Scalping Stocks

Scalping stocks is a fast-paced trading strategy that targets small market changes to accumulate profit. In this article, we review the definition of scalping, what it means in stocks trading, the various strategies available, and how to get started.

Top Scalping Stock Brokers

What Is Scalping Stocks?

Scalping stocks is a short-term trading strategy. It involves targeting minor changes in intraday stock prices and moving in and out of positions regularly to build profit. These tiny market shifts happen frequently on a day-to-day basis, even in exchanges that have little fluctuation, and so these small windows of opportunity are common and profitable. Scalping stocks can be your main trading strategy or used to supplement another technique.

Stock scalpers make numerous speedy trades, holding positions for very short periods of time, sometimes seconds, making multiple small wins before the market changes. Big wins are not the goal. Scalping stocks is appealing to investors who can devote time to monitoring markets and acting quickly—some even scalp stocks for a living.

During an average trading day, stock scalpers can make hundreds of trades meaning the size of wins may be small but the win to loss ratio is improved. However, as a result of making a large volume of trades, commission and fees can often build up, reducing total profit. Any trade can be turned into a scalp by taking a profit near the 1:1 risk-reward ratio.

Scalping Stocks Vs Day Trading Stocks

Scalping stock strategies are different from traditional day trading where positions are held for longer periods of time with the aim being to make more profit from each trade. Investors would normally hold a position, resisting exiting too early, therefore maximising their earning potential. However, the opportunity for bigger losses is increased in normal day trading as the longer you stay, the greater the risk that trades won’t stay in profit.

Scalping stocks adopts the opposite mindset. Scalpers holds positions for much shorter timescales—seconds or minutes rather than hours—especially in the case of micro-scalping where timescales can be reduced to 10-20 seconds.

In addition, scalping stocks depends on higher volumes and increased leverage compared to day trading, allowing investors to make a profit in shorter periods.

Scalping Stocks Strategies

There is an abundance of online resources for scalping stocks strategies, including YouTube videos of live tutorials and discussions on various forums. We have explained a few scalping strategy examples below too.

Scalping stocks is more frequently done using technical analysis, using various indicators to spot patterns and make stock price forecasts. By predicting trends, investors can make decisions as to whether the risk-reward ratio is appropriate. Fundamental analysis can also be useful by monitoring external market events to help you identify hot stocks.

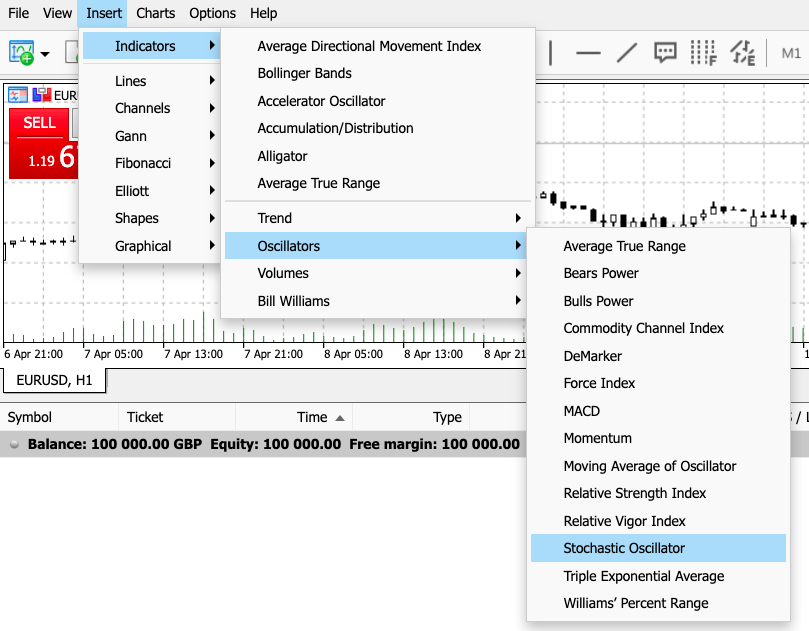

Stochastic Oscillator

Scalping stocks using a stochastic oscillator aims to capture momentum in markets. By comparing the current price of a security to its recent price range, this indicator attempts to predict turning points. Prices tend to close near the extreme of the recent range.

This indicator is used to generate trading signals, using values between 0 and 100 to indicate whether a market is trading above or below its true value. For example, a value of 80 or more is considered to be overbought whereas a value under 20 would be seen as oversold.

Stochastic Indicator

The current value of the stochastic indicator is sometimes referred to as the fast indicator. The slow indicator is taken as a 3-day moving average of the fast indicator. Transaction signals are created when these two indicators cross, suggesting a reversal.

- Downward trending high stochastic indicators provide entry points for short positions while upward trending low stochastic indicators provide entry points for long positions. The stochastic indicator can be used in tandem with the moving average indicator (see below), by only trading when the stochastic indicator is in the same direction as the trend according to the moving average.

- If the stochastic oscillator trend continues into more than 80 or under 20 (the oversold or overbought areas), sell the position.

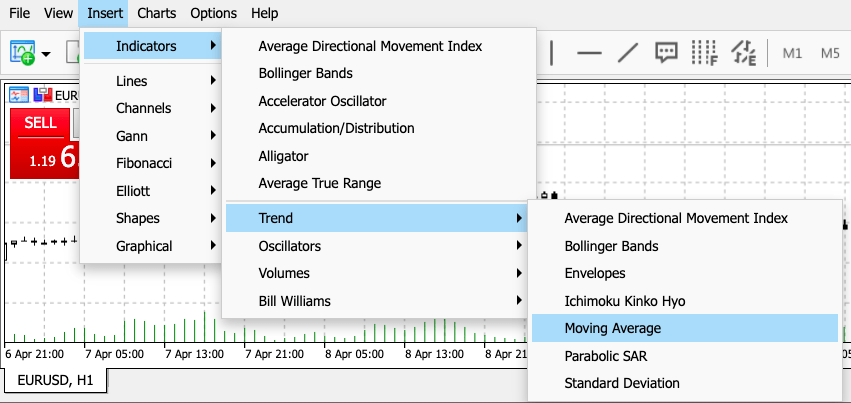

Moving Averages

One simple method of scalping stocks is to use moving averages (MA) to indicate trends in equities. It sums up data points of a security over a specific time period and divides it by the total number of data points. It is continually recalculated based on the latest price update. The indicator removes noise from the chart i.e. frequent short-term fluctuations and smooths out prices by updating the average over a specific period of time.

Moving averages

For example, select a 200-day period moving average to indicate an overall trend. You then select a short-term MA and a longer-term one, such as 5 day and 20-day periods, which will show you whether to buy or sell. The best timescale for this scalping stocks strategy would be 1 minute or 5 minutes.

- If the 5-day moving average crosses above the 20-day one, enter positions in the same direction as that trend (i.e. as indicated by the 200-day MA)

- If the moving averages cross each other back (i.e. the 5-day MA crosses below the 20-day one), sell the position

Market Making

Market making is an advanced stock scalping tactic where traders capitalise on the bid-ask spread by putting out a bid and making an offer on the same stock at the same time. This strategy works best with stocks that are not showing any real-time price changes. Difficulties arise because of competition with other market makers for the shares on bids and offers.

Find out more about scalping trading strategies.

Pros Of Scalping Stocks

The benefits of scalping stocks include:

- Fast and regular profits – Scalping stocks provides investors with quick returns thanks to the short-term investment periods

- Reduced level of volatility – Trading in stocks is less volatile than in other instruments

- Can profit from flat markets – By targeting small stock price movements, traders can operate in slower markets and still make a profit

Cons Of Scalping Stocks

There are also some downsides of scalping stocks:

- Requires focus and commitment – Scalping stocks can be intense due to the speed at which trades are executed. You need to be glued to your screen for effective scalping as possible entry points can appear and disappear rapidly

- Emotional pull – To be a successful stock scalper you need to know when to quit. The premise of scalping is to sell when making a profit and having the discipline to do so can be hard

- Potential losses – Scalping stocks is riskier as it uses high leverage. If you stay in a losing position too long, it could result in larger overall losses. Make sure you have an appropriate risk management system in place

- Multiple trades mean higher commission – Apps typically charge commission for trading stocks, unlike other instruments like forex. Scalping stocks involves executing hundreds of trades in a short period of time, meaning greater commissions. Stock trading volume is also lower vs forex, resulting in higher spreads and lower liquidity

- Timing – scalping stocks occurs within local exchange trading hours whereas forex, for example, can be traded 24/5

Scalping Stock Tips

Here are some 101 tips and rules on scalping stocks to consider before getting started:

- Times – Scalping stocks can only occur within local stock exchange trading hours. The busiest trading times are best for scalping, specifically 13:00 to 17:00 GMT as London and New York Stock exchanges intersect

- Have a plan – The high-octane nature of scalping stocks can be intense due to execution speeds. Investors need to concentrate at all times and make sure they don’t hold a position for too long. Set a target profit amount per trade and stick to it

- Stop – As above, setting a trading stop that reflects your risk-reward ratio reduces your risk of large losses

- Stay connected – Make sure that your internet connection is reliable when scalping stocks i.e. don’t trust your mobile phone network. By its nature, scalping requires the trader to be fast-paced and you need a connection that allows to you enter and exit positions efficiently

- Liquidity – Scalping stocks is not suitable for penny stocks which have low volume. Good scalping stocks have high liquidity and volume, making them easier to buy and sell

- Research – Scalping stocks requires investors to have a clear strategy and plenty of research will help to develop this. As well as YouTube videos and forum discussions, there are various resources such as books, eBooks, online courses, and downloadable PDFs to become better informed on scalping stocks strategies. Following economic news will also help to spot trends and keep on top of external factors that could impact security volatility.

Final Word On Scalping Stocks

On the surface, scalping stocks looks like an easy trading strategy to make a profit, even in flat markets. However, it is not for the faint-hearted. While there are many useful online resources, the high-pressured environment and opportunity to offset small profits with a lack of discipline means novice traders need to be careful before jumping in.

FAQ

What Does Scalping In Stocks Mean?

Scalping trading is a strategy where investors can build profits by targeting small price changes that can be applied to stocks. The stock market generally has higher commission fees and scalping can make it harder to maintain a profit.

Is Scalping Stocks The Same As Day Trading?

No, scalping stocks is different from day trading in several ways. Timescales are much shorter when scalping stocks (seconds or minutes vs hours) and scalping requires higher volumes and leverage in order to make a profit in those shorter time periods.

Is Scalping Stocks Illegal?

Scalping stocks is legal and is used by both retail and institutional investors but it is not easy or a game. Only a few brokers actually offer stock scalping on their trading platforms.

Is Scalping Stocks Trading Profitable?

Yes, scalping stocks can be profitable if executed accurately. Winnings tend to be smaller but the win to lose ratio can be greater. Scalping is an extremely fast-paced trading environment so investors need to be precise and disciplined by setting appropriate risk-reward ratios. By holding a position for too long, stock traders run the risk of losing any profits they have earned.

How Do I Start Scalping Stocks?

To start scalping stocks, you need to choose a top scalping broker. However, many brokers do not offer scalping on their platforms as they do not have the appropriate software to handle the speed needed for scalping. There are various online resources for dummies to help you get started such as YouTube videos, forums, eBooks, courses, and PDFs.