Best Trading And Investing Communities In The UK 2026

Timing is key in investing, but I know from firsthand experience that so is having the right crowd. The best trading communities go beyond trading tips, offering live insights, shared strategies, and real support when the markets get choppy.

We’ve handpicked the best trading and investing communities in the UK where savvy investors swap ideas, dissect charts, and grow together.

Best Brokers With Trading Communities

-

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

FXCM, a reputable forex and CFD broker founded in 1999, is headquartered in the UK. It has garnered multiple accolades and operates in several regions, including the UK and Australia. Offering more than 400 assets and comprehensive analysis tools without any commission charges, FXCM is a favoured option among traders. The broker is also under the regulation of leading bodies such as the FCA, ASIC, CySEC, FSCA, and BaFin.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Best Trading And Investing Communities In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading And Investing Communities In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Trading And Investing Communities In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Eightcap | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best Trading And Investing Communities In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| FXCM | ✔ | $50 | Variable | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Trading And Investing Communities In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading And Investing Communities In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Eightcap | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| FXCM | |||||||||

| Axi | |||||||||

| CMC Markets |

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

- Leading traders participating in the broker's Popular Investor Programme can earn yearly compensation of up to 1.5% of the copied assets.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- A variety of funding options, such as bank cards, Apple Pay, and PayPal, are available with immediate processing.

- FXCM boasts a strong international reputation, holding licences from the FCA, ASIC, CySEC, and FSCA. With two decades of experience, it commands respect in the trading industry.

- FXCM has broadened its trading options by offering stock CFDs via MetaTrader 4.

Cons

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

Cons

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- The brokerage excels with an extensive array of valuable resources, such as pattern recognition scanners, webinars, tutorials, news feeds, and research from reputable sources like Morningstar.

Cons

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

What Is A Trading & Investing Community?

Online trading communities have become valuable spaces for UK traders and investors looking to sharpen their skills and stay ahead of fast-moving markets.

Whether hosted on social media platforms or broker-run forums, these groups bring traders together to share real-time analysis, strategies, and hard-won lessons.

What sets the best UK communities apart isn’t just the trade ideas – it’s the collective mindset. From beginners learning technical setups to seasoned traders challenging consensus views, everyone brings something to the table. A sharp chart breakdown or a timely macro insight can shift your perspective.

In volatile UK and European markets, I’ve learned having a group that keeps you grounded and disciplined can make a real difference. Sometimes, the best trade you make is the one you avoid, because someone else spotted the risk you didn’t.

In my experience, the most valuable communities aren’t echo chambers – they’re places where feedback flows freely, and no question is too fundamental.It’s less about copying positions on social trading platforms and more about developing your edge with input from people who’ve been through the ups and downs.

How To Choose The Best Trading Community

With so many trading groups, choosing the right one can feel like filtering signals from static. Not every community adds value, and the wrong fit can do more harm than good.

So, how do you find a group that helps you grow as a UK trader or investor? Here’s what matters – plus a few hands-on tips from my experience to help you spot the difference between noise and genuine edge:

Substance Over Hype

It’s easy to get drawn into trading groups flashing big wins and wild “turned £500 into £5k” stories. But real, lasting progress doesn’t come from chasing hype – it comes from understanding the process behind the trades.

The best UK trading communities focus on the why, not just the what. They don’t just shout out tickers – they walk you through the reasoning behind a move, whether based on macro trends, company fundamentals, or technical structure.

Don’t judge a trading group by the profits they post – look for the ones that explain their thinking. A solid community will help you build your strategy, not just follow someone else’s.

When I first started trading, I joined an impressive-looking Telegram group – constant updates, loads of charts, and daily ‘wins.’ But it quickly became clear it was just noise – no context, no strategy, just FOMO and groupthink.

I ended up buying into a penny stock tip that tanked overnight. That loss taught me more than the group ever did: I needed to learn how to trade, not just what to trade. I left and found a smaller, UK-focused forum where members explained their analysis – that’s where things started to click.

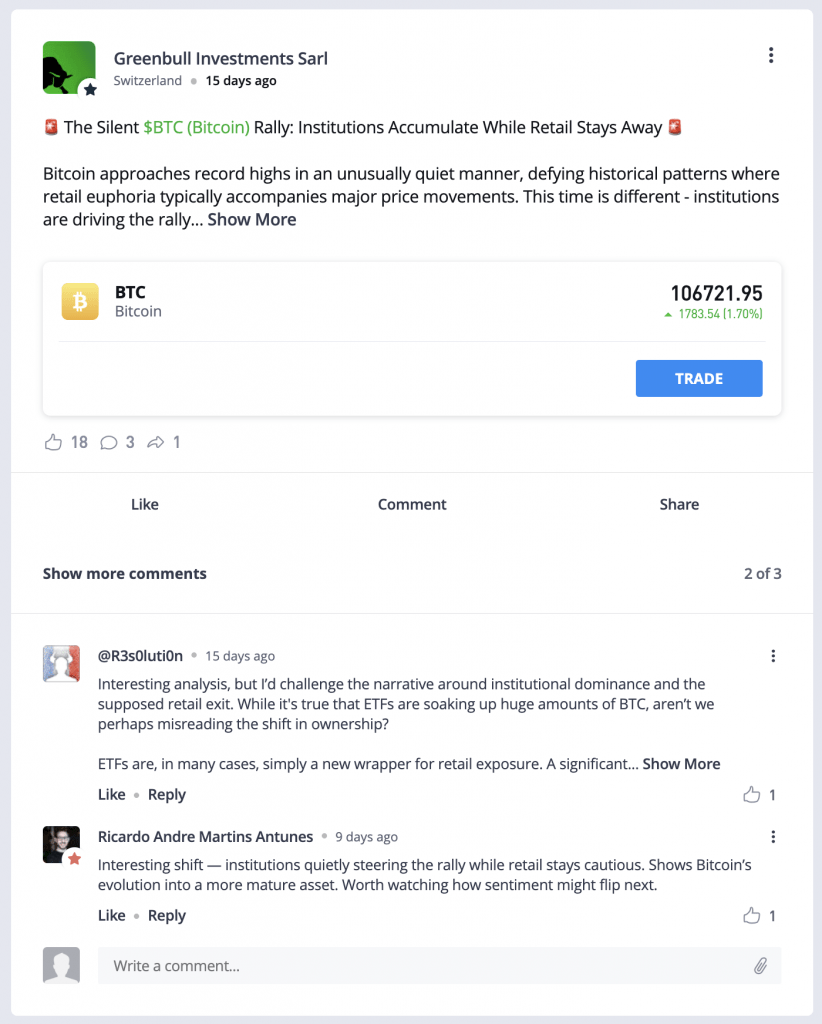

eToro’s community is great for beginners keen to learn from experienced traders

Constructive & Courteous Participation

A quality trading community isn’t defined by its activity but by the value of the conversations inside it. It’s not about endless tickers and hype but thoughtful discussion, honest feedback, and shared growth.

The best UK-focused groups feel like collaborative think tanks, where traders are encouraged to ask questions, break down setups, admit missteps, and challenge each other constructively. That environment is gold—especially if you’re still refining your approach.

I realised I was in the right place when I posted an FTSE 100 trade idea, and someone pushed back with a different take, pointing out a macro factor I’d overlooked.It wasn’t combative – just a smarter angle I hadn’t considered. That exchange taught me more than a dozen likes or “nice trade” comments ever could.

Expertise & Guidance

Strong communities start at the top. The most valuable trading groups are led by experienced, transparent traders who focus on teaching – not just showing off results. They take the time to explain their market views, break down trades in plain English, and discuss risks, not just rewards.

Good leadership means learning how to think, not just what to copy. Conversely, groups run by so-called ‘experts’ who charge for vague alerts or constantly push upsells tend to offer more noise than knowledge.

Follow communities where the leaders educate, not just broadcast. If they explain their thinking and welcome questions, you’re in the right place.

I once joined a UK stock trading group run by a former prop trader. Each week, he posted detailed analysis on FTSE and AIM stocks, walking through both winners and losers.

He explained what he looked for in earnings reports and how he sized his positions around macro events like Bank of England rate decisions. That kind of leadership gave me a framework I could apply to my trades – far more helpful than signal-chasing ever was.

Features & Support Materials

A strong trading community offers more than just chat – it equips members with practical tools and learning resources tailored to real-world needs.

For UK traders and investors juggling busy schedules, features like curated daily watchlists, detailed trade breakdowns, and end-of-day market summaries can make a big difference.

The best groups often include handy extras like charting software access, trade journaling templates, and recorded tutorials so you can learn at your own pace – perfect if you can’t monitor markets all day around your job or studies.

An investing group I used to belong to shared a simple Excel trade log alongside weekly video lessons focused on FTSE movers and economic news.Keeping a journal and reviewing these lessons helped me spot recurring patterns and improve my timing without needing to be glued to the screen.

Suitability With Your Trading Style

Even the most active trading group won’t help much if it doesn’t align with your trading style. Some communities thrive on fast, high-risk moves in forex, while others lean toward steady analysis of blue-chip stocks or longer-term macro plays.

If your approach is focused on commodity breakouts or dividend-paying value stocks, and the group is all about forex and crypto chatter, you’ll likely be more distracted than informed.

Many traders make the mistake of joining fast-paced groups filled with constant alerts, only to realise the noise doesn’t suit their slower, more structured strategy.

Finding a community that matches your time horizon, risk appetite, and focus leads to better results. When others trade the way you do, the insights are more relevant, the discussions more focused, and the learning far more effective. It’s easier to grow when surrounded by people tackling the same challenges.

Trial Access & Openness

Before joining any trading community, especially one with a subscription fee, it’s worth checking how open and transparent it is.

Reputable groups often offer a free trial, sample content, or access to a public channel so that potential customers can get a feel for their operation.

This lets you assess whether the group offers real value or just recycled hype. Pay attention to how trades are explained, how members interact, and whether the guidance is helping people improve – not just throwing out tickers.

One practical approach is to follow the group or its leaders on platforms like X, YouTube, or LinkedIn. If they regularly post market insights, walk through trade setups, or respond thoughtfully to questions, it’s a good sign that their teaching style might suit you.

For example, good UK-based communities share weekly outlooks on the FTSE or break down inflation data in ways retail traders can act on. That kind of content speaks louder than a flashy profit screenshot ever could.

Bottom Line

To find the right trading community, identify what you’re looking for – education, market commentary, strategy discussion, or simply a place to connect with like-minded UK investors.

Look for groups where members actively share ideas, ask questions, and stay focused on long-term improvement rather than chasing hype.

Watch how the group’s leaders communicate: Are their insights consistent and backed by real analysis? Do they respond to questions or just broadcast calls? That tone sets the standard for the whole community.

If a group charges for access, don’t jump in blind. Start by exploring free channels, trial content, or public posts – many solid UK communities post regular insights on platforms like YouTube or X.

The right community will sharpen your thinking, keep you grounded during market swings, and help you build confidence through clarity – not noise.