XTB Review 2026

XTB is an online broker providing forex, stock and CFD trading to clients in the UK. This XTB review evaluates key considerations for British traders, including FCA regulation, GBP accounts, market access, trading platforms, investing apps, and pricing.

Our Take

- XTB is one of the most trusted brokers in the UK with FCA authorization, a listing on the Warsaw Stock Exchange, and 20+ years of experience.

- XTB is one of the few UK brokers to offer interest on unused GBP funds, with an increased rate of 4.5%, meaning you can earn while identifying opportunities.

- XTB will serve both short- and long-term traders with thousands of CFDs, and more recently Investment Plans featuring over 390 ETFs, plus both cash and stocks & shares ISAs.

- The xStation platform continues to deliver a superb environment for investors at all levels with a clean design and advanced tools.

Is XTB Regulated In The UK?

XTB is a secure choice for UK traders, boasting regulation by reputable authorities, including the Financial Conduct Authority (FCA).

Client funds are held in segregated accounts in accordance with FCA regulations, providing an additional layer of security.

In the unlikely event of insolvency, British traders’ funds are protected by the Financial Services Compensation Scheme (FSCS), offering coverage up to £85,000.

Renowned for its transparency and efficient execution, XTB has garnered numerous accolades for its services and research efforts, underscoring its commitment to delivering a dependable and secure trading environment.

Accounts

Live Accounts

Two account types are offered at XTB UK: Standard and Professional.

The spread varies depending on account type and specific market. Standard accounts feature competitive floating spreads with a minimum spread of 0.5 pips, adjusting based on liquidity.

Professional accounts also have floating spreads but with a minimum spread of 0.1 pip, incorporating market execution and requiring a small commission for market-level spreads. Notably, professional accounts offer increased leverage and trading limits, attainable by meeting specific criteria.

XTB deserves recognition for providing negative balance protection to professional clients, a feature typically reserved for retail clients.

Opening an account with XTB is a straightforward process for UK residents, conducted entirely digitally and taking only a few minutes to complete, based on my personal experience.

A particularly appealing feature is the introduction of up to 5.2% interest on uninvested GBP cash balances, providing earnings while assessing market opportunities. The interest is automatically calculated and the broker recently removed the balance requirements, so it’s available to all clients.

Demo Account

XTB provides a free demo account. This account includes access to £100,000 in virtual funds and round-the-clock support from Sunday to Friday.

The demo account is where I started and it serves as a useful tool for testing the xStation platform and experimenting with trading strategies without risk.

However, it’s accessible for only four weeks, which is a shame for beginners in particular, providing limited time to fully learn platform features.

Funding Options

XTB offers an average range of payment methods for British traders, including credit/debit cards (Visa, Mastercard, Maestro) and wire transfers.

However, it’s missing notable e-wallets like PayPal, Skrill, and Neteller, which are popular with UK residents.

XTB offers a choice of accepted base currencies, including GBP, which is advantageous compared to platforms like eToro, which only offers USD.

Choosing GBP as a base currency can help avoid conversion fees when funding your trading account.

Deposits

The minimum deposit requirement is £0, making XTB great for newer investors, and there are no fees for depositing funds via bank transfer or credit/debit cards,

However, UK residents encounter a 2% fee for Skrill deposits. Additionally, exchange rate charges may apply when transferring funds in a currency different from your account’s base currency.

Most payments are processed instantly.

Withdrawals

Withdrawals are fee-free, provided they exceed £60, although the introduction of this minimum withdrawal threshold is disappointing compared to other top-tier brokers I use.

Withdrawals can only be made to a verified bank account, a regulation-driven requirement that may be inconvenient for some users preferring withdrawal to the same payment source used for deposits.

Based on my experience, withdrawals from XTB are typically processed on the same day if requested before 1:00 pm GMT, or on the next business day if made after 1:00 pm. Withdrawals are transferred to the nominated bank account and require appropriate documentation.

While most withdrawals are free of charge, small sums may incur a fee.

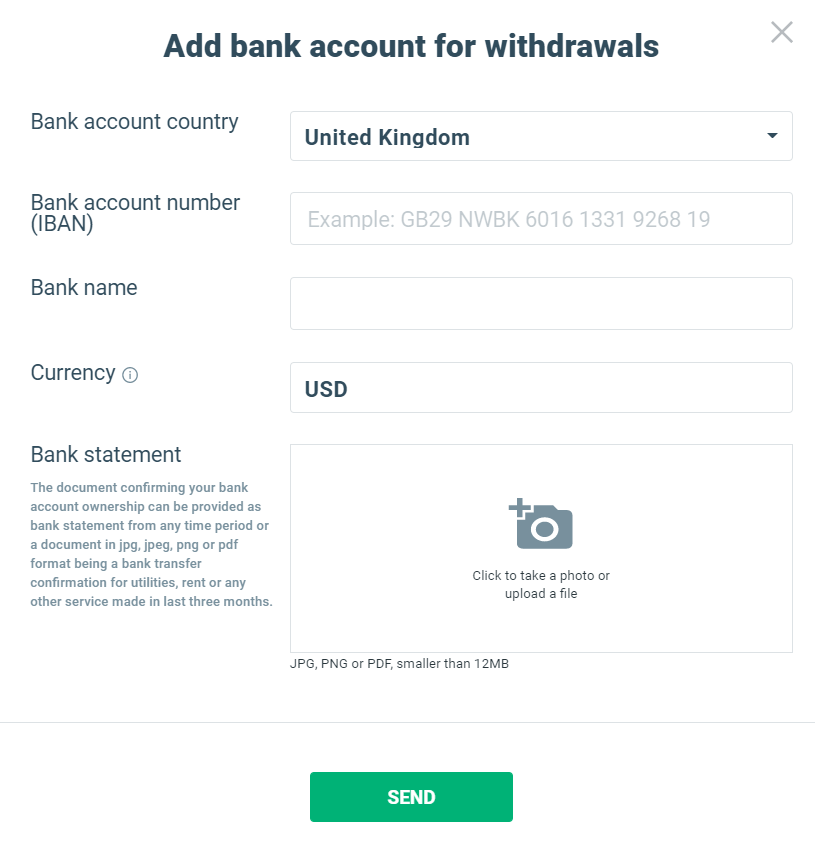

UK Bank Transfer Withdrawal

Market Access

I’m continuously impressed with the huge range of trading opportunities at XTB, encompassing a huge range of CFD, stock and forex assets:

- Forex: 71 currency pairs, including GBP/USD, EUR/GBP and GBP/CHF.

- Stocks: Trade over +3548 real stocks, 2042 CFDs on stocks, including prominent UK companies Barclays PLC, GlaxoSmithKline PLC, and ITV PLC.

- Indices: Covering 33 global stock exchanges, including major indices like the UK 100, Nasdaq 100, Dax 30, and S&P 500.

- ETFs: Providing access to more than 494 real ETFs, including SPDR gold shares and core US aggregate bonds.

- Commodities: Offering 27 commodities such as gold, cotton, oil, and sugar.

It’s disappointing that spread betting is not available for UK clients. Spread betting products are provided by top-rated alternatives, CMC Markets, providing a tax-free way to speculate on financial markets for British traders.

XTB does not facilitate crypto investing, including popular coins such as Bitcoin and Ethereum, due to FCA regulations.

However, you do have the option to trade fractional stocks, which is an excellent option if you are new to stock and ETF trading and have a limited budget. You can invest in major companies like Meta without buying a whole share and zero commissions.

Investment Plans

I’ve also been pleased to see improvements in XTB’s investment offering, notably for hands-off traders. In September 2023, XTB introduced ‘Investment Plans’, which help to streamline long-term passive investing.

You can generate up to 10 unique portfolios, each comprising a maximum of 9 exchange-traded funds (ETFs). From the XTB app, you can define the amount you want to invest (£10 minimum). The system then allocates these funds according to your risk tolerance and chosen investment horizon.

Investment Plans can be initiated or terminated at any time, enabling you to actively adjust and redistribute your funds as your financial objectives change.

Leverage

UK residents onboarded to XTB Limited UK, regulated by the FCA, have a maximum leverage of 1:30. Professional traders can benefit from 1:500 leverage.

A notable limitation for me is the inability to adjust default leverage levels at XTB, which may pose risks.

Below are the limits applicable to each market type for retail investors:

- Forex: 1:30

- Indices: 1:20

- Commodities: 1:10

- Stock CFDs: up to 1:5

Pricing

XTB offers competitive fees.

Standard account holders benefit from commission-free trading, while professional account trades are subject to varying commission charges.

Forex spreads are close to industry averages based on tests. For instance, the average spread on GBP/USD is 1.4 pip during peak trading hours, while major indices like the UK 100 have a target spread cost of 1.9 points.

Although XTB launched commission-free trading for stocks and ETFs in the UK if trading less than €100,000 in a month, this offer is not as competitive as platforms like eToro, which provide commission-free trading without any restrictions. For trades exceeding the €100,000 monthly limit on stocks or ETFs, a fee of 0.2% with a minimum of £10 applies.

Like most UK brokers, overnight positions may incur swap fees calculated using tom-next rates, and there could be additional charges for currency conversion if trading in a currency other than your account’s base currency.

It is important to note that XTB applies a 0.5% conversion fee when trading real stocks and real ETFs in a currency different from your account’s base currency, including GBP.

Additionally, XTB imposes an inactivity fee on dormant accounts after 12 months of inactivity, resulting in a £10 deduction from the trading account each month until you initiate a position, or until the account balance reaches zero.

To avoid inactivity fees, withdraw your balance entirely if you plan to stop trading for a period.

Trading Platform

XTB’s proprietary platform, xStation 5, boasts impressive features and a user-friendly interface that I really enjoy trading on.

Available in web and desktop versions for both Windows and Mac, as well as a sleek mobile app for iOS and Android, including smartwatches (very unusual), it offers seamless functionality across devices.

xStation 5

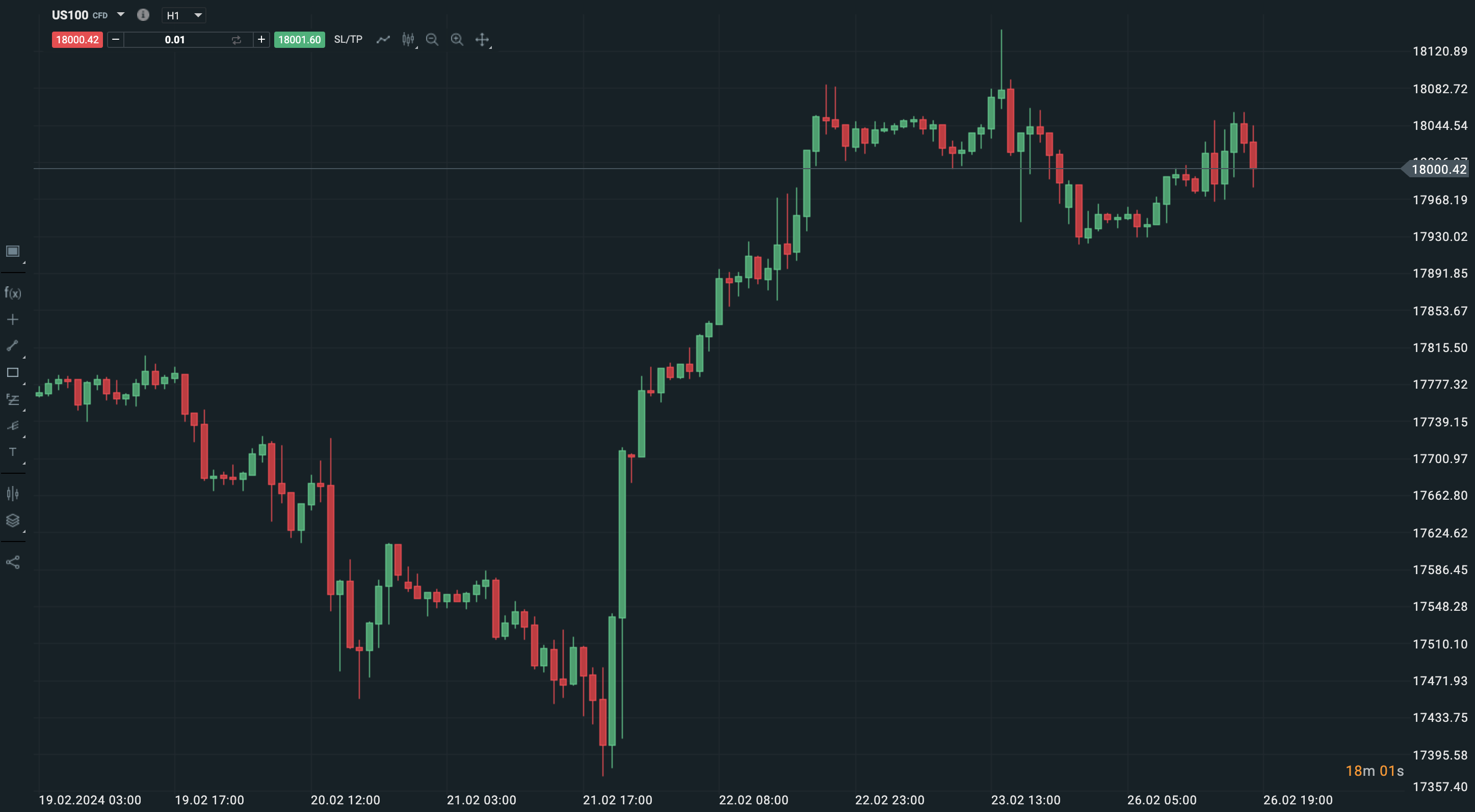

For me, notable highlights are the exceptional search function for easy instrument discovery, market analysis tools for gaining fundamental insights on assets, the intuitive economic calendar, filterable news channel, sentiment heatmaps, and stock screener that makes it easier to locate opportunities.

Educational videos are also conveniently integrated into the platform, eliminating the need to search external sources, and providing key support for newer investors.

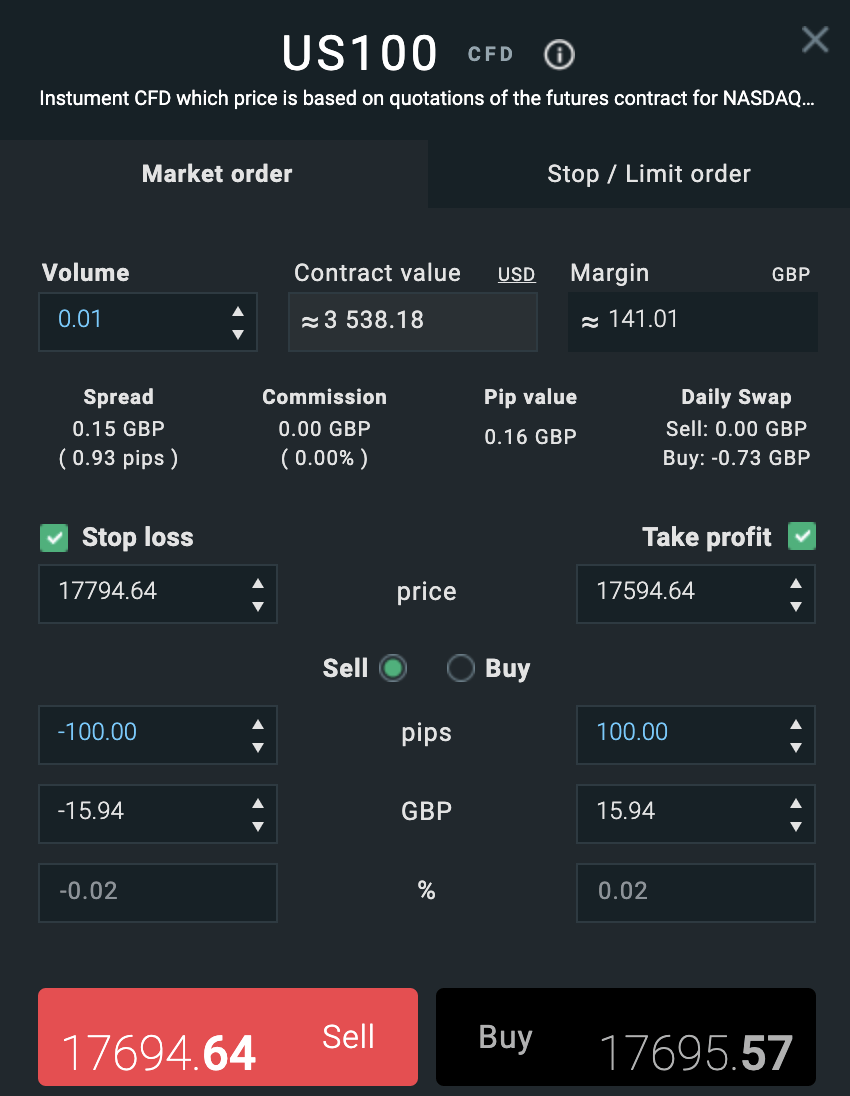

Executing trades is simplified with various order types like Market, Limit/Stop, Stop-loss/Take-profit, and Trailing stop, while the trader calculator aids in calculating essential parameters such as margin and commission. Order time limits like Good ’til’ time (GTT) and Good-til-Canceled (GTC) provide additional control over trade execution.

Trade Order

I find setting up alerts for events such as margin calls, deposits, withdrawals, and changes in positions is intuitive. Support for email, SMS, and push notifications also keep you informed about market developments.

However, it is worth noting that while xStation 5 offers robust tools for combining fundamental and technical analysis, XTB doesn’t support external trading platforms with advanced charting features, which may be a drawback if you’re an experienced trader accustomed to platforms like MetaTrader 4 or cTrader. Pepperstone is an excellent alternative here.

Extra Tools

XTB provides an extensive range of research tools accessible through the xStation 5 platform and some on its main website, available in multiple languages including English.

These include fundamental analysis, technical analysis, and market insights featuring up-to-date news streams from XTB’s research team. However, I do feel there is a lack of third-party analysis from reputable sources such as Autochartist, which would provide helpful technical summaries for short-term traders.

Rich fundamental data is delivered through the economic calendar and market analysis sections, offering summaries and historical data for upcoming events, as well as key facts about stocks such as market capitalisation and debt-to-equity ratio.

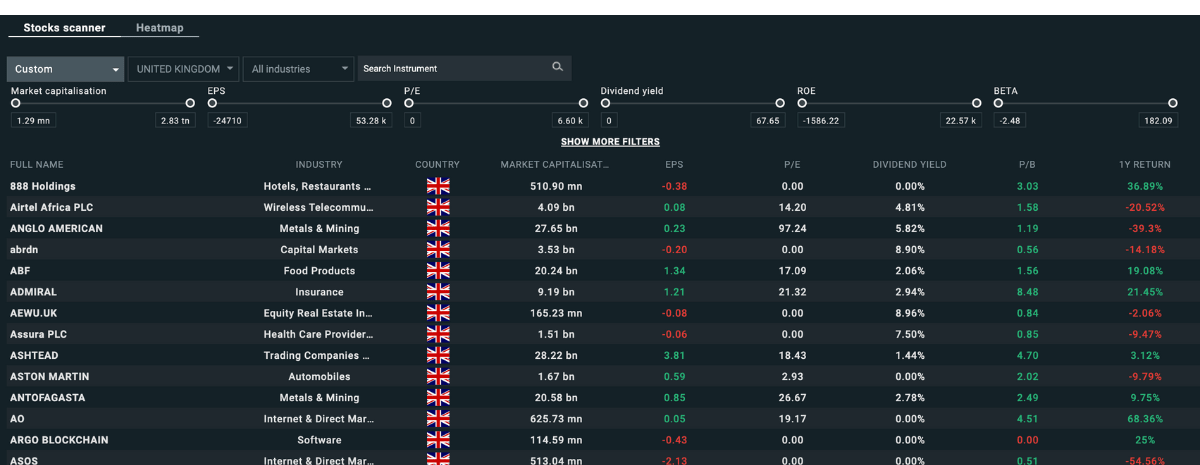

Additionally, XTB offers useful research tools like a ‘Stocks scanner’ to refine trading options and a ‘Heatmap’ for visualising market movements.

Heatmap and Stocks Scanner

For educational resources, XTB offers a diverse array including training videos directly accessible on the platform and online articles covering various trading topics and platform guidance. These are great for beginners, but they don’t offer much for experienced traders.

Also, many of the videos need updating – the last live session was from 2021.

I think XTB could improve its education and research offering by providing regular live market analysis videos and adding filtering options (such as experience level) for education articles.

Customer Service

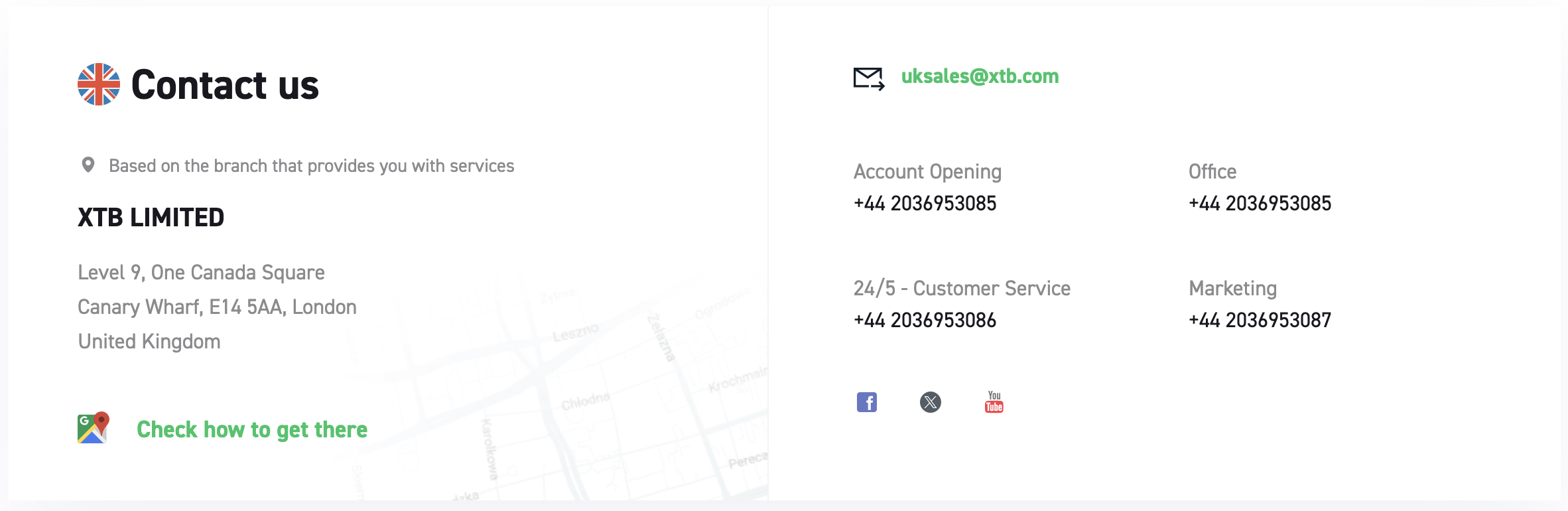

The customer service team at XTB offers round-the-clock support from Sunday to Friday via phone, email, and live chat. XTB can also be contacted through social media platforms like Facebook, Twitter, and YouTube.

Furthermore, you have access to a dedicated account manager to assist with account-related inquiries and concerns. A notable feature is the live chat available within the platform during working hours, Monday to Friday.

During multiple tests spanning many years, representatives have responded promptly and professionally to UK account and trading queries.

Should You Invest With XTB?

XTB is a reputable broker regulated by various financial authorities globally, notably the UK’s FCA.

Its proprietary trading platform, xStation, is easy to use and offers competitive spreads. While stock and ETF trading are usually commission-free and UK clients can earn interest on uninvested cash, the product range is primarily focused on CFDs, but it does offer a separate app for investing long-term in ETFs.

In summary, XTB is a great option, especially for those primarily trading forex or CFDs.

FAQ

Is XTB Good For UK Traders?

Yes, XTB is regulated by the UK’s Financial Conduct Authority, ensuring compliance with stringent regulatory standards.

Additionally, XTB offers competitive pricing, a user-friendly xStation platform and app, and superb research tools and educational resources.

Furthermore, UK clients benefit from commission-free stock and ETF trading.

Can You Trade In GBP With XTB?

Yes, you can trade in GBP with XTB. The broker offers a range of account base currencies, including GBP, USD, EUR, and HUF, providing flexibility to operate in your preferred currency.

Can You Trade Cryptocurrency With XTB In The UK?

Due to regulations imposed by the FCA, XTB does not offer cryptocurrency trading services to UK clients.

Article Sources

Top 3 XTB Alternatives

These brokers are the most similar to XTB:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- eToro - eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

XTB Feature Comparison

| XTB | Pepperstone | IG | eToro | |

|---|---|---|---|---|

| Rating | 4.8 | 4.8 | 4.5 | 4 |

| Markets | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs |

| Minimum Deposit | $0 | $0 | $0 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $10 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, KNF, DFSA, FSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4, MT5, cTrader | MT4 | - |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 70% of accounts lose money when trading CFDs with this provider. |

71.9% of retail investor accounts lose money when trading CFDs |

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

61% of retail CFD accounts lose money. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. |

| Review | XTB Review |

Pepperstone Review |

IG Review |

eToro Review |

Trading Instruments Comparison

| XTB | Pepperstone | IG | eToro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | No | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | No |

XTB vs Other Brokers

Compare XTB with any other broker by selecting the other broker below.

Popular XTB comparisons:

|

|

XTB is #2 in our rankings of CFD brokers. |

| Top 3 alternatives to XTB |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, KNF, DFSA, FSC |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Payment options, such as Visa, Wire Transfer, PayPal, Debit/Credit Card, and Skrill, differ by registration country. |

| Copy Trading | No |

| Signals Service | No |

| Islamic Account | Yes |

| Commodities | Aluminium, Cattle, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Lean Hogs, Livestock, Natural Gas, Nickel, Oil, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc |

| CFD FTSE Spread | 1.8 |

| CFD GBPUSD Spread | 1.4 |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | 0.2% |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 1.0 |

| GBPEUR Spread | 1.4 |

| Assets | 70+ |

| Crypto Coins | ADA, BCH, BNB, BTC, DOGE, DOT, DSH, EOS, ETH, IOTA, LINK, LTC, NEO, TRX, UNI, XEM, XLM, XLM, XMR, XRP, XTZ |

| Crypto Spreads | 0.22% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |