Best Brokers For Trading Chia (XCH) in 2026

Chia (XCH) is a crypto token that lets eco-conscious traders speculate on crypto markets without the massive energy consumption of major digital currencies like Bitcoin.

Discover the best Chia brokers and exchanges chosen by our experts, including seasoned crypto investors.

The UK’s Financial Conduct Authority (FCA) has banned crypto derivatives (including chia CFDs) to retail investors. UK residents can still access crypto derivatives through international brokers that are not FCA-regulated, but doing so means you may not be protected under UK regulations, such as the Financial Services Compensation Scheme (FSCS).

Top Chia Brokers and Exchanges

-

Founded in 2017, OKX is a reputable cryptocurrency company, providing a comprehensive range of offerings, including trading and NFTs. It enables traders to access more than 400 crypto tokens through OTC trading and derivatives. Its excellent web platform, developer tools, and interactive charts make OKX a preferred option among technical traders.

Instruments Regulator Platforms Spot, futures, perpetual swaps, options VARA AlgoTrader, Quantower Min. Deposit Min. Trade Leverage 10 USDT Variable -

Pionex is a cryptocurrency trading platform that excels in automated trading. It provides traders with an array of pre-built bots and strategies, alongside AI tools for strategy customisation or creation. These tools are available for both spot and futures crypto markets.

Instruments Regulator Platforms Cryptos FinCEN Own Min. Deposit Min. Trade Leverage $0 0.1 USDT

Safety Comparison

Compare how safe the Best Brokers For Trading Chia (XCH) in 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| OKX | ✘ | ✘ | ✘ | ✘ | |

| Pionex | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Trading Chia (XCH) in 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| Pionex | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Trading Chia (XCH) in 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| OKX | Android & iOS | ✘ | ||

| Pionex | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers For Trading Chia (XCH) in 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| OKX | ✔ | 10 USDT | Variable | ||

| Pionex | ✘ | $0 | 0.1 USDT |

Advanced Trading Comparison

Do the Best Brokers For Trading Chia (XCH) in 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Pionex | Crypto bots | ✘ | - | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Trading Chia (XCH) in 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| OKX | |||||||||

| Pionex |

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- Access a diverse array of trading instruments, such as futures, options, and perpetual swaps, through both mobile and desktop platforms.

- Active traders benefit from competitive rates, with maker fees starting at 0.02% and taker fees at 0.05%.

- In 2025, OKX obtained a MiFID II licence, allowing it to offer regulated derivatives across Europe, ensuring peace of mind for traders.

Cons

- Testing revealed that customer support quality varied.

- The broker's platform and features might feel intricate for beginners.

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

Our Take On Pionex

"Pionex is a superb choice for crypto traders keen on advanced AI technologies, such as ChatGPT, and automated trading."

Pros

- Twelve free integrated trading bots available, requiring no coding or programming skills.

- Superior and innovative liquidity engines sourced from top exchanges like Binance and Huobi.

- With trading fees as low as 0.05% for both makers and takers, this platform offers competitive rates compared to other leading exchanges.

Cons

- Withdrawal fees and limits might be applicable.

- Inadequate regulatory oversight raises concerns about security.

- Does not accept deposits in traditional currency.

How Investing.co.uk Chose the Best Platforms for Trading Chia (XCH)

We only considered reputable exchanges and brokers that support Chia trading. Our team reviewed trading conditions and, where necessary, contacted customer support to verify Chia availability.

Providers were eventually sorted by their overall ratings, which take into account over 200 data points and the lived experiences of our crypto platform testers.

What To Look For In A Chia Trading Platform

Chia has something of a niche position in crypto markets, with a market capitalisation and trading volume that’s far below Bitcoin and the other large tokens.

As a result, you’re most likely to find Chia tokens on dedicated crypto exchanges that provide trading opportunities on a large range of altcoins, and during our testing, we did not find many reliable brokers with Chia tokens on their books.

Look for these essential things when choosing a provider:

- Trust – You should only trade with a broker or exchange with proven credentials. We evaluate this by looking at a firm’s track record in the industry to rule out scams or dishonest practices, evaluating any FCA regulatory licenses and checking they’re up to date, prioritising for platforms that serve large client bases, and looking for firms that provide protections such as segregated client and business funds.

- Fees – You need to keep your trading fees to a minimum so you have the best chance of profiting from your Chia investments. We look for chia exchanges that have low maker/taker fees on trades, and low or no extra charges like deposit/withdrawal fees.

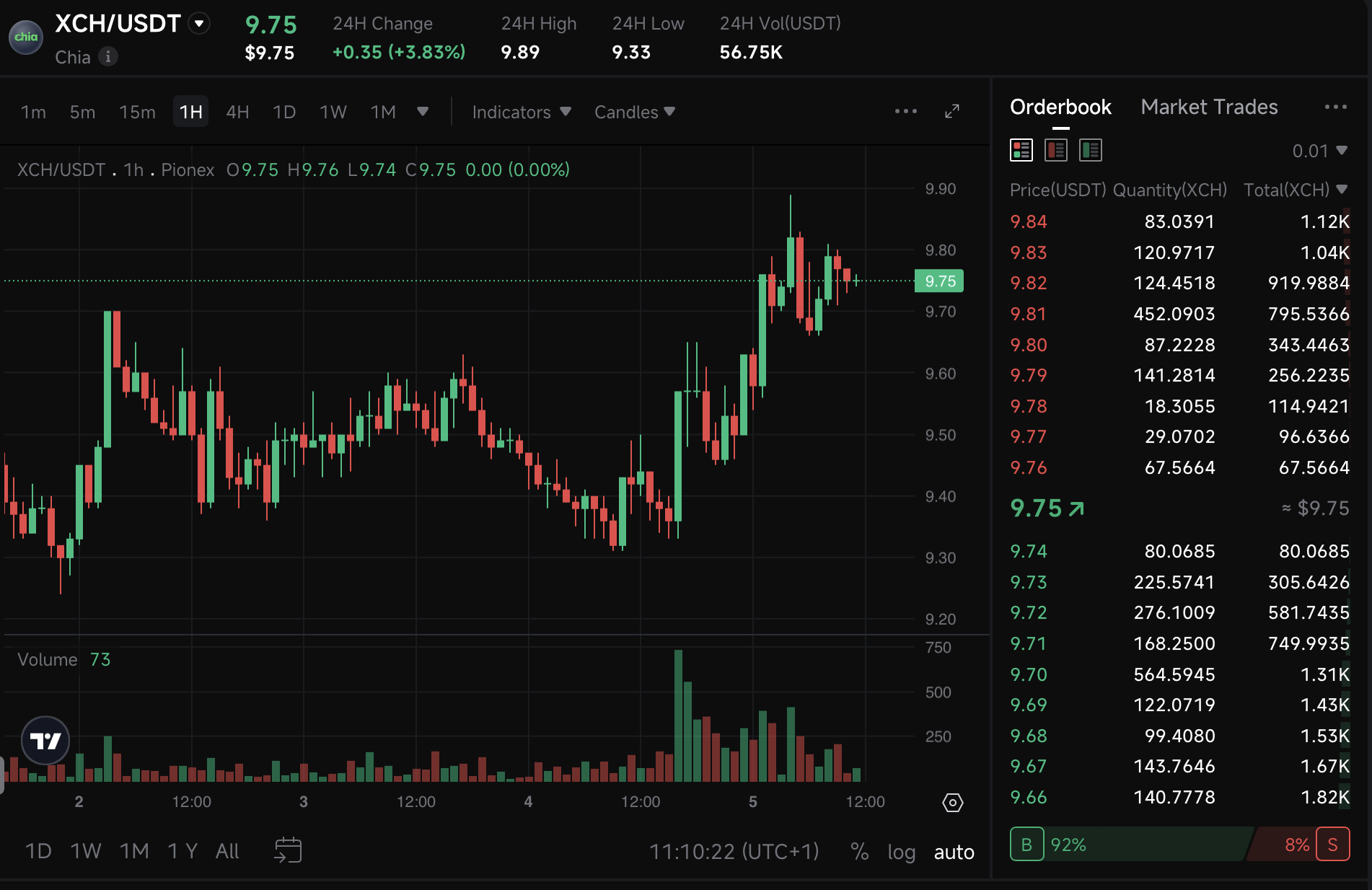

- Platform – A user-friendly and powerful trading platform allows you to analyse Chia price movements using in-built tools and indicators to find sensible entry points and price targets. We enjoy using Pionex‘s proprietary platform, as it integrates TradingView‘s powerful charts alongside real-time market data.

- Leverage – Leverage trading gives you the flexibility to capitalise on Chia trading opportunities using borrowed funds, but both profits and losses are amplified so you should use it carefully. OKX is one of our top choices for leveraged crypto trading because it is a reliable platform with flexible levels from 1:10.

Pionex – XCH chart

What Is Chia?

The Chia network was created in 2017 by Bram Cohen, inventor of a file-sharing system called BitTorrent.

Chia was designed to tackle the energy-intensive Proof of Work and Proof of Stake models that major cryptocurrencies use. Instead of requiring massive amounts of computing power, Chia relies on unused storage space on hard disk drives. This energy-efficient method of verifying transactions is called Proof of Space and Time.

Chia was made available for trading on Monday 3rd May 2021. It opened at $1,600 per unit followed by an all-time high of $1,800.

How Chia Works

The Chia network runs on a Proof of Space and Time consensus method. Proof of Space is a cryptographic technique that enables network participants to prove that they have unused hard drive space over a period.

For XCH farming to work, users on the blockchain “seed” unused space by downloading farming software from the network’s website, known as a mining rig.

Proof of Space is tied to Proof of Time. It ensures that block times have consistency, which increases the overall security of the Chia blockchain. Farmers increase their chances of winning a block by obtaining greater storage space. After the farmer’s obtained sufficient space, they use a farming rig or pool such as Raspberry Pi to plot the coin.

Pros Of Trading Chia

- Eco-friendly – Crypto mining requires costly single-use hardware that takes massive amounts of electricity. In contrast, Chia farming leverages existing hard disk space. Once you’ve farmed storage, it can then be repurposed for storing other files.

- Atomic swaps – The Chia network allows for atomic swaps. Peer-to-peer trading via smart contracts eliminates the need for third parties and reduces the transaction costs required on an exchange.

- Rewards – Farmers can receive rewards for helping secure the blockchain. After downloading the node software and plotting is complete, the software tracks your rewards for you. Farming rewards include 64 XCH every 10 minutes.

- Security – Chia’s blockchain claims to have significantly better security than Bitcoin due to its unique decentralised blockchain. It runs on Chialisp, which is a newer smart transaction programming language that also increases security.

Cons Of Trading Chia

- Volatility – The XCH coin is not necessarily intended as a long-term investment vehicle but rather as a viable global financial payments system. The Chia coin plans to become a public company. This will allow financial institutions to hedge and leverage coins and equity. The company will use strategic reserves to reduce volatility. This may limit the profit potential for day traders and longer-term investors.

- Purchasing – XCH can’t easily be purchased with traditional fiat money i.e. USD or GBP. You can primarily buy Chia tokens using other cryptocurrencies, such as Tether or Bitcoin. As a result, purchasing XCH is more suited to experienced traders or those with a good crypto knowledge.

How To Buy & Sell Chia

To get started trading Chia, follow these simple steps:

1. Pick A Trading Platform

First, you will need to buy XCH coins. You can purchase tokens on several global exchanges, including OKEx. It is not available on major exchanges like Coinbase from our last tests.

Once you’ve purchased coins, you will need to store them in a digital wallet. This is generally considered safer than keeping them on the exchange as you don’t own or control the coins or private keys. Furthermore, you may lose your tokens if an exchange were to be hacked.

2. Choose A Strategy

You will need to decide on your preferred strategy for trading Chia. Here are a few techniques to consider:

- Day trading – Day traders can make use of Chia’s relatively volatile price swings. According to Coinmarketcap, the 24-hour price change can be as high as 49%. As the value of new cryptos can fluctuate quickly, traders should utilise risk management techniques.

- News trading – There can be a correlation between news announcements and changes in the price of cryptos. Traders can use market sentiment to decide whether it’s a good time to buy or sell Chia.

- Farming – If you are experienced in cryptocurrencies and have a large amount of computer or hard drive storage, you may opt to farm the crypto. You can acquire Chia at a low cost and then sell XCH on exchanges to try and generate profits, though this isn’t guaranteed. There are online coin calculators that estimate how much you can earn from farming Chia.

Trading cryptocurrencies is high-risk and potentially even more so when dealing in altcoins like Chia where large price swings and liquidity issues can make entering and exiting positions challenging. Only risk what you can afford to lose.