FXCM Review 2026

Find out all you need to know about day trading with Stratos Group (FXCM). This review offers a comprehensive insight into every aspect of the broker, from forex spreads and leverage to trading platforms and asset lists. Let’s see if FXCM is the broker for you.

About FXCM

FXCM is a leading online forex and CFD broker. Since its inception in 1999, the company has connected traders to the world’s largest financial markets and trading instruments, including spread betting.

In 2015, FXCM was bought by Leucadia Investments which forms part of the Jeffries Financial Group. Today, FXCM has over 130,000 customer accounts globally with a long list of British traders supported from the broker’s London headquarters.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Platforms

Trading Station

Trading Station is FXCM’s proprietary forex and CFD platform. The powerful web-based solution is popular, owing to its intuitive interface and variety of features:

- Automated strategies

- Advanced market analytics

- Desktop and mobile compatible

- View historical and order flow data

- Custom live charts and pre-loaded indicators

- Economic calendars and the latest market news

Trading Station

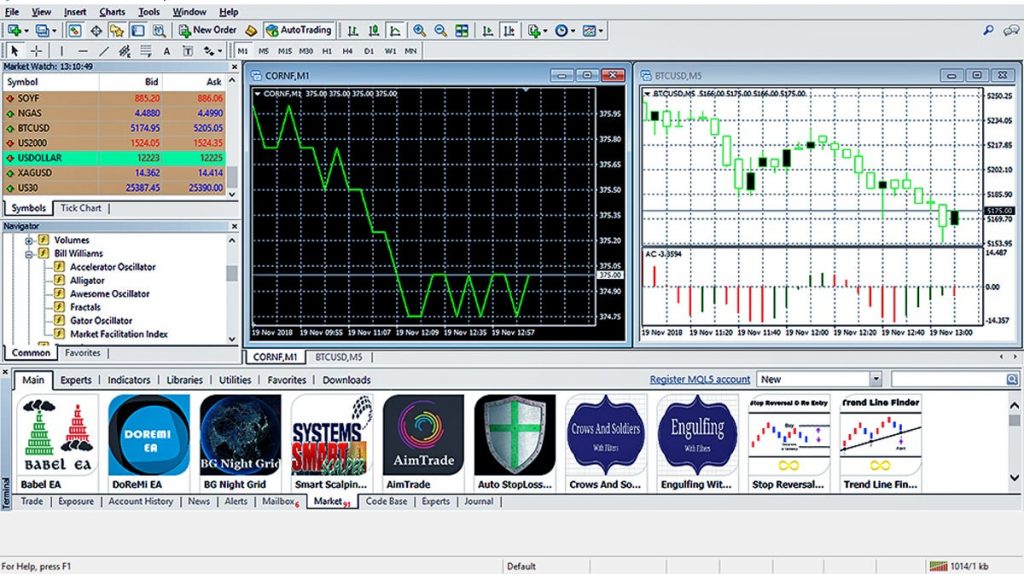

MetaTrader 4

FXCM also offers the hugely popular MT4 platform. The gold-standard for retail forex trading, the user-friendly terminal has a lot to offer beginners, in particular:

- VPS hosting

- 3 execution modes

- 30 built-in indicators

- Mobile app download

- EAs for automated trading

- Set guaranteed stop loss and take profit orders

- Execute with precision using 0.01 micro lot sizes

MetaTrader 4

If you are new to the MetaTrader platforms, use the risk-free MT4 demo account to get familiar with the features.

Note, FXCM does not support the MetaTrader 5 (MT5) downloadable platform.

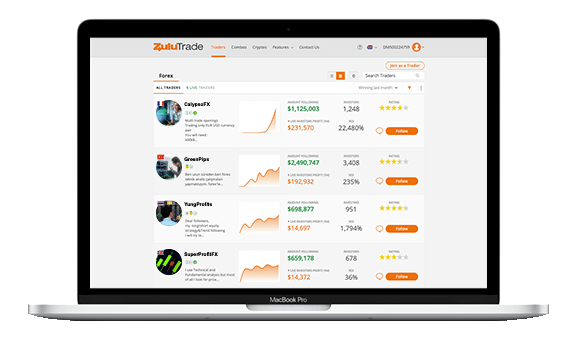

ZuluTrade

ZuluTrade is a peer-to-peer social trading platform that lets users interact with other traders and replicate their market positions. This is a great option for beginners looking to learn more about trading shares for example. Users can follow free market signals or pay to copy established investors.

ZuluTrade

API trading is also supported. For more information regarding Rest API, Java API or API Python, head to the ‘API trading tab’ under the algorithmic trading tab on the broker’s website.

FXCM Markets And Assets

FXCM boasts a variety of tradeable markets:

- Forex – Trade on the largest and most liquid market in the world. A long list of popular currency pairs are offered, including GBPUSD and EURUSD

- Stocks CFDs – Trade shares in the world’s most talked about stocks, including Amazon, Tesla and Gamestop

- Commodities CFDs – Enjoy commission-free trading on popular commodities like XAUUSD, XAGUSD and Oil

- Indices CFDs – Speculate on the largest indices, including the FTSE 100, NASDAQ 100, US 30, DAX 30, JPN 225 and S&P 500

Fees

The spreads offered by FXCM are generally competitive. Forex spreads start from 1.3 pips on EUR/USD and 1.8 pips on GBP/USD according to FXCM’s spread report (2020 Q4). Active Trader account holders benefit from more competitive rates but require a larger upfront deposit.

FXCM offers commission-free* trading, so users only need to take into account floating market spreads. Clients will, however, have to pay rollover or ‘overnight’ fees if positions are left open into the next day. A £50 inactivity fee is also charged by the broker if no trades are made for a year.

* FXCM can be compensated in several ways, which includes but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up to rollover, etc. Commission-based pricing is applicable to Active Trader account types.

Leverage Review

FXCM provides leverage upto 400:1 for it’s SVG clients.

Leverage is a risky tool that should only be used alongside effective risk management strategies and with an eye on margin requirements. Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors.

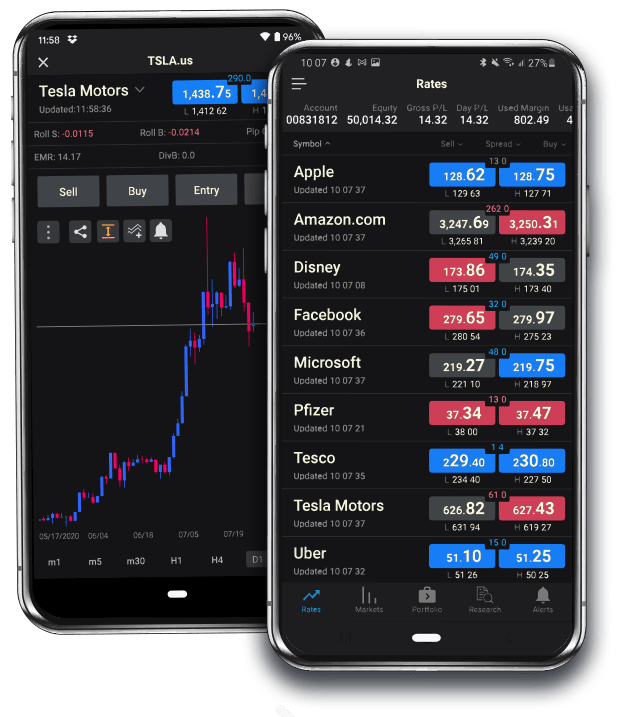

Mobile Apps

FXCM’s Trading Station and the MT4 platform are available for use on mobile devices. The apps host many of the features available on the desktop terminals but with the added flexibility of investing on-the-go.

Mobile users can log in to their portals from any WiFi-enabled location. The apps are available to download from the App Store or Google Play store.

Mobile trading

Deposits & Withdrawals

There are no fees for depositing or withdrawing cash. Funding your FXCM account can be done via several methods:

- Bank wire transfer – CHAPS, SWIFT, BACS and SEPA are all accepted. Transfers take between 1 – 5 days

- Skrill and UnionPay – these can take between 1 and 2 days to be credited to your account

- Credit and debit cards – payments are usually processed the same day

The methods listed above also apply to withdrawals. However, debit and credit card withdrawals can only amount to the sum originally deposited. If the sum is larger, it will need to be processed via bank transfer. To request a withdrawal, select ‘withdraw funds’ in the MYFXCM portal.

Note, for any payment problems, contact customer service.

Demo Account

FXCM offers a demo account to all prospective traders. A demo account is a great way to get to grips with a new broker, trial strategies and explore novel instruments. The demo account is credited with £50,000 virtual funds and traders can choose between trading platforms, including ZuluTrade.

FXCM Regulation

Stratos Global LLC (“FXCM”) is incorporated in St Vincent and the Grenadines with company registration No. 1776 LLC 2022 and is an operating subsidiary within the Stratos Group of companies (collectively, the “Stratos Group”). FXCM is not required to hold any financial services license or authorization in St Vincent and the Grenadines to offer its products and services.

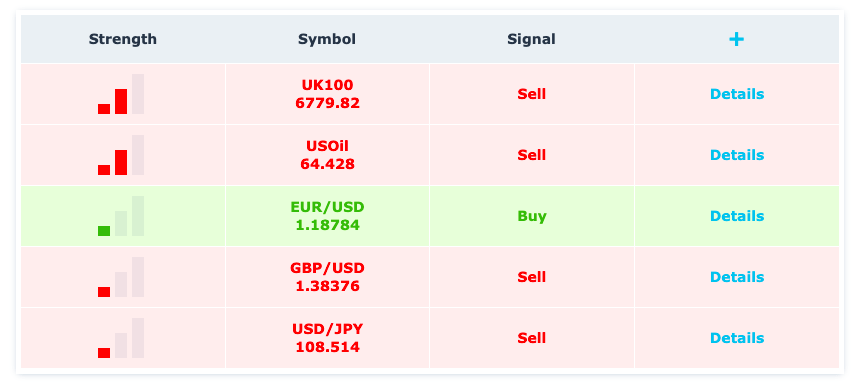

FXCM Additional Features

FXCM’s range of additional resources is comprehensive with something for traders of all abilities. Users benefit from regularly updated market news, live forex charts and quotes, plus economic and position size calculators. FXCM also offers sentiment indicators and a host of video tutorials, blogs and online classes.

The bank of resources is extensive and an advantage of trading with FXCM. Novice traders, in particular, stand to gain a lot from the wealth of materials on offer.

Market Scanner

FXCM Accounts

FXCM offers three account types:

- Standard – The standard account has no minimum deposit requirement and traders can choose between several powerful trading platforms. The standard account is the broker’s most basic offering but rates remain competitive.

- Active Trader – Targeted at high volume traders, the Active option comes with dedicated support, tailored solutions and an optimised commission structure.

FXCM does not offer an Islamic trading account but clients can operate joint accounts from a single web login.

Opening An Account

Opening an account with FXCM is relatively straightforward. First, you will need to register and supply details regarding your financial history and employment status. Once the necessary KYC information has been submitted and approved, you can log in to your account via the MYFXCM portal.

Benefits

Trading with FXCM has a number of benefits:

- Low fees for standard account holders

- 2FA secure logins on web terminals

- A wide range of trading platforms

- Valuable educational resources

- MT4 demo account login

- Copy trading solution

- Positive user reviews

- No deposit bonuses

- Yen index basket

Drawbacks

Downsides of trading with FXCM include

- Overnight charges

- No managed accounts

Trading Hours

Opening hours vary depending on the instrument and market you wish to trade. Forex trading is open 24/5 Monday to Friday, for example. Note, spreads are likely to widen during periods of low liquidity and public holidays, including Christmas, often come with different trading hours.

Contact Details

UK traders can contact FXCM via:

- Email – info@fxcm.co.uk

- WhatsApp – +44 7537 432259

- Live chat – click on the chat icon in the MYFXCM portal

- Address – 125 Old Broad Street, 9th Floor, London EC2N 1AR, United Kingdom

FXCM can also be found on X, Facebook and YouTube.

Client Safety

FXCM is a regulated broker offering decent levels of security. The trading platforms are password-protected with two factor authentication (2FA) available at the login stage on the MetaTrader terminals. Mobile apps are also secure to prevent hacks and the broker follows industry-standard data privacy regulations.

Should You Trade With FXCM?

FXCM has a lot to offer prospective traders. Forex and CFD spreads are competitive with a variety of trading platforms to choose from. The suite of educational resources and additional tools are also impressive. Overall, FXCM is a good option for both beginners and experienced traders.

FAQ

Is FXCM A Good Broker?

FXCM is regulated by the UK’s FCA and offers a suite of automated and manual trading platforms. Market scanners, heat maps, live forex charts and rates are also offered. With no payment fees and interactive mobile trading, we’re happy recommending FXCM to our readers.

Is FXCM A Legitimate And Regulated Broker?

Yes, FXCM is regulated by leading regulatory authorities including the FCA in the UK and the CySEC in Cyprus. Both are among the most respected agencies and are a good sign the broker can be trusted.

How Do I Find My FXCM Account?

To sign in to your account head to the MYFXCM portal on the broker’s website. From there you can manage your account and trading operations, including making deposits, withdrawing profits and loading the online platforms. You can also speak to the customer support team if you get stuck.

Does FXCM Offer Mobile Trading?

Yes, clients can trade CFDs and forex from mobile devices. FXCM’s Trading Station and MetaTrader 4 can both be downloaded for free to Android and iOS devices. They both promise an intuitive mobile trading experience with free deposits, one-click trading a host of analysis tools.

Is FXCM A Market Maker?

Yes, FXCM does act as a market maker. This is why the broker can offer lower entry requirements vs most ECN brokers. It also helps FXCM offer access to a wide range of financial markets with decent liquidity.

Top 3 FXCM Alternatives

These brokers are the most similar to FXCM:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- FXPro - Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

FXCM Feature Comparison

| FXCM | IG | FXPro | Pepperstone | |

|---|---|---|---|---|

| Rating | 4 | 4.5 | 4.4 | 4.8 |

| Markets | Forex, Stock CFDs, Commodities CFDs, Crypto CFDs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $50 | $0 | $100 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, ASIC, FSCA, BaFin, CIRO | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, CySEC, FSCA, SCB, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:400 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

71.9% of retail investor accounts lose money when trading CFDs |

||

| Review | FXCM Review |

IG Review |

FXPro Review |

Pepperstone Review |

Trading Instruments Comparison

| FXCM | IG | FXPro | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | No | Yes | No | Yes |

FXCM vs Other Brokers

Compare FXCM with any other broker by selecting the other broker below.

Popular FXCM comparisons:

|

|

FXCM is #13 in our rankings of CFD brokers. |

| Top 3 alternatives to FXCM |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Stock CFDs, Commodities CFDs, Crypto CFDs |

| Demo Account | Yes |

| Minimum Deposit | $50 |

| Minimum Trade | Variable |

| Regulated By | FCA, CySEC, ASIC, FSCA, BaFin, CIRO |

| Trading Platforms | MT4 |

| Leverage | 1:400 |

| Mobile Apps | iOS and Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Apple Pay, Credit Card, Debit Card, Google Pay, PayPal, Wire Transfer |

| Copy Trading | Yes |

| Islamic Account | Yes |

| Commodities | Cannabis, Copper, Corn, Gold, Oil, Silver |

| CFD FTSE Spread | 1.18 pts var* |

| CFD GBPUSD Spread | 0.5 pips* |

| CFD Oil Spread | 0.05 (var)* |

| CFD Stocks Spread | 0.2% Var* |

| GBPUSD Spread | 0.5 pips var* |

| EURUSD Spread | 0.2 pips var* |

| GBPEUR Spread | 0.5 pips var* |

| Assets | 40 |

| Currency Indices | JPY |

| Crypto Coins | BTC, BTC, ETH, LTC |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |