Best High-Frequency Trading Brokers In The UK 2026

In the ultra-competitive world of high-frequency trading (HFT), milliseconds mean money. Whether you’re an experienced trader deploying algorithms or a tech-savvy investor exploring the edge of market execution, choosing the right broker is mission-critical.

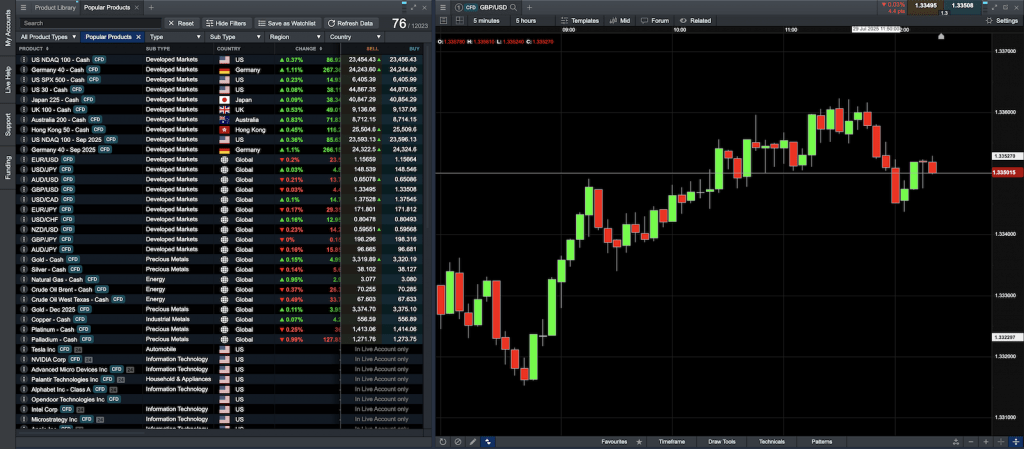

We break down the best HFT brokers in the UK to help you find the speed, access, and reliability you need to stay ahead of the market.

Top High-Frequency Trading Brokers

-

During our test, Interactive Brokers showcased impressive execution speed under 10ms through their Gateway API, offering substantial multi-asset liquidity and accurate order routing. Spreads differed across venues, dipping to just 0.1 pips on EUR/USD, with costs between $2 and $3.50 per lot equivalent. The FIX API, co-location, and smart order routing facilitate high-frequency trading on an institutional level.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our HFT assessments, IC Markets showed execution times under 20ms on cTrader and MetaTrader, with minimal slippage. Spreads for EUR/USD averaged 0.1 pips, with a $7 round-turn commission per lot. True ECN links, FIX API access, high liquidity, and close hosting at Equinix NY4 and LD5 suit traders excellently.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

In recent tests tailored for high-frequency traders, Global Prime delivered swift execution under 30ms with negligible slippage. Spreads begin at 0.0 pips, coupled with a $6 round-turn commission. With FIX API and extensive multi-bank liquidity pools, it affords institutional-level access, ideal for latency-sensitive trading strategies.

Instruments Regulator Platforms Forex, indices, commodities, cryptocurrencies, shares, bonds ASIC, VFSC, FSA MT4, TradingView, AutoChartist Min. Deposit Min. Trade Leverage A$200 0.01 Lots 1:200 -

In our HFT tests, BlackBull Markets achieved execution speeds of 20-40ms and tight spreads beginning at 0.0 pips. With their FIX API, Equinix co-location, and scalable VPS, they support ultra-low latency trading. Raw ECN liquidity and clear slippage control meet institutional-grade trading needs.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

In our test at Pepperstone for high-frequency trading, execution time was reliably under 30ms with almost no slippage on cTrader via Equinix LD5. Spreads were between 0.1–0.3 pips for EUR/USD, with a $7 round-trip commission per lot. The FIX API, raw ECN feeds, and deep liquidity pools render it ideal for low-latency algorithmic strategies.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our testing, FP Markets demonstrated fast execution with 30–45ms latency on raw ECN accounts, featuring spreads of 0.0–0.2 pips and $6–$7 round-turn commission per lot. Their FIX API, cTrader platform, and VPS options provide robust infrastructure for HFT trading, ensuring dependable liquidity and narrow spreads.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto ASIC, CySEC, FSA, CMA Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $40 0.01 Lots 1:30 (UK), 1:500 (Global) -

During our recent assessments, Eightcap provided sub-40ms execution through cTrader, with raw ECN spreads starting at 0.0 pips and a $6 round-trip commission, ideal for high-frequency configurations. FIX API and VPS hosting ensure reliable, low-latency algorithmic trading. Its deep liquidity and clear pricing make it competitive for high-frequency strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best High-Frequency Trading Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Global Prime | ✘ | ✔ | ✘ | ✘ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| FP Markets | ✘ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best High-Frequency Trading Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Global Prime | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| FP Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best High-Frequency Trading Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| IC Markets | iOS & Android | ✘ | ||

| Global Prime | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| FP Markets | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Best High-Frequency Trading Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Global Prime | ✔ | A$200 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| FP Markets | ✔ | $40 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best High-Frequency Trading Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Global Prime | ✔ | ✘ | 1:200 | ✔ | ✔ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| FP Markets | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (UK), 1:500 (Global) | ✔ | ✘ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best High-Frequency Trading Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| IC Markets | |||||||||

| Global Prime | |||||||||

| BlackBull Markets | |||||||||

| Pepperstone | |||||||||

| FP Markets | |||||||||

| Eightcap |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

Cons

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

Our Take On Global Prime

"Global Prime is ideal for novice and experienced traders, offering superb market access, competitive fees, and diverse tools, including copy trading."

Pros

- Comprehensive investment options offering over 150 assets, including cryptocurrencies.

- Round-the-clock customer support

- Trade Receipts

Cons

- The selection of account types is limited.

- Clients from the United States and Canada are ineligible.

- No integration with MetaTrader 5.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull better suits budding traders after revamping its ECN Prime account. It now offers improved spreads, averaging 0.16 on EUR/USD, and eliminates the previous $2,000 minimum deposit requirement.

- BlackBulls's research excels, particularly in the daily 'Trading Opportunities' articles. These publications simplify complex market dynamics into clear insights, enabling traders to effectively capitalise on emerging trends.

- After collaborating with ZuluTrade and Myfxbook, upgrading its CopyTrader, and activating cTrader Copy, BlackBull provides an exceptionally thorough trading experience.

Cons

- Despite enhancements such as webinars and tutorials in the Education Hub, our review indicates that the courses still require greater emphasis on elucidating broader economic factors affecting prices.

- Unlike many leading brokers, BlackBull imposes a bothersome $5 fee for withdrawals. This charge can reduce the overall cost-effectiveness, particularly for traders who regularly transfer funds.

- Despite an expanding range of over 26,000 assets, including new additions to Asia Pacific indices, their offerings are primarily equities. The selection of currency pairs and indices remains average.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On FP Markets

"FP Markets achieves a perfect blend of affordability and quality for active traders. They maintain low trading costs while enhancing investment options, charting tools, and research features, alongside providing reliable support for urgent queries."

Pros

- FP Markets provides an excellent range of trading options, thanks to its broadened commodities offerings and support for more than 10,000 stocks.

- FP Markets provides swift and reliable support, accessible 24 hours a day, five days a week, with average response times under one minute during tests.

- FP Markets now offers advanced research tools from Trading Central and Autochartist. These tools assist traders in spotting short-term opportunities by analysing chart patterns, indicators, and other technical elements.

Cons

- Traders Hub offers valuable resources such as the Daily Report, Technical Report, Market Insights, and Fundamental Analysis. Yet, it should diversify its daily content and ensure its forex news remains current to compete with market leaders like IG.

- The Raw account offers excellent pricing. However, the Standard account has wider spreads, averaging 1.1 pips on EUR/USD, which lags behind the competitive 0.8-pip spread at IC Markets.

- FP Markets’ Iress platform is exclusively available to Australian clients. The platform is geared towards stock trading rather than forex. Data fees may accumulate quickly unless you are an active trader or hold a high-balance account.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

How Investing.co.uk Chose The Top HFT Brokers

To identify the top UK brokers for high-frequency trading, we conducted a deep dive into the HFT environment at various platforms available to UK-based traders.

Each broker was scored on a 1–100 scale based on how well they cater to high-frequency strategies. Our testing focused on factors that matter most to HFT traders in the UK: ultra-low latency execution, raw spread pricing, direct market access (DMA), FIX and REST API support, and algo trading infrastructure.

We then ranked the top-performing brokers using a dedicated HFT score, which combined measurable data with insights from our trading experts.

How To Pick A High-Frequency Trading Broker

- Low-latency execution and co-location services can determine whether a trade is profitable. By placing trading servers physically close to exchange data centres—a service known as co-location—you can reduce the time it takes for orders to reach the market. This speed is essential for strategies like arbitrage and market making, where price opportunities disappear almost instantly. Exchanges like the London Stock Exchange (LSE) host co-location facilities in data centres such as Equinix’s LD4 data centre in Slough, and some brokers offer direct access to these, giving you a competitive edge.

- Asset classes supported by an HFT broker—such as equities, forex, and futures—are essential because different markets have varying liquidity, volatility, and trading rules that impact strategy performance. For example, futures markets often offer high leverage and standardised contracts ideal for ultra-fast execution, while currency markets provide vast liquidity and continuous trading hours. Brokers that support multiple asset classes allow you to diversify and deploy arbitrage strategies across markets. Choosing a broker with broad and reliable access ensures your algorithms can operate efficiently in the most profitable venues.

- Trading platforms and API options like FIX, REST, and WebSocket are vital for high-frequency trading because they enable direct, programmatic access to markets with minimal delay. These protocols allow you to send and manage orders, receive real-time market data, and implement complex algorithms seamlessly. Direct market access brokers further reduce latency by bypassing intermediaries, speeding up order execution. Brokers offering robust API support and customisable solutions let you build and optimise HFT strategies that react instantly to market changes—an edge that’s not possible with standard trading platforms.

- Leverage and margin facilities allow you to control larger positions with a smaller amount of capital, amplifying potential returns on tiny price movements. However, using leverage also increases risk, as losses can multiply quickly if the market moves against a position. Brokers that offer flexible margin requirements enable HFT strategies to maximise capital efficiency while managing risk through real-time margin monitoring and automated risk controls—essential features for fast-paced trading where positions open and close within seconds.

- Fee structure is paramount for high-frequency trading because HFT strategies rely on executing hundreds or thousands of trades with very slim profit margins per trade. Even small commissions or fees can quickly erode overall profitability. Brokers offering low commissions, volume-based rebates, or maker-taker pricing models help you reduce transaction costs and improve net returns. Finding a broker with transparent, cost-efficient pricing ensures that frequent trading remains economically viable.

- Reliability and uptime are critical in high-frequency trading because any downtime or technical failure can lead to missed opportunities or costly errors in milliseconds. Brokers with robust technical infrastructure use redundant systems, backup servers, and continuous monitoring to ensure their platforms remain operational 24/7—even during market spikes or technical glitches. Choosing a brokerage known for high uptime minimises the risk of execution delays or outages that can severely impact HFT strategy performance and profitability.

- Regulation and strict rules from the FCA and frameworks like MiFID II ensure that trading is fair, transparent, and free from manipulative practices like spoofing or layering. These regulations require brokers to implement advanced market surveillance and compliance tools that monitor algorithmic behaviour in real time. Selecting a broker that actively complies with these standards not only protects your trading capital but also helps avoid legal risks and penalties, ensuring your strategies operate within a secure and well-regulated environment.

In my experience, the brokers that truly empower high-frequency traders are those who treat latency reduction and risk management as equally critical, creating an ecosystem where innovation and stability coexist.

What Is A High-Frequency Trading Broker?

A HFT broker is a specialised brokerage firm that provides the ultra-low latency infrastructure, Direct Market Access (DMA), and API connectivity required to support high-speed automated trading.

Unlike standard retail brokers, HFT brokers cater to traders and firms who need to execute hundreds or thousands of trades per second with minimal delay.

Brokers like IG and CMC Markets offer advanced tools such as co-location services, FIX/REST APIs, and deep liquidity access—making them suitable for professional quants and algorithmic traders.

These brokers serve as the critical link between your trading system and the market, where microseconds can define profit or loss.

CMC Markets offers data and trade execution through FIX API protocol

Pros Of High-Frequency Trading

- Ultra-fast execution with minimal latency: HFT systems are engineered to execute trades in microseconds by leveraging colocated servers, high-speed fibre or microwave data links, and DMA. This allows algorithms to respond to order book changes and market events faster than traditional traders, giving a significant advantage in competitive, time-sensitive environments.

- Enhanced market liquidity & tighter spreads: HFT strategies often function as automated market makers, continuously placing and updating large volumes of buy and sell orders. This constant activity increases market depth and typically results in narrower bid-ask spreads, improving overall price efficiency for all participants.

- High-efficiency arbitrage across markets: By simultaneously monitoring multiple trading venues, HFT algorithms can detect and exploit brief pricing discrepancies—such as latency arbitrage or statistical arbitrage—before they disappear. To do this effectively, they rely on low-latency data feeds, ultra-fast order routing, and real-time analytics to make split-second decisions at scale.

Cons Of High-Frequency Trading

- High infrastructure & operational costs: Running an HFT strategy requires significant investment in specialised infrastructure—colocated servers, ultra-low latency networking, real-time data feeds, and custom-built algorithms. These costs make HFT largely inaccessible to individual traders and require ongoing maintenance, frequent upgrades, and skilled technical staff.

- Regulatory & compliance complexity: HFT firms must comply with strict regulations, including real-time reporting, algorithm testing, and market abuse controls (e.g., under MiFID II in the UK). Ensuring compliance requires advanced surveillance systems, thorough audit trails, and constant monitoring to avoid penalties for behaviours like spoofing or layering.

- Increased market risk from speed & volume: While HFT can be profitable, the speed and scale of execution also amplify risks. System errors, faulty algorithms, or unexpected market conditions can lead to cascading losses in milliseconds. Additionally, reliance on automated strategies means a small coding mistake or latency spike can have outsized financial impacts before manual intervention is possible.

Successful high-frequency trading hinges not only on cutting-edge algorithms but also on the quality and consistency of data feeds. I’ve found that even the most minor data lag or feed disruption can cascade into significant execution errors.That’s why selecting a broker with robust, low-latency market data and reliable API access is just as crucial as the trading strategy itself.

Bottom Line

High-frequency trading demands more than just speed—it requires the right combination of technology, infrastructure, and regulatory reliability.

Choosing the best HFT broker means looking beyond basic features to assess execution latency, API support, asset coverage, and cost efficiency.

With the right broker, you can maximise the potential of your algorithms while staying compliant and competitive in today’s fast-moving markets.