Best Social Trading Platforms in the UK 2026

Social trading has become one of the most popular trading methods among beginners, as it allows them to see and copy the actions of more experienced traders. Essentially, it is the use of large groups of people to understand markets and make decisions about them.

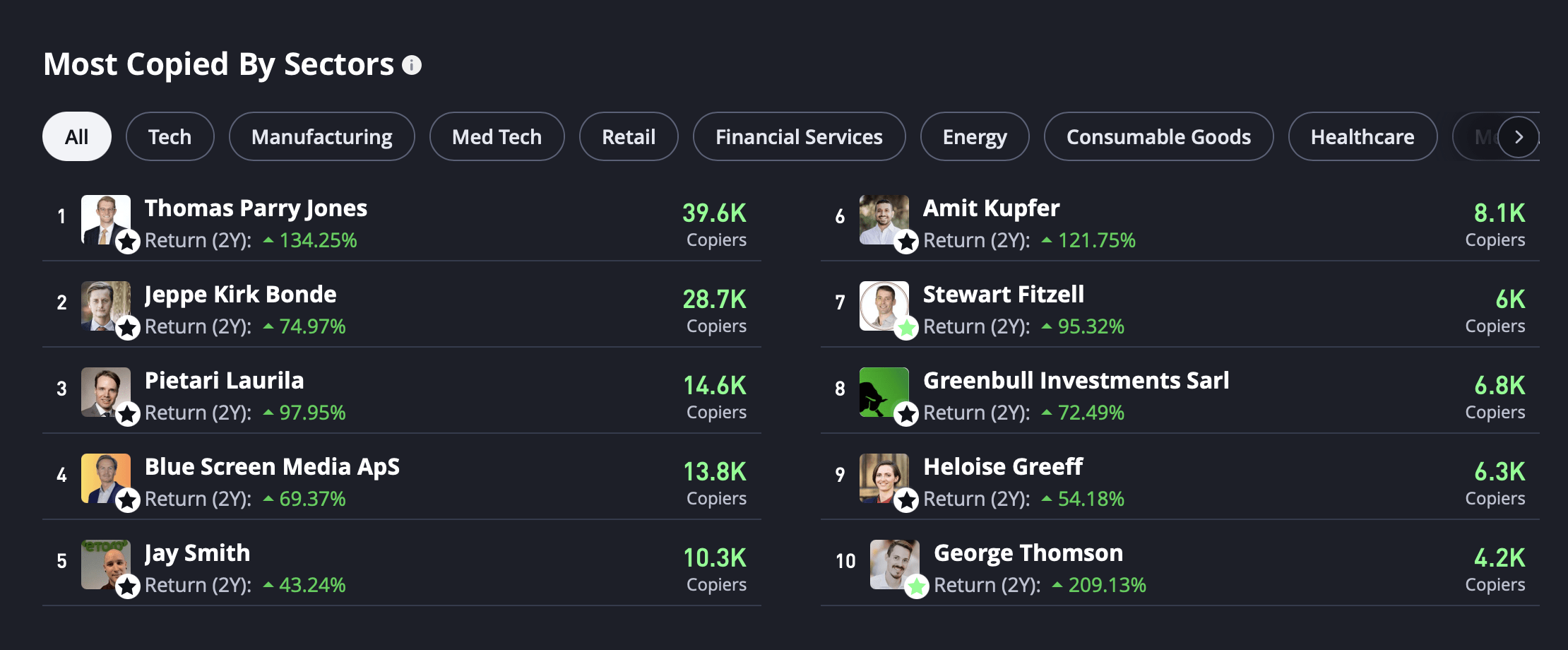

Brokers with social features enable traders to see pertinent data about what other traders, both as individuals and as a group, are doing. This gives traders valuable insight into market perceptions. In addition, data about individual traders are generally displayed, which can help those who use social trading platforms to identify the most successful traders to emulate and copy.

We’ve run extensive tests to reveal the top social trading platforms for UK investors.

Best UK Social Trading Brokers

-

Pepperstone offers the replication of skilled traders' strategies via MetaTrader Signals, DupliTrade, and its new proprietary copy trading app, in collaboration with Pelican Trading. This service, available in select regions, grants access to numerous experienced traders and customized risk settings. However, it does not support cTrader Copy, which might discourage traders who prefer Spotware's platform.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Trade Nation Seychelles provides signals and copy trading, appealing to novices and those preferring a passive trading strategy. Capitalise on experienced traders' insights to engage in popular financial markets like forex, stocks, and commodities.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

eToro consistently provides an outstanding proprietary trading platform for clients, free of charge. The web-based system is both intuitive and engaging, complemented by a community chat that appeals to novice traders. The recent 'Live Trades' feature grants immediate access to real-time insights on securities purchased by top investors on the platform.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Traders benefit from social and copy trading at Vantage through MetaTrader, DupliTrade, ZuluTrade, and Myfxbook. ZuluTrade stands out as a leading social trading network. It employs an advanced algorithm to rank top signal providers.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

FXCM provides social and copy trading options for forex, CFDs, and cryptocurrencies via the widely-used ZuluTrade platform. Registration is swift, and you can monitor your trading outcomes instantly.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

The TradeCopier service enables aspiring investors to mirror the strategies of leading traders instantly. This tool offers novices an opportunity to learn from seasoned investors, while strategy providers have the potential to earn performance fees.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM)

Safety Comparison

Compare how safe the Best Social Trading Platforms in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Social Trading Platforms in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Social Trading Platforms in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| IronFX | Android, iOS, WebTrader | ✘ |

Beginners Comparison

Are the Best Social Trading Platforms in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| FXCM | ✔ | $50 | Variable | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| IronFX | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Social Trading Platforms in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Social Trading Platforms in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| FXCM | |||||||||

| Axi | |||||||||

| IronFX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- eToro has launched automated crypto staking, offering a pathway to passive income. However, Ethereum requires users to opt in.

- In 2025, eToro altered its fee structure by separating crypto trading fees from the spread. A distinct commission is now listed separately, providing traders with increased transparency while maintaining consistent overall costs.

- eToro has enhanced its investment portfolio by frequently introducing new crypto assets. It currently offers a selection of over 100 digital currencies.

Cons

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

Cons

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- FXCM boasts a strong international reputation, holding licences from the FCA, ASIC, CySEC, and FSCA. With two decades of experience, it commands respect in the trading industry.

- The proprietary Trading Station platform is an excellent option for traders seeking a comprehensive tool for their short-term and automated strategies.

- The broker provides reduced spreads and additional benefits for seasoned traders through the Active Trader account.

Cons

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

Cons

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- IronFX is a well-established firm regulated by respected authorities such as the CySEC, FCA, and FSCA.

- The IronFX Academy provides outstanding educational resources for traders of all levels, from beginners to advanced.

- In addition to MT4, the broker also provides various services such as copy trading, a VPS solution, and PAMM/MAM accounts.

Cons

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

How Investing.co.uk Chose The Best Social Trading Providers

We evaluated the social trading services of each shortlisted UK provider, documenting key details such as copy trading features, supported markets, fees, and platform usability. Each broker was then assigned an overall rating, and the results were ranked from highest to lowest.

How To Pick The Right Social Trading Platform

Consider these key features when you choose your social trading broker:

Trust

Our first priority when we review brokers is to check their credentials, and this should be yours, too.

Social trading can involve putting someone else in charge of your trading funds, so this is especially true if you plan to use this type of social trading.

A broker that’s overseen by the Financial Conduct Authority needs to comply with stringent regulatory requirements, submitting frequent financial reports and undergoing audits to ensure continued compliance – one of the strongest signs that a broker and its social trading functions are above board.

- Vantage has earned its reputation as a reliable social trading broker by obtaining licences from top bodies like the FCA and ASIC while providing excellent service to its thousands of customers including powerful social trading on ZuluTrade, DupliTrade and MyFxBook.

Social Trading Platform

While your regular charting platform will show you the performance of specific assets, social trading software often need to give users insight into the other traders who use them.

After using dozens of social trading brokers, we’ve found that the two most significant features in a social trading platform are the ‘social’ side – which allows traders to share their thoughts on a public platform – and if there are copy-trading features, the engine used to track and compare traders’ styles and past performance.

I regularly use social trading platforms to check out successful traders’ portfolios, watching when they enter and exit positions and reading their posts about market movements. It’s an incredibly useful tool for improving my own trading skills, as well as giving me ideas on what to trade.

Some of our most highly rated social trading platforms allow you to use filters for risk tolerance, trading style (eg long-term, value, etc) and preferred assets while searching for a trader to copy.

eToro provides detailed information to help traders choose high-performing copy trading providers

- eToro has been a copy trading pioneer and is still one of the best out there thanks to its powerful social trading platform, allowing you to interact with thousands of fellow traders and compare highly rated master traders according to your specific criteria.

Fees

You should choose a broker with low fees, both for executing trades and for using copy trading providers or any other paid social trading features.

Some of the best social trading brokers provide access to their social features free of charge through third-party platforms like DupliTrade, ZuluTrade and MyFxBook.

- Fusion Markets continues to impress both with its low fees, including spreads from 0.0 pips on its Zero account and access to social trading functions and one of the largest forex-trading forums via MyFxBook.

Markets

A broker with access to diverse markets will provide more events and topics to discuss with you peers, as well as more opportunities for master copy traders to generate profit from.

Some of the best social trading brokers provide access to thousands of instruments across diverse asset classes. For us, the minimum for a good multi-asset broker should be 40+ forex pairs, a range of commodities, indices and ETFs, and a good range of popular stocks.

- BlackBull Markets remains a superb social trading provider, both for its in-house copy trading platform and for its huge range of 26,000+ tradable instruments.

What Is Copy Trading?

Many social trading platforms also offer automatic copy trading.

This is a method that can be implemented once an experienced trader has been identified as having a good track record of profitable trading. Users can set their accounts to automatically copy the actions of their favourite traders.

This essentially relieves newer traders of the burden of making constant decisions, instead allowing other more experienced traders to make the choices of what assets should be bought or sold.

Pros Of Social Trading

Social trading has some advantages over more traditional methods, especially for new or time-poor traders.

New traders can benefit from the knowledge and experience of others rather than learning through trial and error, which can often prove costly.

This is especially true if you lack the time to research markets and develop a strategy – you’d be very lucky to outperform an experienced trader who does spend the required hours, so why not benefit from their expertise?

Social trading can also be useful at regulating a newer traders’ emotions and preventing decisions made under stress or panic. With one or more experienced traders guiding your trading decisions, it is easier to confidently hold a position through temporary reversals and fluctuations.

This can make trading more enjoyable, the decision-making process less stressful, and the outcome more profitable.

How To Use Social Trading

We’ve revealed the top social trading accounts that copy the positions of experienced traders, but there are several other ways to use this powerful tool.

For example, we are huge proponents of using social trading tools as part of your trading education.

There is almost no other venue in which new traders can see their already successful counterparts executing trades in real time at no cost, and this makes social trading a uniquely powerful tool.

With enough time, a trader who patiently uses social trading tools in this way and uses what they learn to develop a successful strategy of their own can go on to become a copy trading provider and earn more from the traders who copy them!

Bottom Line

Social trading has been one of the most exciting innovations in the worlds of trading and investing. It not only provides an excellent educational resource for new traders, but also enables them to potentially profit much more easily as they learn to trade successfully.

Of course, work and research are still components of success in the world of social trading. A trader who does not learn from what others are doing to profit but instead only copies them will only go so far. And of course, these aren’t qualified financial advisors you’re typically following – they are often experienced and skilled retail-level traders.

To get started, explore our choice of the top social trading platforms.