IG Review 2026

IG is a trustworthy, FCA-regulated brokerage, dealing in CFDs, forex and shares. As one of the leading UK brands, IG offers a wide range of trading instruments and investment vehicles including ISAs and Smart Portfolios. This IG review unpacks the different products available. We also assess IG’s trading platforms and apps, investing fees, research tools, accounts, and minimum deposits.

IG is a top-rated trading platform in the UK. The award-winning brand offers significantly more instruments than competitors, alongside low fees and 24-hour customer support. With an excellent reputation and an intuitive platform, IG is a great option for both beginner traders and experienced investors.

Accounts

IG offers two trading accounts (CFD and Spread Betting) and two investment accounts (Share Dealing and Smart Portfolios). Premium/VIP accounts are also available for high-volume traders.

Trading Accounts

The trading accounts give you access to over 18,000 derivative markets across forex, commodities, indices and stocks.

We liked that both accounts offer hedging capabilities, negative balance protection, and access to state-of-the-art platforms. We also rated that minimum spreads in both accounts start from 0.6 points on major forex pairs, which is competitive.

In addition, our team were pleased to see that IG offers round-the-clock support, from 8:00 am on Saturday to 10:00 pm on Friday. Another useful bonus is that traders get free access to IG’s Trading Academy, catering to all skill levels.

We have broken down the key features and differences between the accounts below:

CFD Account

- No stamp duty, but may be liable for capital gains tax

- Direct Market Access (DMA) on shares

- Hedge other assets in your portfolio

- Commissions only on shares

Spread Betting Account

- No capital gains tax or stamp duty

- Out-of-hours trading available

- Bet in chosen currency

- Commission-free

Note, joint accounts are also available.

Investment Accounts

Investment accounts at IG offer an impressive list of 12,000+ shares, ETFs and investment trusts with the benefit of dividend adjustment payments on certain stocks. IG’s share dealing account and Smart Portfolios are available via the broker’s proprietary platform or dealing software.

Both accounts also give you the option to open an Individual Savings Account (ISA), which means you can benefit from tax-free investment gains of up to £20,000 per year. The best part is that you can open both an IG Smart Portfolio and a share dealing ISA, allowing you to move money freely between each account. Alternatively, set up a Self-Invested Personal Pension (SIPP) and save for retirement.

We also like that, unlike other competitors, you are permitted to withdraw money at any time for free.

One downside is that IG Markets does not offer Junior ISAs. With that said, our team were still pleased to see that each investment account comes with access to 24-hour support and IG’s team of investment experts.

Share Dealing Account

- Self-directed investing in 12,000+ shares, ETFs and trusts

- Proprietary platform and mobile app, and L2 Dealer

- Out-of-hours trading available

- £3 commission per UK share

Smart Portfolios Account

- Fully managed investing in diverse portfolios (iShares ETFs from BlackRock)

- Markets include government bonds, emerging markets and property

- Average total fees of 0.72% (free for portfolios over £50,000)

- Proprietary platform and mobile app

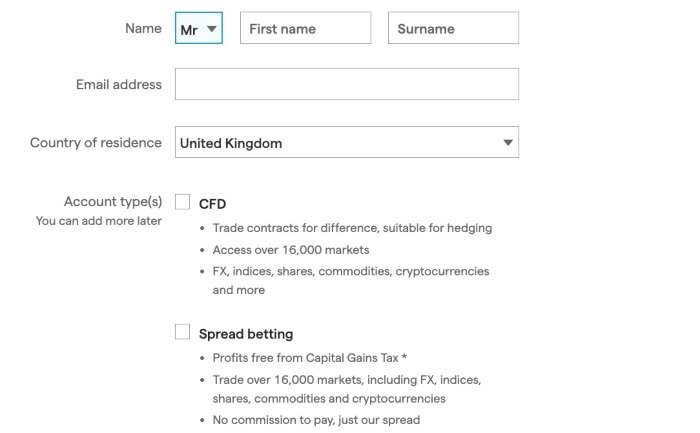

How To Open An IG Account

We found it quick and easy to open an IG account:

- Open the account registration form at IG

- Fill out your basic profile information and verify your nationality

- Choose which account/s you wish to open

- Complete the personal and financial details sections (you won’t need your bank details until after account creation)

- Fill out your current trading experience

- Agree to the terms and conditions and submit

- After receiving a confirmation email, you can access your live account and use your Windows app, desktop or mobile to login to your dashboard

Our team also appreciated that opening an account is free and there is no pressure to deposit funds until you are ready to trade.

Payment Methods

Deposits

Deposits at IG can be made via a personal debit/credit card, PayPal or bank transfer. Non-UK cards will incur a charge of 1.5%. Deposits can also be made via the same options over the mobile apps.

Successful card payments are deposited immediately, whilst bank transfers can take up to 3 working days to process.

We were disappointed to see that there is a minimum deposit of £250 if you use bank cards and PayPal, which is quite steep when compared to CMC Markets which do not require a minimum. With that said, there is no minimum deposit for bank transfers at IG.

Maximum deposit limits depend on the method but start at £25,000 for PayPal.

Withdrawals

Withdrawals at IG are free and available via the same methods as deposits. Our experts found that there is a minimum withdrawal amount of £100 per day.

Withdrawals to cards are typically processed between 2 to 5 working days, whilst bank transfers have a turnaround time of up to 3 days. PayPal is usually processed immediately, or within 1 working day.

Note that withdrawals requiring a currency conversion will be subject to a 0.5% conversion charge. There is also a £15 fee for any same-day withdrawals less than £100.

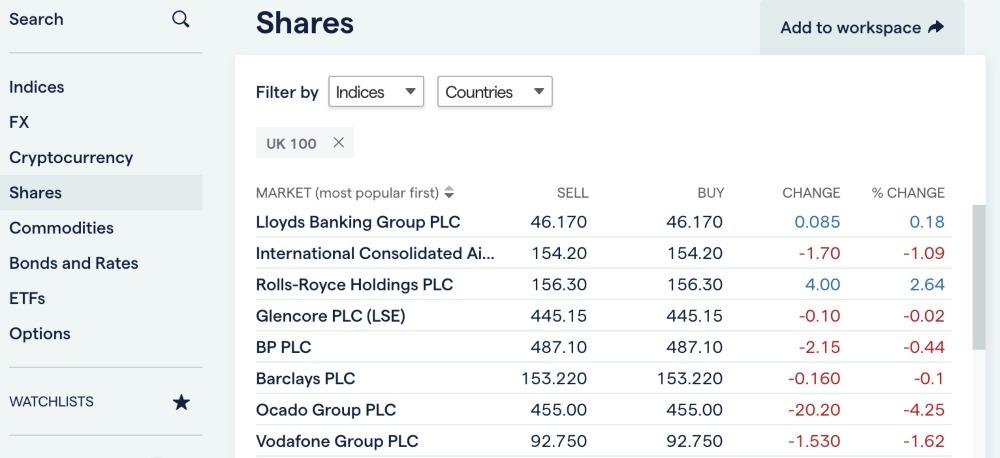

Market Access

IG’s selection of markets is vast, with over 18,000 forex, commodities, shares, bonds, ETFs, IPOs and more. The offering is impressive vs other major players including CMC Markets (11,000+) and City Index (13,500+). In fact, it is difficult to match IG in terms of market access.

Popular instruments include:

- Forex – Trade major forex pairs with IG’s CFD or spread betting accounts, including EUR/USD and USD/JPY, plus minors and exotics including EUR/CHF and USD/MXN.

- Indices – Over 80 world indices, plus weekend trading available on key indices including FTSE100, Dow Jones and Nikkei 225. You can also gain exposure to IG’s volatile markets, including the Volatility Index (VIX) and EU Volatility Index (VSTOXX)

- Commodities – Speculate on 35 commodities across precious metals, energies and agricultural markets such as Gold, Silver, Brent crude oil and sugar prices

- Shares – Short-term trading or long-term investment on thousands of UK, US and international stocks including Apple and Tesla. Out-of-hours trading is also available

- ETFs – Diversify your portfolio with over 5,000 ETF markets spanning indices, currencies, commodities and industry sectors. Popular ETFs include the iShares Core S&P 500 ETF and the Vanguard FTSE 100 UCTIS ETF. Thematic baskets are also available, including ESG stocks or cannabis stocks

- Futures – Trade futures prices on indices, commodities and bonds via IG’s CFD or spread betting accounts

- Options – Explore CFDs and spread bets on flexible forex, index and equity online options with daily, weekly, monthly or quarterly timeframes

- IPOs – IG lets you trade pre-IPO, as well as during and after the IPO, with exposure via IG’s ‘grey market’, primary market, or secondary market. Interesting opportunities include ByteDance (TikTok) IPO and BrewDog IPO

- Bonds – Trade on leveraged derivatives such as government bonds futures, or invest in bond ETFs tracking government or corporate bonds

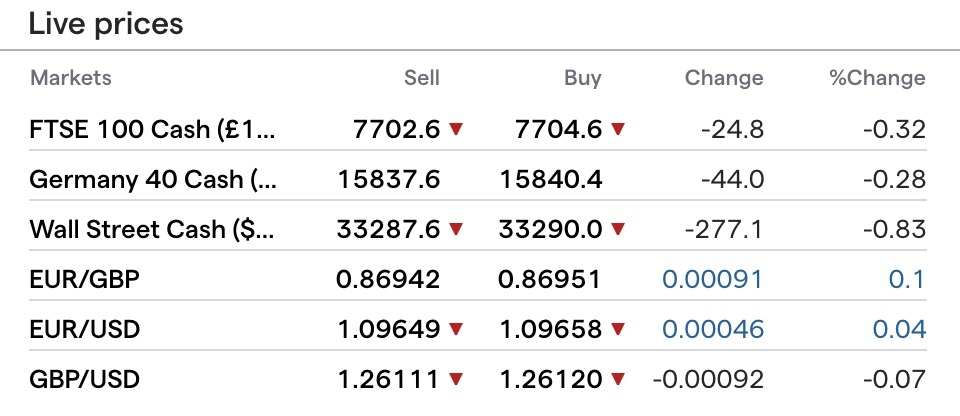

- Spot – IG offers almost all markets on the spot, including spot forex and commodities such as EUR/GBP, gold and natural gas, as well as cash indices such as Wall Street (DJI) and S&P 500 (SPX)

IG Fees

IG are transparent about its trading fees, with all market information fully accessible on the website. All CFD and spread betting fees are reflected in the spreads, except for share CFDs where you only pay a commission.

You can expect minimum CFD spreads from 0.6 pips on major forex pairs and 1 point on major indices. When we used the platform, we were offered a spread of 0.9 points on EUR/USD. This is competitive since the minimum spread for the same pair at XTB is 0.8 pips, for example.

IG commissions on share CFDs are typically from 0.10% per side on UK and EU shares, and 2 cents per side on US shares. Again, this compares well with alternatives. Standard and mini lot sizes are also available on all CFD trades.

For spread bets, minimum bet sizes depend on the asset traded but range from 50p to £1 for currency pairs.

Our experts did find that a £12 monthly inactivity fee applies to accounts left inactive for 2 years or more, which is reasonable compared to other brands.

Other potential charges to be aware of at IG include overnight rollover charges, currency conversion fees, guaranteed stop premiums, and borrowing fees on shorting stocks.

Trading Platforms

Our team were impressed with IG’s wide selection of tools, making the broker more beginner-friendly vs similar brands such as Interactive Brokers and Plus500.

IG offers two proprietary platforms (a core online trading platform and the Progressive web app) and three specialist third-party platforms (ProRealTime, MetaTrader 4 and L2 Dealer).

IG Online Trading Platform

IG’s core web-based trading platform offers impressive customisation and analysis features, comparable with market leaders such as MetaTrader 4. When testing the platform, we found the interface clean, stable and easy to navigate. We like that you can use multiple workspaces whilst also carrying out actions easily in just a few clicks.

Compared to other proprietary platforms we use, the analysis tools within IG’s core platform are excellent. The platform comes with news and market analysis integrated from Twitter, Reuters and in-house analysts. The unique ‘IG Live’ feature is also a bonus for us, offering exclusive coverage of major events, live and on-demand.

Other key technical features include:

- 32 technical indicators and 19 drawing tools

- Trade directly from charts using Deal Ticket

- Access spread bets, CFDs and share dealing

- Four timeframes and five chart types

- Custom automatic price alerts

Progressive Web App (PWA)

IG’s PWA platform is another browser-based system with additional access via a mobile app. The app allows global investors to trade seamlessly, while still offering the intuitive features found in the web platforms.

Like the web platform, IG’s PWA app is user-friendly with good functionality. The charting package is also comprehensive and customisable. The only downside is the lack of an integrated newsfeed and signals.

MetaTrader 4 (MT4)

IG Markets also offers the renowned MeTaTrader 4 platform, available to download for free, or as a web and mobile app. The platform’s charting capabilities are largely unmatched, with advanced custom technical indicators plus thousands of additional tools and robots within the online marketplace.

In addition to the standard package of MT4 indicators, IG provides six free indicators, including pivot points, as well as 12 add-ons including stealth orders and sentiment trader. An MT4 VPS is also available for those who meet minimum capital requirements. We would recommend this for active traders deploying intraday strategies.

The main downside is that you don’t get access to the Reuters live news feed or an economic calendar, which are only available on the other platforms at IG.

- 30 built-in technical indicators, a range of drawing tools, plus 18 free add-ons from IG

- Automated trading capability with Expert Advisors (EAs)

- 9 chart timeframes, from 1 minute to 1 month

- Analysis and alerts from Autochartist

- Historical price data

ProRealTime

The ProRealTime platform at IG is ideal for technical, high-volume traders and is available to download onto PCs. The platform offers advanced automation capabilities where you can build your own algorithms. We also like that you can trade based on automatic trend lines, which are updated every 5 minutes with the ProRealTrend feature.

The platform also boasts an intuitive Options trading function which allows you to sort call and put options by specific criteria and compare scenarios across different prices.

Note that the platform is only free if you transact at least four times per month. Otherwise, there is a monthly charge of £30.

- Integrates with IG’s trading platform

- Fully customisable layout and chart views

- 100+ technical indicators

- Strategy backtesting

- Pro-screener tool

L2 Dealer

The L2 Dealer downloadable platform is designed for advanced share dealing and CFDs. Traders get Direct Market Access and deep liquidity on forex and shares, plus OTC deals on a range of other markets including indices and commodities.

Automated trading is not facilitated, but you do get algorithmic orders, plus a vast range of professional order types including ‘Algo trades’, ‘tranche orders’ and ‘good till cancel’.

Note that this is a professional trader account with a £1,000 minimum balance requirement, so beginners are advised to use the IG core platform or MT4.

- Smart order routing from Tier 1 banks

- Access to cryptocurrencies

- Watchlists and price alerts

- Full market visibility

- Bloomberg add-on

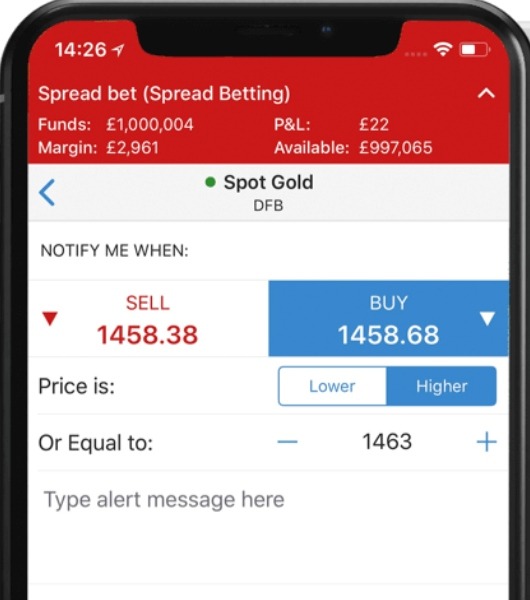

IG Mobile App

IG’s award-winning platform is also available as a free mobile app, available on iOS and Android devices including iPads and tablets. The app offers one-click dealing capabilities so you can open, monitor and close positions directly from charts. You can also edit positions including stops and limit orders in a few taps.

Overall, we found IG’s mobile interface clean and refined, with all major functions and markets easily accessible using the widgets. The broker has also received generally positive ratings on the iPhone App Store with customers noting the app’s ease of use, though there are some complaints regarding app glitches.

- Trailing and guaranteed stops and advanced order types

- Set push notifications for price alerts

- Real-time pricing and market data

- Integrated economic calendar

UK Regulation

IG Group is regulated in all jurisdictions in which it operates. As a result, our experts are comfortable that the firm is legitimate and trustworthy.

IG Markets Ltd and IG Index Ltd are authorised and regulated by the UK’s Financial Conduct Authority (FCA) under license numbers 195355 and 114059, respectively. The FCA have strict requirements regarding client money and assets. This means client funds are strictly ring-fenced from creditors and held in segregated custodian bank accounts such as Barclays and Lloyds.

In the unlikely event that the company goes into liquidation, traders are entitled to up to £85,000 in compensation, as per the Financial Services Compensation Scheme (FSCS).

The broker is also legally required to offer negative balance protection to all retail traders, which means your IG account can never fall below zero.

Overall, our team are confident that IG clients receive the highest standards of financial protection.

Leverage

IG’s spread bets, CFDs and options are leveraged derivatives, meaning you can open a position worth more than what you deposit. The broker uses tiered margin levels, which differ per asset. Your platform will factor this in when you open a position.

Investors should note that gaining exposure to the markets in this manner can magnify your profits but can also lead to significant losses.

As per regulations set by the FCA, leverage ratios at IG are limited to 1:30 for retail traders or a 3.33% margin.

- Commodities – 1:20

- Indices – 1:20

- Forex – 1:30

- Shares – 1:5

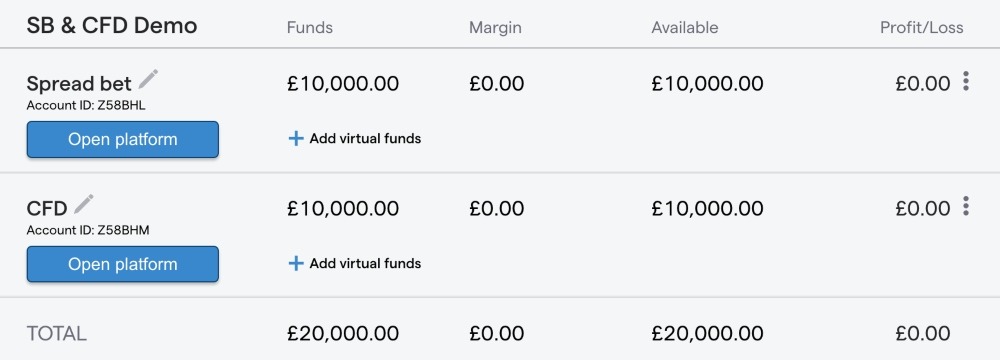

Demo Account

We were pleased to see that free demo accounts are available on all IG retail platforms. You can sign up and login within minutes.

Demo accounts essentially simulate real market environments and allow you to practice trading without risking any capital. IG demos come with a pre-loaded virtual balance of £10,000.

Much of the functionality is the same, such as real-time quotes and advanced charts. With that said, trades made through demo mode are not subject to slippage, interest adjustments or out-of-hours pricing.

We liked that with the MT4 demo, you also get access to the same technical indicators and customisable add-ons that you would get in a live account.

Research & Education

Trading education and market research resources are substantial. While using IG, we were impressed with the volume of training tools available for beginners, as well as experienced traders.

Notably, the IG Academy is an excellent resource centre, offering free online courses and a library of tutorial videos, webinars and seminars. Courses cover anything from financial market basics to trading options with CFDs. I also like that you can book free live sessions via the IG website.

The news section is vast and updated daily, with articles offering a good level of detail and analysis of the markets. Social media-savvy traders can also follow the broker’s market insights on Twitter, or sign up to ‘The Week Ahead’, a weekly calendar and expert analysis of upcoming events and price levels to watch. There are also special reports and guides on interesting or topical subjects, such as the psychology of trading.

For traders who want to learn on the go, IG offers a series of podcasts covering a range of topics, from common trading mistakes to investing in cannabis stocks.

Analysis Tools

IG’s classic platform comes with a trading analytics tool, where you can get a personalised trading report of your trades, including a breakdown of profit/loss ratios, win rates and costs of adjustments. I was impressed by the useful profit and loss chart summary, which helps you identify trading mistakes.

Our team was also pleased to see free trading signals on IG’s platform, which identifies buy and sell suggestions based on emerging chart patterns. Signals originate from two reputable third parties, Autochartist and PIA-First. The best part is that signals are accessible on both the mobile app and web platform, so you can get seamless trade insights from wherever you are.

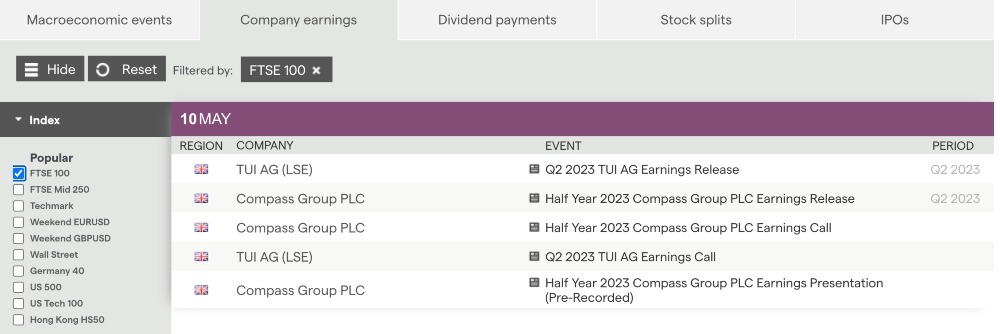

In addition, we liked the selection of calendars, including economic, company reports, and dividends. Overall, our team find that IG’s resources and trading analysis is superior vs competitors such as FXCM.

Company Details

Founded in 1974, IG Index Limited and IG Markets Limited are the brand names of IG Group Holdings PLC. The company’s headquarters is in London, though it also has 15 other locations around the world, including South Africa, Singapore, Australia and Germany.

IG has a strong presence and reputation as a financial services provider in the UK, being a FTSE 250 company with robust licensing from the FCA. The company is listed on the London Stock Exchange (ticker symbol: IGG).

The brand’s number of employees exceeds 2,500, who provide services to over 300,000 clients worldwide. The CEO is June Felix.

Trading Hours

IG offers some of the most accessible trading hours for major assets, with out-of-hours trading and weekend hours available on certain markets including EUR/USD and Germany 40 (DAX).

Specific trading hours for certain markets depend on the relevant exchange. The good news is, some forex trading is available around the clock since currencies can be traded in multiple locations.

For example, forex market opening times are 9:00 pm on Sunday to 9:59 pm on Friday (UK time). For indices, 24-hour dealing is available from 11:00 pm on Sundays to 10:00 pm on Fridays (UK time) for major indices such as FTSE 100 and NASDAQ.

IG will publish market holiday hours on the website.

Customer Support

Our team are always satisfied with the reliability of IG’s customer support and other reviews are also generally positive online. Problems are dealt with promptly via telephone, email, and live chat. When we test the live chat feature at IG, responses are typically received in 1 minute. The broker is available from 8:00 am to 6:00 pm (UK time) Monday to Friday.

IG Group’s UK contact details are:

- Telephone number – 0800 195 3100

- Email address– newaccountenquiries.uk@ig.com

- Live chat – Located in the bottom right of the home page

- IG social media accounts – Facebook, LinkedIn, Twitter, YouTube and Instagram

- London office address – IG Group, Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA

Another excellent feature is the broker’s community forums, where you can find relevant support from other traders and IG staff. There is also a comprehensive FAQ section covering topics including how to withdraw funds, how to close an account or how to set rollover rules.

Safety

We are confident that traders will receive top-quality security protections on their client dashboards and trading accounts. IG uses industry-standard web security, including 256-bit SSL encryption on all transactions between servers and client accounts, and two-factor authentication upon login.

The broker also segregates client funds in Tier 1 custodian banks, so you can be assured that your funds are kept separate from the broker’s assets.

Should You Trade With IG?

IG is a solid spread betting, CFD and share dealing broker with a strong reputation and robust FCA licensing. With thousands of markets across forex, indices, commodities and shares, as well as Smart Portfolios and ISAs, our team are confident that investors will have no shortage of opportunities. In addition, beginners and experts alike can take advantage of the IG Academy and the vast range of market analysis tools.

FAQ

Who Are The IG Group?

IG Markets Ltd, IG Index Ltd and IG Trading and Investments Ltd are trade names of IG Group, a UK-based financial services provider offering spread betting, CFDs, share dealing and investment products. The company offers over 18,000 products across forex, indices, commodities, stocks, ETFs and more. The company’s head office is located in London.

Are IG Group Regulated?

IG Group and its associated trading names are regulated by the UK’s Financial Conduct Authority (FCA). This means the broker must adhere to strict client money and asset rules to protect customers, which includes using segregated accounts. Additionally, traders receive negative balance protection in all retail accounts and are entitled to compensation under the FSCS.

What Investment Products Are Available At IG?

IG offers two investment accounts: Share Dealing and Smart Portfolios. Share dealing is self-directed investing where you can buy and sell stocks outright, whilst Smart Portfolios are fully managed portfolios of ETFs. Both accounts give you the option to invest in an Individual Savings Account (ISA).

Is IG Good For Beginners?

IG’s vast asset selection, good choice of investment products and user-friendly platforms make the broker a best pick for beginners. There are plenty of educational resources within the IG Academy, including podcasts, live seminars, webinars, trading courses and a glossary with key trading terms explained.

Does IG Offer Low Trading Fees?

In most cases, IG’s fees are included in the spread. These charges apply to all CFD markets except shares. For example, average spreads for major currency pairs such as EUR/USD are around 1.04 pips. UK share CFDs are charged a 0.10% commission per side, whilst US shares cost 2 cents per share. Other applicable charges may include inactivity fees, guaranteed stop costs, or fees for rolling over positions. Overall though, IG offers relatively low fees compared to alternative brokers.

What Does DFB Mean At IG?

A Daily Funded Bed (DFB) is a term used in spread betting referring to an open position that remains open until you decide to close it. Interest adjustments are applied every day that the position remains open. A DFB has a long expiry date and therefore differs from a forward spread bet, which expires after a set time.

Is IG A Market Maker?

Yes, IG is a market maker brokerage, which means you deal directly with IG when you place trades over a dealing desk. This also means spreads are typically wider than at ECN brokers. With that said, access to deep liquidity pools and zero commission on most assets keeps spreads competitive at IG.

Article Sources

Top 3 IG Alternatives

These brokers are the most similar to IG:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- CMC Markets - Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

IG Feature Comparison

| IG | Pepperstone | Interactive Brokers | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.5 | 4.8 | 4.3 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

68% of retail CFD accounts lose money. |

|

| Review | IG Review |

Pepperstone Review |

Interactive Brokers Review |

CMC Markets Review |

Trading Instruments Comparison

| IG | Pepperstone | Interactive Brokers | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | Yes | No | No |

| Futures | Yes | No | Yes | No |

| Options | Yes | No | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | Yes | Yes |

| Warrants | Yes | No | Yes | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | Yes | Yes | No | Yes |

IG vs Other Brokers

Compare IG with any other broker by selecting the other broker below.

Popular IG comparisons:

|

|

IG is #11 in our rankings of CFD brokers. |

| Top 3 alternatives to IG |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA |

| Trading Platforms | MT4 |

| Leverage | 1:30 (Retail), 1:222 (Pro) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, Mastercard, PayNow, PayPal, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities | Aluminium, Cannabis, Cattle, Coffee, Copper, Gold, Iron, Lean Hogs, Lithium, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Precious Metals, Silver, Soybeans, Steel, Sugar, Wheat |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.9 |

| CFD Oil Spread | 2.8 |

| CFD Stocks Spread | 0.02 |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.9 |

| Assets | 80+ |

| Currency Indices | USD |

| Crypto Coins | AAVE, ADA, APT, ARB, AVAX, BCH, BTC, CRYPTO10, DOGE, DOT, EOS, ETH, HBAR, ICP, LINK, LTC, NEAR, NEO, ONDO, PEPE, POL, SHIB, SOL, SUI, TIA, TON, TRX, UNI, XLM, XRP |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |