Best Apple Pay Brokers 2026

Apple Pay is widely used in the UK—in shops, online, and now with trading accounts. For many traders, it’s the easiest way to add funds, but brokers don’t all handle it the same. Some limit deposits, others block withdrawals, and a few don’t support it at all.

We reveal the best UK brokers that accept Apple Pay deposits and what details to check first.

Top Apple Pay Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 2008 and based in Israel, Plus500 is a leading brokerage with over 25 million registered traders across more than 50 countries. It focuses on CFD trading, offering a user-friendly proprietary platform and mobile app. The company provides competitive spreads and does not impose commissions or charges for deposits or withdrawals. Plus500 stands out as a highly trusted broker, licensed by respected authorities such as the FCA, ASIC, and CySEC.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

FXCM, a reputable forex and CFD broker founded in 1999, is headquartered in the UK. It has garnered multiple accolades and operates in several regions, including the UK and Australia. Offering more than 400 assets and comprehensive analysis tools without any commission charges, FXCM is a favoured option among traders. The broker is also under the regulation of leading bodies such as the FCA, ASIC, CySEC, FSCA, and BaFin.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 2012, Coinbase began as a platform for buying and selling Bitcoin through bank transfers. Now, it's a major player in the crypto world. It offers more than 240 crypto assets and advanced trading platforms for retail investors. Coinbase is listed on the US Nasdaq and holds multiple regulatory licences. By May 2025, it became the first crypto firm in the S&P 500, boosting its credibility.

Instruments Regulator Platforms Crypto FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE Coinbase, Advanced Trade, Wallet, NFT, TradingView Min. Deposit Min. Trade Leverage $0 $2 -

Established in 2015, VT Markets is a leading Australian multi-asset CFD broker. Offering over 1,000 trading instruments, it supports both MetaTrader 4 and MetaTrader 5 platforms. With these resources, VT Markets provides extensive trading opportunities to more than 400,000 clients globally. It operates under the regulation of ASIC, FSCA, and FSC.

Instruments Regulator Platforms CFDs, Forex, Commodities, Stocks, Indices ASIC, FSCA, FSC VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral Min. Deposit Min. Trade Leverage 50 - 500 USD 0.01 Lots 1:500 -

Founded in 2017, OKX is a reputable cryptocurrency company, providing a comprehensive range of offerings, including trading and NFTs. It enables traders to access more than 400 crypto tokens through OTC trading and derivatives. Its excellent web platform, developer tools, and interactive charts make OKX a preferred option among technical traders.

Instruments Regulator Platforms Spot, futures, perpetual swaps, options VARA AlgoTrader, Quantower Min. Deposit Min. Trade Leverage 10 USDT Variable -

Nexo, a centralised cryptocurrency exchange established in Bulgaria in 2018, now operates from Switzerland in approximately 200 regions. Its offerings include spot and futures trading, peer-to-peer lending, cold wallet storage, and fiat on-ramps for purchasing crypto tokens. Nexo is registered with respected financial bodies like the ASIC. Additionally, it provides unique services, such as a credit card.

Instruments Regulator Platforms Cryptos Nexo Pro Min. Deposit Min. Trade Leverage $10 $30

Safety Comparison

Compare how safe the Best Apple Pay Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Coinbase | ✔ | ✘ | ✘ | ✔ | |

| VT Markets | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| Nexo | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Apple Pay Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Coinbase | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| VT Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| Nexo | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

Mobile Trading Comparison

How good are the Best Apple Pay Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Coinbase | iOS & Android | ✘ | ||

| VT Markets | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| Nexo | iOS & Android | ✘ |

Beginners Comparison

Are the Best Apple Pay Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Plus500 | ✔ | $100 | Variable | ||

| FXCM | ✔ | $50 | Variable | ||

| Coinbase | ✘ | $0 | $2 | ||

| VT Markets | ✔ | 50 - 500 USD | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| Nexo | ✘ | $10 | $30 |

Advanced Trading Comparison

Do the Best Apple Pay Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Coinbase | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| VT Markets | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Nexo | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Apple Pay Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Plus500 | |||||||||

| FXCM | |||||||||

| Coinbase | |||||||||

| VT Markets | |||||||||

| OKX | |||||||||

| Nexo |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- In 2025, Plus500 expanded its range of share CFDs to include emerging sectors such as quantum computing and AI. This update opened up trading opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- Plus500 offers a dedicated WebTrader platform tailored specifically for CFD trading. It features a user-friendly and streamlined interface.

- Plus500 has expanded its range of short-term trading instruments by adding VIX options, which feature increased volatility. Additionally, it has extended trading hours for seven stock CFDs.

Cons

- Educational resources are not as extensive as leading brokers such as eToro, which affects beginners' ability to learn quickly.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- The broker provides reduced spreads and additional benefits for seasoned traders through the Active Trader account.

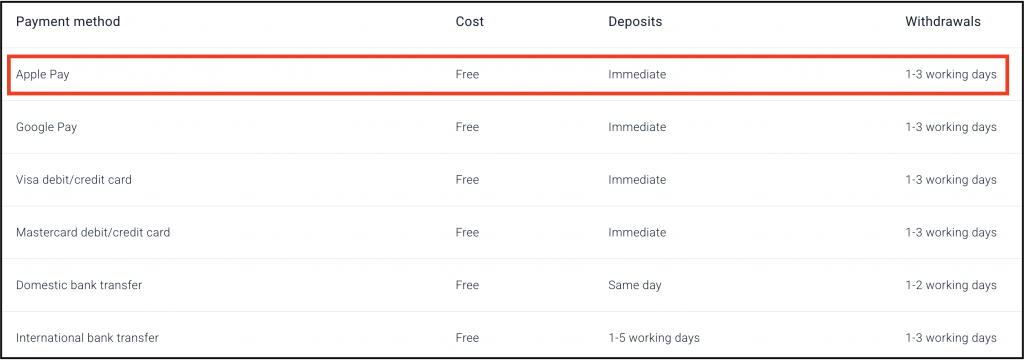

- A variety of funding options, such as bank cards, Apple Pay, and PayPal, are available with immediate processing.

- FXCM has broadened its trading options by offering stock CFDs via MetaTrader 4.

Cons

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

Our Take On Coinbase

"Coinbase is perfect for novices seeking a user-friendly platform to trade a diverse range of cryptocurrencies, offering strong security and adherence to regulations. However, its fees are higher than those of competitors, and it's less suited to short-term traders."

Pros

- Coinbase Advanced now integrates TradingView, a feature uncommon among crypto platforms. This allows traders to access spot and futures markets directly via real-time charts while utilising robust technical analysis tools.

- As a Nasdaq-listed entity, Coinbase adheres to stringent financial regulations and holds licences in the US, UK, and Europe. Its security measures feature FDIC insurance for USD balances up to $250,000 and implement two-factor authentication (2FA).

- Coinbase offers support for over 240 cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The platform also provides early access to newly listed altcoins like $Trump, enabling traders to engage with emerging tokens.

Cons

- The research tools available are inadequate. Advanced Trade offers TradingView charts, yet it is missing critical features such as news feeds, economic calendars, and AI-driven market insights.

- Tests show that crypto fees are high, particularly when compared to competitors such as Kraken and BitMEX. This is especially true on the standard trading platform.

- Customer support during testing is frustrating, as most assistance options require a login. This complicates matters for traders who are locked out or do not have an account, as they struggle to access help.

Our Take On VT Markets

"VT Markets is an excellent option for traders seeking tight spreads and robust charting tools. The broker excels in share CFDs, offering hundreds of commission-free assets across various global markets."

Pros

- Spreads are highly competitive, tested at 0.2 pips for EUR/USD in the ECN account, comparable to leading firms such as Pepperstone.

- Traders have access to various analytical tools from trusted sources, such as the Market Buzz AI by Trading Central and a personalised economic calendar.

- The top-tier MetaTrader 4 and 5 platforms are available, providing sophisticated charting tools and access to Expert Advisors (EAs).

Cons

- Unlike peers such as Fusion Markets, VT Markets lacks cryptocurrency trading options.

- The broker's bonus programmes have strict conditions, including limits on minimum deposits and acceptable payment methods.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- Active traders benefit from competitive rates, with maker fees starting at 0.02% and taker fees at 0.05%.

- Access a diverse array of trading instruments, such as futures, options, and perpetual swaps, through both mobile and desktop platforms.

- Traders can obtain historical market information for both spot and futures markets, including OHLC data, aggregate trade details, and trading records.

Cons

- Testing revealed that customer support quality varied.

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- The broker's platform and features might feel intricate for beginners.

Our Take On Nexo

"Nexo offers traders a platform to trade, invest, lend, and borrow digital assets efficiently, excelling in credit functions with substantial yields for lenders. Nevertheless, fees are steep, and some traders may opt for a more regulated broker."

Pros

- Nexo Pro is an intuitive platform tailored for traders, offering robust charting tools that enhance strategic trading.

- Nexo's platform facilitates cryptocurrency lending and borrowing through its staking and credit features, offering traders some of the most competitive yields in the market.

- A well-regarded crypto exchange, established in 2018, has initiated steps towards regulatory compliance.

Cons

- The selection of tokens is broad relative to many crypto brokers, yet it remains limited when compared to similar crypto exchanges such as Kraken.

- While Nexo is registered with certain reputable regulators, trading with it carries more risk compared to established crypto brokers such as AvaTrade and Vantage.

- High deposit and withdrawal fees for cards and e-wallets may deter many traders from using these convenient payment methods.

How Investing.co.uk Chose The Best Brokers That Use Apple Pay

We tested brokers that support Apple Pay, focusing on how easy deposits were to set up, speed of processing, transaction fees, and overall payment security. Our team combined these checks with broader platform testing to see how Apple Pay fits into the full trading experience.

From there, we ranked the shortlisted providers by overall ratings to identify the best Apple Pay brokers for traders.

What To Look For In An Apple Pay Broker For Trading

Check If Apple Pay Is Fully Supported

Plenty of brokers list’ mobile payments’ or ‘digital wallets’ on their sites. That doesn’t always mean Apple Pay. Some support Google Pay or Samsung Pay, but not Apple Pay. Others only allow it through specific devices.

If you want to avoid disappointment, look for the actual Apple logo on the broker’s payment page.

And don’t stop there. Ask yourself: Is Apple Pay supported for both deposits and withdrawals, or just one way? Many platforms allow you to put money in with Apple Pay, but not take it out again.

A quick check before signing up saves hassle later.

Pepperstone is a prominent broker that supports Apple Pay

Deposit Speed Matters

The main draw of Apple Pay is speed. You tap a button, use Face ID or Touch ID, and the money shows up almost instantly. For traders who need to react quickly, this can be useful.

But speed isn’t always guaranteed. Some brokers credit deposits instantly from our tests, while others add delays. In a few cases, deposits may be held for review if the amount is high or if you’re new to the platform.

If you plan to fund your account right before making a trade, test the deposit speed first with a small amount. That way, you know how long it really takes.

When I’ve topped up with Apple Pay, the money usually shows up in my account straight away, but I’ve also had the odd time where it took an hour or two—fast most of the time, but not something I’d call guaranteed.

Understand Withdrawal Rules

Withdrawals are where Apple Pay gets complicated. Even if you can deposit with Apple Pay, most brokers in the UK don’t allow withdrawals to go back the same way. They’ll usually send funds to your bank account instead.

That means you need to know:

- How long does a withdrawal take?

- Which account will it go to?

- Are there extra checks for security?

Some platforms can take two to five working days for a bank transfer. If you expect to get money back fast, Apple Pay may not be the complete solution.

Look Closely At Fees

Apple doesn’t charge users to make payments, but brokers set their own rules. Some pass on costs to customers, especially for smaller deposits. Others set high minimum amounts—for example, £50 or even £100—which can feel steep if you’re just testing the platform.

Check both deposit and withdrawal fees. A £2.50 charge per transaction doesn’t sound much, but if you deposit often, it adds up. Also, watch for conversion fees if the broker uses dollars or euros as the base currency.

Deposit & Withdrawal Limits

Apple Pay has its own limits, and brokers add theirs too. The limits vary a lot:

- Some UK brokers let you deposit as little as £10.

- Others set £200 as the minimum.

- Daily and monthly caps may also apply.

If you plan to trade larger amounts, make sure the broker’s limits won’t slow you down. On the other hand, if you want to try trading with small sums, pick a platform with low minimums.

Currency & Conversion

Most UK brokers accept deposits in pounds. But some still default to dollars or euros, especially international platforms. When this happens, your Apple Pay deposit may be converted automatically.

These conversions usually come with a cost. Sometimes it’s hidden in the exchange rate. At other times, it’s shown as a fee. Either way, it’s worth checking before you deposit. Even a 1–2% fee can eat into your funds over time.

I learned the hard way that if the broker’s account isn’t in pounds, Apple Pay deposits get converted by default—the fee isn’t huge, but it chips away at your balance over time.

Security Beyond Apple Pay

Apple Pay is known for being secure. It uses tokenisation, so your card details aren’t shared. You also confirm payments with Face ID, Touch ID, or your passcode.

But once your money reaches the broker, it’s down to their security. That’s why it’s essential to check whether the broker is FCA-regulated and how they handle client funds.

Do they keep customer money in segregated accounts? Do they have two-factor login for trading?

Apple Pay makes the transaction safe, but the broker is responsible for everything that happens after.

Device & Platform Compatibility

Apple Pay works across iPhones, iPads, Macs, and even smartwatch apps like Apple Watches. But the broker also needs to support it properly. Some platforms only let you use Apple Pay through their mobile app, not on desktop.

If you prefer to trade on a laptop, that might be a problem. Others have clunky integrations that feel like workarounds rather than a smooth process. A good broker should make Apple Pay as easy as using it in a shop—quick and seamless.

Keep An Eye On Ease Of Use

The whole point of Apple Pay is simplicity. If a broker forces you to re-enter card details or complete extra forms, then they haven’t integrated it properly.

The best platforms let you add money in a couple of taps. It should feel the same as paying for groceries with your phone. Anything more complicated defeats the purpose.

Watch Out For Broker Policies

Brokers sometimes add rules that apply only to Apple Pay users. For example:

- Deposits via Apple Pay may not qualify for promotions or welcome trading bonuses.

- Larger deposits may trigger extra ID checks.

- Withdrawals could take longer than deposits.

Policies aren’t always obvious when you first join. Take time to read the payment terms before adding funds.

Don’t Forget Customer Support

When something goes wrong with Apple Pay—a failed deposit, a double charge, or a withdrawal delay—Apple won’t fix it. The broker will. That’s why customer support matters.

Look for a platform with live chat or at least fast email response times. If support is slow, you could be waiting days to get money cleared. And that’s frustrating when you want to trade.

Test Before You Commit

One of the best ways to check Apple Pay support is to try it. Deposit the minimum amount, see how fast it arrives, and then request a withdrawal.

This small test shows you how the broker really handles payments. It’s better to spend £10 on a test than run into problems after you’ve put in a much larger sum.

Which Traders Apple Pay Works For And Doesn’t

Apple Pay is a good choice if you:

- Want to top up quickly without entering card details.

- Prefer using mobile devices for trading.

- Don’t want to share payment info directly with brokers.

But it’s less valuable if you:

- Rely on fast withdrawals.

- Trade in large sums that might hit deposit caps.

- Prefer desktop platforms where Apple Pay isn’t always supported.

Bottom Line

Apple Pay can make funding a UK trading account quick and secure, but the experience depends on the broker. Some process deposits instantly, while others add fees, limits, or awkward rules.

Check whether Apple Pay works for both deposits and withdrawals, how long payments take, and whether the account runs in pounds to avoid extra charges. The easiest way to know is to test with a small deposit before committing more.

When a broker supports Apple Pay properly, it’s reliable and straightforward. When they don’t, you’ll notice straight away—which is why it’s worth checking the details first.