VT Markets Review 2026

VT Markets is a popular forex, CFD and commodities broker regulated across the globe by prominent financial bodies. The firm has a quick, easy account opening and login process, low spread costs and several bonus offers. This 2026 VT Markets review will explore the broker’s account types, quality of service and industry award recognition. Find out whether to trade with VT Markets.

VT Markets offers low fees on popular assets, copy trading, plus 1000+ instruments. The broker is not regulated by the FCA, but it is registered with several other financial watchdogs. Overall, VT Markets is a good all-round brokerage.

Company History

Starting in 2015 and operating out of the Cayman Islands, VT Markets has grown to be an internationally renowned multi-asset broker, with its user base stretching over more than 160 countries.

The success of the company is reflected in its statistics, hosting over 4 million trades each month from 200,000 accounts, totalling over £160 billion in equity movement. This is aided by the firm’s wide range of asset classes and effective accessibility, offering services suited to beginners and experienced investors.

VT Markets is regulated by the FSCA, SVGFSA and ASIC.

Trading Instruments

Users of VT Markets gain access to an impressive range of 1,000+ trading instruments and products, spanning many asset classes, instrument types and global markets.

- Seven bonds

- Four energies

- 40+ forex pairs

- 140+ EU stocks

- 100+ UK stocks

- 15+ global indices

- Five precious metals

- 50 Hong Kong stocks

- Five soft commodities

- 500+ US blue chip stocks

- 51 US ETFs, including MSCI Emerging Markets

Platforms

VT Markets offers two popular trading platforms to its users, MT4 and MT5. Each of these can be accessed via a free Windows and Mac desktop client download, mobile phone or computer web browser. Sitting at the top of the industry standard, these platforms are widely used for a reason, offering an intuitive yet sophisticated trading and technical analysis experience.

Key features of MT4 include:

- Pricing signals

- 2FA integration

- Four order types

- Nine timeframes

- One-click trading

- Asset price histories

- Copy trading add-ins

- 30 built-in indicators

- Integrated news updates

- Automated trading via MQL4

- Open-source indicator and bot marketplace

MetaTrader 4

Key features of MT5 include:

- Pricing signals

- 2FA integration

- 21 timeframes

- One-click trading

- Asset price histories

- Strategy backtesting

- Copy trading add-ins

- 38 built-in indicators

- Integrated news updates

- Automated trading via MQL5

- Open-source indicator and bot marketplace

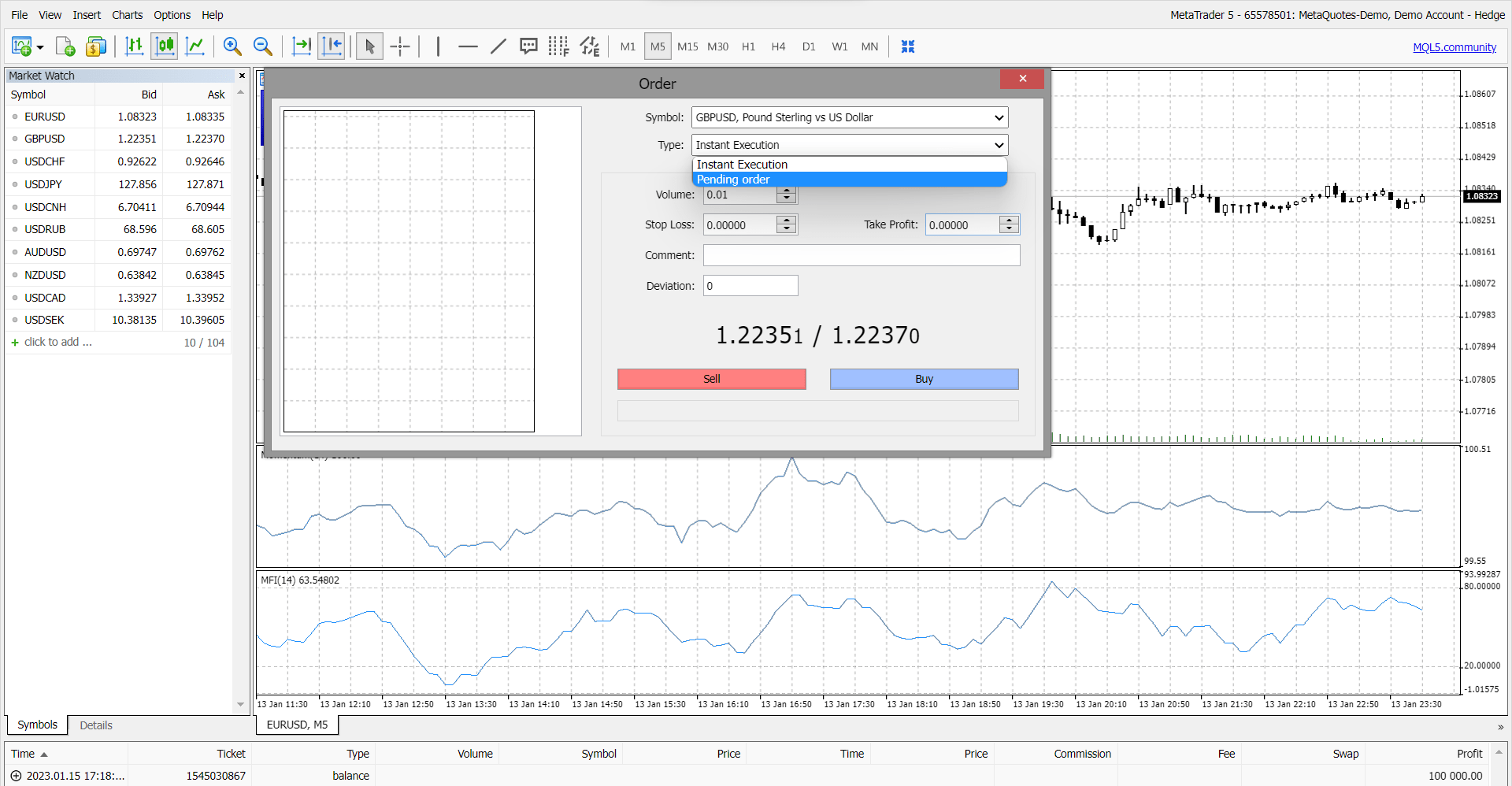

How To Place An Order With MT5

- Open your desired version of MT4 (desktop client, web portal or mobile app)

- Click the “New Order” icon, which looks like a sheet of paper with a green plus

- On the screen shown below, fill out the order details, including the desired instrument, order type, volume, any stop-loss or take-profit additions and a deviation limit

- Click the red “sell” or blue “buy” button

Placing an MT5 order

Mobile Apps

While available on a desktop website, VT Markets also offers users access to a fully functioning mobile app that makes investing easy for those often on the go. The application offers access to the same assets that can be traded on the desktop client and allows users to choose from multiple different languages. The mobile platform is available for free download from both the Apple App Store and Google Play Store.

Spreads & Fees

Spreads on VT Markets are floating and so vary with market liquidity, volatility & volume. Representative values for top instruments are given below, demonstrating significantly lower investment costs than many competitors:

- GBP/USD: 0.4 pips

- EUR/USD: 0.3 pips

- CL-OIL: 3.5 pips

- XAU/USD: 4.3 pips

- Cocoa-C: 3.2 pips

Different account types may also provide users access to more competitive spreads.

Leveraged Trading

VT Markets offers users a variety of competitive leverage rates on its assets, going up to a maximum of 1:500. Users can request a change in margin limit by logging into their client portal and requesting a ‘forex leverage change’ on their account.

Leverage can result in large account losses and using it is a high-risk move that should only be undertaken by those with the collateral capital to absorb such a loss. For individual advice on leverage, clients should consult a registered financial advisor.

Account Types

VT Markets clients can open one of two investing accounts, allowing for different levels of experience. These are the standard STP account, which caters to newer traders, and the Raw ECN account, which is designed for investors with more experience. All accounts can be opened with GBP, USD, AUD, CAD and EUR base currencies.

The standard STP account is simple and accessible, offering direct access to market trading with no commissions. Spreads on this account range from 1.2 pips and, importantly for UK readers, it supports GBP as the base currency. The minimum deposit needed to open an STP account on VT Markets is £100.

In addition to this, the firm offers a Raw ECN account. This follows the ECN execution model, so spreads on this account start from an ideal 0.0 pips, balanced by a £6 commission per lot per round turn. As with the STP account, the minimum deposit is £100.

The firm also offers a halal swap-free account, which closely mimics both STP and ECN accounts but without any swap fees and overnight interest payments on CFDs.

How To Register For A Live Account

- Click the visit button at the top of this page

- On the VT Markets homepage, click on “Start Trading” or the “Open A Live Account” button at the top of the screen

- Select your desired account type and fill in your contact details, including name, email address and phone number

- Upon receiving your login details via email, head to the client portal and click “Open Live Account” on the dashboard

- Provide additional personal details, including your DoB and intended identification method

- Follow through the following screens, providing your residential address, employment details, financial information and experience level

- Next, configure your account, choosing between MT4 and MT5 access, STP and ECN execution, leverage limits and base currencies

- Confirm your identification by uploading photos of your ID and proof of residency

- Finally, click the blue button and get trading

Demo Account

VT Markets offers a demo account to beginner investors that want to try out the platform or test new strategies without putting any real capital at risk. The demo accounts offered by VT Markets are sadly time-limited, lasting only 90 days. However, clients can open as many accounts as they would like, effectively removing the time limit. The demo accounts function almost identically to the regular account but with virtual funds instead of live capital. Therefore, users can speculate on the same 1,000+ instruments they would find on a regular VT Markets account.

How To Open A VT Markets Demo Account

- Head to the broker website’s homepage

- Click on “Try a free demo”

- Fill in your contact details

- Choose your account configuration (MT4 vs MT5, STP vs ECN, leverage rate, base currency and account balance)

- Click “Open a demo account”

- Open the trading platform and login with the details emailed to you

Promotions & Bonuses

VT Markets offers a 50% welcome bonus to new traders, as well as a 20% deposit bonus that can be used indefinitely. Deals and bonuses offered by the firm may change, be removed or be added to over time.

UK Regulation

VT Markets is licensed and regulated by the FSCA in South Africa and the ASIC in Australia. The firm is also registered in St Vincent and the Grenadines with the FSA. This is good to see as licensing from several regulatory watchdogs demonstrates a dedication to client security.

However, it is difficult to recommend the broker to UK investors without oversight from the FCA, which provides much greater levels of client protection in the form of compensation schemes, ombudsman access and service restrictions.

Additional Features

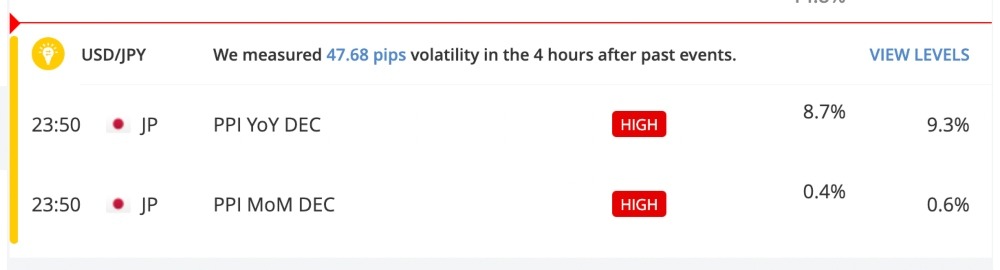

In addition to their trading services, VT Markets also offers a range of additional content that provides users and the public with up-to-date market analyses and educational videos on investing for beginners. The firm also reports on daily financial news, allowing clients to stay up to date on the latest developments in the financial world.

Economic calendar

Payment Options

Users of VT Markets have access to a small range of payment and withdrawal methods, listed below:

- International wire transfer

- Credit/debit cards

- Skrill/Neteller

- Fasapay

- USDT

The time taken for your money to be withdrawn varies across each method. For credit/debit card and wire transfers, VT Markets claims that withdrawals are processed within 3-7 working days after the withdrawal has been approved and deducted from your account. This is a little faster for e-wallet and USDT withdrawals, which take around 1-3 working days. There is a small withdrawal fee of £20 for withdrawals under £100 but no fees for those over £100. It should be noted that UK regulation requires you to use the same withdrawal method as used for your deposit.

How To Deposit Via Debit Card

- Login to the VT Markets client portal

- Click the “Deposit Now” button

- Select Credit/Debit Card from the available options

- Choose your desired currency, how much you wish to deposit and which trading account you want it to go to

- Click “submit”.

Trading Hours

VT Markets offers forex investing services 24/5, though some other assets may not be available throughout this period. Generally, commodities, indices and equities will be listed from a specific exchange and therefore follow the opening hours of that exchange.

Customer Support

The broker provides several contact options to get in touch with customer support, including a 24/5 live online chat widget, email or callback request.

- Email Address: info@vtmarkets.com

Client Safety

As a regulated broker, VT Markets can guarantee users total transparency when it comes to the privacy and security of their accounts. The firm keeps user funds in holding accounts that are segregated from their own, as such guaranteeing that client money is not being put at risk to prop up the company’s own accounts. Moreover, its registration process encrypts all user data with SSL (secure sockets layer), as do all online payments, ensuring that the privacy of its users is protected to the highest level.

Should You Trade With VT Markets?

Overall, VT Markets is a competitive broker, offering a definitively positive investing experience for both newcomers and adept traders. The trading platforms on offer are some of the best and the firm boasts more than 1,000 available instruments across several global markets and asset classes. Moreover, clients can access effective customer service, a 50% welcome bonus and a wide range of supported payment methods, including cryptocurrencies. One area of weakness is perhaps the educational content on offer, though this is an area the company is committed to improving.

FAQs

Where Is VT Markets Regulated?

VT Markets is regulated in several international jurisdictions. For UK and international investors, the SVGFSA manages company oversight, while global customers are protected by the ASIC and FSCA.

Does VT Markets Offer A Demo Account?

Yes, VT Markets offers a demo account that is almost identical to its live accounts, though with simulated capital at risk. This allows a prospective trader to try out the broker and trading strategies without committing to risking their real money.

Is VT Markets A Good Investments Broker?

Yes, VT Markets is a good broker to be used by an investor of any experience level. The firm is regulated by several global authorities, offers STP and ECN accounts and provides access to more than 1,000 instruments with low trading fees.

Is VT Markets Legit?

Yes, VT Markets is a legitimate broker that is regulated by the FSCA in South Africa, ASIC in Australia and FSA in St Vincent and the Grenadines. With regulation comes legal protection from an independent third party set up to ensure financial fair play.

What Is The Minimum Deposit On VT Markets?

The minimum deposit on VT Markets is £100 for both STP and ECN accounts.

Top 3 VT Markets Alternatives

These brokers are the most similar to VT Markets:

- Vantage FX - Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

VT Markets Feature Comparison

| VT Markets | Vantage FX | Pepperstone | IG | |

|---|---|---|---|---|

| Rating | 4.2 | 4.7 | 4.8 | 4.5 |

| Markets | CFDs, Forex, Commodities, Stocks, Indices | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | 50 - 500 USD | $50 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FSCA, FSC | FCA, ASIC, FSCA, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4 |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 71.9% of retail investor accounts lose money when trading CFDs |

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | VT Markets Review |

Vantage FX Review |

Pepperstone Review |

IG Review |

Trading Instruments Comparison

| VT Markets | Vantage FX | Pepperstone | IG | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | No | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

VT Markets vs Other Brokers

Compare VT Markets with any other broker by selecting the other broker below.

Popular VT Markets comparisons:

|

|

VT Markets is #32 in our rankings of CFD brokers. |

| Top 3 alternatives to VT Markets |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Demo Account | Yes |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, FSCA, FSC |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Alipay, Apple Pay, Credit Card, Debit Card, FasaPay, Google Pay, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Cotton, Gold, Natural Gas, Oil, Orange Juice, Silver, Sugar |

| CFD FTSE Spread | From 40 |

| CFD GBPUSD Spread | 0.4 pips |

| CFD Oil Spread | From 16 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.4 pips |

| EURUSD Spread | 0.4 pips |

| GBPEUR Spread | 1.4 pips |

| Assets | 40+ |