Best Bitcoin Brokers 2026

Bitcoin (BTC), the world’s first decentralized cryptocurrency, has had a remarkable run since its launch in 2009 from niche investment to mainstream asset. Having gained recognition, and even adoption, by some states and regulators, Bitcoin is no longer only for tech-savvy speculators, and the best brokers and investment firms let any British investor buy and sell BTC or even gain exposure in their ISAs via some stocks and ETFs.

The UK’s Financial Conduct Authority (FCA) has banned crypto derivatives (including Bitcoin futures, options, and CFDs) to retail investors. UK residents can still access Bitcoin derivatives through international brokers that are not FCA-regulated, but doing so means you may not be protected under UK regulations, such as the Financial Services Compensation Scheme (FSCS).

Top Bitcoin Brokers in the UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Bitcoin Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Bitcoin Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Bitcoin Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Bitcoin Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Bitcoin Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Bitcoin Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring traders with a slick design and over 80 technical indicators for market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

How We Choose The Best Bitcoin Brokers & Investment Platforms

Over decades of combined investing experience, our experts have found that the best Bitcoin brokers have these common features in common:

Regulation & Trust

Not long ago, cryptocurrency was the Wild West of investing, but regulators including the FCA have begun to catch up so you should take advantage of the increased oversight.

We have been pleased to see reliable, regulated brokers enter the Bitcoin market, as these offer a more secure way to make crypto investments.

FCA-regulated brokers:

- Need to submit yearly reports and are frequently monitored to ensure they’re in compliance with the UK’s robust regulations, greatly reducing the risk of a broker acting irresponsibly or illegally.

- Are obliged to keep clients’ trading funds separately from business funds in segregated accounts, and to offer protection to traders by limiting their available leverage and closing trades that would leave their balance in the red.

- Are bound by UK laws related to complaints and arbitration, providing a clear framework for dealing with complaints and disputes.

You can check the FCA’s register to find out if a Bitcoin broker is licenced to operate in the UK.

Some well-established crypto brokers and platforms like IG are also publicly traded companies on the London Stock Exchange, providing a further layer of oversight.

For crypto investors, this amounts to a great deal more security than you’d get trading Bitcoin on an unregulated exchange.

But if you want access to Bitcoin derivatives or trade BTC with leverage, you’ll need to look elsewhere as UK regulations prohibit this.

We have traded Bitcoin with reliable exchanges in the UK, and the best of these have built up solid reputations over years in the industry serving thousands of clients.

- Year after year, IG earns its place as our most trusted crypto broker because of its emphasis on client security and excellent track record over decades in the industry. It’s one of a handful of high-quality FCA-regulated brokers that offers direct Bitcoin trading as well as CFDs and spread betting on a huge range of other assets.

Bitcoin Investment Vehicles

You should choose a Bitcoin broker with instruments that suit your investing style and strategy.

Direct Bitcoin purchases are a straightforward way to invest in BTC and are available from many brokers and exchanges, as well as some e-wallets and digital payment providers like PayPal.

Some traders enjoy using derivative instruments like contracts for difference or perpetual swaps, which allow for margin trading Bitcoin without directly buying and selling the tokens; however, note that the FCA has prohibited leveraged crypto trading, so if a broker offers this it is not FCA-regulated.

Bitcoin broke through to the mainstream with the approval of the first ETFs in the US in 2024; the UK’s FCA approved similar products for professionals to trade on the London Stock Exchange the same year, but it has been cautious about approving their sale to retail investors.

You may not be able to trade a pure Bitcoin ETF, but you will find ETFs that are related to Bitcoin like Vaneck’s Crypto and Blockchain Innovators UCITS. However, in my experience this hasn’t always correlated closely with BTC price movements, so it’s not necessarily your best bet.

A closer correlation is found in some company stocks – MicroStrategy (MSTR) and Coinbase (COIN) are the most famous, though many Bitcoin mining companies are also publicly traded. UK traders sometimes use these stocks to make leveraged bets on BTC price movements.

Trading BTC with eToro

- eToro continues to impress our experts with its range of Bitcoin investment vehicles, including direct BTC trading, plus CFDs of stocks including MSTR, COIN and Bitcoin mining company Hut 8 Mining Corp.

Fees

Trade your Bitcoin with a broker or platform that charges competitive fees, or you’ll see a large part of your profits vanish.

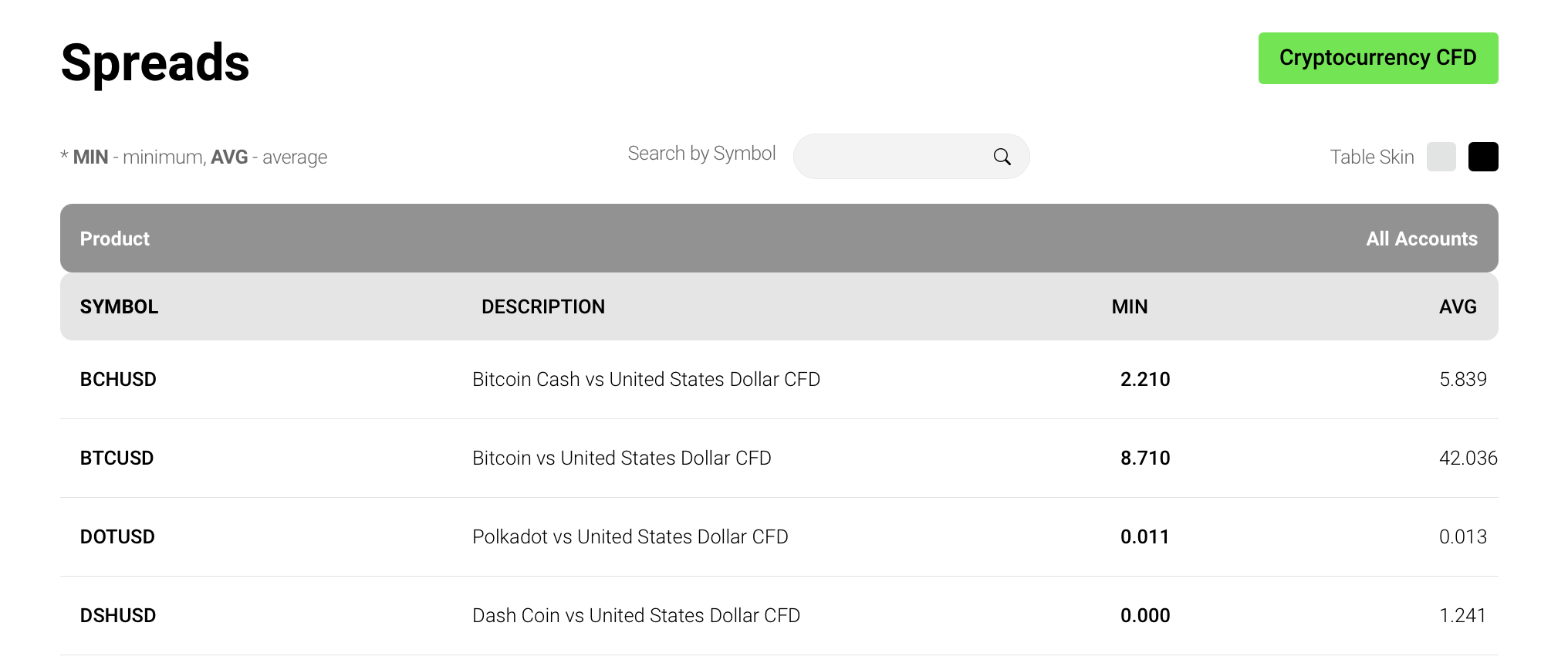

The spread – the difference between the price a broker buys and sells an asset at – acts as an in-built fee, and we’ve found this is especially important if you’re an active trader who frequently opens and closes Bitcoin positions.

Spreads may not be as great a concern for longer-term investors. However, if you use a platform to make long-term investments in stocks or ETFs related to Bitcoin, you’ll probably need to pay a service fee, which is usually a percentage of your account value charged annually.

Crypto pricing from IC Markets

- IC Markets‘ pricing is still among the lowest for BTC traders in the UK, with spreads averaging around 0.04%.

Trading Platform & Tools

Bitcoin is a volatile asset that’s known for extreme price swings, and we’d advise any BTC investor to choose a charting platform with the power and tools necessary to analyse its price movements and plan your trades effectively.

Indicators like moving averages and RSI will help you identify prevailing trends as well as momentum and potential reversals; these can help you identify when to enter and exit a position.

Indicators help me plan when to enter a trade, but I find that access to different order types is crucial for implementing my strategy. Limit orders let me enter a position at my preferred price point; a stop loss guards against large losses, and I can use a trailing stop loss to protect my profits – crucial when reversals can be swift and brutal, as with an asset like Bitcoin.

In our experience, classic platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most widely available and come with all the order types, charting tools and indicators you’ll need to make effective trades.

More modern platforms like TradingView have upped the ante by introducing a host of in-built social trading and research features, allowing you to easily browse professional analysis and check what’s trending before seamlessly transitioning to charts.

- IC Trading‘s platform selection of MT4, MT5, cTrader and TradingView is still one of the best available for Bitcoin trading in the UK, allowing every stripe of trader from beginner to seasoned auto-trader options they can adapt to their individual styles.

Leverage

Bitcoin traders use leverage – essentially borrowed funds – to increase the size of their positions and to augment profits.

While we see leverage as unnecessary for most Bitcoin investors, if you want to use it in your trades you’ll need to trade with an exchange or an offshore broker due to UK regulatory restrictions.

The amount of leverage available can vary greatly, with some offering 1:100 or more.

However, Bitcoin is a volatile instrument that often experiences wild price swings, so we recommend choosing an exchange or broker with flexible leverage rates and sticking to lower rates.

Leverage augments the size of your position with borrowed funds, and this increases the extent of losses as well as gains. With 1:20 leverage on a long BTC position, a 5% price decrease equates to losses worth 100% of your initial investment.

- FXCC consistently tops our list of brokers for leveraged Bitcoin trading, offering UK investors up to 1:20 leverage and charging no commission on its BTC/USD CFD pair.

Account Options

You may rightfully focus firstly on fees or the charting platform when choosing your Bitcoin broker, but in our experience, you should never overlook the account options on offer.

Some of the best Bitcoin brokers like IG allow you to buy and hold BTC tokens while trading other instruments like CFDs and spread betting on the same account.

I also find it convenient to trade Bitcoin with a broker like eToro that offers clients an ISA account as well as its standard brokerage account. This lets you buy and sell BTC in your standard account while easily investing profits in your tax-efficient ISA account.

Finally, dedicated crypto exchanges and brokers may give you the option to stake your Bitcoin and earn crypto token rewards – this can be a great feature if you plan to hold BTC investments for the long term.

- Kraken‘s account options remain among the best on the market for serious crypto traders seeking an exchange, as it allows you to fund your account in Bitcoins and put these to work by staking them to earn interest. In fact, even if you don’t stake your BTC, it will earn a small amount of interest, and when it comes to trading Kraken provides a good range of BTC derivatives with low fees and an excellent charting platform.

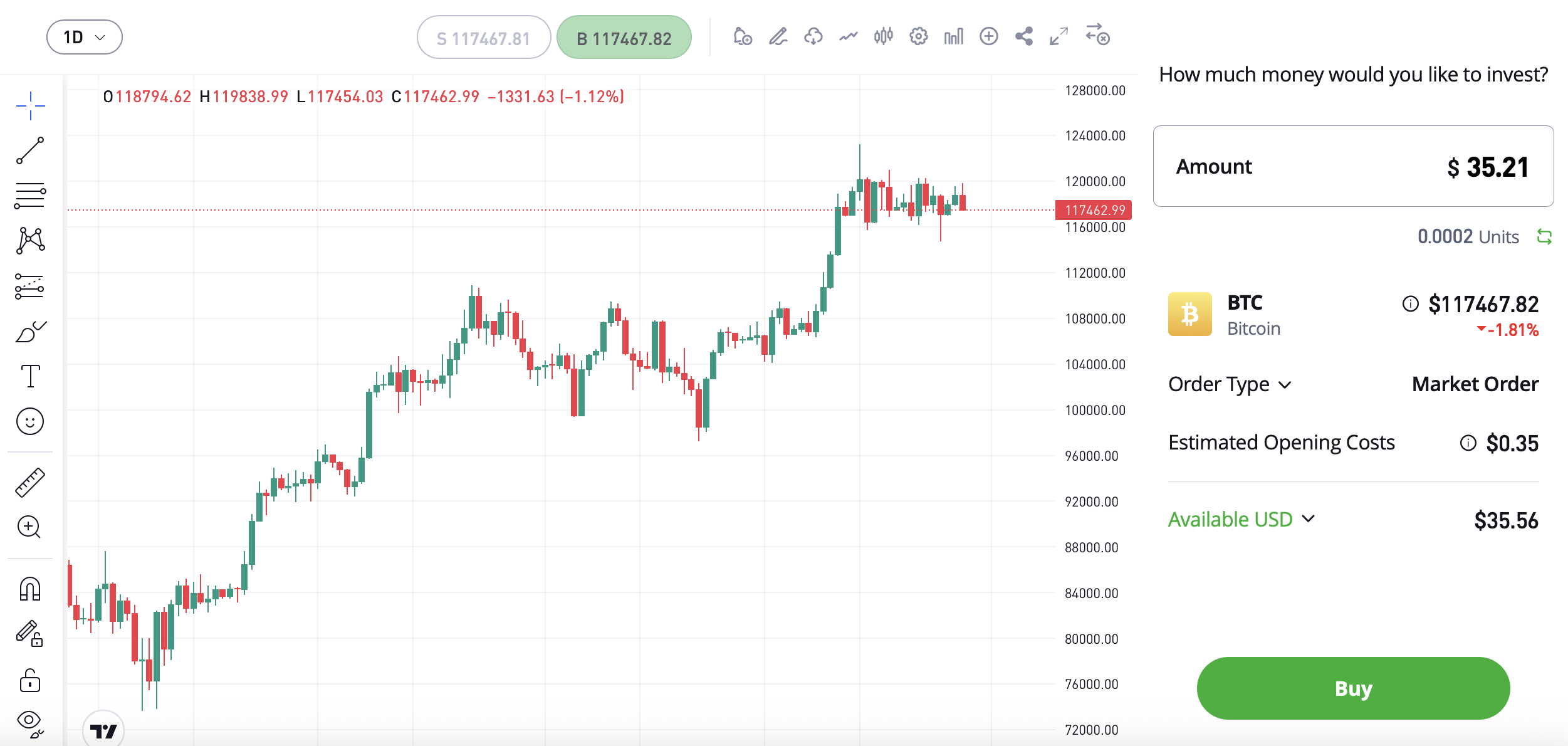

Bitcoin Chart

How to Invest in Bitcoin

Broker, Exchange or Investment Platform?

Like other cryptocurrencies, Bitcoin is primarily bought and sold on online exchanges. However, UK traders can also use brokers and other investment platforms to invest in BTC and these have some advantages over buying directly through an exchange.

Our experts have been following Bitcoin since it’s early days, and we’ve found that unless you’re looking to regularly trade large volumes of BTC or want to trade BTC derivatives with leverage, we’d advise against using an exchange.

Crypto exchanges may have lower fees, but they’re not covered by the same Financial Conduct Authority-mandated regulatory framework as many of the brokers on our toplist. That means they’re not obliged to meet the same stringent financial reporting requirements as FCA-regulated brokers.

Clients of FCA-regulated brokers also benefit from up to £85,000 insurance of their capital per firm in cases of business failure, as well as measures such as negative balance protection, which prevents them from losing more than they hold in their accounts.

We’ve found over the years that, without the clarity provided by a regulatory licence, exchanges have often collapsed due to fraud or poor management – as with FTX in 2022 – or faced legal restrictions, as with Binance in the UK.

Because of this, FCA-regulated brokers usually offer the most secure way to invest in Bitcoin in the UK.

Other options include digital wallets like PayPal and financial platforms like Uphold. The advantage of the latter is that it specialises in crypto, meaning you’ll often get competitive fees on Bitcoin and a wide range of crypto assets, and the platform allows you to send and receive crypto payments.

Finally, investment platforms offered by companies like Vanguard and Fidelity for ISAs and SIPPs won’t usually allow you to invest in Bitcoin, but you might be able to gain exposure to BTC price movements through correlated stocks and/or ETFs.

Which BTC Instrument is Best for Me?

The best way for you to invest in Bitcoin depends on your personal aims and preferences.

- Do you plan to invest in Bitcoin for the long term? Consider buying Bitcoin tokens directly and adding to your position over time. Many investors buy BTC on a dollar-cost average basis, making them less vulnerable to short-term price swings.

- Want to add BTC exposure to your ISA or pension? This has been tricky in the UK due to regulatory rules limiting retail access to crypto investment products, but there are a few ETFs and stocks that correlate with BTC price movements.

- Want to make leveraged trades on BTC? FCA-regulated brokers in the UK shouldn’t offer any leveraged trading on cryptocurrencies, but you can make leveraged trades on stocks that tend to track BTC price movements like MSTR and COIN. To trade BTC derivatives directly, you’ll need to sign up with an exchange or an offshore brokerage.

It’s easy to get caught up in the hype of a Bitcoin bull run, but think twice before trying to capitalise by trading with leverage via an offshore broker. We often come across horror stories of unregulated brokers that load the deck against traders or refuse to pay out, and the lack of proper oversight adds to the risk of Bitcoin investing.