Best Stock Trading Apps In The UK 2026

The best stock trading apps in the UK offer a superb mobile investing experience with access to shares from the London Stock Exchange. The top applications are also regulated in the UK and provide excellent stock screeners and research tools.

We’ve evaluated the 50 largest UK stock trading apps from the App Store and Google Play based on these criteria, drawing on our direct testing experiences and feedback from other mobile traders, to identify the top 5 for British investors.

List Of Best Stock Trading Apps In The UK 2026

These apps continue to stand out as the best for trading stocks in the UK:

- XTB is the best stock trading app in the UK: Commission-free UK stocks. Seamless mobile navigation. 4.5% interest on GBP balances.

- IG: Best-in-class education. Comprehensive research. FCA-regulated and highly trusted.

- Interactive Brokers: Professional-grade tools. £3 commission on UK shares. Fast and stable.

- eToro: Mobile-first design. User-friendly stock screener. Fractional shares on UK equities.

- Spreadex: Incredibly intuitive. Built for short-term traders. Quick support, under 5-min wait.

Comparison Of Top 5 UK Stock Trading Apps

| XTB | IG | IBKR | eToro | Spreadex | |

|---|---|---|---|---|---|

| UK Stocks | Yes | Yes | Yes | Yes | Yes |

| FCA Regulated | Yes | Yes | Yes | Yes | Yes |

| GBP Account | Yes | Yes | Yes | Yes | Yes |

| Design & Usability | 4.5/5 | 4.3/5 | 4.2/5 | 4.6/5 | 4.1/5 |

| Stock Screeners & Research | 4.6/5 | 4.7/5 | 4.5/5 | 4.4/5 | 4.1/5 |

| Average App Store Rating | 4.4/5 | 4.3/5 | 4.4/5 | 3.9/5 | 4.5/5 |

| Minimum Deposit | £0 | £0 | £0 | £50 | £0 |

XTB

iOS Rating: 4.7 / 5

Android Rating: 4.1 / 5

Why We Picked It

XTB is our favourite stock trading app in the UK after delivering in all areas. It caters to short- and long-term traders in a way that’s largely unmatched, featuring 3,000 stocks from 16 exchanges, including 249 UK shares, and an array of trading vehicles, most recently ‘Investment Plans’.

XTB has also evidently focused on improving its app over the past few years. It now features an impressively user-friendly design that we love, in addition to top-tier resources designed to uncover stock market opportunities. This includes organising equities into helpful categories such as ‘Dividend Kings,’ ‘Meme Stocks,’ and ‘Bargains,’ among others.

Like a growing number of stock trading apps, XTB offers commission-free trading on stocks (up to €100K monthly volumes) with a £10 minimum investment, keeping pricing simple for aspiring traders.

XTB Stock Trading App

Pros

- The XTB app stands out with its stock trading offering that caters to investors of all strategies, budgets and experience levels with short-term stock CFDs, long-term ‘Investment Plans’ featuring 300+ ETFs and auto-dividend reinvesting (2024 addition, under ‘Save’ tab), and fractional shares for beginners (UK, US, EU shares with a £10 minimum).

- XTB’s research tools offer first-rate market insights, notably through Morningstar Ratings, the News tab, daily stock movers, plus market sentiment data on the FTSE, providing all the tools needed to discover investment opportunities from your palm.

- XTB is one of the few stock trading apps in the UK to pay interest up to 4.5% on unused balances of 30K+, with lower balance requirements than rivals like eToro with 4.3% on 250K+, allowing you to earn while identifying opportunities in the stock market.

Cons

- Although XTB is one of the most trusted stock brokers in the UK with FCA authorisation, a listing on the Warsaw Stock Exchange, and over 20 years in the industry, its app lacks two-factor authentication – a key security measure available in the Interactive Brokers app.

- XTB still has work to do carrying over all the desktop features to its app, notably in the risk management department with no trailing stop loss and issues using take profit and stop loss orders during testing – features that all worked smoothly at Spreadex.

- XTB’s price alerts are useful for tracking opportunities in the UK stock market, but you can only view them on individual stock tabs, whereas IG offers a more seamless user experience with a single view in the app where you can see triggered vs untriggered alerts.

IG

iOS Rating: 4.6 / 5

Android Rating: 4 / 5

Why We Picked It

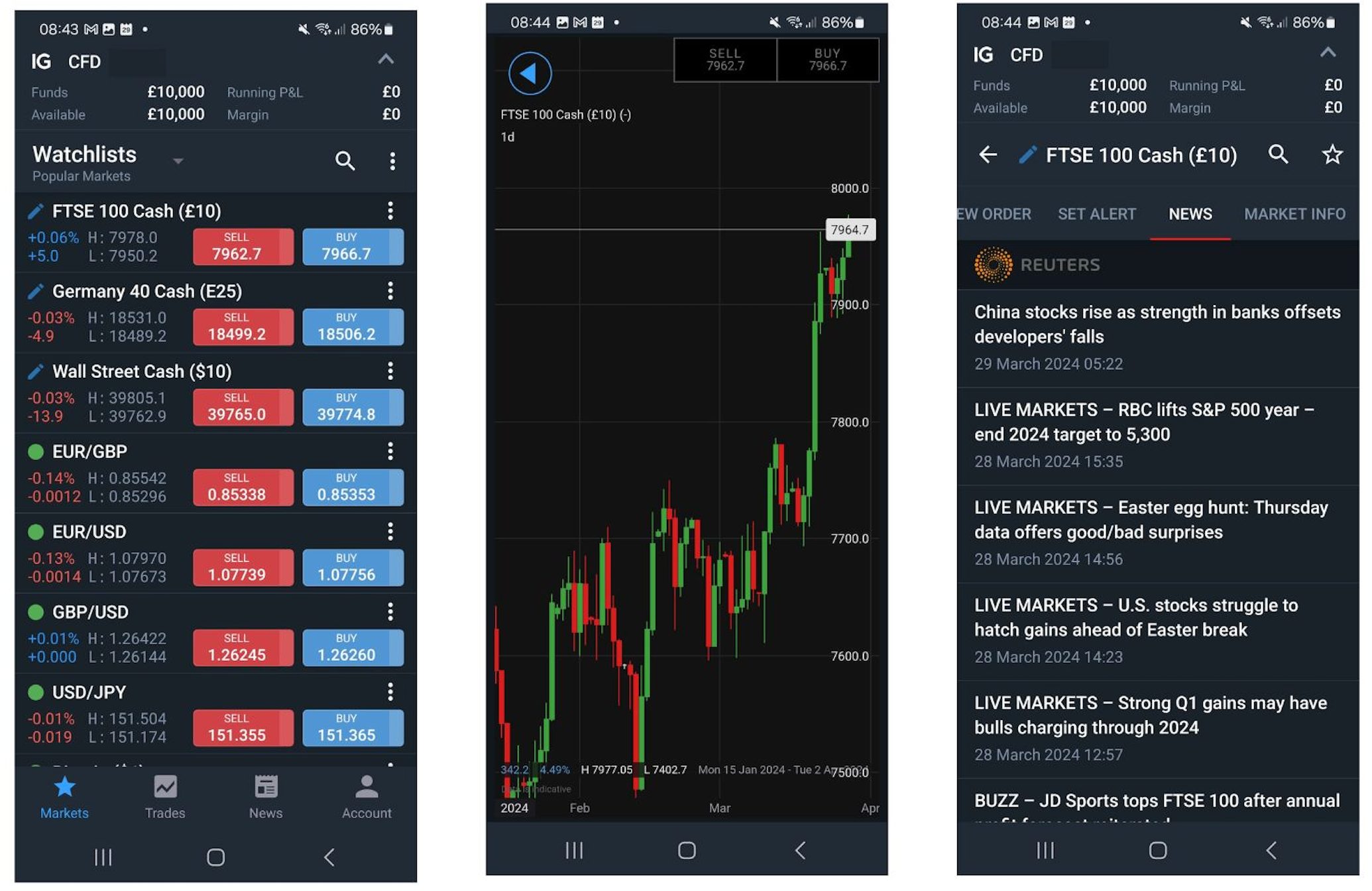

IG offers a superb trading app with 13,000+ stocks, including UK shares, flexible risk management tools, plus an excellent array of educational tools. You can also open a GBP trading account in minutes directly through the app, making for a seamless entry into share dealing, and helping it earn ‘Runner-Up’ position in our 2026 rankings.

Additionally, IG is one of the most trusted brands among British traders, with authorisation from the FCA plus 6 other tier-one regulators, an excellent reputation stretching over 50 years, plus a listing on the London Stock Exchange, highlighting its financial transparency. Our UK investors have also traded stocks on the IG app with real money and have not experienced any withdrawal problems.

IG Stock Trading App

Pros

- IG offers a comprehensive mobile stock trading experience with ideas from the Signal Centre, Autochartist and PIA First, plus a ‘News’ tab from Reuters. The ‘Price Alerts’ are particularly good – I used them on Barclays PLC (LON:BARC) and it showed me the trigger time and date, the current price on alerts that had been activated, plus the set time on those that hadn’t.

- IG’s educational tools for aspiring stock traders are best-in-class. It’s one of the few firms to offer a dedicated app, IG Academy, with live sessions and courses featuring interactive quiz elements, covering essential topics for stock investors, notably ‘Fundamental Analysis’ plus ‘Planning and Risk Management’.

- The IG app offers guaranteed stops, a useful risk management tool that’s only charged when used, unlike firms such as CMC Markets that charge for setting one up. I used this on Ocado (LON:OCDO) shares during a period of significant volatility and it worked effectively, helping me manage risk.

Cons

- While the IG app is fairly easy to use, it could do with a facelift, especially compared to XTB which has clearly invested in the look and feel. The resources also feel scattered with a lot of flicking back and forth between various tabs. For example, Signal Centre and Price Alerts can be found in the ‘Accounts’ tab, while the ‘Markets’ and ‘Trade’ tabs feature other tools.

- Despite zero commissions on US stocks and a £3 commission on UK shares, IG trails the cheapest stock trading apps, notably Interactive Brokers. Casual investors should also beware that a £12 monthly inactivity fee applies after two years if you stop using the app.

- While IG offers an array of vehicles to speculate on stocks, including share dealing, spread betting, smart portfolios, CFDs, ETFs, ISAs and SIPPs, beginners may feel overwhelmed by the various accounts and products. eToro manages to offer many of the same products in an easier-to-digest account structure for newer traders.

Interactive Brokers

iOS Rating: 4.3 / 5

Android Rating: 4.5 / 5

Why We Picked It

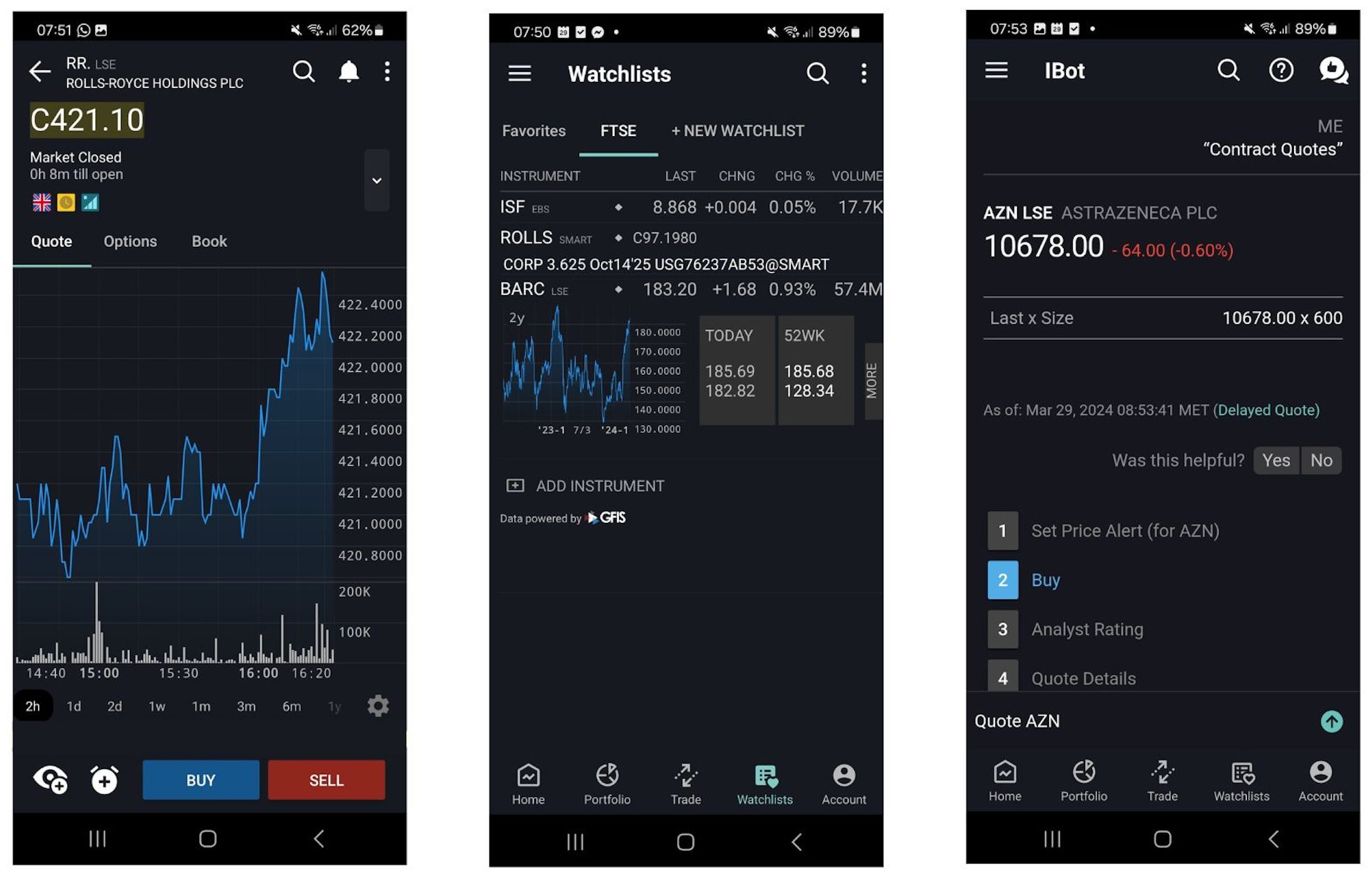

Interactive Brokers (IBKR) continually ranks as one of the best stock brokers in the UK, so it’s no surprise to see their mobile platform, which has been downloaded over 1 million times, has secured a podium finish in our top stock trading app rankings for 2026.

We’ve found that Interactive Brokers’ computer software, including the recently improved IBKR Desktop, can be lacklustre in its prioritisation of feature-rich technology over usability, however this is where its mobile app is a winner. The developers have clearly been forced to think about designing an intuitive mobile platform and it shows – it’s well-presented and easy to get to grips with, making for an enjoyable stock trading experience from both Apple and Android devices.

IBKR Stock Trading App

Pros

- The Interactive Brokers mobile app is a breeze to use, allowing quick access to deposits (click ‘Account’ then ‘Banking’), plus watchlists, portfolio management, and stock trading via the bottom menu bar. Additionally, it’s one of the few stock trading apps easily downloadable via a QR code from the broker’s website.

- Despite not adopting the increasingly popular ‘free’ trading model, Interactive Brokers is one of the lowest-cost stock trading apps in the UK with a £3 commission for Western European shares and no additional spreads. But where it shines is value – you get many of its professional-grade platforms and research tools, which can’t be found at competitors, at no additional charge.

- The IBKR app packs a punch for advanced short-term traders with an excellent charting package for technical analysis, comprising 70+ indicators. As a comparison, just 5 indicators are available on the VT Markets app. The Interactive Brokers app is also fast and stable, with no lagging during testing despite opening upwards of 30 stock tickers.

Cons

- IBKR’s desktop platforms deliver market-leading research tools spanning 90+ stock markets, including the UK, with features like Fundamentals Explorer that offers data on 30K+ companies and 5.5K+ analyst ratings from TipRanks. However, the app lacks many of these tools, offering mainly IB Daily Briefings, creating a less complete mobile trading experience.

- The in-app support still needs work. Although the iBot service provides basic account information and FAQs, it doesn’t connect you to live agents, meaning I had to return to the desktop website for assistance on queries about UK stock trading fees for example, a notable drawback compared to Spreadex’s superb support offering.

- Despite 90+ ETFs, including many with UK equities, the search function in the app is frustrating – if you don’t know the exact name and spelling it often draws a blank. Also there are apps, notably XTB, that serve you a tailored investment strategy on a plate – and IBKR just isn’t one of them, reducing its appeal to newer investors.

eToro

iOS Rating: 4 / 5

Android Rating: 3.8 / 5

Why We Picked It

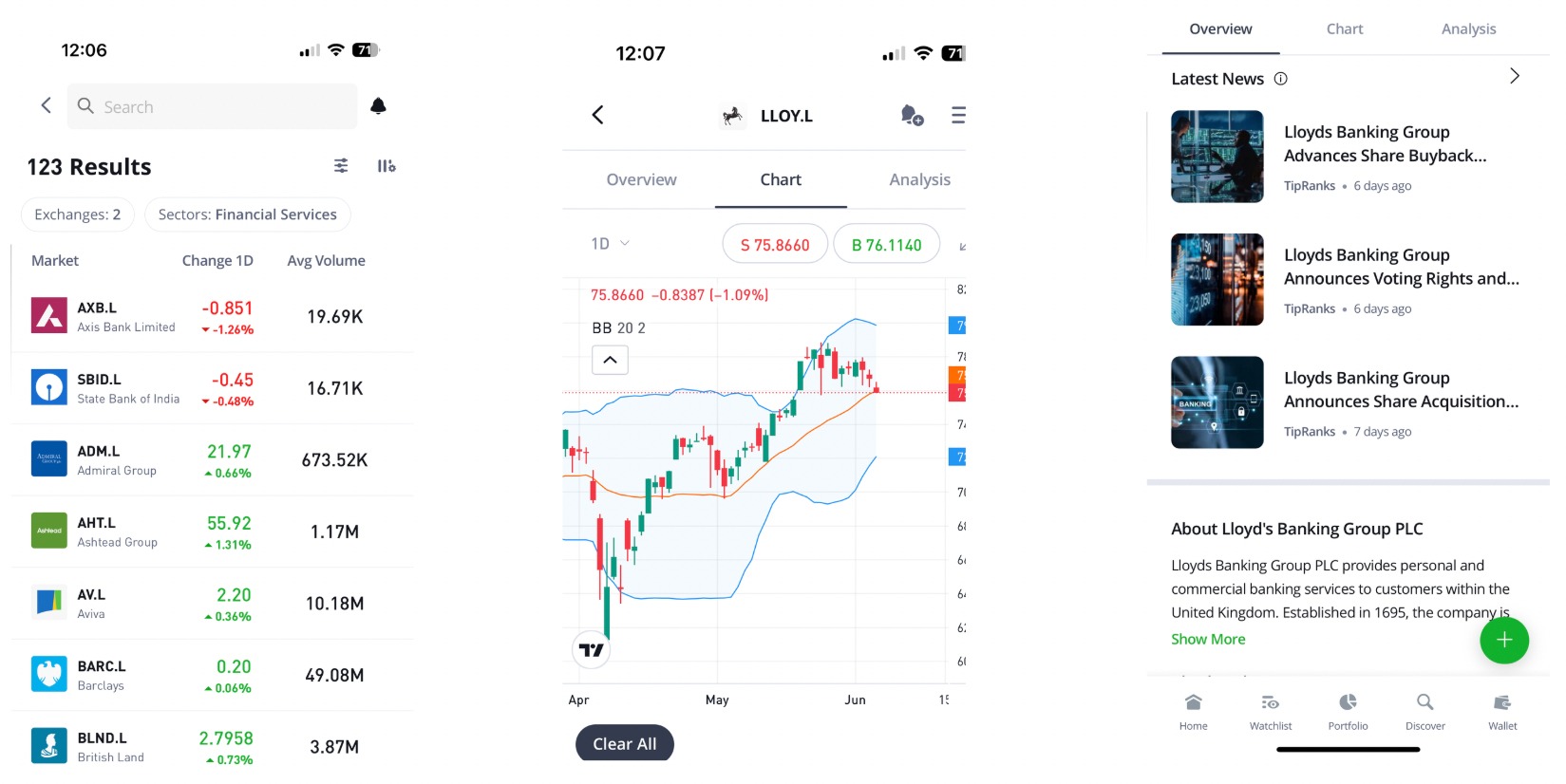

For traders who want to do their own research into the stock market and build diverse portfolios from over 6,000 shares across more than 25 exchanges, eToro is top of the range.

eToro added a GBP account in 2024 and a stocks and shares ISA in 2025, bolstering its appeal to UK investors and gaining it a late entry to our list of the top 5 stock trading apps. And you get all this in the company of one of the world’s largest social trading networks, featuring countless budding traders from the UK.

With an average rating of 3.9 across the App Store and Google Play, plus over 10 million downloads, eToro is gathering a cult following for those looking for a user-friendly mobile platform to buy and sell popular equities.

eToro Stock Trading App

Pros

- The eToro app is super intuitive and easy to use. Even rookie stock investors will get the hang of this one in a flash. Plus, the design is incredibly slick. Think clean, white, dynamic widgets, and a user-friendly menu at the bottom. Getting started is also a breeze – it took me less than 10 minutes to download the app, sign up and start trading stocks.

- Once you start investing, eToro supports you with a terrific stock screener. During testing, I filtered the screener for London and LSE AIM stocks in the financial services sector and significant price fluctuations in the preceding three months – it took less than 30 seconds and fewer than 5 clicks.

- eToro offers fractional shares on UK and US equities, allowing budget investors to buy a portion of big names like Tesla and Microsoft, a feature not available on many rival apps in the UK, including Saxo and Interactive Investor.

Cons

- eToro is best suited to medium- and longer-term investors looking for share dealing and ISAs due to its average to slow execution speeds. In fact, one of our testing team had to wait around 2-5 minutes for a trade to execute around when the US session opens. This could deter day traders and scalpers, especially compared to rivals like IG with its fast, dependable execution on stock trades.

- The eToro app could do even better when it comes to research tools. Whilst the ‘Discover’ tab breaks down stocks into daily movers, trending assets, real-time trades and more, much of its news and insights come third-parties like Motley Fool or TipRanks, which can result in a less consistent user experience.

- eToro has gone down the route we’re seeing many stock trading apps go of providing AI chatbots in place of human support. The result? Getting the help you need now takes several minutes longer. Annoying and frustrating. Spreadex performed much better in our customer support tests.

Spreadex

iOS Rating: 4.5 / 5

Android Rating: 4.5 / 5

Why We Picked It

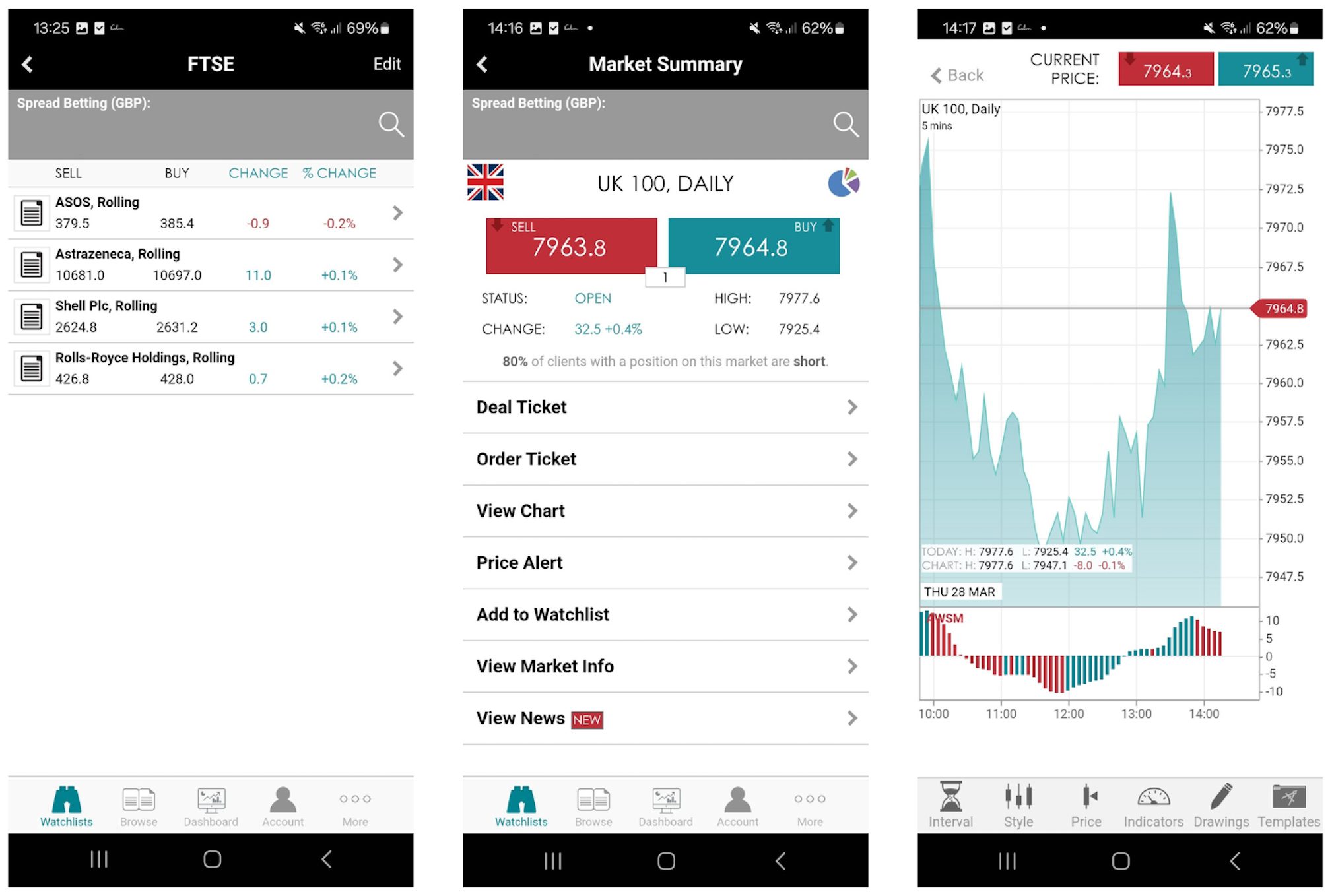

Spreadex is one of the easiest stock trading apps out there to navigate and is a real winner for simplicity. It offers thousands of stocks from more than 15 countries, including the UK, small-cap stocks with a market cap of £5M+, plus out-of-hours trading on UK, US and German equities.

Spreadex is a fairly new-to-market app (originally released in 2020), which is sometimes obvious, for example, its design is not as modern and slick as competitors like XTB and Interactive Brokers. Despite this, traders from the Google and Apple app stores have given it an average of 4.5/5 – and we love it too, awarding it the final spot in our UK stock trading apps toplist.

Spreadex – Stock Trading App

Pros

- The Spreadex app is incredibly intuitive. Straight away I felt comfortable navigating the suite of stocks, charting features and curated ‘Watchlists’. If you’ve ever used a stock trading app before, you’ll pick this up in seconds. And if you’re a true beginner, you’ll find it easy to learn.

- The Spreadex app delivers for short-term traders with a great charting package, featuring 4 chart types, 29 indicators, 11 tools for drawing and annotations, plus the ability to save templates, ticking all our boxes and outgunning the basic tools on the Freetrade app as an example.

- Spreadex offers fast and dependable support directly via the app, ensuring newer stock traders have access to urgent support if needed. During tests, I got through to agents using the in-app chat in less than 5 minutes and staff could assist with questions about UK stocks, trading fees, and withdrawals.

Cons

- Whilst the Spreadex app is easy to navigate, something about the harsh boxed edges and basic fonts gives it a cheap feel. I’d like to see more investment in the look/feel. The research tools are also pretty basic. There is no news feed or economic calendar, and there are no stock screeners accessible directly through the app – you’re taken to an external web page, resulting in a less complete mobile trading experience.

- Spreadex excels for short-term stock trading with spread betting (free from Capital Gains and Stamp Duty in the UK) and leveraged CFDs, however, it’s less suitable for longer-term investors with no ISAs or SIPPs. These are available at leading alternatives IG and eToro, which cater to a wider range of strategies.

- Despite authorisation from the FCA and improvements to its app in recent years, Spreadex lacks the clout of the most trusted stock trading platforms in the UK. It’s only been downloaded around 10K times from the Google Play Store and doesn’t boast the long row of licenses, awards and industry standing of stock trading platforms like XTB and IG.

How Did We Choose The Best Stock Trading Apps In The UK?

We evaluated 50 of the UK’s most popular stock trading apps, combining our firsthand experiences with ratings from the Apple App Store and Google Play Store. This process led us to identify key benchmarks that our top 5 apps needed to meet:

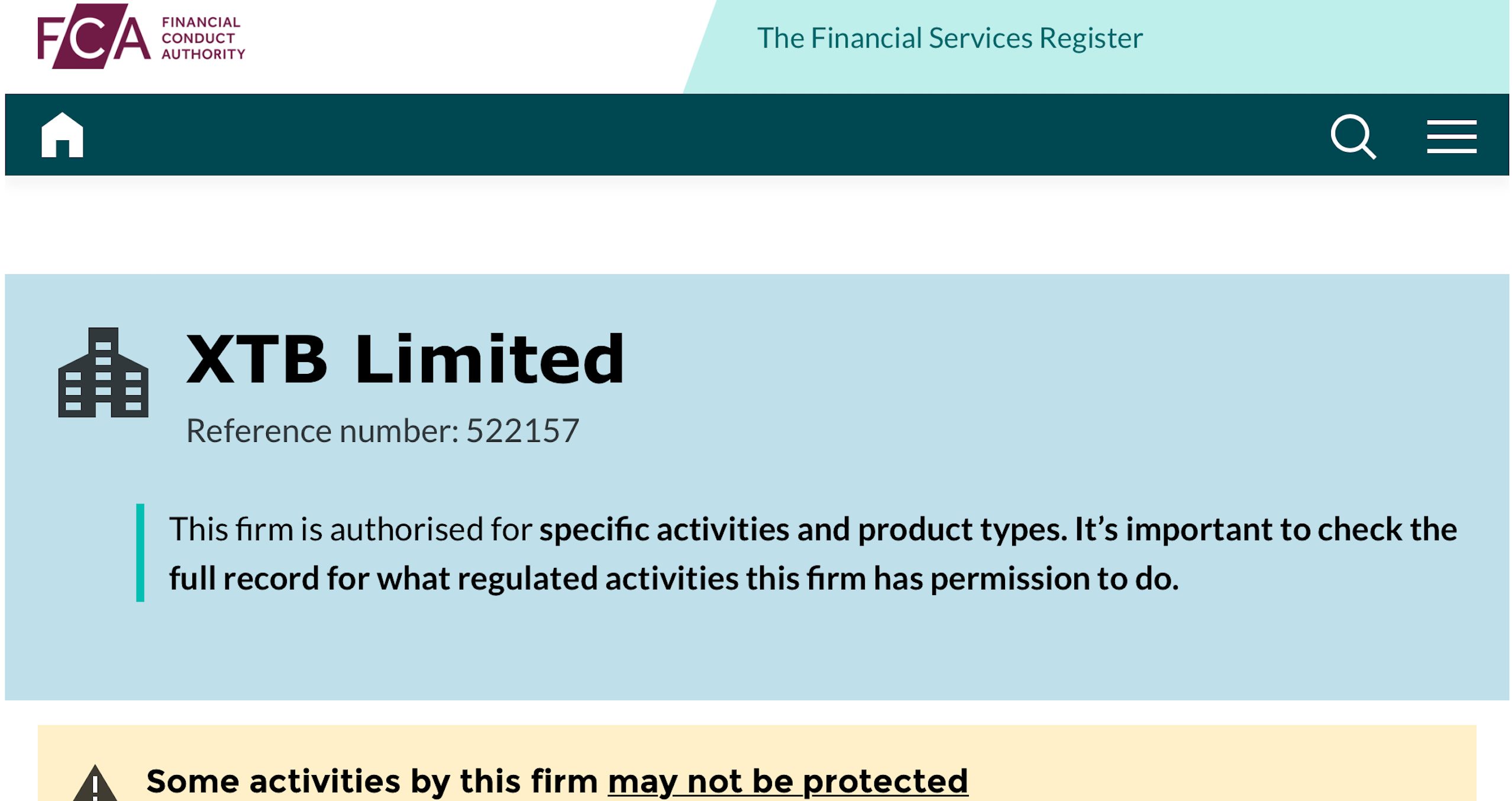

FCA Regulated

They had to be regulated by the UK’s Financial Conduct Authority (FCA), ensuring a high level of trust and critical safeguards for British investors, notably up to £85,000 through the Financial Services Compensation Scheme (FSCS) and limits on leverage (up to 1:5 on UK stocks) to protect against large losses.

Application

We ran each firm’s company name and/or license number through the FCA’s Financial Services Register to check they are authorised to provide stock trading services in the UK.

- XTB Limited (FRN: 522157)

- IG Markets Ltd (FRN: 195355)

- Interactive Brokers UK (FRN: 208159)

- eToro (UK) Ltd (FRN: 583263)

- Spreadex Limited (FRN: 190941)

XTB Limited – FCA License

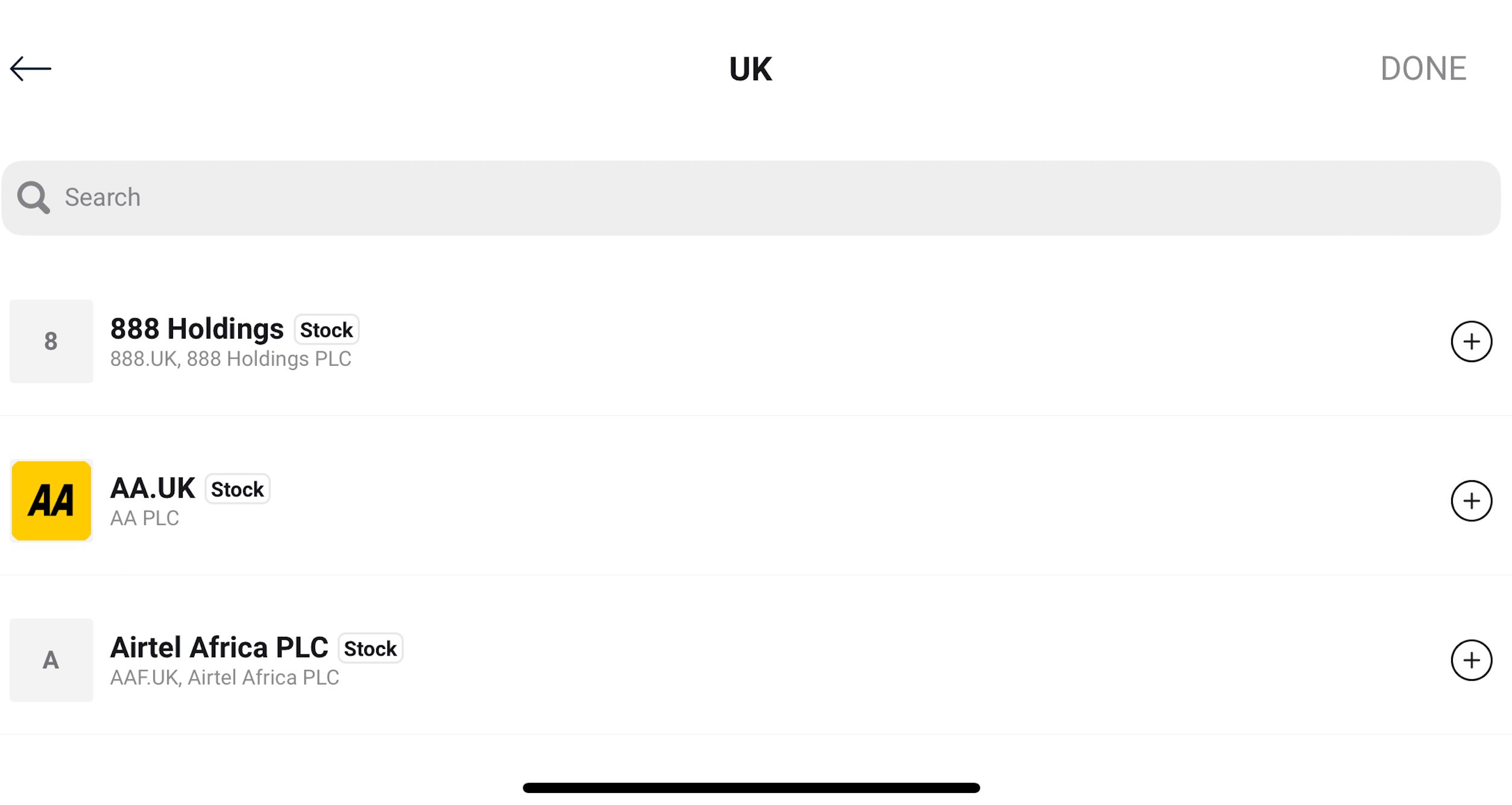

UK Stocks and Shares

They had to provide trading in shares listed on the London Stock Exchange (LSE), either through direct share dealing, contracts for difference (CFDs) or spread betting, providing British investors the opportunity to speculate on UK equities.

Application

We logged into each app to confirm UK stocks were available to trade.

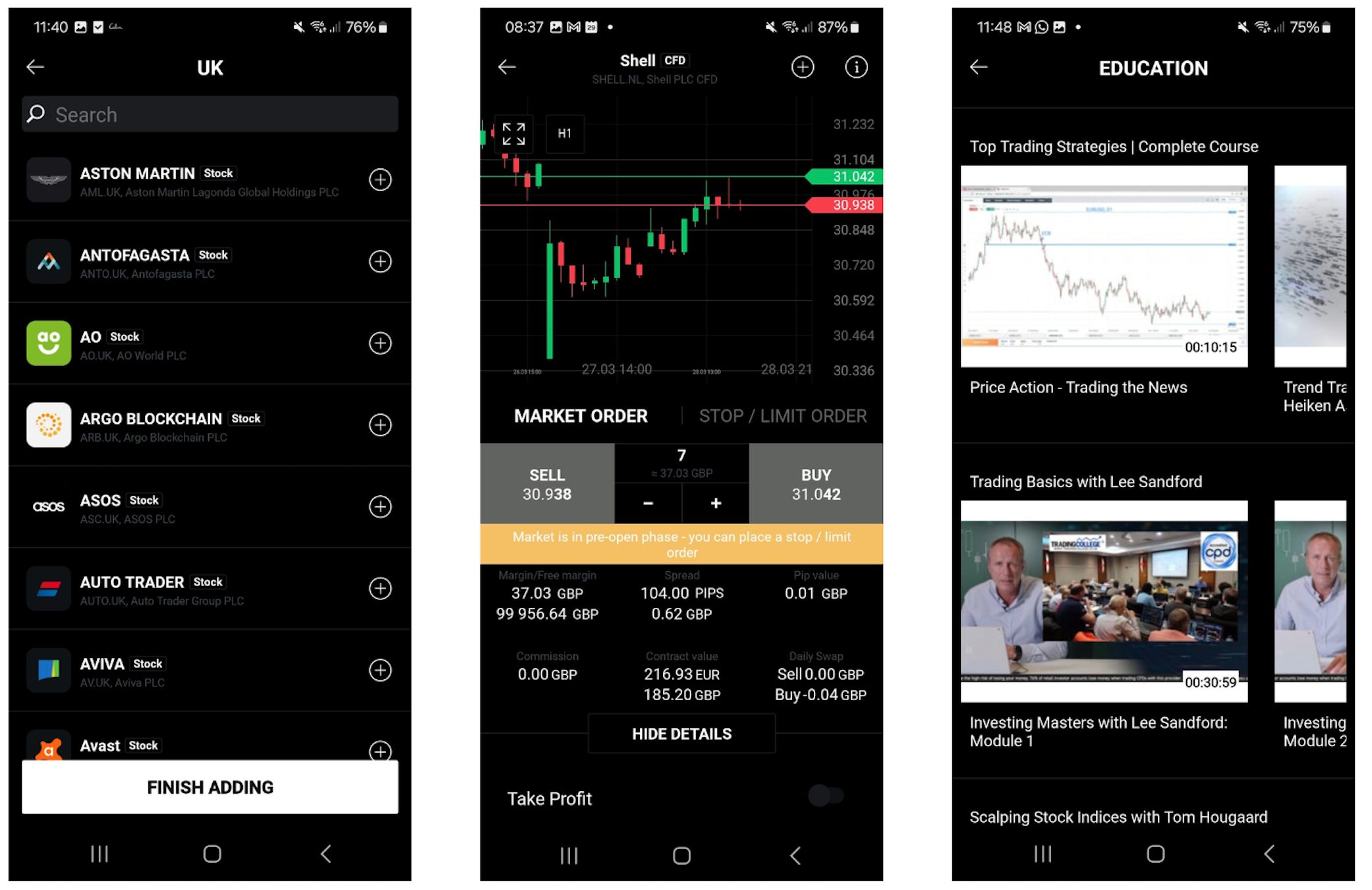

For example, XTB advertises 3,000 shares from 16 exchanges, and we were able to filter to UK shares in the app, of which there were 249.

In contrast, Robinhood began offering stock trading to UK investors in early 2024, however it only offers US Stocks, so it did not make our toplist.

XTB App – UK Stocks

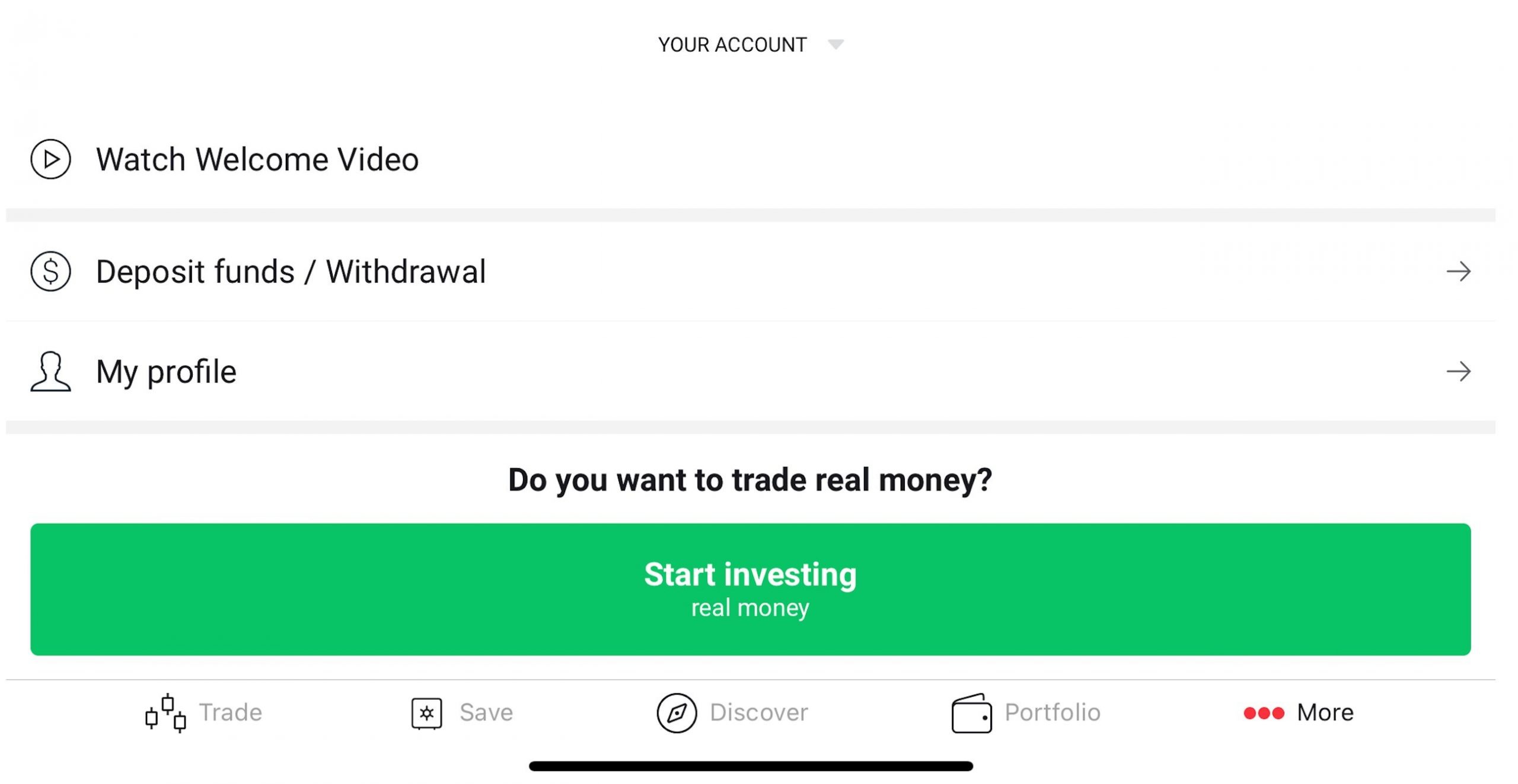

In-App GBP Deposits

They had to provide a GBP trading account with in-app funding, ensuring convenient deposits and withdrawals while minimising conversion fees.

Application

We checked the account options available in each app to confirm whether a GBP-based account was offered.

We also navigated to the cashier portal to check you can fund stock trading accounts using a convenient payment method, such as Apple Pay or Google Pay.

XTB App – Deposits

Design and Usability

They had to score at least 4/5 for design and usability based on our firsthand experiences, ensuring a comprehensive and enjoyable mobile trading experience.

Application

We tested 50 stock trading apps, assessing how intuitive the user experience was, how modern the design was, and how much stock trading could be completed solely on the app.

For example, eToro scored 4.6/5 because we loved the look and feel of its app with a slick design and full trading functionalities from your palm.

In contrast, we rated Hargreaves Lansdowne 3/5 because the design is dull and creating regular payments requires offline elements – paper-based or a desktop device to complete. As a result, it didn’t make our list of top 5 stock trading apps for UK traders.

Hargreaves Lansdowne App – FTSE 100

Research and Stock Screeners

They had to score at least 4/5 for stock screeners and research tools based on our hands-on tests, helping investors discover opportunities in the stock market.

Application

We tried 50 apps, evaluating the availability and quality of stock screeners, economic calendars, integrated news streams, social feeds, analyst insights, and third-party stock picks.

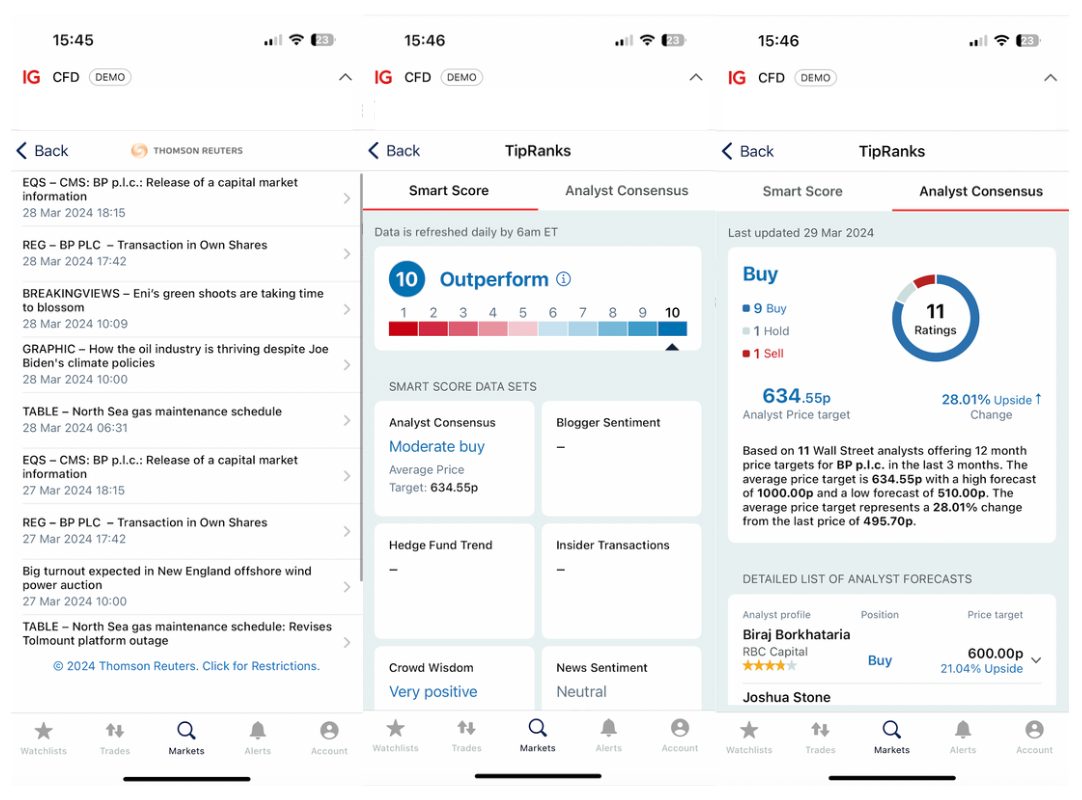

For example, we rated IG 4.7/5 because it excels with its ‘News’ tab providing releases from Reuters, alongside the Signal Centre, plus insights through TipRanks and Autochartist.

In contrast, we scored Revolut just 2/5 because while the ‘Discover’ tab had collections which broke stocks out into industries, plus a ‘Top Movers’ list, we found no news, economic calendar, or any insight services in the app. As a result, it didn’t make our top 5 UK stock trading apps.

IG App – Research Tools

Average App Store Rating

They had to score an average of at least 3.8/5 across both the Apple App Store and Google Play Store, instilling confidence that both iOS and Android traders are catered for.

Application

We recorded respective app store ratings for 50 of the largest stock trading apps in the UK, then averaged the two figures.

For example, IBKR Mobile had a rating of 4.3 on the App Store and 4.5 on Google Play, resulting in an average rating of 4.4.

Picking a stock trading app is ultimately a personal decision. If you are unsure which application to choose, I recommend testing the mobile platform using a demo account, which will allow you to get a feel for the app and place simulated stock trades before trading with real money.

FAQ

What Is The Best Stock Trading App In The UK?

XTB is the best stock trading app in the UK for 2026 following our exhaustive tests.

Runners up in our latest rankings are IG, Interactive Brokers, eToro and Spreadex.

What Is The Most Popular Stock Trading App In The UK?

Trading 212 is arguably the most popular stock trading app in the UK by number of downloads (10+ million).

However, following our in-depth tests and evaluations of the 50 largest stock trading apps for British investors, it didn’t make our toplist of the 5 highest-rated applications.