Best Credit Card Brokers 2026

Using a credit card to fund your trading account can feel convenient. It’s quick, most people already have one, and you don’t need to set up anything extra. But in the UK, there are specific rules, limits, and costs that make it less straightforward than it looks.

Find the best brokers that accept credit card deposits in the UK, along with the key considerations.

Top Credit Card Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Credit Card Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Credit Card Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Credit Card Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ |

Beginners Comparison

Are the Best Credit Card Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Credit Card Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Credit Card Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| Vantage FX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- The trading firm provides narrow spreads and a clear pricing structure.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

How Investing.co.uk Chose the Best Brokers That Allow Credit Cards

We verified that each shortlisted platform accepts credit card deposits by checking cashier portals and, where needed, confirming with customer support.

Brokers were then ranked by our overall ratings system, which covers more than 200 factors — including accepted payment methods, deposit and withdrawal speed, trading costs, platform reliability, and FCA regulatory strength.

Trading Rules With Credit Cards

The first thing to understand is regulation. In 2020, the Gambling Commission banned the use of credit cards for gambling in the UK.

The ban included spread betting and many CFD accounts, since these products are high-risk and often treated like gambling.

What this means in practice:

- If you want to trade CFDs in the UK, you usually cannot fund your account with a credit card.

- If you’re trading regular stocks, ETFs, or certain forex products, some brokers still allow credit card deposits.

So, whether you can use your card depends on the type of account you’re opening. Don’t assume all brokers will treat deposits the same way.

[tCheck their funding page or ask for support directly. If they avoid giving a straight answer, that’s a warning sign.

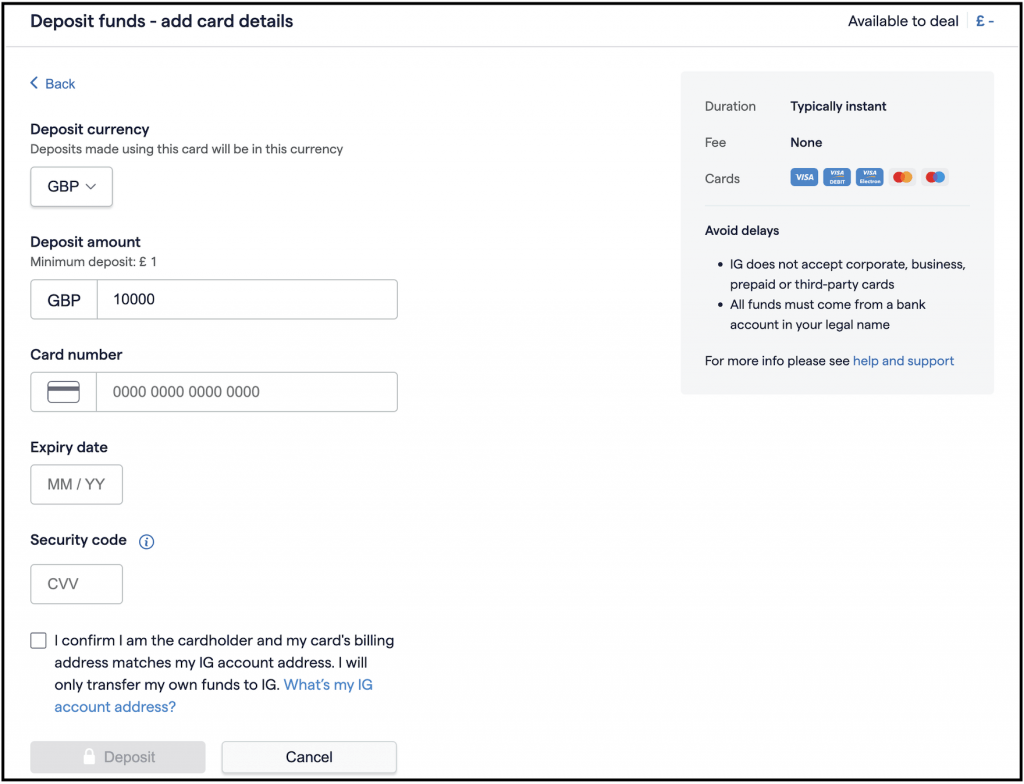

IG lets you fund your account with a credit card in just a few clicks

Deposit Fees From Brokers

Most brokers charge a fee for card deposits. The cost can be a flat charge, but it’s more often a percentage of the deposit. A rate of 1%–3% is standard. That doesn’t sound like much until you’re putting in larger sums.

If you deposit £2,000 and the broker charges 2%, that’s £40 gone straight away. Over multiple deposits, this adds up.

Some brokers advertise ‘no deposit fees,’ but always read the fine print. Sometimes they absorb the fee for debit cards but still pass it on for credit cards. Others waive the fee only for deposits above a specific size. Don’t rely on assumptions—confirm the exact cost.

Cash Advance Fees From Your Bank

Even if the broker doesn’t charge you, your card provider might. We’ve seen that many UK banks treat deposits to brokers as ‘cash advances.’ That comes with:

- A fee, usually around 3% of the deposit.

- A higher interest rate than for regular purchases.

- No grace period, meaning interest begins to accrue immediately.

This can make credit card funding far more expensive than it looks. Imagine you deposit £1,000, and your card charges a 3% cash advance fee. That’s £30 before you’ve even placed a trade. If you don’t clear the balance promptly, interest will also begin to accumulate.

The only way to know for sure is to check your card’s terms or call the provider. Ask them specifically how they treat payments to trading brokers.

Withdrawal Rules & Limits

Depositing with a card is one thing. Getting your money back is another. Many brokers only let you withdraw to the card up to the amount you originally deposited.

For example, say you deposit £500 with a credit card, make £200 profit, and then request a £700 withdrawal. Often, only £500 will go back to the card. The remaining £200 has to be withdrawn by bank transfer. That can slow things down, since bank transfers usually take longer to process.

Other brokers don’t allow card withdrawals at all. They may accept your card for deposits, but insist all withdrawals go through your bank account. This isn’t always a deal-breaker, but it’s worth knowing upfront so you don’t get caught off guard.

Funding Speed

The main reason traders use cards is speed. UK bank transfers with Faster Payments are usually quick, but not always instant. Sometimes they take a few hours, or even until the next working day.

Credit card payments usually appear in your account within minutes. That can make a significant difference if you need to move quickly and open a trade immediately.

But not every broker processes card payments around the clock. Some only credit your account during working hours. If you plan to fund your account late at night or over the weekend, test it with a small deposit first.

Currency Conversion Costs

If your broker’s account is in USD, and your credit card is in GBP, you’ll pay conversion costs. There are usually two parts to this:

- The broker’s exchange rate when converting your deposit.

- Your bank’s foreign transaction fee is often 2%–3%.

It doesn’t take long for these fees to eat into your balance, especially if you deposit and withdraw often.

If possible, choose a broker that offers GBP-denominated accounts. That way, you avoid double conversion and keep costs down.

Deposit Limits

Both your credit card and the broker may limit the amount you can deposit. Some brokers only allow a few thousand pounds per day to be charged to a card. Others set monthly limits.

If you plan to trade with larger sums, these limits may be too restrictive. In that case, bank transfers are usually a better option. They’re built for higher amounts and rarely come with extra costs.

Security & Regulation

Card payments are generally safe, but it’s still advisable to closely examine the broker’s safeguards. Always check that the broker is FCA authorised. This means they adhere to UK financial regulations, and your funds are protected under client money rules.

Additionally, ensure the broker utilises secure, encrypted payment systems. A trustworthy broker will never ask you to email card details or send payments to an individual’s account. If anything feels off, don’t proceed.

The Risk Of Using Credit

The biggest issue with using credit cards for trading isn’t the broker—it’s the debt that accumulates. When you deposit with a card, you’re trading with borrowed money. Losses don’t cancel out what you owe the bank.

Even if you plan to pay it off immediately, things can still go wrong. A slow withdrawal, a bigger loss than expected, or a delay in settlement can leave you stuck paying interest.

If you wouldn’t borrow money to make the same trade another way, think twice about using a credit card. The risk isn’t just market losses—it’s debt that follows you even after you stop trading.

Alternatives To Credit Cards

In the UK, two main alternatives are safer and cheaper:

- Debit cards: Just as fast as credit cards, but without the ‘cash advance’ treatment from banks. Most brokers accept them with little or no fee.

- Bank transfers: Slower in some cases, but usually free. Faster Payments often clear in hours, sometimes minutes.

Some UK brokers also support PayPal, Skrill, or Neteller. These are convenient but often more expensive. E-wallets can be helpful if you want to keep trading funds separate from your main bank account. However, be sure to check the fees carefully.

Practical Steps Before You Start

Here’s a simple checklist to follow before using a credit card with a broker:

- Confirm FCA regulation.

- Ask directly if your account type supports card funding.

- Read the broker’s deposit and withdrawal fee schedule.

- Contact your card provider to inquire about their treatment of broker deposits.

- Test the system with a small deposit before committing a larger amount.

Doing this may feel tedious, but it can save you a lot of money and frustration.

Bottom Line

Credit cards can be a quick way to get funds into your trading account. But they’re rarely the cheapest or safest method. Between broker fees, bank cash advance charges, and withdrawal restrictions, costs add up.

For many traders, debit cards or bank transfers are simpler and better value. If you decide to use a credit card for trading deposits, start small, understand the risks, and closely monitor the fees.

A reliable trading broker that accepts credit card deposits will be upfront about their terms, and it’s worth taking the time to read them closely before you deposit.