Options Trading

It is important to understand the basics of trading options before entering the market. Speculating on this type of derivative is popular with traders in the UK, offering access to stocks, indices and commodities, among other assets. In this guide to trading options, we look at strategies for beginners, how to find and capitalise on live opportunities, plus tips for getting started. We also list the best brokers and platforms for trading options in 2026.

Brokers with Options Trading

Best UK Brokers For Trading Options

Trading Options Explained

An options trading contract is a legal and binding agreement between a trader and a broker that permits the trader to buy or sell an asset at a pre-agreed time and price. For example, trader X wants the option to buy 10 shares in BP at £450 per share at the end of the month.

The buyer has the right to exercise the options contract but is not compelled to do so (a key difference versus futures). The seller is obligated to meet the transaction terms of the contract if the option is exercised before or on the expiration day.

Importantly, the buyer will pay a premium for the right to exercise the options contract. This cost will depend on the price of the asset and its intrinsic and extrinsic value – the difference between the contract’s strike price and the current price of the asset.

An investor trading options will use calls when buying an asset and puts when selling an asset. Standard options contracts are also known as ‘vanilla options’.

Options trading ultimately allows investors to take positions on:

- A rise or fall in the current value of an asset

- The extent to which an asset’s price will rise or fall

- When these price fluctuations will take place

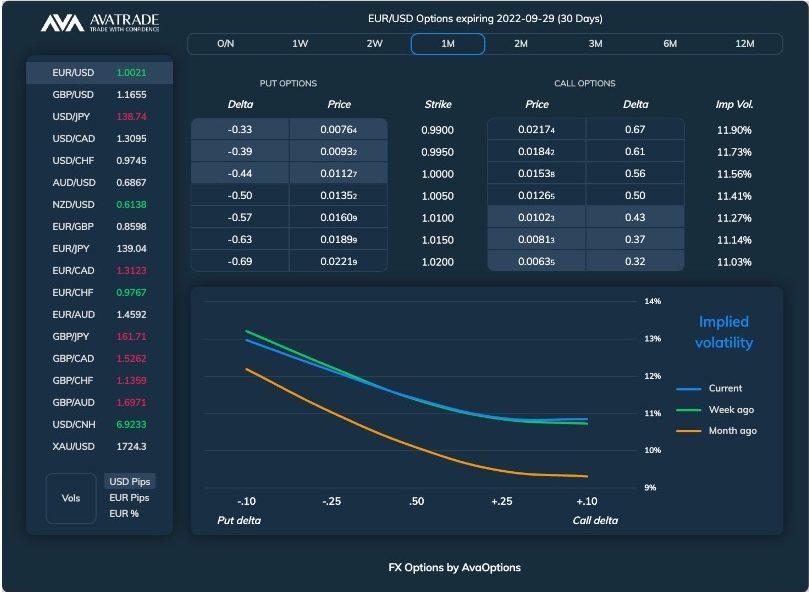

Trading Options At AvaTrade

How Does Trading Options Work?

Options contracts are derivatives which means they derive their value from an underlying asset. Underlying assets can span various markets, from FTSE-listed stocks and precious metals like gold to forex pairs with the GBP.

Both retail and institutional investors trade options with leverage. This means for a small capital outlay, they can take much larger positions than their cash would otherwise allow. This can significantly increase potential returns, making it a popular way to speculate on equities, for example, as opposed to directly buying and selling stocks.

Regardless of whether you are swing trading or day trading options, investors will often find the same rules and components in the products provided by online brokers. Each option requires details of the following to constitute a contract between the broker and trader:

- The underlying security

- The number of units/shares

- Type of option (put or call)

- Exercise/strike price (the price at which an option can be exercised)

- Expiration time and date (the time in which the trader can exercise the option)

Note, when you buy options, your risk exposure is normally capped to the premium you paid to take the position. However, when you sell options, your risk can be unlimited.

Example

To understand how an options trade works, let’s look at a standard stock purchase versus a leveraged options contract…

A trader has £1,000 to invest. Rolls Royce (RYCEY) stock is currently trading at £50 per share and therefore the trader can buy 20 shares. If the share price increases by 10% then each share increases to £55, taking the total portfolio value to £1,100. Excluding costs/commissions associated with the trade, the total gain from the trade is £100 (£1,100 – £1000).

Now let’s look at the potential returns if the trader buys Rolls Royce stock call options with a strike price of £50 that expires in two weeks. The shares cost £2 per share or £200 per contract (each contract holds 100 shares). With £1,000, the trader can buy five contracts or 500 shares. If the stock price increases 10% to £55 by the expiry, each contract will be worth £5 (£55 from a strike price of £50). Therefore, the total trade will be worth £2,500 on 500 shares, making a profit of £1,500.

In both examples, the amount of capital being risked is the same – £1,000. However, the key difference is that the potential profit is higher with the call options because of the leverage available.

Pros & Cons Of Trading Options

Pros

Benefits of trading options include:

- Greater Margins – Investors can make larger returns with the same capital via a margin account

- Cost Effective – The premiums for puts and calls are often cheaper than purchasing the underlying asset, making them popular with beginners

- Broad Market Access – Options contracts are available on a variety of markets, including stocks, indices, forex and commodity. This also means options contracts can be used for hedging

- Reduced Risk – Your risk exposure is often lower than directly trading the underlying asset. This is because the trader only stands to lose the premium paid for the option whereas the value of the asset bought outright could decrease significantly

Cons

There are also downsides to trading options:

- Complex – For new traders, options contracts are not the most straightforward instrument to understand. Fortunately, the best brokers offer a selection of beginner-friendly training content and free demo accounts

- Requires Active Trading – Options contracts, by definition, give traders the right to exercise the trade and therefore investors will need to keep a regular eye on their positions

- Fast Paced – Many retail trading platforms offer options contracts with short timeframes. The likelihood of an options contract spanning several months is unlikely, which may deter some retail traders

- Prices – Some brokers charge high commissions for short-term options contracts, for example weekly, versus the fees for buying stocks directly

- Taxes – UK traders may have to pay capital gains on profits

Bottom Line

Trading options can be low-risk and high reward. Although a complicated concept to grasp for beginners, investors can make steady returns if used correctly. Make sure to practice options trading using a demo account before risking real money. Also implement risk management tools like stop-loss orders.

Use our list of the top options trading brokers and platforms to get started.

FAQs

What Is Options Trading?

Options traders speculate on the future price of an underlying asset. The trader has the right but is not obliged to buy or sell the security. The underlying asset could be stocks, commodities, indices, cryptocurrencies, and other popular markets – the list of supported assets varies between brokers. Importantly, clients pay a premium for the flexibility to decide whether to exercise the trade.

Is Trading Options Profitable?

Options trading can be profitable with an effective strategy and a sensible approach to risk management. Reliable market insights, competitive puts and calls, plus a tested investing system will be needed to make money in the long run.

Is Trading Options Halal?

Trading options is prohibited under Sharia Law according to some Islamic scholars. This is because of the speculation involved and the opportunities to take positions in haram industries, such as alcohol and tobacco. With that said, some market commentators believe options trading can be halal. Consult a local religious leader for guidance. Alternatively, see our guide to halal trading for more information.

Does Trading Options Count As Day Trading?

Options products can be used to day trade. Day trading is essentially the practice of opening and closing positions in the same trading session. Binary options are also popular with short-term investors, especially beginners.

Can You Make Money Trading Options?

While options traders can make decent returns, beginners should not expect to get rich quick. Discipline and a successful trading strategy will be needed. Fortunately, one benefit of trading options is that traders cannot go negative – the premium is the maximum loss an investor can encounter.