Automated Trading

Automated trading, known also as algorithmic trading, involves programming a set of rules which a computer system follows to open and close orders on your behalf. Automated trading is offered by many platforms and apps in the UK, and investors can access major markets like forex and crypto using algorithmic strategies. Our guide explains how automated trading works and which brokers and software offer the service, including MetaTrader 4 (MT4).

Brokers with Auto Trading

-

Pepperstone ensured fast execution and reliability during algo testing, offering MT4/MT5, cTrader, and API connections with low-latency VPS. Slippage remained minimal across FX, indices, and commodities.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

IBKR excels in automation through its native APIs, such as TWS/IB Gateway, FIX, and Python. These allow direct strategy integration and deployment on third-party VPS. Tests show trades are executed swiftly and reliably across equities, FX, and futures.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our view, Eightcap facilitates easy EA deployment. MT4/MT5 integrations function seamlessly, while VPS ensures continuous system operation. Execution remains accurate for FX, commodities, and indices even under stress.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30

Safety Comparison

Compare how safe the Automated Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Automated Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Automated Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ |

Beginners Comparison

Are the Automated Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 |

Advanced Trading Comparison

Do the Automated Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Automated Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| eToro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

- eToro has enhanced its investment portfolio by frequently introducing new crypto assets. It currently offers a selection of over 100 digital currencies.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Automated Trading Explained

The simple definition: an investment strategy where clients set up a program of parameters like price and amount, which if met will trigger the execution of a specific trade.

For example, a trader could instruct the system to enter a long position of 50 lots of EUR/USD if it rises above 1.500, or to buy Google shares if the price falls lower than the 20-day moving average. In theory, automated trading results in a strategy based on data and not emotional sentiment, meaning that earnings may increase for both beginners and experienced investors. Systems are also able to monitor market volatility much more broadly, so can detect changes and respond more rapidly than a human.

Automated systems include Expert Advisors (EAs) and trading robots. Robots automatically place market orders based on the set algorithms discussed above. EAs offer the client trading signals, which are alerts about a potential order opportunity, that a user can manually act on or have the EA place automatically depending on their set-up. Copy trading is another form of automated investing that allows users to replicate the strategies and positions of successful traders.

To get started at home, clients should select an online broker that allows order execution with robots.

Markets

Algorithmic strategies can be used across the majority of markets that offer manual trading. It is particularly popular with forex brokers and in futures markets, though bots are also used with cryptocurrency exchanges, hedge funds, ETFs, CFDs, and for options and commodities. Automated stock and gold trading systems are also utilised at high volume, for example buying and selling on the ASX or NSE stock exchanges.

How To Create An Automated Trading Bot

Building an automated trading system requires coding knowledge, whether you start from scratch or use a program to help you. Robot software is readily available in the UK and many of those with positive reviews offer free trial periods. Artificial intelligence (AI) is also becoming widely used in automated trading software. You may also decide to hire a developer to create the program, which could match your requirements more closely but might carry extra expense compared to buying a robot directly.

An automated trading robot, or bot, can be created in any programming language – some users prefer Python as it can eventually allow your bot to use machine learning. However some platforms require the program to be written in a specific language, for example MetaTrader systems must use MQL.

Users should then pick a broker for automated trading, a choice which depends on the assets you wish to buy/sell and on whether they have an open-source API – this is critical for your bot to be functional. After selecting a host server for the bot, e.g. a cloud or even a Raspberry Pi, you are ready to start creating an automated trading system.

Automated Trading With Python

Many users choose to create their automated trading bot using Python. This language is prevalent in the algorithmic space as it gives access to excellent frameworks for using machine and reinforcement learning in the future. Programmers can usually find API documentation, e.g. for stock trading, using Python on Github.

Other languages like R and Java are popular in the development of bots. MATLAB and artificial neural networks have also been applied to generate these systems, and they can even be created from Excel.

Best Automated Trading Software & Brokers

Automated trading is now offered by a wide range of brokers and companies. Below we cover some popular choices.

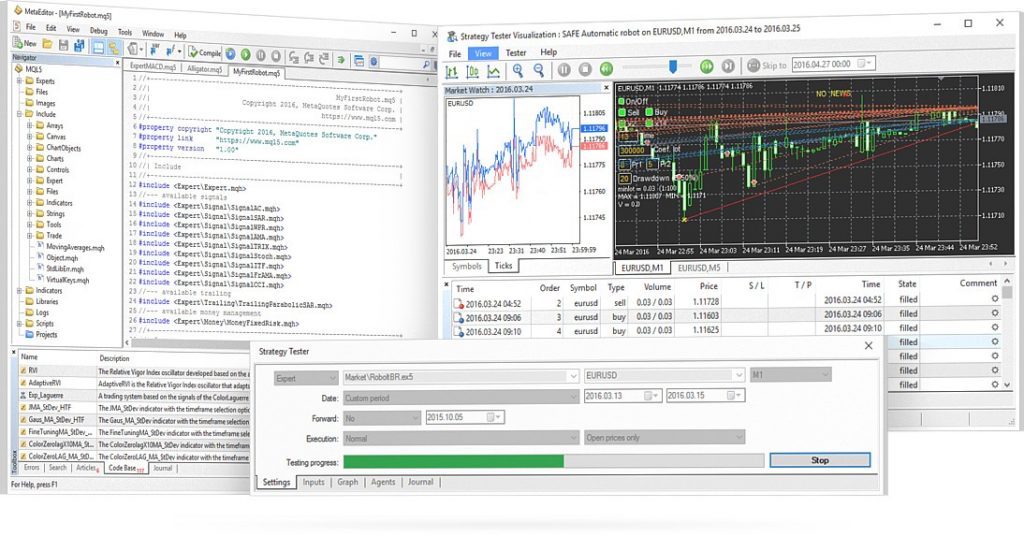

MT4

Automated trading in the MetaTrader4 (MT4) platform, as well as the updated MetaTrader 5 (MT5) solution, is performed using Expert Advisors (EAs). Clients can either buy EAs directly from the platforms marketplace or can opt to program their own bots using the system’s programming language, MQL4. Reviews for this software are generally excellent, and it often appears in top five lists for automated investing systems. Traders can find many tutorials and forums online to get started.

Potential users may also be interested in MultiCharts, a similar offering to MT4 that was created with algorithmic strategies in mind.

NinjaTrader

Regulated by the National Futures Association (NFA), NinjaTrader 8 is a dedicated platform for automated trading strategies. It allows clients to create or purchase systems, and then execute orders either with the NinjaTrader brokerage or another partner broker like TD Ameritrade. Traders can use the key aspects of NinjaTrader 8 free of charge, but may also choose to rent or own the platform to access more advanced features and lower commission rates.

Robinhood

Robinhood is a platform where clients can trade stocks, ETFs, or options commission-free and with no account minimum. Building an automated trading system in this platform requires an API, which is available from the firm in Python via Github. Potential clients with little coding experience should note that automated trading on Robinhood appears to have no technical support from the firm, and may be better suited to advanced programmers.

Zerodha

The Zerodha technology suite includes several trading platforms, which offer free equity delivery and mutual fund investments alongside stocks, futures and options. Fully automated trading using Zerodha is possible using the online Kite platform with the Kite Connect API, available on Github. The firm provides an in-depth video tutorial on their website. Traders can also install Zerodha Pi, the software platform offering, to access additional features.

Interactive Brokers

Interactive Brokers is regulated by the Financial Conduct Authority (FCA) and advertises the lowest costs in the industry. The firm also offers its own desktop platform named Trader Workstation (TWS), and a trading app for iPhone and Android called IBKR Mobile.

Several programming languages including Java and DDE for Excel are supported on the TWS API, which is the connection that makes automated trading with Interactive Brokers possible. The broker also offers Capitalise.ai, a subscription that allows traders to generate algorithmic strategies without coding.

Thinkorswim

Clients with TD Ameritrade can use the thinkorswim platform to make trades on a wide array of assets including stocks, options, and ETFs on a commission-free basis, plus futures, forex, and mutual funds. Automated trading is possible with the algorithm panel in thinkorswim, which is used for selecting trigger conditions, and more complex strategies can be achieved by writing manual code.

TradingView

TradingView is a social trading network for stocks, futures, and forex markets. Clients can start automated trading on TradingView by creating a bot in the PineScript language, with a set of predefined conditions. The bot can then be automated with the Wunderbit Trading platform by connecting to the API and linking the bot with a TradingView signal.

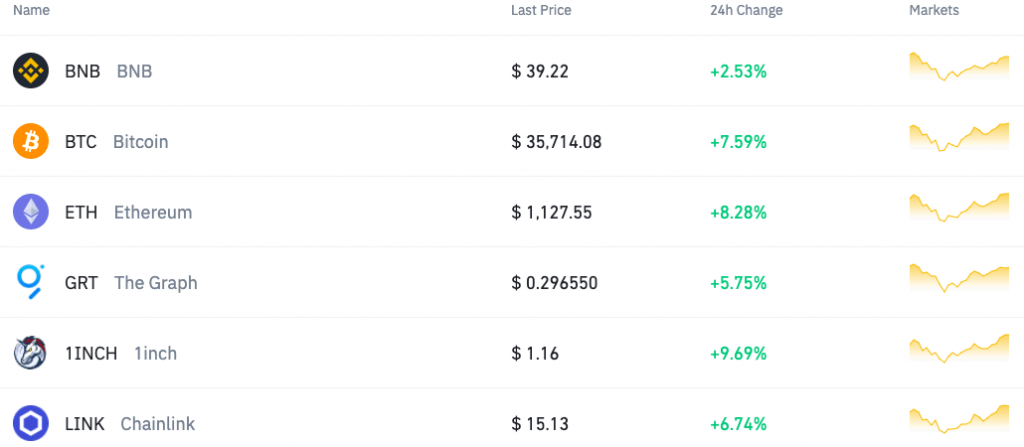

Cryptocurrency Exchanges

Automated trading robots and platforms for cryptocurrency such as Bitcoin and XRP are particularly popular, as the crypto asset market runs 24/7 and system bots can also operate round the clock. Automated Bitcoin trading in the UK is done on exchanges such as Binance, Coinbase Pro, and Kraken – clients have access to established bots like Cryptohopper or 3commas if they do not wish to create their own. These bots cost around $20 per month, often require no installation, and can even alter the automated trading strategy based on market news.

Other Brokers

Many more brokers offer automated forex and stock trading with at least a public API – these include IG, eToro, and XTB. Brokers that offer useful tools such as a trading journal to keep track of algorithmic investments are beneficial.

Automated Trading Strategies

Time-Series Momentum/Mean Reversion

This concept, sometimes called trend-following, involves using the past price return of an asset to predict its future values. In time-series momentum, it is expected that the future price will follow the same trend as previously observed, and in mean-reversion it is anticipated to go in the opposite direction.

Dollar-Cost Averaging

This strategy involves investing money into an asset bit by bit instead of all at once, to reduce the effect of volatility. By using smaller and similar amounts periodically, you could avoid investing all your capital at high price points.

Day Trading Automation

Many day trading approaches can be automated, including popular systems like the gap-up momentum strategy. This idea is used when a financial instrument opens considerably higher or lower than it closed on the previous day, which generates momentum that can be exploited as not all instruments will keep rising.

Clients can evaluate the viability of their automated trading strategies using backtesting, which applies the set parameters to previous market data.

How To Start Automated Trading

Clients should start by selecting a broker, and taking into account how much automation they want readily available. For example, Interactive Brokers clients can create automated strategies without involving any code, whereas traders with brokers like Robinhood would have to be experienced in programming languages to use algorithmic methods.

After signing up with the chosen broker and depositing funds, your strategies can be operational straight away. Beginners might first consider copy trading, which is an automated form of execution that copies the orders of other investors with a successful track record. This does not require the more complex set up of a trading robot and may make clients more comfortable with the risk associated with an automated process.

It’s also worth checking out the multiple books and online courses available to get a boosting approach to automated trading.

Pros Of Automated Trading

- Reduces emotional impact – where humans may become hesitant after losing trades or over-confident after winning, bots simply adhere to the predetermined criteria and execute orders when these are met

- Faster and simultaneous order execution – bots can place trades more rapidly than humans, operate 24/7 and execute multiple orders at once which is critical in fast-moving markets

- Backtesting – applying the strategy you have developed to historical data allows you to assess the validity of the set parameters, which can help to improve profits by fixing issues before trading with real funds

- Diverse portfolio – as bots can monitor several assets, markets, and strategies at once it encourages the traders’ portfolio to widen and also mitigates risk as capital is spread over many instruments

- Legal – UK laws do not prohibit the use of automated trading strategies

Cons Of Automated Trading

- Monitoring still required – automated systems are vulnerable to IT issues like internet crashes just as a computer operating manual trading would be, and as such should be monitored so any problems can be rectified swiftly

- Needs technical knowledge and experience – automation requires considerable trading and programming expertise, and it is best to consider especially as a beginner whether it would be beneficial compared to manual strategies

- Perfecting strategies in backtesting – testing your automated system and adjusting it to be entirely profitable based on previous market data is not a guarantee that it will fare well as a live strategy, and so initial automated trades should always be relatively small

Final Word On Automated Trading

Automated trading systems, or bots, work by adhering to a pre-programmed set of parameters and will execute orders if the parameters are met. Markets like cryptocurrency and forex are popular with these algorithm bots, alongside platforms such as MT4. Bots can be created from scratch using languages like Python or can be purchased and optimised using software. Although these strategies remove the human emotional aspects of trading and can execute orders simultaneously 24/7, they require a lot of technical expertise, and orders must still be checked frequently.

FAQs

How Does Automated Trading Work?

Algorithms follow pre-defined instructions to scan the financial markets and execute trades based on specific criteria. This allows for the automatic opening and closing of trades in line with a trader’s specific strategy. Online systems still need careful development and monitoring.

What Types Of Automated Trading Systems Exist?

Automated trading algorithms can follow different strategies, from following detailed technical analysis to acting upon major news events. Copy trading is also a form of automated trading that will see the positions and strategies of successful investors automatically followed.

Is Automated Trading Legit?

Yes, automated trading is a legitimate way to invest in the financial markets. In fact, up to 80% of certain markets, such as FX, are thought to be automated. Institutional investors, in particular, use sophisticated algorithms to approach the markets. Retail traders are quickly realising its potential too.

How Do I Start Automated Trading?

To get started automated trading, you’ll first need to sign up with a broker that offers auto trading. You can then buy pre-built expert advisors or trading bots. Alternatively, you can use software, such as MT4 and MT5, to build, test and deploy your own trading algorithms.

Will Automated Trading Make Me Money?

Automated trading is no shortcut to profits. Algorithms still require careful development and monitoring. The bots are only as good as the humans that have designed them. Left to their own devices without the proper supervision, trading bots can accumulate losses. It’s therefore important to have a careful risk management strategy with alerts and halts in place.

Should I Start Using Automated Trading?

Automated trading isn’t for everyone. However, for those with established manual strategies that want to automate to save time and increase volumes, it could work. Buying established trading bots may also suit beginners who don’t have time to analyse the markets and want to see how successful strategies operate and perform on the forex market, for example.