Best TradingView Brokers in the UK 2026

In the UK, a growing number of brokers now integrate directly with TradingView, allowing investors to analyse markets, place trades, and manage positions seamlessly from one powerful platform.

Explore the best TradingView brokers, so that you can focus less on tech headaches and more on market opportunities.

Top TradingView Brokers

-

Pepperstone’s TradingView integration allows smooth access to over 65 asset classes, offering low spreads from 0.0 pips and commissions beginning at $3.50 per lot. Testing showed fast execution and easy feature navigation. Advanced charts, alerts, and customised strategies enhance real-time trading decisions.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Eightcap’s TradingView offers access to over 500 forex and CFD assets with ultra-tight spreads from 0.0 pips and low commissions starting at $3.50 per lot. Our experience showed fast, reliable execution with no minimum deposits or inactivity fees. Additionally, their advanced Flash Trader tool enhances trading efficiency.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

IG seamlessly integrates with TradingView, providing access to over 17,000 markets, including forex, stocks, indices, and cryptocurrencies. In our tests, forex spreads began at 0.6 pips. Execution speed was reliable, with no minimum deposits or inactivity charges. Advanced charting tools and expert analysis on TradingView support informed decisions.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Interactive Brokers integrates seamlessly with TradingView, facilitating trading in global stocks, futures, forex, and options with fees starting at $0.005 per share. Our tests showed reliable, swift order execution. Professional traders benefit from advanced analytics and algorithmic tools, providing comprehensive market insights.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

FOREX.com offers TradingView users access to over 80 forex pairs and CFDs, boasting tight spreads starting at 0.2 pips and commission-free standard accounts. In tests, execution speed proved consistent and dependable for traders. Enhanced alerts and charting on TradingView refine trade timing and strategy.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

Vantage offers complete TradingView integration for over 50 forex and CFD assets, featuring spreads as low as 0.0 pips and commissions starting at $3.00 per lot. Our testing showed quick, reliable execution and easy alert setup to support short-term trading strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Best TradingView Brokers in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best TradingView Brokers in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best TradingView Brokers in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ |

Beginners Comparison

Are the Best TradingView Brokers in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best TradingView Brokers in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best TradingView Brokers in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| Tickmill |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

Cons

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

How Investing.co.uk Chose The Best Brokers That Offer TradingView

Tested by UK traders, our process combined 200+ data points with real testing to evaluate brokers that integrate with TradingView.

We reviewed execution, costs, charting access, and ease of linking accounts – key factors for traders who rely on TradingView for analysis and execution.

Brokers were then ranked by overall ratings, ensuring UK traders get the most reliable TradingView-connected platforms.

What To Look For In A Broker That Supports TradingView

- Not all TradingView integrations are equal in our experience—some only support order placement, while others allow full account management, position monitoring, and advanced order types directly from the charts. You should check if your broker’s TradingView connection is native and stable, as API-based workarounds can introduce delays.

- Prioritise brokers regulated by the Financial Conduct Authority (FCA) to ensure fund segregation, dispute resolution, and FSCS protection where applicable. Offshore-licensed brokers might integrate well with TradingView, but can lack the same safeguards.

- The best TradingView broker will offer access to the specific markets you trade most—whether that’s FTSE 100 stocks, GBP forex pairs, or commodities. Some TradingView brokers focus heavily on forex and CFDs, while others provide exchange-traded access to LSE-listed stocks, ETFs, and global markets.

- While TradingView provides the interface, order execution is still handled by the broker. Look for low-latency infrastructure and Tier-1 liquidity access if you trade in fast-moving markets, as execution delays can erode profitability, particularly for intraday trades.

- Even with TradingView’s robust interface, your trading reliability ultimately depends on the broker’s platform uptime and server redundancy. You should look for brokers with proven stability records, as a brief outage during a high-impact news event can mean missed opportunities or unmanaged risk.

- Check if the broker supports the full range of order types available in TradingView—including stop-limit, trailing stops, and OCO (one-cancels-the-other) orders. Robust risk controls, such as guaranteed stop-loss orders, can be essential for volatile GBP markets.

- While TradingView’s Pine Script library is extensive, some brokers impose restrictions on which custom indicators or automated strategies can be executed when trading live. You should verify that your chosen broker fully supports the scripts and strategy automation you rely on, ensuring seamless workflow from analysis to execution.

I’ve learned that TradingView is only as powerful as the broker you pair it with—a sleek chart means little if your orders lag or key markets aren’t accessible.Choosing the right broker isn’t just about fees—it’s about reliability, real-time data, and full feature support, so every trade flows smoothly from analysis to execution.

What Is TradingView?

TradingView is a cloud-based charting and market analysis platform that lets you track global markets in real time, test strategies, and place trades through integrated brokers.

Also available as a dedicated desktop app since 2020, this version offers faster performance, multi-monitor support, and a smoother workflow for serious market analysis on Windows, macOS and Linux computers.

Beyond its sleek interface and advanced charting tools, TradingView’s real edge lies in its massive community-driven library of indicators, scripts, and trade ideas—something you can use to tap into global sentiment and niche market insights.

When trading stocks, forex, or CFDs, the broker integrations allow you to execute directly from the charts. However, execution speed and available markets still depend on your chosen broker, not TradingView itself.

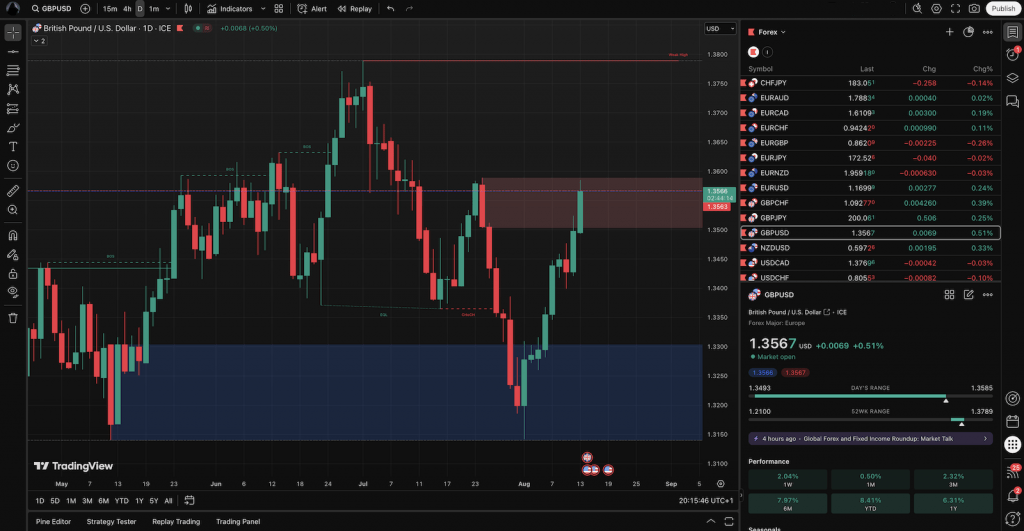

TradingView’s community-curated indicators offer a wealth of strategies and insights

Pros Of TradingView

- Highly customisable charting & scripting: TradingView’s charting engine supports multiple chart types, advanced drawing tools, and granular timeframes—from one-second intervals to monthly views. The real power lies in Pine Script, its proprietary coding language, which allows you to build, backtest, and optimise custom indicators and strategies.

- Multi-asset, multi-broker integration: Unlike broker-specific platforms, TradingView lets you monitor and trade forex, stocks, indices, crypto, and commodities from a single workspace. With supported broker integrations, you can route orders directly from your charts—reducing platform-switching friction and helping maintain focus during high-volatility periods.

- Community-driven market intelligence: Its vast public library of user-generated indicators and strategies is more than a gimmick—it’s a source of tested, niche-market insights. You can, for example, access custom tools for FTSE 100 analysis, or GBP-specific forex strategies that may not exist in conventional platforms.

Cons Of TradingView

- Broker integration limitations: While TradingView supports direct trading via certain brokers, the list is still relatively small for UK-based accounts. Not all UK brokers offer full integration, and even with supported brokers, available markets, order types, and execution speeds are determined by the broker’s infrastructure—not TradingView.

- Limited depth-of-market & order flow data: TradingView’s market depth tools are basic compared to specialist platforms like NinjaTrader or Sierra Chart. Serious futures or equities traders who rely on detailed order book data, footprint charts, or time-and-sales feeds may find the execution layer insufficient for advanced order flow analysis.

- Subscription costs for advanced features: Although the free version is powerful for charting, you’ll quickly hit limits—such as restricted indicators per chart and fewer alerts. To unlock complete functionality, a paid plan subscription is required.

One thing I’ve learned trading on TradingView is that community-driven indicators can be a game-changer, but they’re not a substitute for solid market understanding.The real edge comes from blending these tools with your strategy and testing them rigorously before committing real capital.

Bottom Line

TradingView has become a go-to platform for UK investors seeking advanced charting, real-time data, and seamless broker integration—but the experience ultimately depends on the broker you connect it to.

The best TradingView broker can unlock faster execution, better market access, and a more streamlined workflow, while the wrong choice can limit features or trading performance.