Best Demo Trading Accounts For 2026

Demo accounts act as virtual trading platforms, letting you practice buying and selling financial instruments without risking real money. They’re ideal for newcomers learning the ropes and also useful for seasoned traders experimenting with new techniques.

Browse our selection of the best demo trading accounts, reviewed by UK-based experts with hands-on experience executing countless paper trades on hundreds of demo platforms.

Top Demo Trading Accounts In The UK

-

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

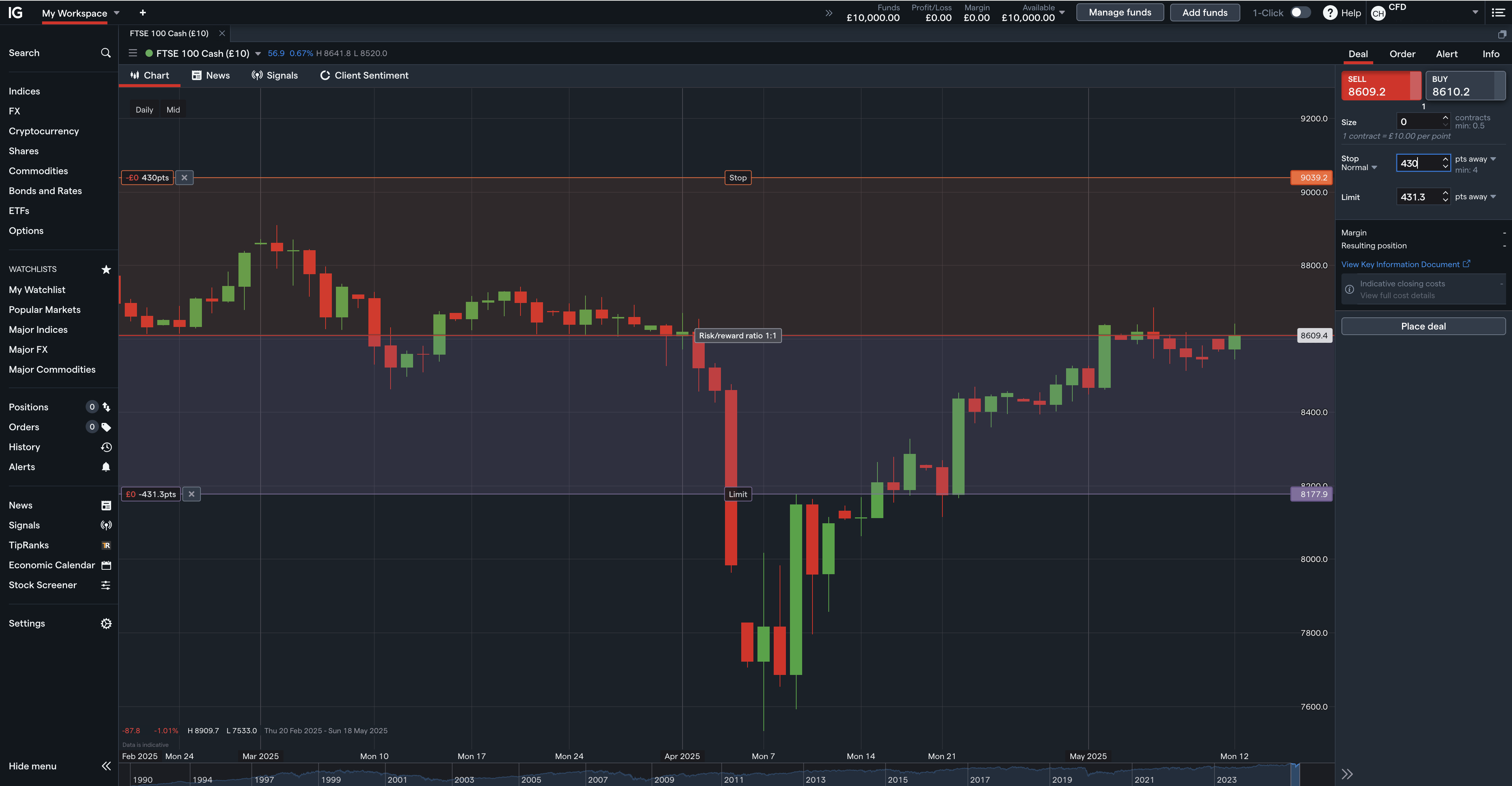

In our assessment, IG's demo account provided a $10,000 virtual fund. Execution was dependable with minimal slippage, and real-time market data was accessible. There is no time restriction. Setup required just an email, and users can replenish their virtual funds anytime. The platform is available via MT4, ProRealTime, L2 Dealer, and WebTrader. IG Academy also offered superb educational resources.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

In our tests, Vantage's demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Using Interactive Brokers' demo mirrored the live TWS platform, featuring global market access and advanced order types. Execution speed felt genuine, although fast-moving assets experienced slight slippage. Basic details were needed for setup. With a virtual balance of $1M, paper trading started post-account approval.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our tests, Eightcap's demo account matched actual trading conditions with live pricing and execution. Accessible via MT4, MT5, and TradingView, it offers over 1,000 instruments like forex, indices, commodities, stocks, and crypto. Setup merely required an email, offering a $5,000,000 virtual balance for 30 days, extendable on request. Perfect for both novice and experienced traders seeking realistic practice.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Demo Trading Accounts For 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Demo Trading Accounts For 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Demo Trading Accounts For 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Best Demo Trading Accounts For 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Demo Trading Accounts For 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Demo Trading Accounts For 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| IG | |||||||||

| Vantage FX | |||||||||

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

How Did Investing.co.uk Choose The Best Demo Accounts?

To identify the top brokers offering demo trading accounts, we followed a comprehensive evaluation process.

This method ensures our recommendations reflect both quantitative data and real-world usability:

- Reviewed our evolving database comprising hundreds of online brokers, all welcoming UK-based investors.

- Identified brokers that offer free demo accounts, confirming availability through hands-on testing.

- Ranked each provider based on overall performance, using a combination of over 200 data metrics and our own in-depth experience using their demo trading platforms.

What Is A Demo Trading Account?

A demo account is a free, interactive trading mode that most online brokers offer to help prospective clients explore their platforms and understand market mechanics before committing real capital.

These simulated accounts mirror live market conditions, allowing you to practise investing in UK and global financial instruments—such as FTSE 100 stocks, GBP/USD currency pairs, or UK government bonds (gilts)—in a risk-free environment.

Demo accounts are funded with virtual money, which varies by provider but typically ranges between £10,000 and £100,000 from our investigations.

This allows you to experiment with strategies and become familiar with order types, platform tools, and market behaviour without financial consequences.

IG’s powerful demo account lets you trade real market prices with virtual funds

While some demo accounts offer unlimited access, many are time-limited, usually expiring within 30 to 90 days. Still, this is often enough time to evaluate the platform and test basic strategies.

These practice accounts can be invaluable for investors, especially if you’re considering leveraged products like CFDs or spread betting.

Leveraged trading amplifies profits and losses, so gaining experience with virtual funds can help mitigate early mistakes and build confidence before entering the fundamental markets.

When I started, using a broker’s demo account was a game-changer for me, not just because I could test strategies risk-free but also because it revealed how I actually react under pressure.Watching a simulated trade swing £1,000 in minutes showed me more about my emotions than any book ever could.

What To Look For In A Demo Trading Account

In recent years, we’ve watched online brokers in the UK significantly increase their spending on technology upgrades, educational content, and promotional deals to attract new traders.

Despite these advancements, demo trading accounts remain among the most effective and widely used methods for engaging potential clients.

However, after testing numerous demo platforms, it’s clear to use that not all trading simulators offer the same quality or user experience—some are far more realistic and functional than others.

To help you get started, here are the key factors to keep in mind when choosing a demo account for trading:

1. What To Trade

The first step is to decide which asset class—or combination of asset classes—you’re interested in trading. This matters because not all brokers we’ve evaluated support the same range of instruments, and some limit the assets available in their demo accounts compared to live trading.

For example, OKX is focused primarily on cryptocurrencies, which may suit those specifically interested in digital assets.

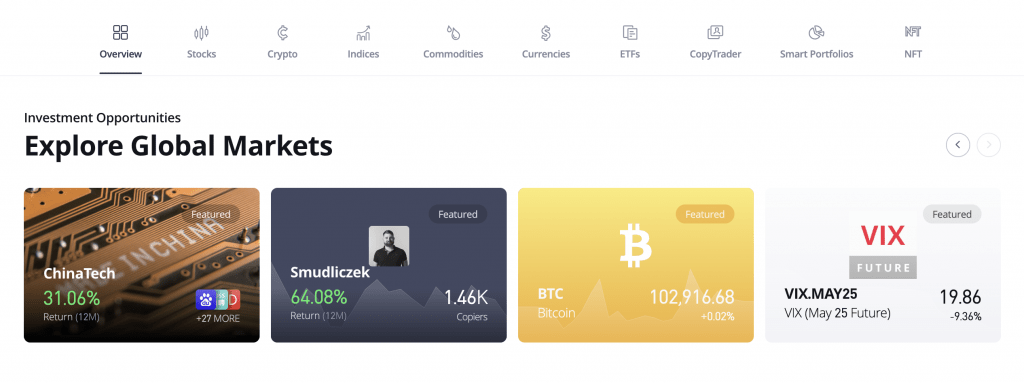

In contrast, multi-asset brokers like eToro give you access to a wide variety of markets, including UK and international stocks, commodities, indices, ETFs and even cryptocurrencies.

Choosing a broker that aligns with your trading interests will ensure your demo experience closely reflects the live trading environment you’re preparing for.

eToro offers an extensive range of assets that you can paper trade on one platform

2. Bankroll Size

Another key consideration is how much virtual capital the broker provides in the demo account. A larger simulated balance allows you to place bigger trades, test more complex strategies, and extend your practice period before exhausting the funds, helping to create a more realistic trading experience.

The amount of virtual money varies significantly between platforms from our tests. For instance, UK-regulated brokers like City Index and FOREX.com typically offer £10,000 to get started.

Plus500 provides a more generous £40,000, while XTB goes further with £100,000. IC Markets is one of the few that offer unlimited demo funds, which can be particularly useful for extended practice or high-volume strategies.

Some platforms also let you manually top up your demo account or through customer support. At eToro, for example, you can request to double your $100,000 demo balance by contacting the support team—ideal if you’re testing riskier or leveraged positions.

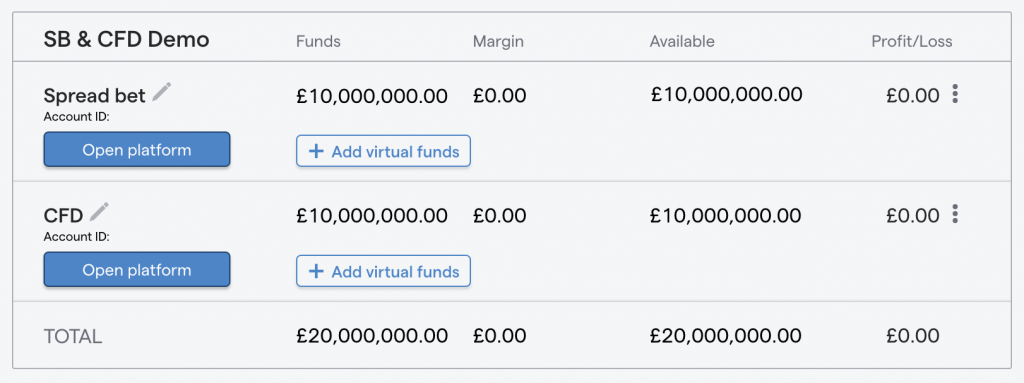

It’s also worth noting that demo funds can differ depending on the product type. IG provides a huge £20,000,000 in practice capital, split evenly between its spread betting and CFD demo accounts.

This reflects how real-money accounts are separated based on product type and regulation, which is especially important for UK investors navigating FCA rules.

IG’s £20m virtual funds is perfect for testing strategies across spread betting and CFDs

3. Trading Timeframe

Consider how long you’ll need access to a demo account, especially if you’re a beginner who may benefit from a more extended practice period.

An extended timeline allows you to explore different asset classes properly, learn to use trading tools, and test various strategies without pressure.

In our experience testing numerous demo platforms, we’ve found that many brokers impose time limits on their demo accounts. Once the trial period ends, you may lose access to the simulator unless you upgrade to a live account.

The duration of demo access varies widely. For example, XTB offers a 30-day trial, which may suit more experienced users. On the other hand, easyMarkets provides unlimited demo use, making it a more flexible choice for newer or more cautious traders.

You should also be aware of inactive policies. Some demo accounts are automatically closed if not used for a specific period. IC Markets, for instance, expires demo accounts after 30 days of inactivity.

Always check a broker’s terms before signing up, especially if you plan to take your time before transitioning to a live account.

Traders often underestimate how quickly a 30-day demo account expires—usually just as they’re starting to build confidence. Choosing a broker offering a longer or renewable demo period provides a valuable opportunity to learn and practise comfortably.

4. Trading Platform

One of the most critical aspects of picking a demo account is the quality and usability of the available trading platforms—an essential factor that can impact everything from trade execution to analysis and risk management.

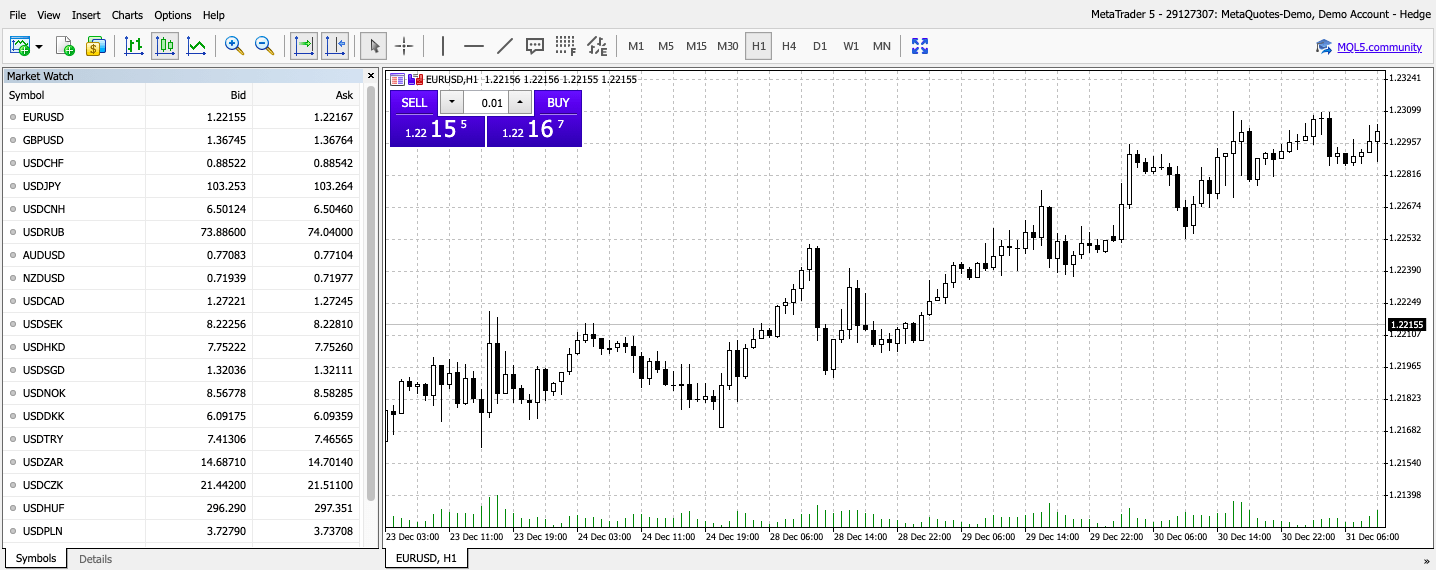

Most brokers offer access to the widely used MT4 and MT5 platforms in their demo accounts. These platforms are popular among more experienced traders for their custom indicators and automation features, but may feel outdated or overly complex for beginners.

Some brokers, however, limit demo account access exclusively to MT4, which might not appeal to newer investors or those who prefer platforms with a more modern design.

Others, like CMC Markets, offer their own proprietary web-based and third-party platforms, which allow you to choose a platform that best suits your preferences and trading style.

Additionally, it is essential to be aware of potential restrictions within demo environments. For instance, FxPro caps the number of open demo positions at 70 on MetaTrader accounts, which may limit strategy testing for more active traders.

On a more positive note, many brokers now offer fully functional mobile demo platforms. This is particularly useful if you prefer managing your investments on the go.

Many brokers limit demo trading to MT4 only, which may not suit beginners

5. Time To Sign Up

Once you’ve selected a broker, registering for a demo account is typically quick and straightforward.

Most platforms require minimal details—such as your name, email address, and country of residence—making it easy to start paper trading in just a few minutes.

However, some brokers request more extensive personal information, even at the demo stage. For example, during testing, FxPro asked for my date of birth, nationality, employment status, and level of trading experience – information more commonly associated with setting up a live account.

A few brokers go even further, requiring full identity verification, including proof of address and official documentation such as a passport, ID card, or residence permit.

While this level of scrutiny may be understandable if you’re planning to transition to a real-money account, it can be unnecessarily time-consuming and frankly irritating if you simply want to try out the platform risk-free.

You should also be aware that while demo accounts aren’t subject to FCA regulation like live accounts, some firms still apply strict onboarding procedures regardless.

Be wary about handing over your phone number to many demo account providers – you can end up getting a lot of phone calls (we know from personal experience!)

Signing up for many demo trading accounts has taught me that not all brokers make it easy – some let you in with just an email, while others treat it like applying for a mortgage.

If you’re just trying to test the waters, that extra admin can kill the momentum.

Pros and Cons Of Using Demo Accounts For Trading

Pros

- Trade without financial risk: Practice and improve your trading strategies using real-time market data, all without risking your own money.

- Hands-on market experience: Demo modes offer a more practical understanding of market behaviour than theoretical learning from books or webinars.

- Build confidence gradually: For cautious investors, demo accounts offer a low-pressure environment to get comfortable with online trading.

- Test-drive brokers: You can use demo accounts to explore a broker’s platform, available instruments, and customer support before committing any funds.

Cons

- Unrealistic expectations: Since demo accounts don’t involve real money, you don’t feel the psychological pressure of live trading, which can lead to overconfidence and unrealistic goals.

- Differences from real-world trading: Demo accounts do not replicate issues like trade execution delays, slippage, or liquidity problems, which can result in outcomes that differ from actual live trading conditions.

- Limited experience: We’ve found some brokers offer a less robust platform for demo trading, and not all provide access to the full variety of asset classes available in live accounts.

Bottom Line

Demo accounts are a valuable resource for investors at all levels. They allow beginners to build confidence by exploring the markets without risking real capital. They also allow more experienced traders to evaluate a broker’s platform, tools, and asset range before committing funds.

For UK investors, demo accounts can also help assess access to local markets—such as FTSE 100 stocks, GBP currency pairs, and FCA-compliant trading features.

That said, after opening hundreds of demo accounts and placing countless paper trades, we’ve learned they can vary widely in functionality, duration, available assets, and platform quality.

Explore our expert-reviewed list of the top-rated demo trading accounts for 2026 to find the best fit for your goals and trading style.

FAQ

Which Is The Best Demo Trading Account In The UK?

This will depend on the markets you want to trade, which platform you want to use, how much paper money you want to test strategies, how long you would like access to the paper trading mode, and how quickly you want to get started.

Use our ranking of the best demo accounts for UK investors to find the right provider for you.

What Is The Difference Between A Demo And Live Trading Account?

The main distinction between a demo and live trading account is that demo accounts operate in a simulated environment. While they mirror real market conditions—including live pricing and volatility—no actual money is involved, so there’s no financial risk or opportunity for real profit.

Unlike live accounts, demo platforms often come with certain restrictions. Most are available for a limited time, whereas live accounts can be used indefinitely as long as they’re funded and active.