Best Copy Trading Platforms In The UK 2026

As an experienced copy trader myself, I know not every copy trading platform operates in the same way. Transparency, fees, user experience, and of course, results, can vary hugely. That’s why we’ve rounded up and ranked the best copy trading brokers in the UK.

Top Copy Trading Brokers

-

Pepperstone offers the replication of skilled traders' strategies via MetaTrader Signals, DupliTrade, and its new proprietary copy trading app, in collaboration with Pelican Trading. This service, available in select regions, grants access to numerous experienced traders and customized risk settings. However, it does not support cTrader Copy, which might discourage traders who prefer Spotware's platform.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Trade Nation Seychelles provides signals and copy trading, appealing to novices and those preferring a passive trading strategy. Capitalise on experienced traders' insights to engage in popular financial markets like forex, stocks, and commodities.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

eToro consistently provides an outstanding proprietary trading platform for clients, free of charge. The web-based system is both intuitive and engaging, complemented by a community chat that appeals to novice traders. The recent 'Live Trades' feature grants immediate access to real-time insights on securities purchased by top investors on the platform.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Traders benefit from social and copy trading at Vantage through MetaTrader, DupliTrade, ZuluTrade, and Myfxbook. ZuluTrade stands out as a leading social trading network. It employs an advanced algorithm to rank top signal providers.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

FXCM provides social and copy trading options for forex, CFDs, and cryptocurrencies via the widely-used ZuluTrade platform. Registration is swift, and you can monitor your trading outcomes instantly.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

The TradeCopier service enables aspiring investors to mirror the strategies of leading traders instantly. This tool offers novices an opportunity to learn from seasoned investors, while strategy providers have the potential to earn performance fees.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM)

Safety Comparison

Compare how safe the Best Copy Trading Platforms In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Copy Trading Platforms In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Copy Trading Platforms In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| IronFX | Android, iOS, WebTrader | ✘ |

Beginners Comparison

Are the Best Copy Trading Platforms In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| FXCM | ✔ | $50 | Variable | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| IronFX | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Copy Trading Platforms In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Copy Trading Platforms In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| FXCM | |||||||||

| Axi | |||||||||

| IronFX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- Traders have access to premium tools such as a market scanner, forex signals, and research from the third-party site eFXPlus.

- FXCM boasts a strong international reputation, holding licences from the FCA, ASIC, CySEC, and FSCA. With two decades of experience, it commands respect in the trading industry.

- The proprietary Trading Station platform is an excellent option for traders seeking a comprehensive tool for their short-term and automated strategies.

Cons

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

Cons

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- Traders gain access to the renowned Trading Central research tool, featuring automated AI analytics and round-the-clock support.

- The IronFX Academy provides outstanding educational resources for traders of all levels, from beginners to advanced.

- The broker regularly hosts trading competitions with cash rewards and provides welcome bonuses for new clients.

Cons

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

How Investing.co.uk Picked The Best Copy Trading Brokers

To find the best copy trading brokers in the UK, we carry out a detailed review of each provider listed in our live broker database.

Our evaluation looks at more than 200 criteria, including the range and quality of copy trading tools, account fees, investor protections and whether the broker is regulated by the FCA.

Our research team includes experienced copy traders like myself who have spent years using leading social trading platforms, such as eToro and cTrader Copy. This first-hand knowledge helps us explain not just the features, but also what UK clients can expect day-to-day when copying other traders.

What To Look For In A Copy Trading Provider

Trader Transparency

The primary benefit of copy trading is the ability to observe what others are doing. Good platforms show clear stats for each trader. That means past performance, win-loss ratios, risk levels, and how long they’ve been trading.

If the data is unclear or feels cherry-picked, that’s a problem. You need real numbers to determine if someone’s strategy aligns with your own tolerance for risk.

Transparency builds trust, and without it, you’re left guessing. Copy trading only works when you can make informed choices about who to follow.

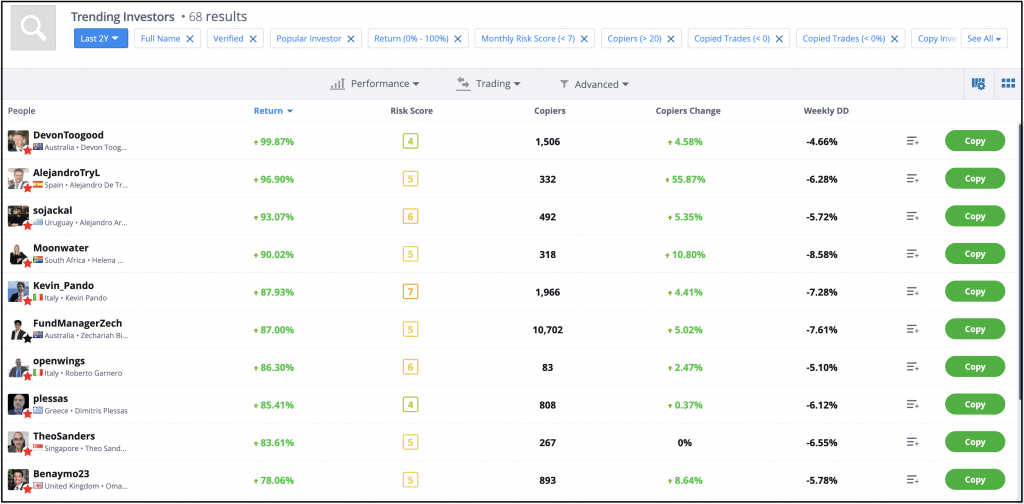

Filtering traders to copy on eToro helps you narrow down by risk, returns, and markets

Range Of Markets

Different traders focus on various markets. Some stick to forex, while others work with stocks, indices, or crypto. The platform you pick should support the markets you’re most interested in.

If you want flexibility, choose a platform that offers more than just forex. But if you only care about one market, you may prefer a specialist platform with strong tools in that area.

The right balance depends on your own goals, but the main point is to avoid being limited by a narrow platform.

Costs & Fees

Copy trading isn’t free. You might pay spreads, commissions, or a share of profits. Each platform has its own fee model.

Don’t just look for the cheapest option. Look at how fees are structured. Some charge a flat spread on trades. Others take a percentage of your gains. Some have hidden costs, such as overnight financing or withdrawal charges.

The important thing is clarity. You should know exactly how much you’ll be paying and when. If a platform makes it hard to find the details, that’s not a good sign. Transparent fees are a key component of fair trading.

Sometimes, a winning streak feels smaller once spreads and commissions are taken into account. I don’t mind paying when the platform is transparent, but hidden charges always leave a bad taste. Knowing the full cost upfront makes me more careful about who and what I copy.

Copy Controls

You don’t want to copy blindly. Good platforms allow you to set limits and controls, such as the amount to invest per trader, the maximum loss you’re willing to accept, or stopping the copy if performance drops below a specified level.

These controls protect you from larger losses if things go wrong. If a platform doesn’t let you manage risk on your side, that’s risky in itself. Having the ability to terminate a copy arrangement quickly is just as important as choosing who to follow in the first place.

Track Record Of The Platform

It’s not just about the traders. The platform itself should have a reliable history. Ask how long it has been running, whether traders actually stay active or churn quickly, and whether the platform has had issues with downtime or withdrawals.

You can usually find answers in user reviews or the financial press. A platform with a solid track record is more trustworthy than one that has just launched.

In trading, history matters because it demonstrates whether a service can withstand the stress of real-world markets over time.

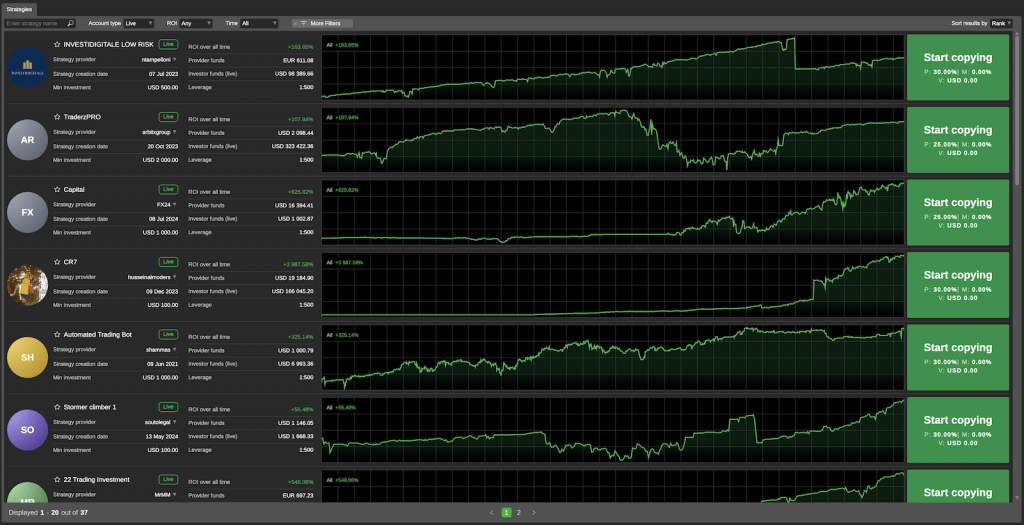

Filter cTrader Copy strategies with over a year of history to see longer track records

Community & Support

Copy trading works better when there’s a strong community. Some platforms allow you to interact with traders, ask questions, or view their thought process. This can provide more context for the numbers and help you better understand the strategies.

Also, check the support available. If something goes wrong, can you reach a real person? Email only isn’t great if you’re dealing with money. Live chat or phone support is better. Reliable support shows the platform takes its users seriously.

Ease Of Use

If the platform is confusing, you’ll make mistakes. A good copy trading platform should be straightforward to use. You should be able to search and filter traders, see performance stats clearly, and adjust your copy settings without hassle.

Always try the demo account if there is one. That way, you can see if it feels natural before putting in real money. Ease of use isn’t just about comfort—it’s about avoiding errors that could cost you.

Regulation & Safety

First, make sure the platform is regulated in the UK. The Financial Conduct Authority (FCA) is the key regulator. An FCA-regulated platform must follow rules that protect your money, such as keeping client funds separate and providing clear risk warnings.

If a platform isn’t FCA-regulated, you don’t have the same protections. That’s a red flag. Always check this first. Without proper regulation, you’re taking on extra risk before you even place a trade.

Mobile & Desktop Options

Most traders check their accounts on the go. A platform with a good mobile trading app makes it easier to stay on top of things. However, desktop versions typically offer more detail.

The best option is a platform that excels in both areas. You shouldn’t feel limited when switching between devices. Whether you’re at your desk or out and about, you should have the same level of control.

Education & Guidance

Copy trading is often marketed as a hands-off approach. But you still need to understand the basics. Some platforms offer learning resources to help you grasp what you’re doing. These can include simple guides on risk, webinars with traders, or updates on market conditions.

This matters because even with copy trading, you’re still responsible for your own money. Education helps you avoid blind copying and gives you the confidence to make better choices.

Withdrawal & Funding Options

Check how easy it is to deposit and withdraw money. Some platforms offer fast withdrawals, while others take several days. Fees can also apply, depending on the payment method.

Ideally, you want multiple options, such as bank transfer, debit card, or e-wallet, and clear rules on withdrawal times. If it feels vague, that’s a sign to be cautious. Access to your own money should never feel uncertain.

Risk Warnings & Reality Check

Copy trading doesn’t guarantee profits. You can lose money, just like with any trading. A good platform should make this clear. If the marketing feels like a promise of easy money, be careful.

Always remind yourself that you’re copying human traders, or algos created by humans. They make mistakes. Past results don’t predict future performance. Copy trading can reduce the workload, but it doesn’t remove risk.

Bottom Line

Choosing the best copy trading platform in the UK isn’t just about finding the most popular one. It’s about matching the platform to your own goals and comfort level.

The main things to check are whether the platform is FCA-regulated, whether trader statistics are transparent, whether the fees are clear, whether strong risk controls are in place, and whether the track record and support are solid.

Take your time before committing money. Try demos, read reviews, and set limits for yourself.

Copy trading can be beneficial, but only if you remain in control of how you utilise it. Ensure the platform aligns with your trading style, not the other way around.