Cryptocurrency Trading In The UK 2026

Cryptocurrency trading in 2026 is big businesses. From Bitcoin and Litecoin to Ethereum and Dash, individuals and institutions are investing billions. Of course, to profit from day trading cryptocurrencies, you need an effective strategy and a brokerage with powerful apps.

This guide explains how to start investing in cryptocurrency for beginners, covering top tips, crypto wallets, UK taxes, plus the best online software and trading bots.

Top 3 Crypto Brokers

List of all cryptocurrency brokers

What Is Cryptocurrency?

Crypto coins are digital currencies, typically built on decentralised blockchain networks and secured through cryptography. Instead of the physical distribution of traditional notes and coins by a government-controlled body, cryptocurrencies are mined and secured through an online system of computers, otherwise known as nodes.

The result is a system of money that governments cannot easily control through laws and rules. It’s this ambiguity that makes their use so hotly debated, leading to market volatility, and in turn, huge day trading volumes as investors try to profit from their fluctuating value.

How To Start Cryptocurrency Trading

Here’s a quick guide if you want to start cryptocurrency trading:

- Own or speculate – If you want to invest by buying and holding cryptocurrency, you need an online exchange, such as BitMex. The straightforward mobile app receives positive customer reviews. Alternatively, if you want to take a position on the price of Bitcoin, for example, you’ll need to open an account with a brokerage. See our guide to finding the best crypto brokers in the UK or check out our tips below on how to compare companies.

- Fund your account – Deposit money into your exchange or cryptocurrency trading account.

- Trade & invest – Take a position on the crypto market or buy the digital coin you want, such as Litecoin.

Note, most cryptocurrency trading is done through short term price speculation instead of the longer-term holding of digital currencies at exchanges. As a result, firms that offer leveraged crypto CFDs and forex trading are often a good place to start.

How To Compare Cryptocurrency Trading Firms In The UK

When you start cryptocurrency trading, one of the key decisions you’ll need to make is which cryptocurrency broker to open a trading account with. This is where you’ll exchange money for crypto products or assets. The tools offered, market access provided, and range of instruments can all impact returns. So when comparing providers, it’s important to consider the below.

Products

If you just want to buy and hold Bitcoin, for example, you’ll be looking for an easy-access and secure crypto exchange that will serve as an online wallet. If you’re looking to start day trading cryptocurrency, you’ll want a competitive instrument that meets your needs. IQ Option, for example, offers investing in cryptos through forex and CFDs. In addition, they provide cryptocurrency trading multipliers which provide extra leverage in return for greater risk. For traders with limited capital, such products may help maximise profits.

Platforms & Apps

For the best results, you want a powerful cryptocurrency trading platform that’s stocked with a suite of volume charts and graphs, statistics, indicators, and analysis tools. This will make judging the market and executing positions easier. Regularly topping PDF lists of user-friendly cryptocurrency day trading platforms is MetaTrader (MT4).

Most popular cryptocurrency trading software in the UK is also available as stand-alone mobile trading apps. The best mobile investing platforms let you make deposits and withdrawals, track prices and take positions on the markets with a few taps. One useful tip is to use free demo accounts to do your own platform comparison.

Cryptocurrency Trading Fees

Investors need to balance features with fees. Payment charges, cryptocurrency trading commissions and exchange costs can all cut into profits. At the same time, opting for the firm with the lowest fees or even without fees will likely come at a price, such as fewer trading tools or reduced reliability.

Cryptocurrency trading fees usually come in the form of:

- Exchange costs – Cryptocurrency trading desks and exchanges charge varying amounts to use their software and services. The cryptocurrency you’re investing in and the volume of trades will impact the size of these fees. Kraken is a popular exchange with low costs. It’s always worth checking for price quotes before you open an account.

- Trading fees – Providers usually profit from the difference in the ask and bid price, known as the spread, or by charging a fixed price per trade, known as a commission. It’s worth checking reviews and doing a comparison before you start cryptocurrency trading as even small differences in fees can quickly add up.

- Payment charges – At some of the best providers, it’s free to make deposits and withdrawals into and from your cryptocurrency trading account. However, other firms may charge a fee for each payment. If you do open an account with these providers, it could be worth making fewer, larger payments to keep costs down. It’s also worth checking with customer support to see which payment options offer the lowest fees.

Licensing

The cryptocurrency trading market is to some extent as an unregulated investing engine. As a result, it’s not considered as secure and reputable as other financial markets, such as forex and stocks. It’s therefore important that traders open accounts with licensed and regulated cryptocurrency trading firms. In the UK, the regulatory agency is the Financial Conduct Authority (FCA). Check the FCA register to make sure a firm is licensed.

Cryptocurrency Trading For Beginners

For cryptocurrency trading dummies, there are a few basics to get your head around before you put your money on the line:

- Understand what’s hot – Cryptocurrencies such as Bitcoin, Litecoin and Ethereum are popular among investors for their large trading volumes and accessibility. However, new crypto coins emerge each week, so it’s worth keeping an eye out for fast climbers, such as Dash, Monero and Ripple.

- Expect the unexpected – Cryptocurrencies are notoriously volatile. If you can’t get comfortable with serious fluctuations in price, you’ll be caught off guard. For example, Bitcoin dropped from close to $20,000 in 2017 to less than $5,000 in 2019 before closing post $20,000 in December of 2020.

- Learn about blockchain – You don’t need a comprehensive understanding of the underlying blockchain technologies that sit behind popular cryptos, such as Bitcoin. However you do need to understand the basics so you can react to relevant news pieces that might affect the value of cryptos. For day trading beginners, there are a host of tutorials, video guides and detailed PDFs online that explaining the meaning of key terms and technologies. See our cryptocurrency trading tips below and investing tutorials for additional information.

Wallets

For beginners, if you want to own and hold cryptocurrencies instead of speculating on the price, you’ll need a wallet. In 2026 there are multiple online companies to choose from. It’s worth opting for a service that’s easy to register with and offers high levels of customer security. Our recommendation is Bitmex – a leading online crypto exchange.

Cryptocurrency Trading Strategies

Once you’ve opened an account with a cryptocurrency trading company, you can then implement a strategy. The best strategies combine technical analysis with a careful approach to risk management.

HODling

This straightforward strategy involves taking a long position on crypto coins in the belief the price will climb over time. This strategy became well known in 2013 when a trader accidentally proclaimed they would be hodling (holding) onto their Bitcoin position despite the fall in price. Of course, due to the volatility of popular crypto coins, this is a risky strategy. Indeed, Bitcoin only returned to its 2018 peak in December of 2020.

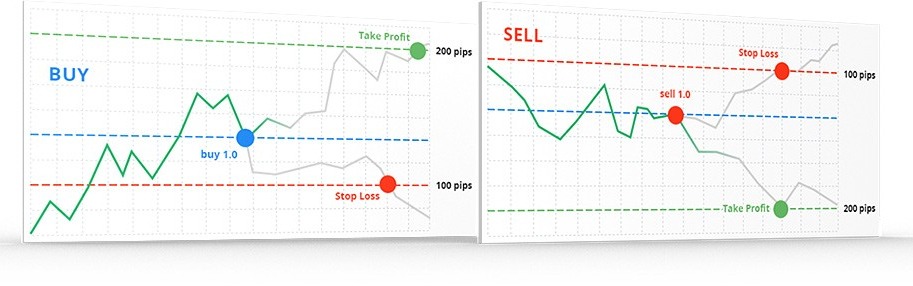

Day Trading

As the name suggests, a day trading cryptocurrency strategy refers to the buying and selling of crypto, such as Litecoin, in the same trading day. Day traders typically place a number of long and short positions intending to profit on intra-day price movements. Day traders usually close all of their positions at the end of the day. This is a particularly popular strategy for those with the time to analyse charts and follow market news.

Find out more about day trading.

Tips

There are several useful tips to bear in mind when you start trading and investing in cryptocurrencies:

- Leverage – Leveraged cryptocurrency trading allows you to increase your position size by borrowing capital from a firm. FCA-regulated firms cap leverage rates at 1:30 for retail traders. Leveraged cryptocurrency trading can also lead to large losses, so caution is advised. Margin exchanges have varying leverage rates. Bitfinex is one leading cryptocurrency trading platform and is our recommendation. Bittrex also receives good customer reviews.

- Risk management – to make consistent profits investing in cryptocurrencies, you’ll need a carefully thought through risk management strategy. The one percent rule is one such example. Providers today offer a multitude of risk management alerts and various orders and trailing stops so you can minimise risk. You can also find strategy PDFs online for additional tips.

- Trading journals – Keeping a journal is an excellent way to track your trading performance and identify opportunities to refine strategies, tweak risk management processes, and maximise profits.

- Market analysis – Trading firms today after a wealth of technical analysis tools, from advanced charting and signals to historical price charts that allow you to track the value of cryptocurrencies. These can all help inform strategies.

- News – The short-term value of cryptocurrencies can be seriously influenced by the news. The announcement of new rules and regulations from the UK government, for example, will likely impact the price of some cryptos.

- Volumes – One particularly useful cryptocurrency trading tip is to analyse current investing volumes against the number of wallets and active wallets. This can help paint a picture of the present market value of cryptocurrencies.

Rules

Due to their short but eventful history, governments are working hard to introduce rules and regulations to control the growth of cryptocurrencies. Before you start cryptocurrency trading & investing, it’s worth understanding your obligations when it comes to taxes and any other legal requirements.

The UK government is yet to introduce any legal rules to prevent trading in cryptocurrencies. Of course, that isn’t to say that cryptocurrency trading doesn’t come with risks. Multiple groups that warn of the dangers of crypto investing, including online scams. It also doesn’t mean that bans won’t be introduced in the future.

Taxes

The UK’s HMRC was among the first countries to introduce rules on cryptocurrency trading taxes. They are also among the most active tax agencies when it comes to collecting any revenue due from investing & trading in cryptocurrencies. In the 2019 – 2020 tax year, for example, HMRC reached an agreement with online crypto exchange – Coinbase, to share information on all accounts that held over $5,000 in crypto assets.

Your tax obligations will depend on your cryptocurrency trading activity:

- Holding cryptocurrency – If you invest in cryptos and hold it as an investment in a wallet or exchange, you will be required to pay Capital Gains Tax. The capital gain is the difference between the GBP value of the cryptocurrency when it’s bought and when it’s sold.

- Trading cryptocurrency – If you are day trading cryptocurrency, for example, you will be subject to Income Tax rules. Thresholds change, but most individuals are entitled to a personal tax allowance, before moving onto the basic rate of tax, higher rate, and then an additional rate for high-income earners.

For more information on UK taxes on cryptocurrency trading and investing, see HMRC’s guidance.

Pros Of Cryptocurrency Trading In The UK

There are several advantages to cryptocurrency trading:

- Profit potential – If you take cryptocurrency trading vs forex or stock trading, there is typically more market volatility, which may lead to greater profits for savvy investors.

- Market tips – There are a host of useful websites and resources that offer daily trading tips, crypto definitions, and investing basics.

- Mining cryptos – Investing can be done through mining and holding cryptos – you don’t have to trade the digital coins on online trading markets.

- Account options – Traders can choose between multiple brokerages and exchanges that offer everything from micro investing up to large volume investment funds.

- Weekend trading – Cryptocurrencies break the traditional mould of financial markets and still see fairly decent trading volumes over the weekends. These extended cryptocurrency trading times and hours may suit some investors with fewer days free in the week.

Cons Of Cryptocurrency Trading In The UK

Downsides of investing in cryptocurrencies include:

- Risky – Cryptocurrencies are more unpredictable than established financial markets. As a result, there is a risk of large losses if prices don’t move in the expected direction. Trading on leverage increases these risks.

- Rules – Whilst the UK government hasn’t thus far brought in strict rules to curtail the use of and investment in cryptocurrencies, it is a possibility. At that point, the value of crypto assets held may fall.

Bots

Cryptocurrency day trading bots are a useful tool that allow you to automate successful trading strategies. Following pre-determined investing algorithms, bots automatically open and close positions based on market data and signals. Used correctly, trading robots can free up time while increasing investing volumes. Zenbot is a particularly popular cryptocurrency trading bot.

A number of automated services in the UK can help you build a cryptocurrency trading robot. You’ll also find tutorials online that explain how to make a bot. Alternatively, there are pre-existing Python scripts and APIs with user-friendly dashboards to help you refine a pre-existing algorithm. As machine learning continues to evolve, traders can expect more intelligent quantitative bots to enter the cryptocurrency trading game.

It’s worth highlighting that there are downsides to investing in cryptocurrencies in the UK with bots. Firstly, learning how to create your own algorithm isn’t easy and can be time-consuming. Bots are also expensive, especially if you pay to use someone else’s. Bots also need monitoring. If the market dives, algorithms may need adjusting.

Cryptocurrency Trading Education

Cryptocurrencies are still relatively new and people are still learning how investing in these digital coins works. Fortunately, there are ample resources online to help upskill prospective traders and investors, including free courses online, detailed PDFs and ebooks, plus newsletters and treading calculators, all of which provide important market lessons and offer tactics.

There are also podcasts and online videos on YouTube to explain how it all works. Online forums and newsletters are another good place to get recommendations and cryptocurrency trading methods explained by successful investors.

For those with deeper pockets and enough time, you can also find cryptocurrency trading mentors who will start with trading 101s and stay with you until you’re generating consistent profits.

It’s worth setting time aside to explore crypto investing websites and studying educational resources to inform your investing strategies.

Demo Accounts

One of the most important tools available is a cryptocurrency trading demo account. Offered by many websites, simulator accounts are an excellent place to practice trading in a risk-free environment. Investors can practice the basics and get a view on how successful cryptocurrency trading strategies may be with a virtual bankroll. Once investors have finished in the training arena, they can open a live account and start trading with real money.

Final Word On Cryptocurrency Trading

We’ve walked you through how to start trading and investing in cryptocurrencies in the UK in 2026. Our guide has explained how to choose a good trading firm, what to factor into good strategies, as well as considering leading software and apps. It’s also worth remembering that while there are crypto millionaires, there is also a long list of traders who lose money trading on the likes of Bitcoin. Crypto investing is not a game.