Scalping Forex

Scalping the forex market is a lucrative trading strategy that requires dedication and time. By making many quick, large trades over the course of a day, scalpers steadily accumulate significant profits. This guide will discuss the benefits and drawbacks of scalping forex, how you can become a scalper, plus other key tips and definitions.

Best Scalping Forex Brokers

What Is Scalping Forex?

Scalping is a long-standing trading strategy that takes advantage of constant, minor price movements to skim lots of small profits. A big difference between scalping forex vs other day trading strategies like swing trading is the timeframes over which the systems are implemented. Scalpers enter and exit several trades in a few minutes or seconds, accumulating returns over the course of the day. Other investors tend to complete a few trades each day or week, looking at longer-term price movements.

Scalping forex is an exciting approach to trading, with lots of trades and analysis occurring in high frequency. Most scalpers aim for between 5 and 10 pips from each trade. While price movements tend to be very low, profits are increased by trading with very large volumes, often requiring the maximum leverage levels that brokers offer.

Strategies For Scalping Forex

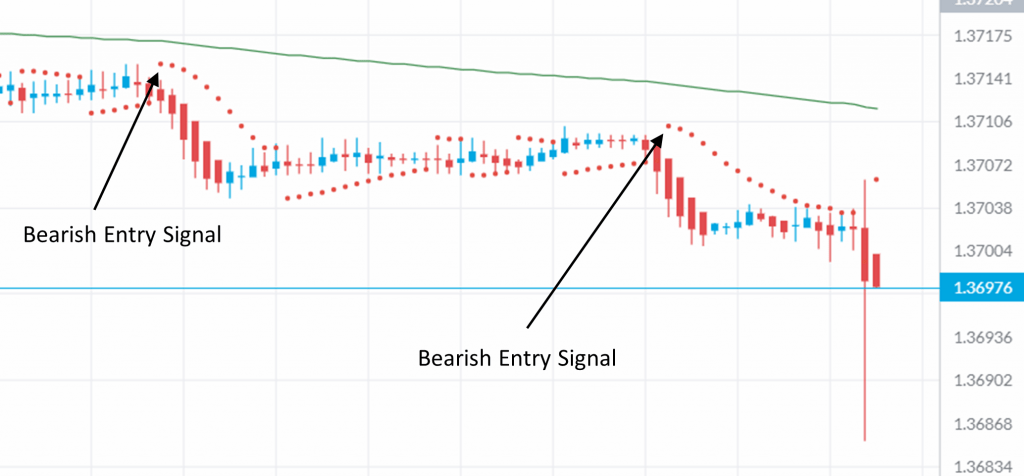

Parabolic SAR

The parabolic SAR indicator, which stands for stop and reversal, aims to identify entry and exit points for forex traders that follow the general market movement. A long-period SMA or EMA line will identify the general trends, leaving specific signals to the SAR indicator.

The indicator itself forms dots either above or below the closing price at each time step. The dots appear above the price bars for bearish movements and below for bullish. The algorithm behind the dots is complex but it generally provides an early indication of a new short-term trend forming.

Parabolic SAR

The changeover of the dots from bullish to bearish indicate the forex trend is changing. When the dots fall below the price levels, open a long position to capitalise on a new uptrend. If the dots cross below the price, short the pair as a downtrend is likely on its way. The exit signal is the dots crossing back in the opposite direction. Stop losses should be placed in line with the SAR dots.

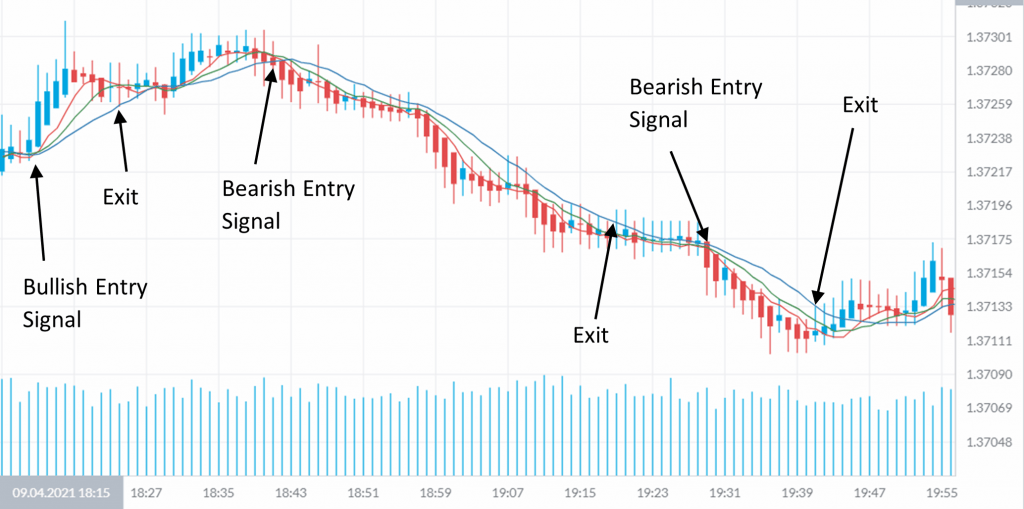

Moving Average Ribbon Entry

Using this scalping forex trading strategy groups three different simple moving averages (SMAs) onto a two-minute chart. The periods are usually 5, 8 and 13 and help identify strong trends for scalpers to take advantage of. When a signal is produced, scalpers can either capture the later section of the trend or wait for a loss of momentum and trade its reversal.

The alignment of the three SMAs points towards a change in the trend, with the 5-bar SMA closely following the price and the others tracking longer-term movements. If the price level penetrates the 13-bar SMA, the momentum is beginning to fall away, and forex scalpers should exit the trade.

Moving Average Ribbon

It is often useful to combine this scalping strategy with Bollinger Bands in forex markets, which can signal exit points for trades.

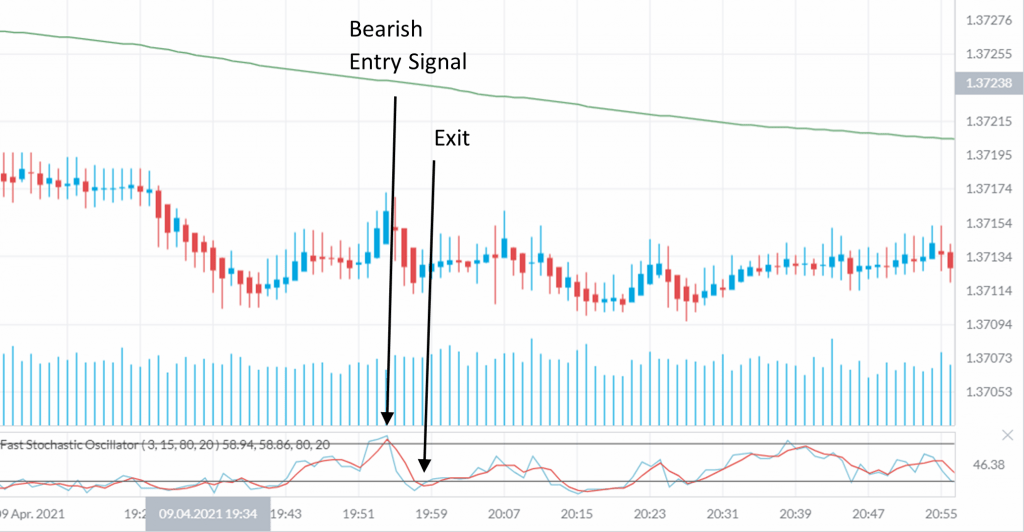

Stochastic Oscillator

Stochastic refers to statistical analysis of difficult-to-predict phenomena with a semi-random distribution, such as price quotes for a scalping forex pair. The stochastic oscillator compares the current price of the instrument with its previous price range to determine turning points in trends.

The indicator appears as a second chart with two lines oscillating roughly between the 20% and 80% marks. The two lines follow the same algorithm but over different time periods. The black solid line is the fast stochastic indicator referred to as %K while the red dotted line is the slow indicator, called %D.

The two lines, %K and %D, are used similarly to a moving average convergence-divergence (MACD) strategy, with crossovers indicating a buy or sell signal. A bullish signal occurs when the lines drop low and the %K line crosses above the %D line. An exit is then signalled by the lines reaching the 80% mark or crossing back over.

Stochastic Oscillator

A bearish signal is the opposite, occurring when the %K line crosses below the %D line while both are at a high percentage. The trade should then be exited when a bullish crossover is seen and the lines close below the 20% mark.

For effective use of the stochastic oscillator, combine it with a long-period SMA, which will capture the long-term trend of the forex market. With this information, you should then only enter trades that follow the general direction of the market movements.

Scalping Forex Tools

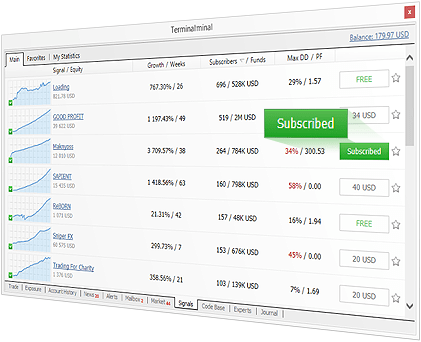

Scalping Forex Signals

Trading signals are widely used amongst scalpers, day traders and short-term investors. Produced by other traders using statistical, graphical or technical analysis, scalping forex signals can be sent by email or platform notifications. Some well-known signals providers are Telegram, Scalp King Forex, MyFXBook and Forex Factory.

Not all forex signals are reliable, however, and none of them are 100% effective. Given their origin, you should be careful how much faith you put in signals and, if possible, identify when and how often they are successful, how they work and what criteria they follow.

MetaTrader FX signals

Unfortunately, many traders want to try and increase their profits by providing signals, offering services like ‘best forex scalping strategy, 90% winners’. A good rule of thumb is to only follow signals provided by professionals and experienced forex traders.

Scalping Forex Charts

The biggest and most important tool in your toolbox for scalping forex, or any day trading, is charting. Live charts provide price information in a visual format that is easy to read and analyse.

Given the short timeframes over which scalping forex is carried out, picking the right charts is vital for success. FX scalpers typically operate with charts no larger than 15-minutes (M15), although most scalping strategies are best implemented on one or two-minute charts.

It is important that you fully understand the basic types of charts, graphical tools and indicators. From basic line charts tracking the closing price to candlewick and Heiken-Ashi plots, different charts are useful for different approaches to scalping forex trading. There are also lots of helpful tools and indicators available, such as Bollinger Bands, cycle indicators and Fibonacci retracements.

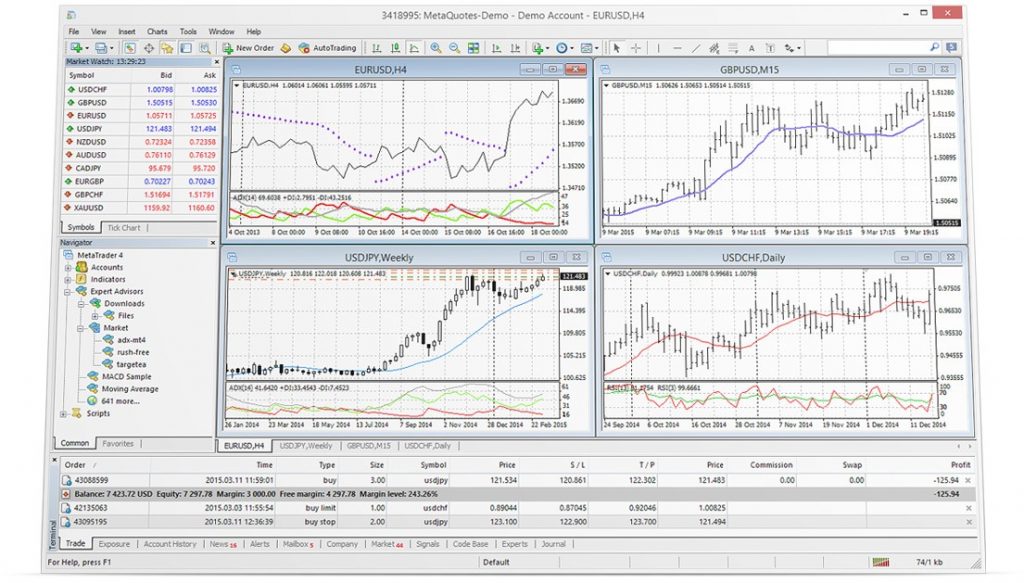

MetaTrader 4

The trading platform you use can also have a big impact on the chart types and indicators available to you. Big, commonly used platforms like MetaTrader 4 (MT4) have a wide range of indicators and visual tools that can help make scalping forex easier, while others provide tools to create custom indicators to follow your own strategies. Many websites also provide free downloadable indicators, such as Forex Factory.

Scalping Forex Robots

Scalping is a trading strategy that stands to gain a lot from the application of automated trading systems. Given the large number of rapid trades that follow a clear set of rules, algorithms can be written with strict criteria to follow a scalping forex strategy. Automated trading can combine a wide range of indicators with a complex algorithm in a way that could be difficult to track and execute manually.

Automated scalping forex can be done in two ways. The first, and easiest, involves finding a suitable electronic advisor (EA) online that follows a strategy you like, which can be downloaded free and implemented with the platform you use. Some platforms even provide stock bots themselves, following a range of strategies including scalping forex, such as MT4. Some of the best big bot providers are Forex Scalper Zone, MyFXBook and Forex Factory EAs.

MetaTrader bots

Reviews of EAs and bots are very useful as not all bots will be as effective as you may hope. There are plenty of review websites that can help you clarify whether a bot is trustworthy. Similarly, lots of trading forums will discuss scalping forex strategies, bots and platforms.

Alternatively, you can write your own strategy into a bot to scalp forex on your own terms. This requires a brokerage platform that supports a suitable API.

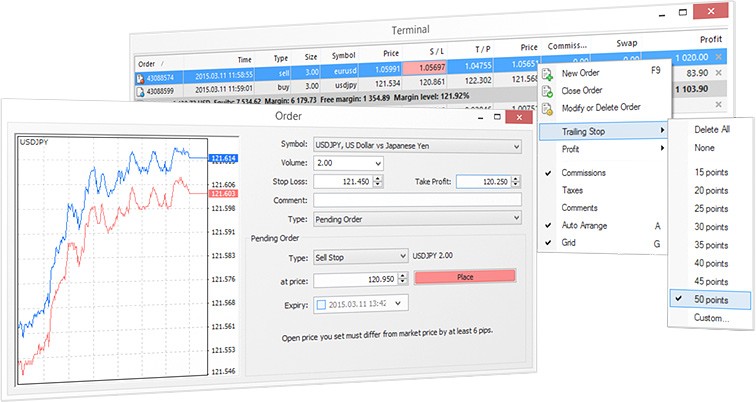

Scalping Forex Stops

Trading stops are an important aspect of any successful investor’s strategy, whether for scalping forex or spread-betting cryptocurrencies. These stops, also called stop-losses, embed a particular exit point into a trade if the price swings in the wrong direction. Once the price hits the specified point, the trade will be exited, mitigating trading losses.

Stop-losses are a simple risk management strategy but should not be underestimated. The chance of a losing trade significantly damaging profits disappears, as the trader can set the maximum level of loss before entering a trade. This helps ensure that winning trades will outweigh losses in the long run, maximising forex profits.

FX trading stops

While most scalping forex strategies will specify where stop-losses should be placed for each trade, it is worth noting that a stop placed too close to the price of the forex pair you are scalping may cause you to leave the trade too early.

Pros Of Scalping Forex

Scalping forex pairs comes with a range of benefits that are attractive to beginner and experienced traders alike:

- Profitable – Despite the low profit-per-share, scalpers leverage massive volumes and high frequencies to produce meaningful profits.

- Opportunity-rich – There are huge numbers of profitable opportunities every day for scalping the forex market.

- Low risk exposure – The short timeframes over which forex scalpers trade means that the likelihood of a trade hitting a big price reversal is lower. Scalpers generally trade at a risk to reward ratio of 1:1.

- Easily automated – The heavy attention requirements and strict rules of scalping forex lend themselves nicely to automated trading.

- Less knowledge depth – Most scalping forex strategies focus on statistical and visual patterns, generally requiring less in-depth knowledge of specific markets than other trading approaches.

Cons Of Scalping Forex

Scalping is not a perfect trading approach, however, and there are certain disadvantages that investors should be aware of:

- Focus – Traders wishing to scalp forex require quick reactions and constant focus to analyse the instrument’s price movements over long periods of time.

- Leverage – Scalpers must make use of leverage to extract significant profits from each trade. This can increase the risk of loss if the market reverses.

- Capital – To best take advantage of rapid price changes, forex scalpers require a constant stream of capital to trade with.

Getting Started Scalping Forex Trading

Choosing A Broker

The first step to kicking off a forex scalping career is to find the right broker. Not all brokers are built with scalpers in mind, and some even ban scalping altogether, analysing the length of time each position is open for. The first step then is to eliminate all these brokers.

In general, scalping brokers follow an STP (straight-through processing) or ECN (electronic communication network) system, rather than dealing desk structures. These brokers offer the quickest execution times and most efficient trades.

The choice is not an easy one, however, our pick of the best brokers for scalping forex is an excellent place to start.

Choosing A Forex Pair

Once you have a shortlist of respectable brokers with tight spreads and quality services, you need to consider which instruments you may want to scalp. Forex pairs have three classifications: major, minor and exotic. Major pairs are the USD coupled with any of the six next biggest currencies, while minor pairs are combinations within those six and exotic pairs are any other combinations.

Different pairs will all have their own characteristics, from liquidity and volatility to the time of day with the most volume or its responsiveness to news events. Generally, the best scalping forex pairs are the majors, as they demonstrate the most liquidity and volume, providing the optimum conditions for scalping very short-term trends.

The liquidity of major forex pairs is not constant throughout the day, though, as they vary with the different global trading sessions. Some pairs will be more liquid during some sessions than others. For example, the JPY/AUD minor pair is more liquid during the Asian-Pacific session, while the GBP/USD major pair is most liquid during the crossover between the London and North America sessions.

Education & Training

Before forex scalpers login to their shiny new account and start trading, make sure to take advantage of the helpful guides and resources that are available.

Good brokers often provide their own range of useful trading resources, including how-to 101 guides and helpful tips. There are lots of other online resources, from discussion forums and blogs to YouTube videos, training courses, academies and dedicated books and e-books. There are also myriad PDFs with 1-minute (M1) trading strategies, 5-minute (M5) indicator notes, rules, cheat sheets, guides for dummies and 24/5 scalping methods; almost anything to do with scalping forex can be found on a PDF you can download for free.

Combining these resources throughout your forex scalping career, not just at the start, with practice on your broker’s demo account will make you a much more successful trader. Demo accounts will not only get you to grips with the broker and platform, but they will give you experience and understanding of forex pairs, scalping strategies and the change in characteristics throughout the day. Make the most of the opportunity and practice implementing your strategies on these demo accounts before risking real capital.

Determine Entry & Exit Points

With an account set up and a solid foundation of understanding, you can begin scalping your selected forex pair. You can open charts and begin technical analysis on your real account, applying indicators and graphical objects to identify both long and short-term trends for scalping opportunities.

You should stay disciplined when scalping forex; it is not a trading approach that has room for emotion or greed. The rules of your strategy will likely be based on lots of research and statistical analysis, so letting emotion or whim guide your hand is dangerous.

Control Risk

As mentioned before, stop losses are vital in the production and maintenance of scalping forex profits. These trading stops will automatically back out of a trade if the price swings the wrong way, limiting any single loss to a precalculated, acceptable quantity.

Another important money management strategy lies in the calculation of position sizes for any one trade using the 1% rule. Savvy traders will only risk around 1% of the net capital in their account on any single trade.

For the 1% scalping forex rule, you should place stop-losses wherever the strategy dictates, which will allow you to calculate the maximum position size. First find the difference between the entry price and the stop-loss, giving you the risk-per-share. Then divide 1% of your capital by this risk-per-share to find the maximum position size that would lose no more than 1% if the stop-loss is hit.

For example, if you have £1,000 in your account, 1% of this capital would be £10, the maximum quantity you would risk on a trade. If you are entering a long position for the GBP/EUR at 1.15, with a stop-loss placement at 1.13, the risk-per-share is the difference between the two, or 0.02. The maximum position size is then simply £10 divided by the 0.02 risk-per-share, giving a position size of £500.

Scalping Forex Tips

Timing

Timing is important for scalping forex in two different ways. Most obviously, the timing of each individual trade will affect the possible profits, as if a trade is entered or exited too early or too late, profitability can drop.

Also important is the time of the day that you attempt to scalp, even though forex markets are open 24 hours a day, trading over the night is unwise. There are three key trading sessions each day: the London session, the North American session based in New York and the Asia-Pacific session based in Sydney and Tokyo.

The highest levels of liquidity are seen during the crossover of the London and North American sessions, especially for all major pairs. Some minor pairs, like JPY/AUD, may have larger trading volumes or liquidity during the Asia-Pacific session, but the liquidity will still be plenty sufficient during the London and North American sessions.

It is also wise, particularly for beginners, to avoid the first and last 45 minutes of the trading day. These two time slots often see disproportionately high levels of volatility that catch traders off-guard. This is often because the impacts of extended-hours trading are being consolidated or negated, commonly resulting in high volatility and low liquidity for a short period of time.

Account For Spreads

Spreads are a vital consideration when scalping forex trading, as they can easily turn a profitable trade into a loss. Tight spreads will allow much smaller price movements to be scalped successfully, increasing the frequency and size of winning trades. Spreads should be considered carefully in the selection of the broker and instrument you wish to use.

You should always pre-calculate the effects of spreads in a trade, taking them into account before opening a position. A good rule of thumb to follow is that targets should be at least double the spreads.

Practice Makes Perfect

As with all things, scalping forex requires practice to master. Most brokers offer demo accounts that allow you to practice trades with live price movements but without any capital being risked.

Beyond simply familiarising yourself with the broker and platform, demo accounts offer useful training and experience. Any new strategies or refinements can be tested on a demo account to assess their efficacy and profitability risk-free.

Similarly, you can learn the ins and outs of different scenarios, instruments and market movements, giving you vital experience before scalping forex with real money.

Liquidity

Scalping forex has very little profit-per-share when compared to other strategies. This, coupled with the very high volumes that scalpers use to gain meaningful profits, makes traders vulnerable to slippage.

Slippage occurs at times of low liquidity in the market when a trade isn’t met at the other end at the price you entered it. This can be avoided by forex trading only when the market is most liquid, which will ensure your trades are met at the quoted price. Liquidity will also help by narrowing spreads at busy times, further increasing your profit margins.

Start Small

Learn to walk before you can run. The adage continues to ring true in many modern scenarios, including when learning to scalp forex markets. Scalping is intense, requiring focus, concentration and constant analysis, which can be difficult to maintain for just one forex pair, let alone several.

Begin with just one pair at a time, giving it all your attention so you can open and close positions at the optimal times, without profits starting to slip from a lack of attention. Once you are more experienced, you may be able to successfully split across more instruments, but a beginner should stick to just one.

Final Word On Scalping Forex

Scalping forex can be a profitable enterprise, combining a large number of small profits every day. Some of the most important factors for ensuring the success of scalping strategies are ensuring high levels of liquidity, fast broker execution times, discipline and tight spreads.

Beginners should start slow and focus on practicing strategies and following the rules of their system to the letter. Scalping the forex market is effective both as a primary strategy, or to supplement other approaches.

FAQ

Can I Make A Living From Forex Scalping?

Scalping for a living is definitely viable, as there are many profitable opportunities daily for forex scalpers, and those who strictly follow the rules of their strategies will tend to win more than they lose. Discipline and focus are important, along with a robust strategy and informed instrument selection.

What Is The Best Scalping Forex System?

While many strategy guides, signal providers and bot writers will claim they have the best strategy or the bot with the best win rates, there is no defined best. There are many scalping forex strategies, 1-minute (1M) to 5-minute (5M), gamma scalping, envelope scalping or scalp hedging, each of which will have varied results across instruments, times of the day and long-term market characteristics.

Can You Scalp Forex Without Indicators?

While most strategies will make use of different graphical or technical indicators, some only follow the price levels. These price action strategies can be harder, though still effective.

What Forex Instruments Can You Scalp?

Scalping forex is most common with standard currency pairs, particularly major and minor pairs. However, other forex instruments can be used for scalping, such as forex futures and commodity systems like gold (XAUUSD). Beyond forex, scalping can be applied to any tradeable instruments, like stocks and indices.

Is Scalping The Forex Market Legal?

Scalping is perfectly legal in the UK; it is commonly thought to be illegal because the US markets do not allow it. In the UK, anyone that has an account with a broker that supports scalping, can scalp forex markets.