Scalping Trading

Scalping trading is a fast-paced strategy that takes advantage of market volatility by repeatedly buying and selling. The intraday trading technique aims to take on less risk in return for smaller profits, which can accumulate over time into larger gains. In this tutorial, we cover the definition of scalping trading, how to get started and the best scalping strategies for beginners.

Best Scalping Trading Brokers

What Is Scalping Trading?

Scalping trading is a technique that chases small returns by trading across short timescales of minutes or even seconds. Each trade aims to scalp just five or ten pips, based on the theory that the trader is exposed to less risk in these reduced time periods. However, high leverage is often used to enable adequate returns from this intraday trading style. The aim is to generate substantial returns through a high number of smaller wins.

Scalping is possible because of price fluctuations, though volatile markets come with heightened risk. It is a strategy that can be applied to sideways markets, making it a great solution for day traders who aren’t willing to wait for a trending market.

Scalping Trading vs Day Trading

The main difference between scalping and day trading is the time period used. Scalping timeframes may be only minutes or seconds, whereas a day trader may look to hold a position for several hours at a time. Either way, scalpers and day traders avoid holding positions overnight, unlike swing traders who may hold positions from a few days up to a few months.

Markets

Scalping trading can be applied to all markets including forex, cryptos, stocks, binary options and CFDs. However, derivatives such as CFDs are particularly suited to scalping trading because they can be traded with leverage. The lack of leverage and high fees associated with trading stocks makes them less suitable for scalping trading. The same applies to indices such as the FTSE100, NIFTY BANK, DAX and ASX.

Pros & Cons Of Scalping Trading

Here, we review the benefits and drawbacks of scalping trading.

Pros

- Versatility – scalping can be used across a range of asset types and during flat markets, meaning positions can be opened at any point.

- Risk level – assuming that traders execute strict exit strategies, scalping can be less risky due to the short timeframe of each trade.

- No requirement for in-depth research – unlike in news trading, scalpers don’t need to carry out in-depth research of the particular market, currency pair or company they are trading. However, traders should still be aware of any scheduled news releases that will have an impact on asset price. Market Profile is a good way to keep on top of the overall market context when scalping trading.

Cons

- Leverage risks – high leverage is required to generate decent returns when scalping. The use of leverage multiplies losses as well as gains, making it a riskier trading strategy overall.

- Discipline – scalpers must not be tempted to deviate from their strategy in an attempt to profit from an extra few pips. This can rapidly result in losses that will wipe out any scalping trading wins.

- Fees – scalping involves the execution of a high number of trades meaning fees can quickly eradicate profits, especially if commission is charged per trade.

- High pressured environment – scalping is an intense trading strategy that requires focus for long periods of time and is therefore not suited to all traders.

How To Start Scalping Trading

Choosing A Broker

A broker is essential for anyone looking to start scalping trading. However, with some brokers banning scalping trading – usually market makers who are not guaranteed to profit off the trade – the first thing to check is whether they permit scalping trading.

Fortunately, we’ve done the hard work already and compiled a list of the top scalping brokers in the UK.

Derive A Plan

A plan of action is key to carrying out successful scalping trading. Here, we list the essentials to consider when deriving a plan.

- Select a market – scalping trading is best suited to assets with high liquidity, to enter and exit positions easily. Some of the best forex scalping trading strategies are based on major and minor currency pairs, because they have the highest liquidity and lowest spreads which makes them a safer trade. Exotic pairs can be more volatile which may reap more profit but at a greater risk. When putting together a crypto trading strategy, try a less volatile altcoin such as Bitcoin first.

- Choose a time to trade – the best time to trade is when the markets are most liquid. For forex scalp trading, this is 12-4pm GMT, as the New York and London exchanges are both open.

- Select your target – a common strategy is the 50 pips a day forex trading strategy, where traders aim to make 50 pips profit from price movements of a single currency pair. For this, the currency pair must have at least a 100 pip per day range, making GBP/USD and EUR/USD viable options.

- Pick a strategy – this is likely to involve the use of technical indicators to enhance your trading strategy. In the next section, we give examples of how you can use technical analysis to better predict price movements.

- Implement risk management – decide your risk-reward ratio and implement a stop loss accordingly. The risk-reward ratio is the amount of capital you could lose versus the amount of profit you’re aiming to achieve. There is no fixed rule for which ratio should be used, as this depends on factors such as fees and the volatility of the market, though 1:2 is common.

- Keep a trading journal – this will guarantee you keep on top of your scalping trades throughout the day and can help you learn from previous mistakes. Just make sure your attention isn’t diverted from executing trades.

- Focus on one trade at a time – one of the most important rules when scalping trading is to ensure you aren’t distracted. Holding more than one position is difficult and may cause you to lose focus.

Scalping Trading Strategies

To ensure scalping trading is profitable, traders need an edge. Scalping trading can be enhanced through the use of technical indicators, to better predict future price movements. Here, we explain how to use popular indicators to carry out some of the best scalping trading techniques, which can be used across multiple systems including MetaTrader 4.

Bollinger Bands

Bollinger bands indicate the volatility of an asset using a middle, lower and upper band. The middle band is a moving average (often a 20 day period) which indicates the price trend. The lower and upper bands are positioned either one or two standard deviations above and below the middle band. A tightening of the upper and lower bands indicates a reduction in volatility, whilst a separation shows the opposite.

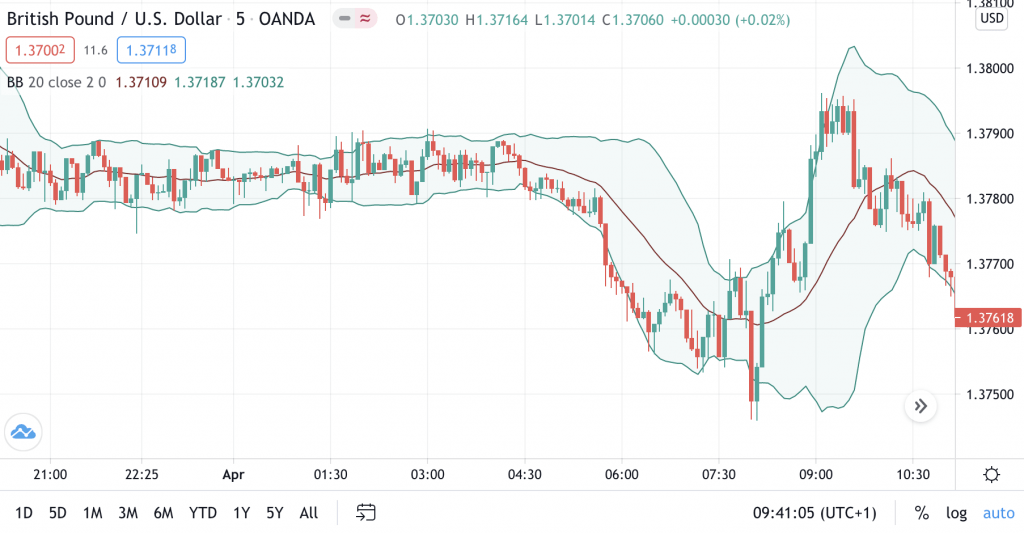

The Expansion of Bollinger Bands shows an Increase in Market Volatility

First, use the distance between the Bollinger Bands to determine whether to open a position based on the current market volatility. When scalping trading, a 1 minute or 5 minute timeframe is most suitable. Higher volatility comes with increased risk as the price can quickly jump even in short timescales. For a safer scalping strategy, only buy and sell when the Bollinger Bands are flat, which signals a trading range (observed from 21:00 to 04:30 in the above chart).

With the 1 or 5 minute scalping trading system still setup, use the position of the bands to determine when to buy or sell the forex pair. If the price touches the lower Bollinger Band, this indicates an underbought region and is a buy signal. If the price touches the upper Bollinger Band, the asset is considered overbought and this is an indication to sell.

Stochastic Oscillator & RSI

The Stochastic Oscillator and Relative Strength Index (RSI) can provide further insights when scalping trading, especially when used together. While the RSI indicates oversold and overbought conditions, the Stochastic Oscillator can be used to detect trend reversals.

The RSI calculation is based on previous trading prices, usually the 14 days prior. The index is a scale of 0-100, with 30 typically quoted as the threshold under which an asset is underbought. A reading over 70 is considered to be overbought.

The stochastic oscillator also uses a scale from 0 to 100 to highlight changes in trend. It works by calculating the acceleration of price changes (called momentum), based on the theory that the momentum of an asset will often change before the price itself. Recognising reverses is important in scalping trading, where every pip counts.

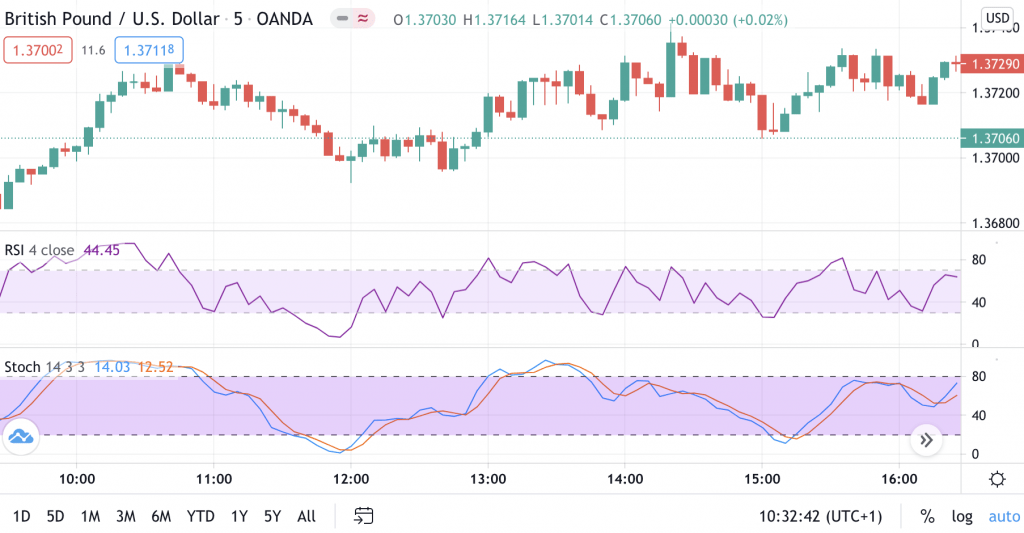

The RSI and the Stochastic Oscillator can be used in combination to determine entry and exit points:

- If the RSI is showing as overbought (above 70) and the stochastic indicator is showing a trend reversal from a bullish market, sell

- If the RSI is showing as underbought (below 30) and the stochastic indicator is showing a trend reversal from a bearish market, buy

By using the stochastic oscillator in combination with the RSI, buying an underbought asset that doesn’t observe a trend reversal and therefore continues to see a price drop is avoided (and vice versa).

Using the RSI in Combination with the Stochastic Indicator

Scalping Algo Trading

Robots can add significant value when it comes to scalping trading, due to the quick and precise nature in which trades need to be enacted.

Algorithmic bots can be used for automated scalping trading by buying or selling at a specified price, which is also known as system trading. However, robots are not foolproof and their effectiveness is determined by the trader’s inputs, which should reflect a planned trading strategy with sufficient risk management in place.

Some trading platforms offer a codebase where users can download free or paid for bot software that has been developed by programmers. For example, the popular MetaTrader platforms have a library of bots called ‘Expert Advisors’ (EAs), that are created using the MQL programming language. Examples include the hamster scalping trading robot EA which uses the RSI and ATR indicators and the 1 tick scalping strategy bot.

Traders may also want to program their own bot or commission a programmer to develop a bespoke scalping bot for them. Outside of MetaTrader, other platforms offer equivalent automated trading, some of which is based on more popular programming languages such as Python.

Further Research

Understanding the fundamentals is crucial before entering the fast-paced world of scalping trading. There are numerous online courses available for beginners who want to learn more about how scalping trading works. YouTube is a great source of strategy training content, including videos of traders scalping in real-time. Live scalping trading rooms are also a great way to see strategies first hand.

Once the basics are covered, there are many books, eBooks and online forums to pick up scalping trading tips. While TradingView offers scalping trading analysis from a range of sources, traders can also take advantage of free online downloads such as the ‘Top 5 Scalping Trading Strategies’ PDF or articles such as ‘Scalping for Profits as a Day Trading Strategy for Dummies’.

Wrapping Up Scalping Trading

Scalping trading is an intense strategy that relies on focused execution of short timeframe trades. Though not an easy technique to master, it can lead to substantial returns if executed correctly. While scalping can be applied to all markets, it works best with low fees, high liquidity and leverage, making major forex pairs highly suited to scalping trading methods.

Preparation is key, so following our step-by-step guide to finding a broker and creating a plan is the best way to execute a successful scalping trading strategy.

FAQ

What Is A Scalp In Trading?

A scalp aims to make a small profit of just a few pips by trading for very short timescales of just minutes or even seconds. It is based on the theory that the trader is exposed to less risk when trading in these shorter periods.

Is Scalping Trading Illegal In The UK?

Scalping trading is legal in the UK though some brokers do not permit it. Make sure to check the broker’s T&Cs and rules before starting scalping trading.

What Is The Best Scalping Strategy?

Some of the best scalping strategies are based on simple techniques, to ensure the trader can remain focused. Using the RSI and Stochastic Oscillator in combination is a great way to predict the price trend and identify oversold and underbought regions in parallel.

How Do I Scalp Gold In Forex?

XAU/USD is a gold forex pair that can be traded using scalping strategies. Its stability means it is more predictable than other assets but may not provide as high returns. FXTM is a broker that permits scalping and offers XAU/USD.

Does Scalp Trading Work?

It is possible to generate good returns from scalping trading if the trader is disciplined and focused. As with all trading, scalping is not risk-free and traders should ensure they have appropriate stop losses in place.