Best Brokers With Fractional Shares In The UK 2026

Want to own a slice of Amazon or Tesla without breaking the bank? Fractional shares make it possible—and they’re changing the game for everyday investors in the UK.

Unpack the top brokers with fractional shares so that you can invest smarter, with less.

Top Brokers for Fractional Stock Trading

-

During our evaluation of XTB, trading in fractional shares for U.S. and European equities was efficient and commission-free. The xStation platform impressed with its user-friendly design and sector filters. Although the share selection is somewhat limited compared to competitors, execution was swift and spreads were narrow, even with micro-investments starting at €10.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In assessing Interactive Brokers, we were impressed by its fractional shares feature, providing wide access to global equities in the U.S., Europe, and Asia, complemented by very low commissions starting at $0.005 per share. Perfect for precision trading, the platform offers sector targeting through institutional-level tools. Both execution speed and liquidity remained strong, even for micro positions.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

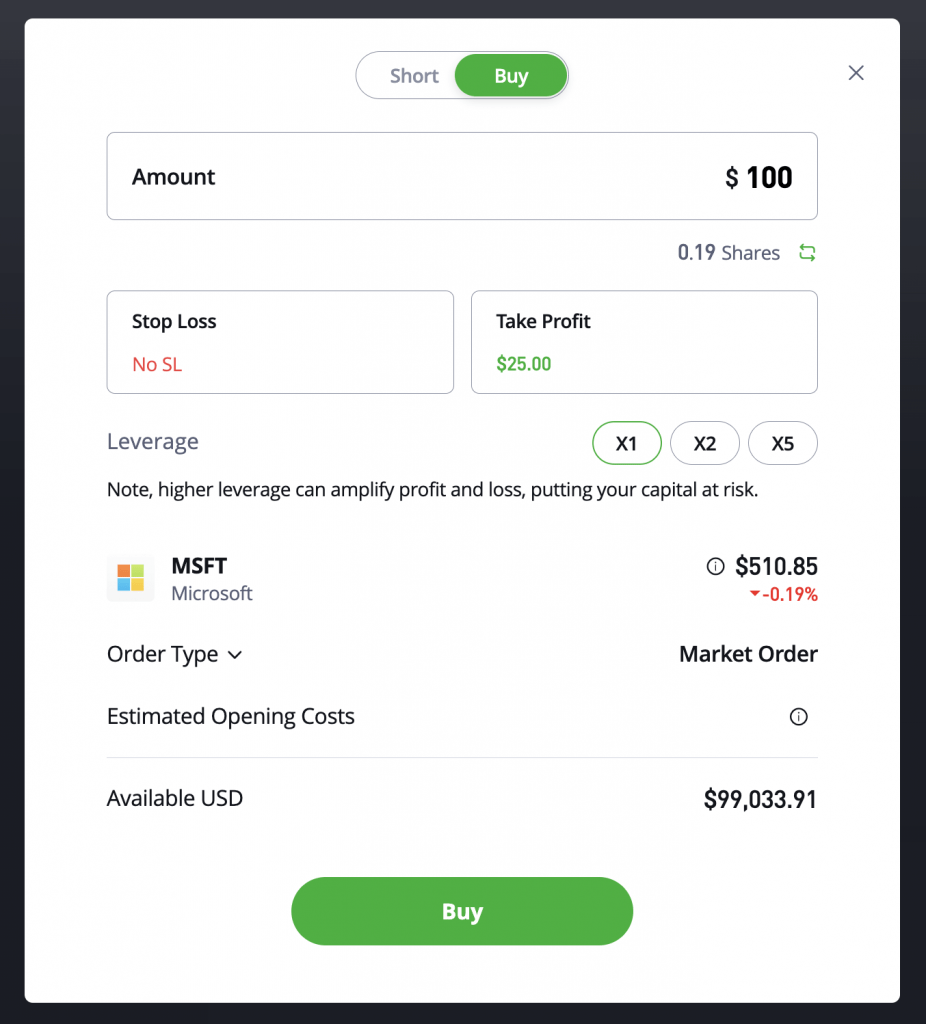

When evaluating eToro’s fractional shares, the platform excelled in global reach, offering over 2,000 stocks across the US, UK, and EU markets. Fractional investment begins from only $10, with no commission on US stocks. Its social trading features and user-friendly mobile interface ensure beginners find diversification and sector access straightforward.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

During our ActivTrades test, fractional shares were accessible for a modest yet expanding range of U.S. and EU stocks. The platform, proprietary in design, offered rapid execution and precise order management, ideal for active traders. Spreads remained tight, usually under 0.1%, and minimal investment requirements were low, facilitating gradual, diverse sector portfolio creation.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) FCA, CMVM, CSSF, SCB ActivTrades, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (UK and EU), 1:400 (Global & Pro) -

During our test of Swissquote, fractional shares were accessible for major stocks in the U.S., Europe, and Switzerland, starting at CHF 50. Trades were executed with precision, and costs were modest, often only a few francs per trade. The platform's advanced tools and sector filters facilitated diversification, while stringent Swiss regulations ensured reliability.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

In our tests, Firstrade offered smooth access to U.S. fractional shares without commissions, ideal for cost-conscious investors. Although limited to U.S. stocks, it includes major sectors such as tech, healthcare, and finance. The platform's simplicity and responsive execution are notable, especially for new traders with smaller funds.

Instruments Regulator Platforms Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed SEC, FINRA Firstrade Invest 3.0, TradingCentral Min. Deposit Min. Trade Leverage $0 $1 -

Testing Zacks Trade revealed access to fractional shares across thousands of U.S. stocks, with minimum investments starting at $1. Execution proved swift and dependable, while commissions stayed competitive at $0.01 per share. Notably, the platform offers advanced tools and sector screening, making it perfect for active traders aiming for precise, affordable diversification.

Instruments Regulator Platforms Stocks, ETFs, Cryptos, Options, Bonds FINRA Own Min. Deposit Min. Trade Leverage $2500 $3

Safety Comparison

Compare how safe the Best Brokers With Fractional Shares In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| ActivTrades | ✔ | ✔ | ✘ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ | |

| Firstrade | ✘ | ✘ | ✘ | ✘ | |

| ZacksTrade | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Fractional Shares In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| ActivTrades | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Firstrade | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| ZacksTrade | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Fractional Shares In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| ActivTrades | iOS & Android | ✘ | ||

| Swissquote | iOS & Android | ✘ | ||

| Firstrade | iOS & Android | ✘ | ||

| ZacksTrade | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Fractional Shares In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro | ✔ | $50 | $10 | ||

| ActivTrades | ✔ | $0 | 0.01 Lots | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots | ||

| Firstrade | ✘ | $0 | $1 | ||

| ZacksTrade | ✔ | $2500 | $3 |

Advanced Trading Comparison

Do the Best Brokers With Fractional Shares In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| ActivTrades | Yes (APIs), Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (UK and EU), 1:400 (Global & Pro) | ✘ | ✘ | ✔ | ✘ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

| Firstrade | - | ✘ | - | ✘ | ✘ | ✘ | ✔ |

| ZacksTrade | Yes (algos) | ✘ | - | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Fractional Shares In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| Interactive Brokers | |||||||||

| eToro | |||||||||

| ActivTrades | |||||||||

| Swissquote | |||||||||

| Firstrade | |||||||||

| ZacksTrade |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Leading traders participating in the broker's Popular Investor Programme can earn yearly compensation of up to 1.5% of the copied assets.

- eToro has enhanced its investment portfolio by frequently introducing new crypto assets. It currently offers a selection of over 100 digital currencies.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

Our Take On ActivTrades

"ActivTrades stands out for traders at every level, offering nearly unparalleled execution speeds of 4ms. Choose from top-tier trading software like MT4, MT5, TradingView, or the user-friendly ActivTrader, perfect for budding traders."

Pros

- While cTrader isn't supported, MT4, MT5, TradingView, and the broker's ActivTrader platform accommodate various trading requirements. The firm's web-based platform has proven user-friendly and visually appealing for novices during testing.

- With execution speeds averaging 4ms and an order completion rate of 93.6%, ActivTrades provides an outstanding platform for traders. It supports rapid strategies without imposing limits on short-term approaches.

- Based on our tests, ActivTrades offers swift and reliable support via live chat, email, and phone in multiple languages. This makes it an excellent choice for both traders and newcomers seeking quality assistance.

Cons

- The platform lacks features for copy or social trading, which is a disadvantage for traders interested in passive investing or replicating the trades of seasoned traders. This is particularly evident when compared to eToro and Vantage.

- The selection of over 1,000 markets includes forex, commodities, indices, and ETFs. However, the overall choice of asset classes is limited, with no stocks available outside the US, UK, and Europe. In comparison, BlackBull provides access to more than 26,000 markets.

- Its research tools are decent, although somewhat lacking. The expanding 'Analysis' hub is useful, but the absence of Trading Central or Autochartist means advanced technical insights are missing. This limitation may hinder traders seeking to spot opportunities in volatile markets.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote is designed for rapid trading strategies, including scalping and high-frequency approaches. With an average execution speed of 9ms and a 98% fill ratio, it also supports FIX API.

- Swissquote offers robust platforms for traders, including MetaTrader 4/5 and its proprietary CFXD (formerly Advanced Trader). During testing, these platforms stood out with their adaptable layouts, advanced charting tools, and comprehensive technical indicators.

- Swissquote is highly reputable due to its status as a bank, its presence on the Swiss stock exchange, and its authorisations from credible regulators such as FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

Cons

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

Our Take On Firstrade

"Firstrade suits novice traders in US stocks, offering zero commissions. It provides abundant free education, top-tier research with FirstradeGPT, and trading insights from Morningstar, Briefing.com, Zacks, and Benzinga."

Pros

- Ideal broker for cost-aware traders, offering competitive low fees on OTC trades.

- Improved trading conditions now include overnight trading and the option to purchase fractional shares.

- In 2025, Firstrade Invest 3.0 will introduce an enhanced platform featuring a streamlined interface and quicker order entry, catering to active traders in areas such as watchlists and options chains.

Cons

- Over 90% of the options assessed lack a demo trading account.

- Customer support requires improvement after testing revealed the absence of 24/7 assistance.

- Firstrade prioritises stocks over forex, restricting opportunities for portfolio diversification.

Our Take On ZacksTrade

"Zacks Trade caters to seasoned traders using advanced platforms. It offers competitive fees, attractive margin rates, and superb market research."

Pros

- Thorough analysis and information

- 20+ account denominations

- Authorised by FINRA, with access to the Securities Investor Protection Corporation.

Cons

- No forex, commodities or futures trading

- Withdrawal fees are incurred for multiple fund removals within a month.

- Platform loading delays and technical issues.

How Investing.co.uk Chose the Best UK Brokers for Fractional Shares

To identify the top brokers for fractional share investing available to UK traders, we carried out hands-on testing across multiple platforms offering access to global equities in small denominations.

We looked at how accessible and cost-effective their fractional investing experience was for UK-based users. Our team examined factors like available markets (US, UK, EU), sector coverage, minimum investment amounts, trading fees, and platform usability.

How To Pick A Broker To Trade Fractional Shares

- Market access is crucial because not all brokers offer fractional shares across the same range of exchanges or assets. Some limit access to US equities only, meaning popular UK or EU-listed stocks may be unavailable in fractional form. This restricts diversification options and could force you to concentrate portfolios in one market, increasing geographic risk. For example, a broker offering only US stocks may prevent exposure to UK dividend payers or EU growth stocks unless bought as full shares. Ensuring broad market access allows for more strategic portfolio construction aligned with personal goals and regional outlooks.

- Commissions and fees impact your investment returns, especially when trading fractional shares with smaller amounts. Even if trades are commission-free, hidden costs like foreign exchange (FX) conversion fees or wider bid-ask spreads can quietly erode gains over time. For example, investing in US stocks from the UK often involves FX fees that vary by broker, which can add up if you trade frequently – I know I’ve paid them myself. Additionally, some brokers impose minimum investment amounts or account maintenance fees that may reduce the benefits of fractional investing for small portfolios, so it’s important to choose a platform with transparent, low-cost pricing tailored to your investing style.

- Platform usability directly affects how easily and confidently you can manage your investments. A straightforward, intuitive interface reduces the risk of costly mistakes—like buying the wrong fraction size or stock—and makes complex features like pie-based portfolios or recurring investments accessible even for beginners. For example, brokers with well-designed apps often allow you to automate small, regular contributions, which supports disciplined investing and dollar-cost averaging. Additionally, knowing minimum trade sizes and any maintenance fees upfront helps you plan your investments efficiently without unexpected barriers or costs disrupting your strategy.

- Order execution and pricing determine how quickly and accurately your fractional share orders are filled, impacting your overall returns. Some brokers execute fractional trades in real-time on the open market, while others batch orders at specific times, which can lead to price delays or slippage—meaning you might pay more or less than expected. Additionally, not all platforms support advanced order types like limit or stop orders for fractional shares, limiting your ability to control entry and exit prices. If you aim to respond to market volatility or execute precise strategies, understanding these execution nuances will help you to manage risk better and maximise investment efficiency.

- Educational support and research tools empower beginner investors to make informed decisions and build well-structured portfolios. Brokers that offer tailored content on fractional shares help you understand how to diversify effectively, manage risk, and take advantage of features like auto-invest or portfolio templates. For example, goal-tracking tools can guide you in aligning your fractional investments with long-term objectives, while research resources enable analysis of asset fundamentals even when buying small positions. Access to these tools enhances confidence and helps turn fractional investing into a disciplined, strategic practice rather than guesswork.

- Customer support and community feedback play a significant role because investing can involve complex issues, especially with fractional shares, where processes like trade execution and dividend payments may differ from traditional shares. Responsive, knowledgeable support helps resolve problems quickly, reducing potential financial risks or delays. Additionally, community feedback reveals real-world experiences with reliability, hidden fees, and platform stability, helping you avoid brokers with poor service or technical glitches. For beginners, having access to both expert assistance and peer insights builds trust and confidence in your chosen platform.

- Regulation, safety, and transparency help protect your investments and ensure the broker operates under strict legal standards. Choosing an FCA-regulated broker means your funds and fractional shares are safeguarded by the Financial Services Compensation Scheme (FSCS) up to £85,000 if the broker fails. It’s also important to understand how fractional shares are held—whether in a custodian account or a pooled omnibus account—as this affects your legal ownership and what happens to your shares if the broker faces financial trouble. Clear transparency around these factors reduces risk and builds confidence in your investment platform.

I’ve learned that the best fractional shares broker isn’t always the cheapest or flashiest—it’s the one that balances seamless execution with clear communication and strong investor protections.A platform that empowers you to invest confidently, even in small amounts, can make all the difference in building a sustainable, long-term portfolio.

What Are Fractional Shares?

Fractional shares are portions of a full stock, allowing you to invest in expensive companies like Alphabet, Amazon, or Apple without needing to buy a whole share.

Instead of paying $512.53 (around £385.67) for a full share of Microsoft stock, you could invest just £10 and own a small slice. This makes investing more accessible and lets you diversify even with limited funds.

Brokers like Firstrade, ActivTrades, and eToro offer fractional shares, helping you build balanced portfolios gradually. And unlike traditional share dealing, fractional investing is typically commission-free, making it cost-effective for small, regular contributions.

eToro lets you invest in top global stocks with as little as a few pounds

Pros Of Trading Fractional Shares

- Greater accessibility: Fractional shares allow you to purchase equity based on a fixed monetary value rather than full share quantities, enabling participation in high-value securities (e.g. shares priced in the hundreds) with as little as a few pounds. This is particularly important in markets with price-anchored stocks and makes it easier to follow asset allocation models without large capital requirements.

- Improved diversification: By enabling partial ownership, fractional shares allow you to spread risk across multiple asset classes, sectors, and geographies, even with small portfolios. This supports principles of Modern Portfolio Theory (MPT), where diversification reduces portfolio volatility and maximises the risk-adjusted return (Sharpe ratio), especially when investing across uncorrelated assets.

- Efficient use of capital: Fractional trading allows for full capital deployment with minimal cash drag, since you can allocate precise amounts (e.g. £25 per stock) rather than rounding to the nearest whole share. This supports strategies like dollar-cost averaging, where consistent contributions reduce the impact of market volatility and allow for granular rebalancing to maintain target weightings in portfolio construction.

Cons Of Trading Fractional Shares

- Limited transferability: Fractional shares are often held in omnibus or pooled accounts and are not legally distinct individual securities. This means they generally can’t be transferred between brokers, making account switching more complex and potentially forcing a sale, which could trigger unintended capital gains or disrupt long-term investment strategies.

- Restricted voting rights: Holders of fractional shares may not receive full shareholder rights, such as voting on corporate actions or attending annual general meetings. In many cases, voting rights are either diluted proportionally or not granted at all, reducing your influence in corporate governance decisions compared to holders of full shares.

- Liquidity & execution risk: Unlike full shares traded on open markets, fractional shares are typically matched internally by the broker or executed in batches. This can introduce slight delays in trade execution or pricing discrepancies, particularly in fast-moving markets, making it harder to benefit from precise order timing or advanced order types like limit or stop orders.

When choosing a fractional shares broker, I appreciate the importance of intuitive tools like auto-invest and portfolio tracking.These features transform investing from a chore into a simple, ongoing habit—helping me stay disciplined and focused on my goals without getting overwhelmed by complexity.

Bottom Line

Choosing the best broker with fractional shares in the UK involves more than just finding low fees—it requires careful consideration of market access, platform usability, and regulatory safeguards.

The right broker should offer a transparent fee structure, reliable order execution, and user-friendly tools that support your investment goals.

By understanding these key factors, you can confidently select a platform that makes fractional investing accessible, efficient, and secure.