Best cTrader Brokers in the UK 2026

Known for its lightning-fast execution, advanced charting, and transparent pricing, cTrader has become the platform of choice for serious forex and CFD traders (myself included).

We highlight the best cTrader brokers in the UK, so you can trade with confidence and focus on what matters most – your returns.

Top Brokers with cTrader

-

Pepperstone’s cTrader offers rapid execution and tight spreads, typically 0.0-0.2 pips on major pairs, with low commissions starting at $7 per round turn. Our experience showed seamless order routing, no minimum deposit, and sophisticated charting and algorithmic tools improving usability for active traders.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IC Markets’ cTrader offers extremely tight spreads from 0.0 pips and a minimal $7 commission per lot. Our testing revealed consistently fast execution and robust liquidity. It boasts advanced features like customizable algorithms and one-click trading, perfect for scalpers and expert traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

IC Trading's cTrader offers tight spreads from roughly 0.1 pips with low commissions beginning at approximately $6 per lot. Testing revealed reliable and swift execution, backed by strong liquidity. The platform excels with its advanced risk management tools and automated trading features, appealing to active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

Fusion Markets' cTrader stood out with extremely low spreads starting at 0.0 pips and a $7 round-turn commission. Our practical evaluation found swift and reliable execution. Customisable indicators and intelligent order types elevate trading for every skill level.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

BlackBull Markets’ cTrader offers tight spreads starting from 0.0 pips and competitive commissions of $6-$7 per lot. Our tests showed consistently fast execution speeds, backed by robust liquidity. Its automated trading capabilities and customisable interface make it ideal for active and professional traders.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

GO Markets' cTrader offers a robust platform for dedicated traders, enhanced by tight spreads starting from 0.0 pips and low commissions of $6–$7 per lot. Our experience showed quick order execution, backed by substantial liquidity. With features such as automated trading, one-click orders, and customizable charting, it suits active traders perfectly.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto ASIC, CySEC, FSC, FSA GO TradeX™, MT4, MT5, cTrader, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

FxPro's cTrader provides tight spreads from 0.0 pips and commissions from about $7 per round turn. Execution proved swift and dependable, enhanced by strong liquidity and no deposit minimums. Advanced features such as one-click trading and customisable algorithms give experienced traders an advantage.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Best cTrader Brokers in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ | |

| GO Markets | ✘ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best cTrader Brokers in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| GO Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best cTrader Brokers in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ | ||

| GO Markets | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ |

Beginners Comparison

Are the Best cTrader Brokers in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots | ||

| GO Markets | ✔ | $0 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best cTrader Brokers in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

| GO Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:500 | ✔ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best cTrader Brokers in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IC Markets | |||||||||

| IC Trading | |||||||||

| Fusion Markets | |||||||||

| BlackBull Markets | |||||||||

| GO Markets | |||||||||

| FXPro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

Cons

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

Cons

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- The selection of charting platforms and social trading features is outstanding. Options like MT4, MT5, cTrader, and the newer TradingView meet diverse trader preferences.

- Fusion Markets provides algo traders with a sponsored VPS and offers a 25% discount for choosing the NYC Servers VPS for MT4 or cTrader.

Cons

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

- The broker stands out with its extensive selection of currency pairs, surpassing most competitors. However, its alternative investment options are merely average, lacking stock CFDs outside the US.

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull provides three ECN-powered accounts—Standard, Prime, and Institutional—to cater to traders of all experience levels, from novices to seasoned professionals. The variety of account types allows for flexible options tailored to individual trading needs and available capital.

- BlackBull better suits budding traders after revamping its ECN Prime account. It now offers improved spreads, averaging 0.16 on EUR/USD, and eliminates the previous $2,000 minimum deposit requirement.

- BlackBull provides everything a trader needs: execution speeds under 100ms, leverage as high as 1:500, and competitive spreads starting at 0.0 pips.

Cons

- BlackBull does not offer its own trading platform, instead utilising MetaTrader, cTrader, and TradingView. Although these platforms are highly regarded, some brokers, such as eToro, provide proprietary platforms with distinct features that cater well to novice traders.

- Despite an expanding range of over 26,000 assets, including new additions to Asia Pacific indices, their offerings are primarily equities. The selection of currency pairs and indices remains average.

- Despite enhancements such as webinars and tutorials in the Education Hub, our review indicates that the courses still require greater emphasis on elucidating broader economic factors affecting prices.

Our Take On GO Markets

"GO Markets is ideal for active CFD traders focused on minimal spreads, clear pricing, and swift execution on robust charting platforms such as MT4, MT5, cTrader, and TradingView. The GO Plus+ account offers raw spreads starting at 0.0 pips with low commissions, making it perfect for scalpers and high-frequency traders."

Pros

- MT4, MT5, cTrader, and TradingView support lets traders access top platforms with fast execution and strong charting capabilities.

- GO Markets simplifies complex topics, creating a supportive learning community. Its educational offerings include courses, webinars, podcasts, and weekly live coaching, perfect for new traders.

- PAMM accounts and copy trading services serve both novice and experienced traders. The rebate programme benefits high-volume traders by lowering expenses.

Cons

- While offering decent multi-asset coverage, our analysis revealed restricted options in categories such as commodities and indices, providing only about 15 indices and 10 commodities.

- GO Markets' research tools are quite basic, missing the depth and frequent updates of larger rivals that provide daily insights, analyst commentary, and sophisticated forecasting tools.

- GO Markets depends wholly on third-party platforms, lacking a proprietary charting system, which might restrict innovation or customised features for traders seeking advanced tools.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

Cons

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

How Investing.co.uk Chose The Best Brokers That Support cTrader

Our rankings were built by UK traders, blending 200+ data points with hands-on testing of cTrader software. We evaluated execution, spreads, commissions, platform stability, and advanced trading tools across each broker — all key factors for serious traders.

Finally, brokers were sorted by overall ratings, highlighting the most reliable and cost-effective cTrader brokers for UK traders.

What To Look For In Broker That Offers cTrader

- Not all brokers fully enable cTrader’s ecosystem based on our tests. Verify support for cTrader Copy for copy trading, and cTrader Algo for backtesting strategies using tick-level data. Also, check that advanced order types (Stop Limit, Market Range, server-side trailing stops) are available, as missing functionality can disrupt algorithmic or precision trading.

- Choose brokers regulated by the Financial Conduct Authority (FCA) to ensure client funds are segregated from corporate accounts and protected by compensation schemes (FSCS up to £85,000). Offshore or lightly regulated brokers may offer high leverage, but you risk counterparty default, delayed withdrawals, or lack of recourse in disputes—critical for anyone trading larger positions or automated strategies.

- Evaluate spreads, commissions, and swap rates with a focus on total cost per round trip. ECN brokers typically charge a separate commission but offer tighter spreads. For example, high-frequency traders can see a significant drag on profitability if spreads widen during news events, so check historical spread data and latency-adjusted pricing before committing.

- Execution quality matters for active strategies. Test brokers’ latency using demo accounts—true ECN pricing with deep liquidity pools minimizes slippage and requotes. High-frequency traders should consider VPS proximity to the broker’s servers to shave milliseconds off execution time—critical for scalping or news-event strategies.

- Fast, predictable funding directly affects your ability to respond to market opportunities. Prioritise brokers offering instant e-wallet transfers, fast bank wires, and multi-currency accounts. Be cautious of brokers with slow withdrawal approvals or hidden conversion fees, as these can erode gains when scaling positions or exiting trades quickly.

- cTrader is available on Windows, macOS, mobile apps, and via a browser, but performance varies. High CPU usage on older devices can delay chart rendering or order execution during volatile markets. Test your typical trading setup and consider brokers that offer server-side trailing stops or VPS hosting to maintain automated strategies without local interruptions.

- Even skilled traders benefit from actionable insights and fast support. Look for brokers offering responsive technical support capable of troubleshooting order execution or API issues. Brokers that provide tutorials for cTrader Algo or pre-built strategy templates can significantly shorten your learning curve.

What stands out with cTrader isn’t just the advanced charts or algorithmic tools – it’s how much your broker can make or break the experience – I’ve learned this myself.Even the most sophisticated strategies fall flat if execution is slow or key features like copy trading aren’t supported. Choosing the right broker is where platform potential meets real-world results.

What Is cTrader?

cTrader is a powerful third-party trading platform for forex and CFD markets, offering institutional-grade features such as Level 2 pricing, ultra-fast execution, and advanced charting with over 65 indicators.

It’s available as a downloadable app for Windows and macOS, on mobile devices, and directly through a web browser—though there’s no native Linux version.

Unlike MetaTrader 5, which is highly customisable but can feel dated, cTrader delivers a modern, intuitive interface with native support for cTrader Algo (formerly cAlgo and Automate) to build, backtest, and run algorithmic strategies.

While TradingView excels at social charting, cTrader’s integrated cTrader Copy goes further by allowing you to follow and mirror top-performing traders with full transparency on performance, making it equally suitable for active, algorithmic, and copy trading.

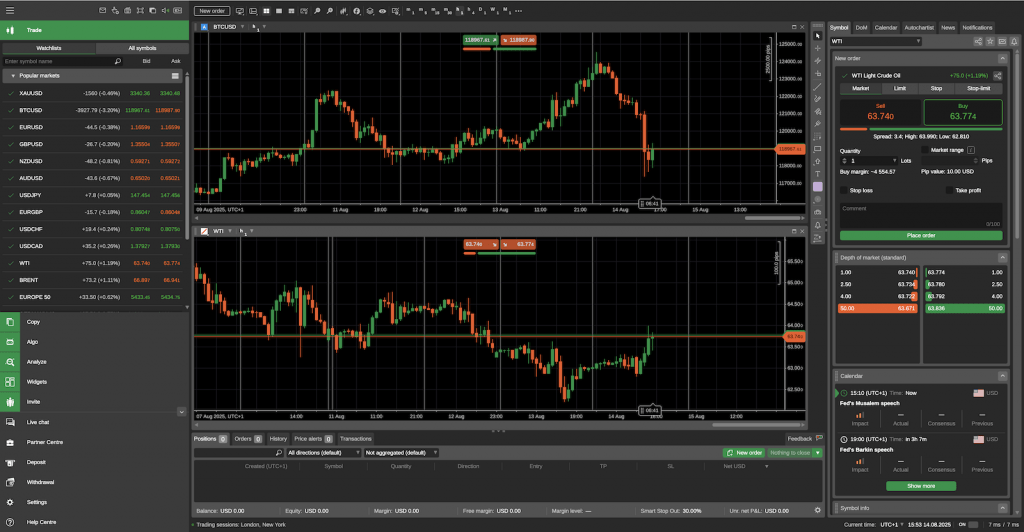

cTrader combines advanced charting and automated trading in one intuitive platform

Pros Of cTrader

- True ECN transparency with Level 2 pricing: cTrader displays full depth-of-market (DoM) data, showing all executable prices from liquidity providers, not just the broker’s best bid/ask. This transparency helps you spot real market liquidity, gauge potential slippage, and execute large orders more strategically.

- Advanced order execution & control: Orders are processed with ultra-low latency, and the platform supports sophisticated order types such as Market Range, Stop Limit, and server-side trailing stops. This is particularly valuable for scalpers and algorithmic traders, where milliseconds and precision execution can significantly impact profitability.

- Native support for algorithmic & copy trading: cTrader Algo allows you to code in C#, backtest with tick data, and run bots 24/7 without third-party plugins. Combined with cTrader Copy, which offers complete visibility into other traders’ equity curves, drawdowns, and trade history, it enables both fully automated and selectively mirrored strategies.

Cons Of cTrader

- Smaller broker availability & feature gaps: Compared to MetaTrader, far fewer brokers offer cTrader from our investigations, and even among those that do, not all provide the complete feature set—such as cTrader Copy for copy trading. This can limit both your broker choice and your access to the platform’s most powerful tools.

- Smaller third-party ecosystem: While cTrader Algo Automate is powerful, its C#-based environment has a smaller library of pre-built indicators, scripts, and EAs compared to MetaTrader’s massive MQL marketplace. This means more reliance on self-coding or hiring developers for custom tools.

- Heavier resource usage: cTrader’s advanced charting, real-time market depth, and graphical interface can demand more CPU and memory than lighter platforms. On lower-spec machines or poor Internet connections, this can lead to slower performance during high-volatility events.

cTrader’s Algo feature is powerful, but the broker you trade through can make or break its effectiveness. Reliable execution, low latency, and full support for automated strategies are essential—without them, I’ve found even the best backtested bots can underperform in live markets.

Bottom Line

For UK investors seeking a robust, modern trading experience, cTrader offers advanced tools for forex and CFD markets, including Level 2 pricing, precise execution, algorithmic trading, and copy trading.

However, broker choice is more limited than MetaTrader, and not all cTrader brokers provide the full feature set.

The best cTrader brokers combine platform reliability, competitive trading conditions, and access to cTrader’s most powerful tools, enabling you to operate smarter and more efficiently.