Litecoin Investing In The UK 2026

Litecoin (LTC) is one of the top 10 global cryptocurrencies by market cap, with some price predictions suggesting a surge in value in the next few years. If you’re thinking about investing in Litecoin, there are a few things to consider such as mining, day trading strategies, the latest news and risks. We also take a look at the Litecoin vs Bitcoin comparison in this review, as well as fees, charts, wallet storage and how to buy and trade the cryptocurrency today.

Note, the FCA has banned the sale of crypto-derivative products such as CFDs in the UK. However, there are still other ways to invest in the digital currency as explained below, from holding Litecoin as a longer-term investment to mining the crypto.

Litecoin Brokers

-

Traders can engage in crypto speculation with commissions starting at 0.05% and leverage reaching 1:200. Furthermore, the broker enhances its services by launching Crypto Futures with 101 new tokens in 2025 and hosting trading contests with tangible rewards.

Crypto Coins- BTC

- LTC

- ETH

- XRP

- EOS

- ADA

- DOT

- SOL

- UNI

- LINK

- DOGE

- BNB

- ICP

- SAND

- more

Crypto Spread Crypto Lending Platforms 0.05% BTC, 0.05% ETH No Own Crypto Staking Minimum Deposit Regulator No $0 -

IC Markets provides a range of over 20 cryptocurrencies for trading through CFDs, featuring less common tokens like Avalanche, Kusama, and Uniswap. Traders can enjoy commission-free transactions and experienced individuals can utilise high leverage up to 1:200 via the MetaTrader platforms.

Crypto Coins- BTC

- BCH

- DOT

- DSH

- EMC

- EOS

- ETH

- LNK

- LTC

- NMC

- PPC

- XLM

- XRP

- ADA

- BNB

- DOG

- UNI

- XTZ

Crypto Spread Crypto Lending Platforms BTC 42.036 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Crypto Staking Minimum Deposit Regulator No $200 ASIC, CySEC, CMA, FSA -

OKX provides an excellent range of over 400 tokens, such as Bitcoin and Ripple. Traders can engage in buying and selling tokens or engage in crypto trading on margin through derivatives like perpetual swaps, options, and futures. The platform is distinguished by its competitive fees, wide token selection, and rapid transaction processing.

Crypto Coins- BTC

- XCH

- ETH

- OKB

- OKT

- LTC

- DOT

- ADA

- DOGE

- XRP

- USDT

- ICP

- BCH

- LINK

- XLM

- ETC

- MATIC

- THETA

- UNI

- TRX

- EOS

- FIL

- XMR

- NEO

- USDC

- AAVE

- SHIB

- LUNA

- KSM

- BSC

Crypto Spread Crypto Lending Platforms Variable Yes AlgoTrader, Quantower Crypto Staking Minimum Deposit Regulator No 10 USDT VARA -

XTB provides a robust array of over 50 cryptocurrencies, featuring competitive spreads beginning at 0.22% on Bitcoin and leverage up to 1:5. The xStation platform facilitates trading with pairs like ETH/BTC and DSH/BTC. Traders can operate round-the-clock in a secure and transparent cryptocurrency trading environment.

Crypto Coins- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

Crypto Spread Crypto Lending Platforms 0.22% No xStation Crypto Staking Minimum Deposit Regulator No $0 FCA, CySEC, KNF, DFSA, FSC -

IG offers a growing selection of over 55 crypto CFDs and digital assets for buying, selling and storing. It also stands out with its crypto index, which tracks the value of the top 10 digital currencies by market cap and provides a holistic way to speculate on the value of the crypto market. Its crypto offering was also bolstered in the UK after it secured a digital asset license from the FCA, providing trading and investing on popular crypto coins in a regulated setting.

Crypto Coins- BTC

- ETH

- SOL

- XRP

- BCH

- ADA

- TIA

- LINK

- EOS

- HBAR

- ICP

- LTC

- NEAR

- NEO

- ONDO

- PEPE

- DOT

- POL

- SHIB

- XLM

- SUI

- TRX

- TON

- UNI

- DOGE

- AAVE

- APT

- ARB

- AVAX

- CRYPTO10

Crypto Spread Crypto Lending Platforms Variable No Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Crypto Staking Minimum Deposit Regulator No $0 FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA -

BitMEX provides an exceptionally competitive environment for crypto trading, offering low-cost $1 contracts and leverage up to 100:1. Its unique platform delivers advanced trading tools, featuring a customisable order book, a depth chart, and numerous technical indicators.

Crypto Coins- BCH

- BTC

- ETH

- LTC

- XRP

- TRON

- EOS

- XMR

- ADA

- DOGE

- BNB

- DOT

- SOL

- SHIB

- AVAX

- GAL

- NEAR

- SUSHI

- AXS

Crypto Spread Crypto Lending Platforms -0.01% maker, 0.075% taker No BitMEX Web Platform, AlgoTrader, TradingView, Quantower Crypto Staking Minimum Deposit Regulator Yes $0.01 Republic of Seychelles -

You have the opportunity to trade over 20 leading cryptocurrencies with leverage up to 1:200, available every day of the week. Direct transactions of assets such as Bitcoin and Ethereum are not supported. The range of tokens is narrower compared to Eightcap, which received our 'Best Crypto Broker' accolade for its offering of more than 100 crypto derivatives.

Crypto Coins- BTC

- ETH

- DSH

- LTC

- BCH

- XRP

- EOS

- EMC

- NMC

- PPC

- DOT

- XLM

- LINK

- DOGE

- XTZ

- UNI

- ADA

- BNB

- AVAX

- LUNA

- MATIC

- GLMR

- KSM

Crypto Spread Crypto Lending Platforms Floating No MT4, MT5, cTrader, AutoChartist, TradingCentral Crypto Staking Minimum Deposit Regulator No $200 FSC

Safety Comparison

Compare how safe the Litecoin Investing In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| BitMEX | ✘ | ✘ | ✘ | ✘ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Litecoin Investing In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| BitMEX | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Litecoin Investing In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| PrimeXBT | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| BitMEX | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ |

Beginners Comparison

Are the Litecoin Investing In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| BitMEX | ✔ | $0.01 | Variable | ||

| IC Trading | ✔ | $200 | 0.01 Lots |

Advanced Trading Comparison

Do the Litecoin Investing In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| BitMEX | BitMEX Market Maker, BotVS, and via API | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Litecoin Investing In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| PrimeXBT | |||||||||

| IC Markets | |||||||||

| OKX | |||||||||

| XTB | |||||||||

| IG | |||||||||

| BitMEX | |||||||||

| IC Trading |

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- In 2025, PrimeXBT significantly expanded its Crypto Futures offerings with over 100 tokens, including AI, NFTs, Metaverse, and Layer 1 & 2 assets.

- The online platform and app cater to traders, offering advanced charts, a customisable interface, and multiple order options like one-cancels-the-other (OCO).

- Trading fees for crypto futures contracts are quite competitive, with maker fees at 0.01% and taker fees at 0.02%.

Cons

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

Cons

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- In 2025, OKX obtained a MiFID II licence, allowing it to offer regulated derivatives across Europe, ensuring peace of mind for traders.

- The platform offers an extensive developer lab and access to a marketplace of pre-built trading bots equipped with automatic arbitrage functionalities.

- Traders can obtain historical market information for both spot and futures markets, including OHLC data, aggregate trade details, and trading records.

Cons

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- Testing revealed that customer support quality varied.

- The broker's platform and features might feel intricate for beginners.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG obtained a crypto asset license from the FCA, allowing it to re-enter the UK market to provide buying, selling and storing opportunities on 55+ digital tokens with fees from 1.49%, and all within an FCA-licensed environment.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On BitMEX

"Traders interested in a wide selection of crypto derivatives will find BitMEX appealing, especially with its Perpetual Contracts. Additionally, the 100x leverage on Bitcoin exceeds that of many other platforms."

Pros

- Traders may accrue interest by holding Tether and Bitcoin.

- BitMEX consistently provides a wealth of free market insights, alongside trading guides and community platforms on Discord, Telegram, and additional channels.

- The BMEX token offers up to 15% discounts on trading fees and other exclusive benefits when staked.

Cons

- BitMEX primarily caters to active traders, offering limited tools and features for beginners.

- Only Bitcoin is allowed for cost-free withdrawals.

- The broker faced legal action from US regulators, resulting in fines.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

What Is Litecoin?

Released in 2011, Litecoin (LTC) was developed by founder, Charlie Lee, who was a Google employee at the time. The altcoin’s development was originally a hard fork of its close relative, Bitcoin.

Bitcoin was the first cryptocurrency released in 2009 and the first to use blockchain, a public transaction ledger which is linked by cryptography. The cryptographic hash of blocks ensures that data is passed through a secure one-way algorithm. The invention of this technology quickly inspired other cryptocurrencies, including our Bitcoin spinoff, Litecoin.

As with many other cryptocurrencies, Litecoin has a limited supply of 84,000,000 coins. There are now over 62,000,000 currently in circulation, which have all been created and verified by the mining process. Because cryptocurrencies are decentralised, there is no third party (such as a bank) to process and verify transactions.

Instead, cryptocurrencies use a distributed ledger which is managed by thousands of miners. Just as the British Pound coin needs to be regulated by the Bank of England and manufactured in the Royal Mint, Litecoins need to be verified and distributed by the online mining process. Crypto mining is explained in more detail later.

Litecoin has enjoyed a strong history of growth, with its aggregate value surging by 100% within 24 hours in November 2013. In 2017, the first Lightning Network transaction was processed through Litecoin and in the same year, the altcoin reached its all-time high of $360.66. It’s expected that digital currency will see its price rise to 5,500 USD by 2025.

Why Invest In Litecoin?

So now you’re more familiar with Litecoin, how it works and how it’s made, but what are the benefits of trading it?

- Volatility – cryptocurrencies are volatile assets which are difficult to value, which can create significant profit potential for investors. This is because cryptocurrencies do not sell products, return dividends or employ many people. Also, limited regulation and institutional capital within the market, as well as media influence, means that it can be manipulated easily.

- Accessible – Litecoin is a popular currency which is now widely available at leading brokers and exchanges. You can also trade Litecoin from anywhere in the world, 24 hours a day and 7 days a week. All you need is a PC, mobile phone or tablet device, and a stable internet connection.

- Leverage – leveraged trading can give you greater exposure to the market without needing to deposit the full value of the trade. As you control more sizeable positions, you can therefore generate more profits. Some crypto trading platforms offer margin trading on Litecoin, including BitMEX and Kraken.

- Similarities with FX trading – if you’re already familiar with how forex trading works, the same principles apply when day trading cryptocurrencies. Both can be highly volatile and involve the digital trading of multiple currencies. You can also employ some of the same strategies to both, as well as risk management tools.

- Low fees – you can generally day trade Litecoin at a fairly low cost, compared to traditional trading, with many exchanges offering a low transaction fee and minimum order. Coinbase, for example, charges between 1.49% to 3.99% in buy/sell fees.

- Strategies – there’s also a variety of strategies that you can use to trade Litecoin, from scalping, which allows you to take advantage of small market movements, to buy-and-hold strategies, for those with a long-term outlook.

Risks Of Investing In Litecoin

- Volatility – whilst volatility can lead to potential profits, it can also lead to losses when the market experiences serious price drops. The unpredictable nature of Litecoin and other cryptocurrencies can be hugely detrimental to your portfolio if proper risk management techniques are not in place.

- Leverage – as with all leveraged trading, you can experience heavy losses just as quickly as gains. Many investors forget that trading on margin means your losses can exceed your initial deposit.

- New market – cryptocurrencies are a new financial market and are still relatively misunderstood. As Litecoin has only been circulating for around a decade, it is still unknown to the financial world. Some investors see this uncertainty as too big a risk.

- Regulations – cryptocurrency regulations and rules are still emerging in many jurisdictions, which may affect trading. In the UK, the sale of crypto-derivative products such as CFDs has now been banned at FCA-regulated brokers. Fortunately, there are other ways to still trade and invest in cryptocurrencies.

How To Start Investing In Litecoin

1. Look At Price Data

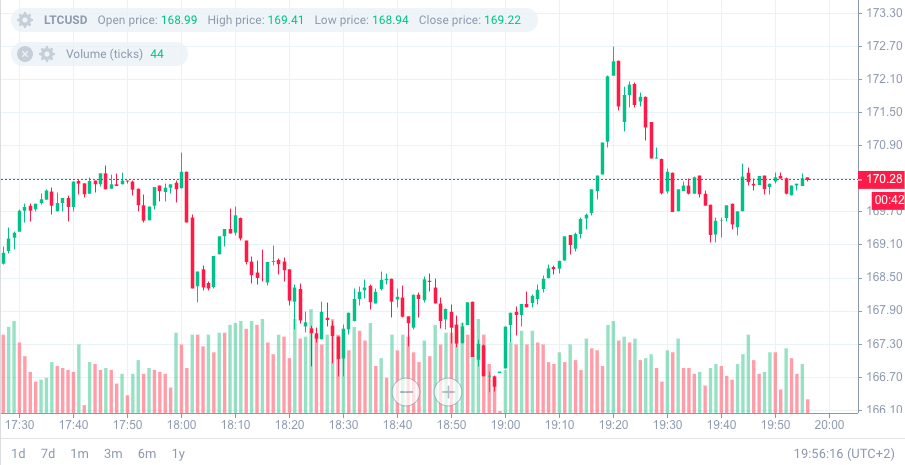

Observing historical and current price analysis charts are a great place to start and can give you a good idea of previous trends and patterns. Good brokers and exchanges will offer a live price chart or graph, which allows analysts to identify the price history of Litecoin, as well as what its future value might be. Even if you’re not day trading Litecoin, you can still use charts to understand their trends and whether you want to hold cryptos over the longer-term.

Whether you’re analysing prices on a daily basis or for the whole year, a candlestick chart is an excellent tool to view detailed information on price trends using different time frames. This kind of chart consists of green (upwards trend) and red (downwards trend) candlesticks which indicate the opening and closing prices in a particular time frame. This can help you to forecast any future price movements that might behave in a similar way.

2. Choose A Broker / Exchange

Choosing a reliable and trusted broker is an important decision if you want to trade Litecoin. Some key considerations should include trading platform features and fees. When day trading cryptocurrencies, pricing is usually based on tiers, which charge taker and maker fees.

A taker fee is when you place an order at the market price that gets filled immediately. A maker fee is when you place an order which is not immediately matched and therefore gets placed into an order book. At Coinbase, for example, maker and taker fees range between 0.04% and 0.50%.

Some brokers also offer useful educational tools and features, such as a blog or tutorials. It might also be worth checking out other sites that can offer support and guidance, such as discussion forums.

Other top Litecoin brokers include BitMEX, Kraken, Binance and Bitfinex. You can find out more info on each by checking out our broker reviews.

3. Deposit Into Your Account

Before you can start trading, you’ll need to deposit money into your account. If you’re new to trading, you should start with a small and manageable amount until you feel more comfortable. Remember that you can lose more than you initially deposit.

Make sure to also take into account what payment methods are accepted and whether they are convenient for you. These can range from bank wire and credit cards using fiat currencies, or crypto deposits if you already hold digital coins.

Note that there may also be funding fees and varying transaction times depending on your chosen exchange.

4. Strategies

Regardless of your experience level, you should always employ sound strategies and risk management tools. We’ve covered a few key methods below.

Technical Analysis

Studying patterns and trends using volume chart data and price history is an essential method of identifying trading opportunities. Technical analysis is based largely on trader psychology of the previous buy and sell patterns. This influences the future uptrends (Bullish), downtrends (Bearish) and sideways trends that you will observe on a graph.

An excellent tool you can use is the candlesticks mentioned earlier, coupled with other advanced indicators such as Bollinger Bands. Applying Bollinger Bands can show you any low volatility or high volatility zones on the graph, with a simple moving average running through the middle. The higher the volatility (and therefore the wider the band) the more likely that asset is to fluctuate.

News

Economic and financial news can also have a huge influence on these trends. Whilst some headlines can produce uncertainty or fear, other stories can inspire confidence in a product. For example, in June 2019, Bitcoin’s prices dropped by 11% after Google announced a ban on cryptocurrency advertising on its platform, with an 8% price drop also for Litecoin.

Long-Term Vs Short-Term

You might also want to consider whether you want to trade Litecoin with a short-term or long-term strategy. There are limitations and merits to both, so it’s important that you determine which might work best for you.

Short-term trading can be done in a matter of seconds or up to weeks. As the crypto market runs 24/7 (unlike traditional trading in the stock market, for example) there is no set opening and closing time. The crypto market is also still relatively small compared to others, which means a comparably small change could cause a significant crash.

With long-term investment over months or years, daily volatility and price changes won’t have a huge effect on your investment. The target for the investor is simply to sell once the price has increased significantly over time. The main advantage here is that it’s easy and requires little effort and initial capital.

Of course, the main disadvantage of long-term investment is that you may miss the chance to make a quick profit when prices rally in the short term.

Risk Management

Using proper money management techniques is essential with any form of investing. To reiterate, you should never risk more than you can afford to lose. This means that even if you lose a number of consecutive trades, you still retain most of your initial balance. Your risk should also become progressively smaller each time.

Another tool you can use is a risk/reward ratio, which can prevent you from jumping blindly into a risky trade. The ratio will indicate the expected return on a trade compared to the proposed risk. The lower the ratio, the higher the risk.

You should also always employ stop loss orders on your positions, which will close a trade for a small loss if it moves against you and hits a certain price.

Litecoin Vs Bitcoin

We touched on the history of Bitcoin and Litecoin earlier, but what are the main differences between the two?

- Speed – Whilst the two coins are technically identical, Litecoin has a faster block time of 2.5 minutes, compared to Bitcoin’s 10 minutes

- Supply – Bitcoin’s supply is limited to 21 million, whilst Litecoin’s supply is four times larger, at 84 million

- Hashing algorithm – Litecoin uses a different proof-of-work algorithm, known as Scrypt, whilst Bitcoin uses SHA-256

- Value – The value of 1 BTC has historically always been more than LTC

- Market cap – Bitcoin’s market cap is over 750 billion USD vs Litecoin’s approximately 11.5 billion USD

Litecoin Wallet

You’ll need to find an e-wallet to keep your Litecoins safe. Wallets can be used to simply store your cryptocurrencies if you want to hold your investment.

There are different types of Litecoin wallet, from hot wallets which are connected to the internet, to cold wallets which are not. We look at the most popular options below: hardware wallets and mobile app wallets.

Hardware Wallet

A hardware wallet is a physical cold wallet and is usually available as a USB device. A hardware wallet is one of the safest and most convenient options because your coins are stored offline and cannot be hacked.

You can purchase a Litcoin hardware wallet directly from the supplier’s website or a trusted manufacturer. We recommend that you do not buy used devices. Also, although a hardware wallet is generally very safe, it is not impossible to hack whilst the device is connected to your computer.

Some popular options for Litecoin hardware wallets include the Ledger Nano S, the Trezor Model T and the Keepkey.

App Wallet

A popular hot wallet is an online app which can be downloaded onto your device from the App Store or Google Play. App wallets are highly convenient as they allow you to access your coins quickly whilst on the go.

The main downside is that these are not as safe as cold storage wallets, as they can be prone to viruses and hackers. Make sure to take advantage of all available security features, such as a secure PIN.

Some of the best Litecoin app wallets include Loafwallet and Jaxx Liberty.

What Is Litecoin Mining?

Litecoins are decentralised assets, which means there is no government or third-party to validate and issue them. Instead, Litecoins are created and verified by a complex mining procedure. This involves processing all previous global Litecoin transactions in a distributed ledger, generating a block.

The ledger is managed by thousands of miners, so instead of one corporation having control, everyone has it. To become a miner, you have to own mining software to solve complex mathematical puzzles, as they are designed so that no human can solve them.

Once a puzzle is solved, the block is verified and a new block then enters the chain. As an incentive, cryptocurrency miners receive a reward in the respective coins. Miners will receive a block reward of 12.5 LTC until 2023. The reward is halved approximately every four years as more miners join the process.

The mining system is known as Proof of Work (PoW) which is also used by other coins such as Bitcoin and Ethereum. Other mining systems can also run on other blockchains, which use Proof of Stake (PoS).

How To Start Mining Litecoin

There are three types of mining that you will need to consider if you want to start mining Litecoin yourself.

1. Solo Mining

This involves buying the required equipment and mining on your own. The advantage is that if you win, you do not need to share the reward with anyone else and you don’t usually need to pay any mining fees.

The difficulty of solo mining is that it can be costly, not only because you are buying the equipment, but also because electricity consumption can get expensive. Another disadvantage is that mining wins can be sparse, as it is essentially like a lottery.

2. Mining Pool

If costs are a concern, then you may want to consider a mining pool. This involves you and other miners sharing electricity, equipment and computing power, therefore giving you a greater chance of winning a block reward. Wins are more consistent with a mining pool because your group of miners can generate more power.

A downside of using a mining pool is that you may need to pay a fee to join, which can vary by company. You will also have to share the rewards with others. Two popular pools include the original Litecoin Mining Pool or Antpool.

3. Cloud Mining

Another low-cost option is cloud mining, which involves using a Litecoin mining rig to do the work for you. A mining rig is a group of computers built solely for mining. This is a great choice for beginners as you don’t need to buy any equipment.

There are fees for using a cloud mining app, whereby the more you invest, the more access you have to the rewards. Traders should be very cautious around cloud mining software companies, however, as there are lots of scammers operating in this area.

A popular Litecoin mining website is Hashflare, which has been operating since 2014.

Mining Equipment

If you’re considering solo or pool mining, you’ll need some robust hardware. Mining was traditionally done using a Central Processing Unit (CPU) and a Graphics Processing Unit (GPU) miner. However, you can now use specialist Litecoin hardware called Application-Specific Integrated Circuit (ASIC) which is more powerful than GPU mining.

The most popular and robust ASIC mining hardware for Litecoin is the Antminer L3+, which is manufactured by BitMain. The Antminer L3+ has a hash rate of 504MH/s, which is the number of puzzle calculations it can make per second. You can check out a mining profit calculator online to find out how much you could make from a certain miner.

Litecoin Regulations

Litecoin trading regulations vary depending on local jurisdiction and in many countries, cryptocurrencies are still widely unregulated.

The UK’s announcement to ban cryptocurrency derivative trading under FCA-regulated brokers was formally made in 2019, with the ban coming into effect on 6th January 2021. Crypto trading is still possible at many brokers, but note that you will not be covered by FCA protections.

You can still buy or sell your coins and keep an eye on the price of Litecoin on popular exchanges, such as Coinbase and Binance.

Final Word On Litecoin

If you are thinking about trading or mining Litecoin, you should now be more familiar with the tools and strategies you need, as well as the potential risks. Whilst Litecoin has seen some strong growth, future projections of all cryptocurrencies are uncertain.

Whether Litecoin is in a bubble or not, make sure you are cautious around where you are putting your capital and how you are going to manage your risks.

FAQ

Litecoin: What Is It?

Litecoin is the oldest peer-to-peer altcoin, released via an open-source client on GitHub in 2011 by Charlie Lee. Litecoin was a hard fork and technology update of Bitcoin Core, but differs slightly from Bitcoin in terms of block time and the cryptographic algorithm used.

Is Litecoin A Good Investment?

Litecoin has been emerging out of a bear market and among the top 3 performing cryptos in recent years. Litecoin also remains one of the top 10 cryptocurrencies by market cap and could therefore be worth investing in 2026. There are risks when trading any cryptocurrency, however, so make sure you conduct thorough research before committing.

How Do I Find The Price Of Litecoin Today?

You can easily do an internet search of the current price of Litecoin. You can also access accurate, real-time price and volume charts on any good broker or exchange. These will indicate historical price patterns, which can guide your speculation of future price movements. At the time of writing, the highest price of Litecoin was reached in 2017, at $360.66.

Is Litecoin Better Than Bitcoin?

Whilst Litecoin has a faster transaction speed and has more coins than Bitcoin, this will not necessarily impact the overall value or usability of Litecoin. Bitcoin’s performance has been in the lead for years, however, Litecoin is still relatively cheap per coin and has the potential to perform well in the near future.

Is Trading Litecoin Profitable?

Trading Litecoin can be profitable depending on the strategies you employ. Crypto markets are highly volatile and can fluctuate rapidly between bullish and bearish markets. This makes Litecoin and other cryptocurrencies a risky investment. You might not make it on to the rich list or become a millionaire straight away, but keeping an eye on price charts will indicate any profitable opportunities.