Best Prop Trading Firms In The UK 2026

Prop trading firms are becoming a common path for UK traders. They let you trade with company money instead of just your own. In return, you share profits with the firm. But each firm has its own way of running things, and the details matter.

We’ve done the hard work to list the best prop trading firms in the UK. We also explain the main points to check before you commit.

Top Prop Trading Firms

How Investing.co.uk Chose The Top Firms For Prop Trading

We evaluated proprietary trading firms by analysing their funding programmes, profit-sharing structures, trading conditions, platform technology, and risk management rules. Our team combined these findings with testing to see how accessible and fair each firm was for traders.

Finally, we ranked the shortlisted providers by overall ratings to highlight the best prop trading firms.

What To Look For In A Prop Trading Firm

Regulation & Safety

Prop firms don’t operate like traditional brokers. Prop firms usually don’t take deposits for live trading, so many sit outside FCA regulation. That doesn’t mean they’re scams, but it does mean the burden of checking falls on you.

Look for:

- A clear company name and registration.

- A UK office address or at least a real, traceable base.

- Transparent rules and contracts.

If a firm hides behind vague contact details or shell companies, think twice. The safer route is to choose one with an open structure and a record that you can verify.

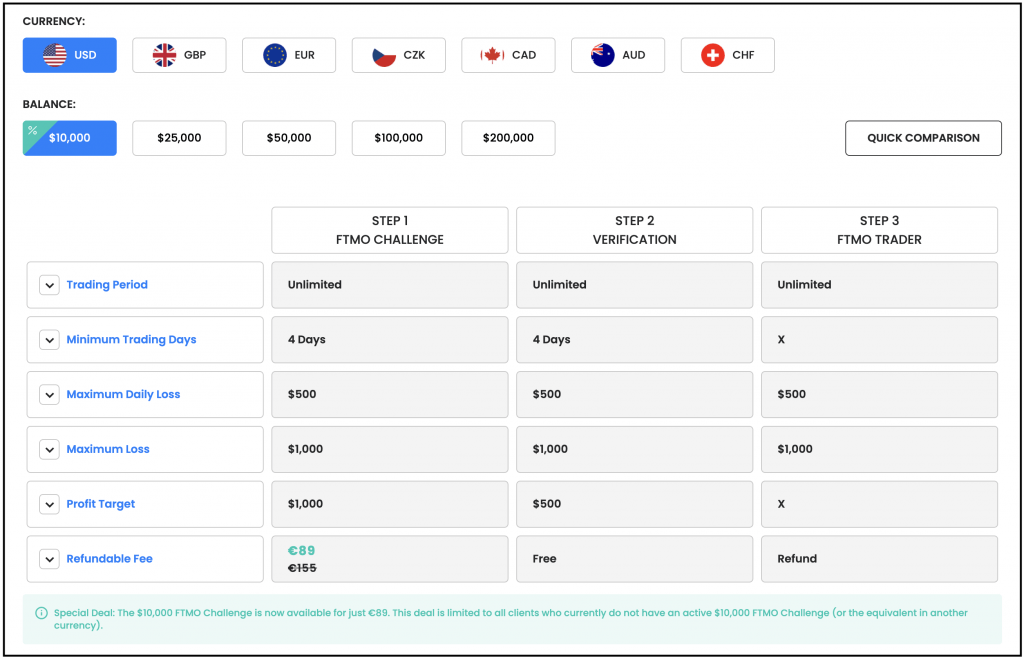

FTMO clearly displays its trading objectives, based on risk management principles

How Funding Works

Most prop firms won’t hand you capital straight away. They want proof you can manage risk. This usually comes in the form of a challenge or assessment.

- Challenge models: You pay a fee and trade under strict targets. If you hit the goals without breaking rules, you qualify for a funded account.

- Instant funding: You pay more upfront but skip the test. You get access to capital right away, though rules can be tighter.

There’s no ‘better’ option for everyone. If you’re patient and steady, challenges can work. If you want to start quickly and don’t mind the cost, instant funding is a quicker option. The key is knowing your style and tolerance.

Profit Split

This is the share of profits you keep. Prop firms usually offer anywhere from 50% to 90% of the total value.

A significant split looks tempting, but look closer:

- Some firms delay payouts or add hidden charges.

- Payment frequency varies—some pay monthly, others every two weeks.

- Check the payout methods available to UK traders. Bank transfers are simplest, but some only use crypto or third-party apps.

A slightly lower split with reliable, fast payouts often beats a high split with poor service.

Trading Rules

Rules protect the firm’s capital. But for traders, they can also restrict how you work. Breaking a rule, even by mistake, can mean losing your account.

Important limits to check:

- Daily loss: The max you can lose in one day.

- Overall drawdown: The total amount your account can drop.

- Strategy rules: Some firms ban scalping, news trading, or EAs. Others allow almost anything.

Pick a firm where the rules align with how you already trade. If your style doesn’t fit, you’ll fight the rules instead of focusing on the market.

A lesson I picked up with prop firms is to stop trading before you hit the daily loss limit. Slippage can push you over even if you think you’re safe, and losing the account isn’t worth squeezing in one more trade.

Platforms & Execution

Most UK prop firms stick to MetaTrader 4 or MetaTrader 5 (MT4/5). Others use cTrader or TradingView. The right choice is usually the one you already know. Switching trading software adds stress you don’t need during a challenge.

Ask:

- Is execution fast enough for your style?

- Are spreads and commissions fair?

- Can you use your own indicators, scripts, or bots?

A strong platform setup matters more than many traders think. Poor execution can quickly erode profits.

Costs & Fees

Every prop firm generates revenue through fees and a profit share. But how they structure costs can differ.

Watch out for:

- Retake fees: If you fail a challenge, you may need to pay again.

- Hidden add-ons: Some charge extra for data, resets, or scaling.

- Refund promises: Many firms offer to refund challenge fees after your first payout. Make sure the policy is clear and achievable.

Don’t just compare upfront fees. Consider the total cost of trading with the firm over time.

I once signed up for a prop firm that initially seemed cheap, but the retake fees accumulated after a failed challenge. By the time I passed, I’d spent more than a pricier firm would have cost. Now I always add up the full price, not just the entry fee.

Payouts

Getting paid is the bottom line.

Check:

- Speed: Do payouts arrive in days or weeks?

- Methods: Can you withdraw to a bank, or only via crypto?

- Reputation: Are traders reporting problems with delays or excuses?

This is where firm reliability shows. If a company is slow or inconsistent with payouts, that’s a red flag.

Support & Community

Prop trading can be isolating. A reputable firm will provide you with access to responsive support and, in some cases, a trader community.

Signs of strong support:

- Quick replies during UK hours.

- Clear answers, not vague templates.

- Active Discord, Telegram, or forum groups where traders share updates.

Support isn’t a bonus—it matters when you hit problems with accounts, payouts, or platform access.

Track Record & Stability

New prop firms pop up all the time, but many vanish just as quickly. Longevity counts.

Check:

- How long the firm has operated.

- Whether rules and payouts have been consistent.

- If the firm communicates changes openly or shifts terms without notice.

Older doesn’t always mean better, but stability reduces the risk of the firm closing while you’re trading.

I joined a new prop firm, thinking it would be easy to get funded, but six months in, they suddenly changed the rules and delayed payouts. After that, I stick to firms with a clear history and stable track record—it’s worth sacrificing a bit on perks for reliability.

Tax & Legal Points

In the UK, profits from prop trading aren’t tax-free. They’re often classed as income. That means you’ll need to report them.

Keep in mind:

- You may need to register as self-employed.

- If you trade through a limited company, tax treatment may differ.

- Keep records of payouts, challenge fees, and expenses.

It’s worth consulting with an accountant once payouts begin.

Location Of The Firm

Some firms market themselves as UK-based but are actually offshore. Offshore doesn’t always mean unsafe, but it does mean fewer protections if disputes arise.

If peace of mind matters, stick to firms with real UK ties. If you’re more risk-tolerant, you may consider offshore firms with bigger leverage or looser rules. Just know the trade-off.

Matching To Your Style

The ‘best’ prop firm depends on who you are as a trader.

- Scalpers need fast execution and no bans on short-term trades.

- Swing traders need the ability to hold overnight or weekend positions.

- High-risk traders may find strict drawdown rules too limiting.

Don’t chase the firm with the most significant numbers. Pick the one that fits your day-to-day style.

Bottom Line

Picking the best prop trading firm in the UK isn’t about the biggest account or highest split. What matters is trust, clear rules, and whether the setup fits your style. A firm should be stable, pay on time, and make its terms easy to understand.

Do your homework before signing up. Check who runs the company, know how their funding model works, and read the rules closely.

Start small, test the process, and only scale up once you’re sure it suits you. Prop trading can give access to bigger capital, but it only works if the firm is solid and a good fit for how you trade.