Best Debit Card Brokers 2026

Funding a trading account with a debit card looks simple on the surface. You pull out your card, type in the details, and the money shows up in your account. But there’s a catch – not every broker handles debit card payments the same way.

That’s why we’ve tested and ranked the best brokers that accept debit card deposits in the UK.

Best Debit Card Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Debit Card Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Debit Card Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Debit Card Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Debit Card Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Debit Card Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Debit Card Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

How Investing.co.uk Chose The Top Brokers That Allow Debit Cards

We checked that each firm we’ve recommended accepts debit card deposits by looking in their cashier portals and, if needed, speaking to their support staff.

Brokers were then sorted by our overall ratings, which looks at over 200 factors — including accepted transfer methods, deposit speed, transaction costs, and FCA oversight.

What To Look At When Picking A Debit Card Broker

Fees & Charges

The first question to ask is whether the broker charges for deposits or withdrawals. Some brokers we’ve used cover the cost themselves. Others pass it on to you. Even if the fee looks small, it adds up if you fund your account regularly.

Currency conversion is another cost to watch. If the broker only offers accounts in dollars or euros, you’ll pay extra every time your bank converts pounds. It’s far easier if the broker supports accounts in GBP. That way, you avoid those conversion charges.

Deposit & Withdrawal Speed

Debit card deposits should be instant. If they aren’t, that’s a red flag. But withdrawals are where brokers differ most. Some release funds within a day. Others take three to five business days, and sometimes longer.

A delay might not matter if you’re investing for the long term. However, if you’re trading actively and need fast access to your money, it’s a significant concern.

Check the broker’s stated withdrawal times before signing up, and look for user reviews to see if those claims hold.

Limits

Every broker sets limits on card payments. There are minimums, which can be a problem if you only want to deposit small amounts, and maximums, which matter if you’re trading with larger sums. The same applies to withdrawals.

If you want flexibility, ensure the limits align with your trading style. Nothing’s worse than finding out you can’t move the amount you need when you need it.

Security

Debit cards are generally safe, but it’s still advisable to have strong security measures in place. A reliable broker will use encryption, two-factor authentication, and account verification steps.

One important rule is that withdrawals should only be made using the same debit card that was used for the deposit. This might feel restrictive, but it’s actually a good sign—it reduces the risk of fraud and protects your money.

I appreciate how quickly trading deposits are processed with my debit card, but the stringent security checks stand out. Withdrawing back to the same card feels limiting at first, yet it proves safer in the long run, even if extra ID checks sometimes slow things down.

FCA Regulation

This point is non-negotiable—only use brokers regulated by the Financial Conduct Authority. The FCA sets strict standards for how brokers handle client money. If something goes wrong, you have legal protection.

Some unregulated brokers might accept debit cards and even offer tempting deals, but the risk is high. If they disappear with your funds, you have little chance of getting them back.

Withdrawals: Card vs Bank

One detail that catches traders off guard is how profits are handled. Many brokers we’ve tested only allow you to withdraw to your debit card up to the amount you originally deposited. Anything above that—your profits—often has to be deposited into your bank account instead.

It’s not a problem, but it does affect timing. Bank withdrawals can take longer and may involve extra steps. Knowing this upfront saves surprises later.

Example Scenarios

It may be helpful to envision how this scenario unfolds for different types of traders:

- Small trader: You put in £100 every month. You’ll care most about low minimum deposits and no deposit fees.

- Active trader: You move funds in and out often. Fast withdrawals and low transaction costs are crucial. Even a £5 fee each time will eat into profits.

- Larger investor: You may want to deposit bigger sums. High maximum limits and clear rules on profit withdrawals will be most important.

Are Debit Cards Good For Trading?

Debit cards are part of everyday life in the UK. Most people use them daily for shopping or bills, so it makes sense that they’ve also become the go-to tool funding for online trading.

Unlike e-wallets or bank transfers, debit cards are linked directly to your current account. There are no extra hoops to jump through.

The biggest reason traders choose them is speed. Deposits typically appear instantly, allowing you to take a position right away. Bank transfers, in contrast, might take hours or even days. Withdrawals also tend to move faster with cards, though timing can vary by broker.

That said, ‘fast and easy’ isn’t guaranteed across the board. Some brokers we’ve traded with through debit cards run smooth systems where payments are reliable. Others can be clunky, adding delays or surprise fees. That’s why it pays to know the details before committing.

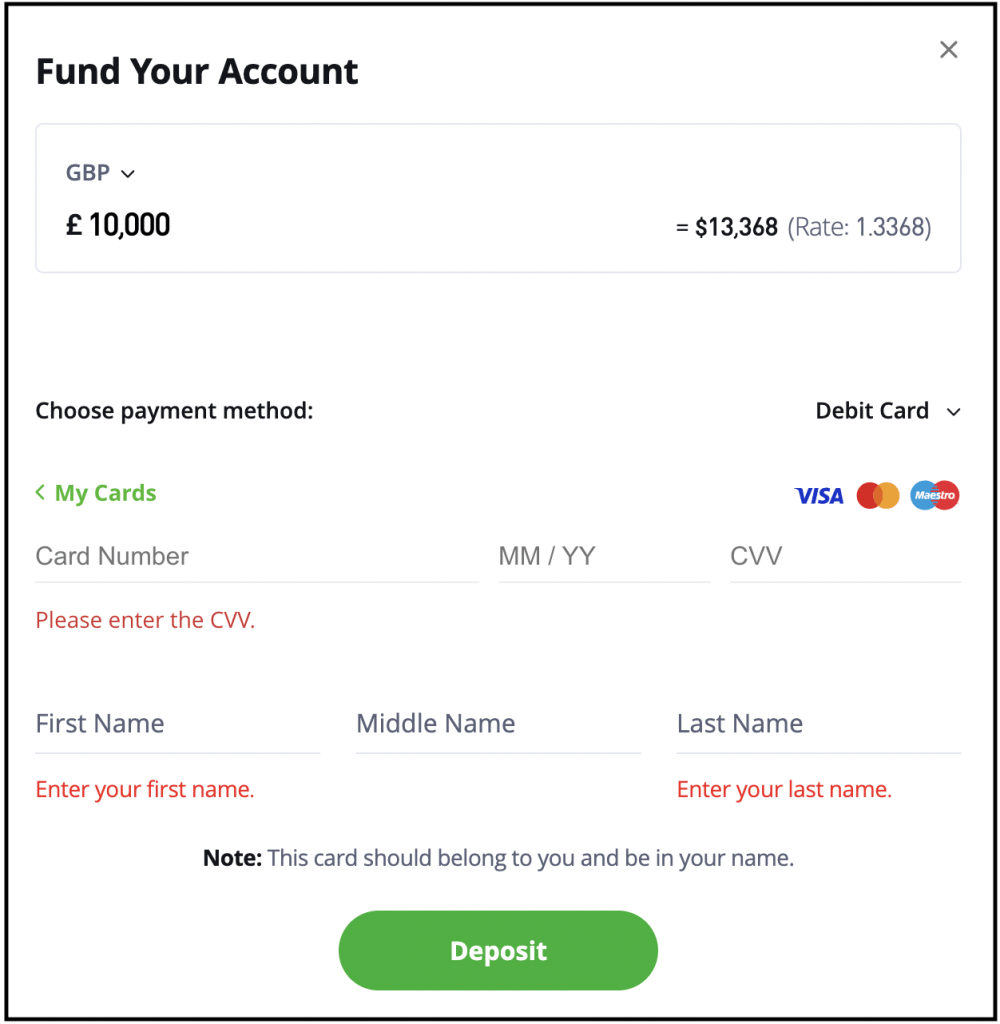

Depositing with a debit card on eToro is quick and simple

Common Debit Card Issues In Trading

Even when you use a trusted broker, a few issues can still pop up:

- Declined payments: Banks sometimes block large or unusual transactions until you confirm them.

- Daily limits: Your bank may impose a daily spending limit on your debit card.

- Name mismatch: If the debit card and trading account aren’t in the same name, the broker will likely reject the transaction.

These problems are typical and usually easy to fix, but it helps to be aware of them.

Tips For Smooth Debit Card Funding

You can also take a few steps on your end to keep things running smoothly.

Stick to the same debit card for both deposits and withdrawals. Switching cards mid-way can cause delays. Keep a backup payment method ready in case your card gets blocked. If possible, fund your account in GBP to avoid currency conversion fees.

Test withdrawals early. Don’t leave all your profits sitting in the account. Withdraw regularly so you can verify the process works and identify any issues before they become urgent.

Bottom Line

Using a debit card to fund a trading account in the UK is a quick and straightforward process. However, not all brokers handle it in the same way. Some charge fees. Some have tight limits. Others are slow to release funds.

The best way to avoid headaches is to stick with FCA-regulated brokers and pay attention to the details: cost, speed, limits, and security.

If you cover those bases, you’ll find the best debit card broker that matches how you trade and avoid most of the common problems along the way.