Best Google Pay Brokers 2026

Google Pay is an established e-wallet and online payment system. It offers a convenient way to make payments from portable devices. This includes mobile apps, websites and physical stores. Our review will cover how to use the payment solution to make deposits to trading accounts. We also explain how Google Pay works, associated fees and we compare it to alternative e-wallets like Apple Pay. In addition, we list the best trading brokers that accept Google Pay deposits and withdrawals.

Google Pay Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

FXCM, a reputable forex and CFD broker founded in 1999, is headquartered in the UK. It has garnered multiple accolades and operates in several regions, including the UK and Australia. Offering more than 400 assets and comprehensive analysis tools without any commission charges, FXCM is a favoured option among traders. The broker is also under the regulation of leading bodies such as the FCA, ASIC, CySEC, FSCA, and BaFin.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 2012, Coinbase began as a platform for buying and selling Bitcoin through bank transfers. Now, it's a major player in the crypto world. It offers more than 240 crypto assets and advanced trading platforms for retail investors. Coinbase is listed on the US Nasdaq and holds multiple regulatory licences. By May 2025, it became the first crypto firm in the S&P 500, boosting its credibility.

Instruments Regulator Platforms Crypto FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE Coinbase, Advanced Trade, Wallet, NFT, TradingView Min. Deposit Min. Trade Leverage $0 $2 -

Established in 2015, VT Markets is a leading Australian multi-asset CFD broker. Offering over 1,000 trading instruments, it supports both MetaTrader 4 and MetaTrader 5 platforms. With these resources, VT Markets provides extensive trading opportunities to more than 400,000 clients globally. It operates under the regulation of ASIC, FSCA, and FSC.

Instruments Regulator Platforms CFDs, Forex, Commodities, Stocks, Indices ASIC, FSCA, FSC VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral Min. Deposit Min. Trade Leverage 50 - 500 USD 0.01 Lots 1:500 -

Founded in 2017, OKX is a reputable cryptocurrency company, providing a comprehensive range of offerings, including trading and NFTs. It enables traders to access more than 400 crypto tokens through OTC trading and derivatives. Its excellent web platform, developer tools, and interactive charts make OKX a preferred option among technical traders.

Instruments Regulator Platforms Spot, futures, perpetual swaps, options VARA AlgoTrader, Quantower Min. Deposit Min. Trade Leverage 10 USDT Variable -

Nexo, a centralised cryptocurrency exchange established in Bulgaria in 2018, now operates from Switzerland in approximately 200 regions. Its offerings include spot and futures trading, peer-to-peer lending, cold wallet storage, and fiat on-ramps for purchasing crypto tokens. Nexo is registered with respected financial bodies like the ASIC. Additionally, it provides unique services, such as a credit card.

Instruments Regulator Platforms Cryptos Nexo Pro Min. Deposit Min. Trade Leverage $10 $30

Safety Comparison

Compare how safe the Best Google Pay Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Coinbase | ✔ | ✘ | ✘ | ✔ | |

| VT Markets | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| Nexo | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Google Pay Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Coinbase | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| VT Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| Nexo | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

Mobile Trading Comparison

How good are the Best Google Pay Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Coinbase | iOS & Android | ✘ | ||

| VT Markets | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| Nexo | iOS & Android | ✘ |

Beginners Comparison

Are the Best Google Pay Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| FXCM | ✔ | $50 | Variable | ||

| Coinbase | ✘ | $0 | $2 | ||

| VT Markets | ✔ | 50 - 500 USD | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| Nexo | ✘ | $10 | $30 |

Advanced Trading Comparison

Do the Best Google Pay Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Coinbase | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| VT Markets | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Nexo | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Google Pay Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| FXPro | |||||||||

| FXCM | |||||||||

| Coinbase | |||||||||

| VT Markets | |||||||||

| OKX | |||||||||

| Nexo |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- The proprietary Trading Station platform is an excellent option for traders seeking a comprehensive tool for their short-term and automated strategies.

- A variety of funding options, such as bank cards, Apple Pay, and PayPal, are available with immediate processing.

- The broker provides reduced spreads and additional benefits for seasoned traders through the Active Trader account.

Cons

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

Our Take On Coinbase

"Coinbase is perfect for novices seeking a user-friendly platform to trade a diverse range of cryptocurrencies, offering strong security and adherence to regulations. However, its fees are higher than those of competitors, and it's less suited to short-term traders."

Pros

- In 2025, Coinbase Advanced expanded its trading options with new futures products. These include Ripple (XRP), Natural Gas (NGS), and Cardano (ADA). This enhancement offers traders accessible methods to trade, hedge, or diversify their portfolios.

- As a Nasdaq-listed entity, Coinbase adheres to stringent financial regulations and holds licences in the US, UK, and Europe. Its security measures feature FDIC insurance for USD balances up to $250,000 and implement two-factor authentication (2FA).

- Coinbase offers support for over 240 cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The platform also provides early access to newly listed altcoins like $Trump, enabling traders to engage with emerging tokens.

Cons

- Tests show that crypto fees are high, particularly when compared to competitors such as Kraken and BitMEX. This is especially true on the standard trading platform.

- The research tools available are inadequate. Advanced Trade offers TradingView charts, yet it is missing critical features such as news feeds, economic calendars, and AI-driven market insights.

- Customer support during testing is frustrating, as most assistance options require a login. This complicates matters for traders who are locked out or do not have an account, as they struggle to access help.

Our Take On VT Markets

"VT Markets is an excellent option for traders seeking tight spreads and robust charting tools. The broker excels in share CFDs, offering hundreds of commission-free assets across various global markets."

Pros

- Traders have access to various analytical tools from trusted sources, such as the Market Buzz AI by Trading Central and a personalised economic calendar.

- The top-tier MetaTrader 4 and 5 platforms are available, providing sophisticated charting tools and access to Expert Advisors (EAs).

- VTrade offers a proprietary trading service accessible on two platforms, connecting you with over 100 providers.

Cons

- Unlike peers such as Fusion Markets, VT Markets lacks cryptocurrency trading options.

- The broker's bonus programmes have strict conditions, including limits on minimum deposits and acceptable payment methods.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- Access a diverse array of trading instruments, such as futures, options, and perpetual swaps, through both mobile and desktop platforms.

- In 2025, OKX obtained a MiFID II licence, allowing it to offer regulated derivatives across Europe, ensuring peace of mind for traders.

- OKX enjoys a strong reputation, serving 20 million clients worldwide and holding a licence from the Dubai Virtual Assets Regulatory Authority.

Cons

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- The broker's platform and features might feel intricate for beginners.

- Testing revealed that customer support quality varied.

Our Take On Nexo

"Nexo offers traders a platform to trade, invest, lend, and borrow digital assets efficiently, excelling in credit functions with substantial yields for lenders. Nevertheless, fees are steep, and some traders may opt for a more regulated broker."

Pros

- Nexo Pro is an intuitive platform tailored for traders, offering robust charting tools that enhance strategic trading.

- Traders can utilise perpetual futures to take long or short positions on crypto assets, thereby enhancing strategic opportunities.

- The trading platform features essential tools such as asset-specific newsfeeds and social media analysis.

Cons

- The selection of tokens is broad relative to many crypto brokers, yet it remains limited when compared to similar crypto exchanges such as Kraken.

- Elevated maker/taker fees result in higher derivative trading costs compared to alternative exchanges.

- Limited educational resources diminish its attraction for newcomers, who may discover more valuable materials with leading platforms such as eToro.

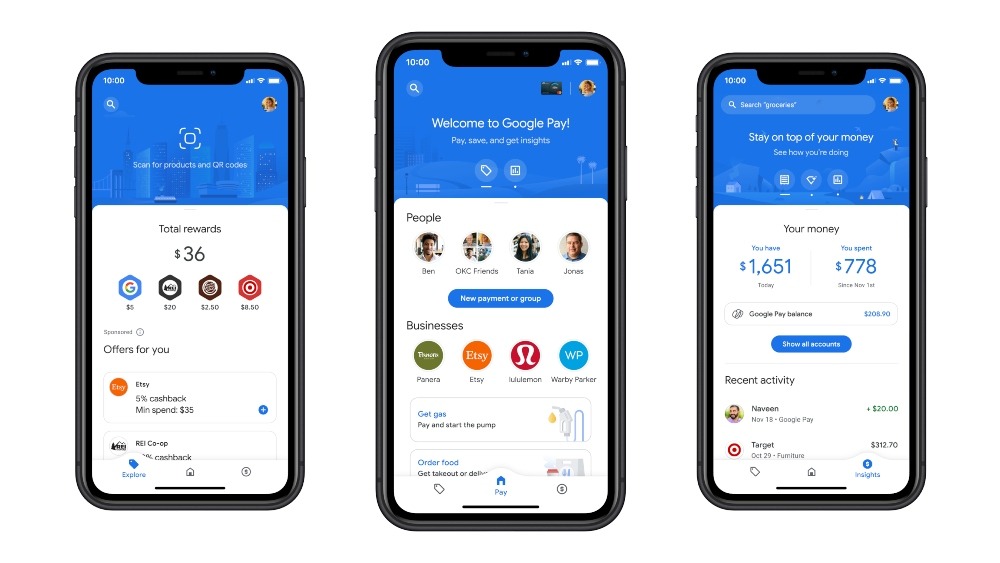

What is Google Pay?

Google Pay is a digital wallet launched in 2011. Users can pay for products and services directly from phones, tablets and smart watches. The technology also facilitates deposits to trading accounts with the click of a button. Importantly, personal payment information is protected with multiple layers of security and a virtual account number.

Originally launched in the UK as Android Pay, the company promptly received support from leading banks, including Halifax, HSBC and Lloyds Bank. The digital wallet is now recognised in more than 40 countries. With that said, the payment app is not the largest digital wallet solution, Apple Pay leads the way with an estimated 227 million users vs Google Pay’s 100 million customers.

How Does Google Pay Work?

Customers can use the solution for online payments, contactless purchases, in-app transactions and more. There is also the option to share money between friends and family, similar to PayPal.

UK clients essentially purchase products and services through a compatible portable device using near-field communication (NFC) chips. This process involves EMV tokenisation. All personal details including credit/debit card numbers are replaced with a dynamic security code generated for each transaction.

Devices are effectively given a virtual card number, in line with the process followed by similar e-wallet solutions, such as Samsung Pay and Apple Pay. In fact, Samsung Pay uses both NFC and Magnetic Secure Transmission (MST) technology, ensuring it works with nearly all popular payment terminals.

Importantly, it is quick and easy to link payment cards to your Google Pay account. You can find YouTube videos with details on how to update/remove a card, the app download process (where the sign-up process is explained in full), how to view a receipt, typical refund times, and more.

Fees

Debit card transactions via Google Pay typically incur a 1.5% fee. There is no charge to transfer funds from your bank account to your Google Pay balance. Trading brokers may apply their own charge for deposits and withdrawals, though Google Pay transfers are free at many top brands. The app is also free to download from the relevant app store.

Since 2020, credit card payments are no longer supported via the application. Instead, you can use credit card services to make contactless payments in merchant stores. However, this is limited to Android users only and subject to charges from your credit card provider (often up to 4% of the transaction value).

Fortunately, UK traders will be pleased to see high maximum transaction limits of £25,000. With that said, brokers may have their own thresholds. This is also much higher than requirements for US investors who are subject to a maximum limit per transaction of $5,000 with a maximum withdrawal amount over a seven-day period of $20,000. This is lower vs PayPal, which has a transfer limit of $10,000 per transaction.

Speed

Google Pay is a relatively fast payment method making it ideal for funding trading accounts. Still, processing times may vary based on the form of payment used. Brokers also have their own timelines.

Typical processing times:

Sending Money

- With A Bank Account – Payments take three to five working days

- With Google Pay Balance – Transactions are typically processed within a few minutes

- With A Linked Debit Card – Transactions are typically processed within a few minutes, though can take up to 24 hours

Receiving Money

The time it takes to receive money, perhaps a profit withdrawal from your brokerage account, will depend on the payment method used by the sender. Typically, payments are processed instantly back to your Google account unless the sender is paying via a bank account. These transactions can take up to five working days to settle.

Alternative e-payment solution, Venmo, guarantees withdrawals to a bank account will be processed within one working day. Instead, a 1% fee (maximum £10) can be paid for an instant transfer.

Note, to remove funds from your Google Pay account to a debit card or bank account, allow a further one to three days.

Security

Google Pay is a secure payment solution. The app is independently verified by the Open Web Application Security Project (OWASP) and follows their Mobile Application Security Verification Standard (MASVS). This is industry prevailing criteria for all developers to adhere to.

Data is transferred over a secure connection with full encryption. Successful payments rely on near-field communication to transmit transaction information. Also, when you pay with your Google Pay account, the digital wallet does not actually share or transmit card numbers. And as WiFi is not required, it reduces the likelihood of interception from hackers.

To use Google Pay, your mobile phone needs to be unlocked using biometrics. Whether you own an iPhone or an Android, permitted verification includes fingerprint, 4 or 6-digit pin passcodes or facial identification. Lock screen payment limits can also be set for iPhone and Android devices.

Remember, no online payment gateway is completely safe. Be aware of potential scams or phishing emails requesting payments.

Customer Service

Google Pay has comprehensive support services for UK customers. This includes an email address, phone number and live chat. Customer care phone numbers and live chat contact channels are available 24/7. Simply login to your Google account to quickly access all helpline methods.

In addition, there are plenty of self-help FAQs available on the official website. Topics include how to access transaction history, how to delete a card, understanding error number messages, activating a balance transfer and viewing personal usage statistics.

How to Make a Deposit & Withdrawal Using Google Pay

To make a transfer, first check that your broker supports Google Pay. Visit the broker’s deposit and withdrawal section and look out for the payment logo. Contact the customer service team if details cannot be found. The payment solution is integrated via APIs so requirements can be incorporated within your broker’s platform.

To make a deposit, follow these steps:

- Download Google Pay from the relevant app store. It is compatible with iOS and Android (APK) devices, including Samsung Galaxy watches

- Link a debit card. Accepted brands and UK banks include Barclays, Monzo, Lloyds, Halifax, AMEX, Revolut and NatWest. This will be the payment card interlinked with your Google account

- Login to your trading account and locate the Google Pay icon on the deposit / withdrawal web page

- Enter the deposit amount and complete the required verification details. Remember, brokers may have their own minimum deposit requirement

- Processing times may vary but contact the broker if any significant delays occur or issues arise

Note, make sure the broker accepts payments in GBP to save exchange rate fees.

Pros of Google Pay

- Available On Many Devices – Google Pay can be integrated into several portable devices including iPhones, Androids, Huawei devices and even Samsung watches.

- Inexpensive – In addition to being free to download, the app is cheap to use and many international brokers support the solution at no charge. With that said, be cautious of charges to debit your account balance. Receipts can also be quickly downloaded free of charge.

- Convenient – As well as being a one-stop payment solution, Google Pay can conveniently store loyalty cards, gift cards, rewards points, boarding passes, and more.

- Secure – Google uses encryption and several layers of authentication to protect transactions. All personal payment details are replaced using tokenisation meaning your card number is never shared

Cons of Google Pay

- Processing Times – Transfers back to a Google account can take up to five working days to settle. This is slower vs Samsung Pay and Apple Pay, which offer instant processing.

- Reliance On Technology – App performance issues or update requirements can outweigh the benefits of the convenient payment solution. There may be times that the Google Pay app is down, a compatible card is not working or a payment is declined.

- Limited Number Of Brokers Accept Google Pay – The number of brokers accepting Google Pay is still limited versus traditional payment methods. Nevertheless, demand for e-wallet solutions continues to rise so there will likely be more accepted providers in the future.

Supported Banks & Cards

Google Pay works with credit and debit cards from several UK financial institutions, including MasterCard, Visa and AMEX. Note, that Barclaycard is not compatible with the e-wallet. The UK bank opted to provide proprietary facilities to their customers via their own application.

UK banks that support Google Pay include the Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, MBNA, Nationwide Building Society, NatWest, and Revolut.

Google Pay Verdict

Google Pay is a secure, cheap and convenient payment solution. Pairing top-tier safety standards with various compatible payment methods is a great addition to the e-wallet landscape. Nevertheless, for UK investors, it isn’t the most readily available deposit solution given the limited number of supporting brokers. Fortunately, we expect this to change in the future.

See our list of Google Pay brokers to start trading today.

FAQs

How Long Do Google Pay Transactions Take To Reach My Trading Account?

Google Pay is a relatively fast payment method. However, processing times vary based on the form of payment used. Brokers may also have their own timelines. Bank wire transfer payments, for example, can take up to five working days.

What UK Banks Support Google Pay?

UK banks that support Google Pay include the Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA, Nationwide Building Society, NatWest, and Revolut, amongst others.

Is Google Pay Safe?

Google Pay is a secure payment method. The service integrates multiple layers of security including tokenisation of personal payment details, transaction encryption and biometric unlocking requirements.

Is Google Pay Free?

Google Pay is a free application. With that said, there may be charges to fund trading accounts. Check your broker’s payment terms and conditions before making a deposit. Note, some trading platforms also offer free demo accounts for new investors.

My Google Pay Won’t Work, How Can I Fix It?

The most common reason for the app to not work is a failure to install the latest version. Visit the app store and make sure you are running the most up-to-date software. Alternatively, reach out to the customer service team for diagnostic support.