Some simulators we’ve investigated are free, while others are time-limited or part of a subscription. If you’re testing over weeks or months, check whether the simulator restricts your access after a trial. Free simulators can offer great value, but make sure they don’t lock features behind a paywall.

Transition To Live Trading

Finally, think about your long-term plan. If you’re likely to open a live account, it helps if the simulator aligns with a broker you trust. Look for platforms where your progress, saved strategies, or preferences can carry over to a live UK-regulated trading account with minimal disruption.

By weighing these factors, you’ll choose a simulator that helps you learn the basics and gives you real-world preparation tailored to the UK trading landscape.

Bottom Line

The best trading simulators provide a risk-free way to gain hands-on experience and build confidence before trading with real money. They can help you practice strategies, understand market movements, and manage emotions without financial pressure.

By simulating real trading scenarios, you can refine your approach, test new ideas, and learn from mistakes—all in a safe, controlled environment. They’re an valuable tool for sharpening your skills and preparing for the live markets.

FAQ

Are Trading Simulators Free?

Many trading simulators are free, especially those that brokers offer as part of a demo account. These typically include real-time data and basic tools at no cost.

However, more advanced simulators—featuring historical data, backtesting, or multi-asset support—may require a subscription or a one-time fee. Always check for time limits or feature restrictions on free versions before committing.