Best FCA-Regulated Brokers 2026

To stay safe, UK traders should choose a broker regulated by the Financial Conduct Authority (FCA). We have tested the best FCA brokers in 2026 and listed them here.

Top 5 FCA Brokers

To help British traders stay safe, our experts have ranked the 5 best FCA-regulated brokers:

- eToro: Best Overall Broker | FCA License Number: 583263

- XTB: Best Broker For Beginners | FCA License Number: 522157

- CMC Markets: Best Broker For Active Traders | FCA License Number: 173730

- Pepperstone: Best MetaTrader Broker | FCA License Number: 684312

- Eightcap: Best Broker For Forex Trading | FCA License Number: 921296

All Brokers Regulated By The FCA

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best FCA-Regulated Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best FCA-Regulated Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best FCA-Regulated Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best FCA-Regulated Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best FCA-Regulated Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best FCA-Regulated Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

Cons

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

How The FCA Protects Traders

FCA-regulated brokers must provide several safeguards to UK traders:

- Negative balance protection so that you cannot lose more than your account balance should the markets move against you, in effect preventing you from becoming indebted to a broker.

- Segregated client accounts to keep your funds separate from company capital, protecting your money from misuse or broker insolvency.

- Limiting leverage to 1:30 for retail investors, helping to minimise losses when trading on margin. The maximum leverage is 1:30 for major forex pairs, 1:20 for other forex pairs, gold and major indices, 1:10 for other commodities and minor indices, and 1:5 for stocks.

- Participation in the Financial Services Compensation Scheme (FSCS), which can compensate eligible clients up to £85,000 per person, per firm if the broker fails and cannot return your invested money or assets (this does not cover trading losses). Separately, from 1 December 2025, eligible client cash held at a UK bank, building society or credit union is protected as a deposit up to £120,000 per person, per banking licence. FCA-regulated brokers should keep this money in client accounts (segregated or pooled), and the FSCS will usually see through account structures and treat you as the beneficial owner of your amount. However, the £120,000 cap is shared with any other cash you already hold with the same banking group, so it’s worth knowing if your broker’s banking provider is the same as for your personal accounts.

- External audits to verify the broker has effective controls and systems, plus sufficient liquidity, adding credibility and trust.

The FCA can also ban investing products for up to a year while it contemplates permanent bans. In addition, they enforce proper data protection, as well as working to protect vulnerable customers from trading scams.

The FCA has the power under trading regulations to proceed with legal action against unregulated brokers, and it can offer compensation to consumers up to £30,000 should they get caught in illegitimate deals.

The financial agency has a history of action, particularly in forex, binary options and cryptocurrency markets. The body has handed out significant fines to brokers for manipulating prices and acting against the interests of traders. In fact, the FCA has seen years where it’s given out close to £230 million in fines. This is significantly more than the fines many forex regulatory bodies have handed out in recent years.

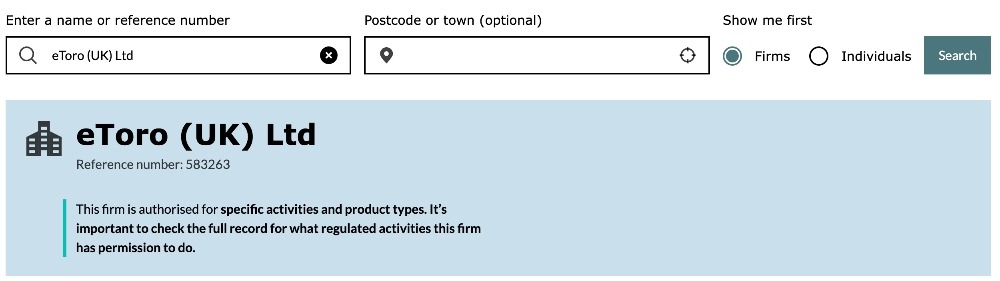

How To Check A Broker Is Regulated By The FCA

You can check whether a forex and CFD broker is regulated by the Financial Conduct Authority by following these steps:

- Find the broker’s license number (usually visible in the website footer)

- Run the license number or company name in the Financial Services Register

- Check the broker is authorised to provide online trading services to UK investors

This is the process our team follows to check whether a brokerage is regulated in the UK. We have verified the regulatory credentials of these FCA-approved brokers:

Dangers Of Unregulated Brokers

Although most financial services providers in the UK are regulated by the FCA, some businesses remain unregulated. We recommend caution if you are considering an unregulated broker – there are several risks:

- Exposure to online scams that may steal your personal information and money

- Fewer applicable trading regulations to foster a safe trading environment

- Limited legal channels if a broker doesn’t pay out your profits

- Limited payment and user security

Bottom Line

The FCA is the gold standard for investing and trading regulations. Other agencies from around the world, including the Cyprus Securities & Exchange Commission (CySEC), often follow the rules and benchmarks laid down by the FCA.

We always check a brokerage is regulated by the FCA before recommending them to our UK readers. We also consider the firm’s reputation and the quality of its trading products, accounts, fees and services.

FAQ

What Is The FCA?

The Financial Conduct Authority (FCA) is a regulatory body, established in 2013, that monitors financial services in the United Kingdom. It was brought in to replace the Financial Services Authority (FSA) in line with the new regulatory structure of the Financial Services Act. The change followed the 2008 financial crisis which led to legislators wanting a tighter grip on the sector.

The FCA aims to create a safe environment for traders, brokers, and other market participants and has a range of powers and trading regulations at its disposal. It regulates both retail and wholesale financial services companies.

The FCA operates as a separate entity to the UK government and is financed by its 50,000+ industry members.

What Markets Do The FCA Regulate?

Markets and products that fall under the FCA’s trading regulations include: forex, stocks, spread betting, binary options, contracts for difference (CFDs), and cryptocurrencies including Bitcoin, Litecoin and Ethereum.

Are All Online Brokers Regulated By The FCA?

No, far from all online brokers are regulated by the FCA, and many will not necessarily make it apparent how they are regulated. Careful traders should make sure they trade with a broker that is regulated by the FCA here in the UK. Use our list of FCA-regulated brokers to find one.

Which Is The Best FCA-Regulated Broker?

There is no single best FCA-approved broker as traders have different needs. With that said, our ranking of FCA-regulated brokers rates the top platforms for a range of trading styles, budgets and markets. Use our list to compare FCA brokers and find the right platform for your needs.