Best Forex Signal Services In The UK 2026

Trading forex is not easy. Even skilled traders face tough decisions every day. The market moves fast, and it’s hard to keep up with all the data, charts, and news. That’s why many traders use forex signal services.

But here’s the truth: not every service is worth your money or trust. Picking the wrong one can cost more than you think.

Get started with our choice of the best forex signal providers in the UK.

Top Forex Signal Providers

-

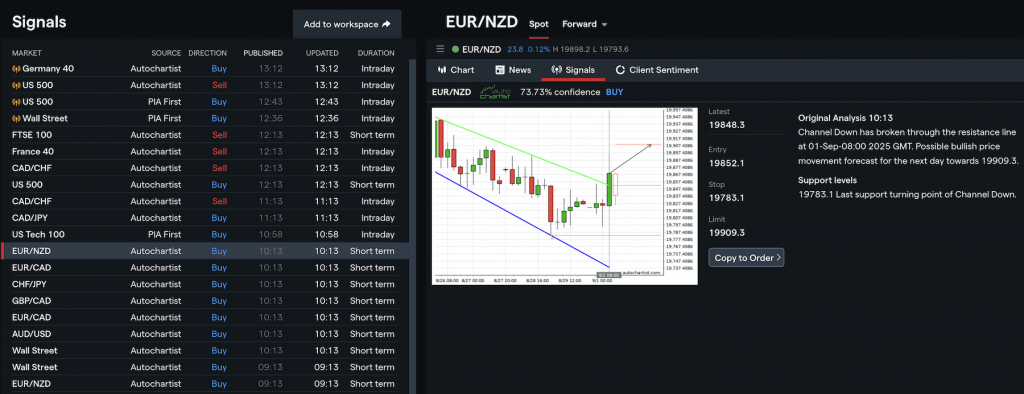

Pepperstone impresses in practical signal tests with Autochartist pattern alerts and seamless Trading Central integration for precise signals. Via MT4/MT5/cTrader, Myfxbook AutoTrade, and SignalStart, it offers flexible signal tracking. Ideal for traders prioritising dependability and rapid market analysis.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation's Signal Centre stands out, offering free daily trade ideas across FX, indices, and commodities, blending technical and fundamental analysis. TN Trader’s in-dashboard signals are prompt and integrate seamlessly with TradingView charts. Ideal for those seeking guidance over full automation.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Our assessments at eToro showed that its CopyTrader™ function excels, enabling users to replicate top investors' trades instantly. This feature advances trading signals significantly. eToro also provides intuitive technical indicators, like Bollinger Bands and Keltner Channels, to help active traders spot potential entry points.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Spreadex, regulated by the FCA, provides spread betting across 10,000+ CFD instruments, including 60 forex pairs. Traders have the option to engage in short-term positions on sporting events as well. With a history exceeding 20 years, the company has earned numerous accolades.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30

Safety Comparison

Compare how safe the Best Forex Signal Services In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Forex Signal Services In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Forex Signal Services In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| Spreadex | iOS & Android | ✘ |

Beginners Comparison

Are the Best Forex Signal Services In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| Spreadex | ✘ | £0 | £0.01 |

Advanced Trading Comparison

Do the Best Forex Signal Services In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Forex Signal Services In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| Spreadex |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Leading traders participating in the broker's Popular Investor Programme can earn yearly compensation of up to 1.5% of the copied assets.

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

Cons

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- The broker provides a user-friendly custom charting platform and mobile application.

- Spreadex offers UK traders the chance to earn tax-free profits via spread betting.

- Spreadex has added trading signals to its desktop platform, using Autochartist to deliver real-time, pattern-based insights. These insights assist traders in spotting potential opportunities.

Cons

- Third-party e-wallets are not permitted.

- The absence of a demo account may dishearten potential clients wishing to evaluate Spreadex's offerings.

- The proprietary terminal does not offer the detailed charting capabilities found in platforms such as MT4 and MT5.

Top Third-Party Forex Signal Platforms

How Investing.co.uk Chose the Best Forex Signal Providers

We applied a strict selection process, only recommending providers we trust after independently evaluating their offering, transparency, and credibility. Many services did not meet our standards, so this list is intentionally short.

How Signals Are Generated

The first thing to understand is how trading signals are created. This matters because it affects the reliability of the signals.

- Human analysts: Some services have forex traders or analysts who study the charts and send signals. The benefit is that human judgment can catch context, like economic news or sudden events, that a robot might miss. The risk is subjectivity. One analyst may see a clear trend, while another considers noise.

- Automated systems: These use algorithms or trading bots. They are consistent, fast, and unemotional. But they can fail in unusual market conditions. A bot won’t always react well to unexpected political news or a sudden event, such as a central bank announcement, which can really impact currency prices.

- Mixed approach: Some providers use both. They let software scan for setups, then a human trader checks them before sending. This can balance speed with judgment.

When comparing services, ask yourself: Do you prefer signals based on human experience, computer logic, or a combination of both? The answer depends on your own trading style.

Autochartist on IG auto-spots chart patterns, giving trade ideas without manual scanning

What To Look For In A Forex Signal Provider

Track Record & Transparency

If a provider can’t show a history of results, be careful. A strong service should be able to show:

- A verified performance record.

- Both wins and losses, not just the best trades.

- Updates that are easy to follow and confirm.

Be cautious of screenshots with no proof or vague claims, such as ‘95% accuracy.’ A real provider knows losses happen. If a service hides them, that’s a red flag. Look for providers who share data through platforms that verify performance.

When I first subscribed to a signal group, I only saw screenshots of winning trades. It looked great until my own results didn’t match what they claimed. Later, I found a provider that published a complete history, wins and losses included, and it was far easier to trust—even when the forex trades didn’t always work out.

Risk Management In The Signals

Sound signals are not just about telling you when to buy or sell. They should also show you how to protect your money. Look for FX signals that include:

- Stop-loss levels: These protect you if the market turns against you.

- Take-profit targets: Clear points to lock in gains.

- Risk-to-reward ratios: You want trades that aim for more potential profit than potential loss.

Some services even suggest position sizes, though not all do. Without risk management, even a signal with a high win rate can wipe out your account.

Delivery Speed & Format

Speed matters in forex trading. A delayed signal can turn a winning idea into a losing one.

Most services deliver forex signals in one of these ways in our experience:

- Mobile apps: Push notifications are quick and easy to use.

- Telegram or WhatsApp groups: These are common, especially for UK traders. Messages arrive instantly.

- Email: Works well for longer-term trades, but is not ideal for fast scalping setups.

Think about your own schedule. If you’re often away from your screen, consider a service that offers mobile alerts. If you’re glued to your desk, any method may work.

Type Of Signals: Scalping, Day Trading, Or Swing

Not all signals are the same. Providers often focus on one style.

- Scalping: Short FX trades that last minutes. You need rapid execution and low spreads.

- Day trading: FX Trades held for hours during the same day. This suits individuals who can regularly monitor charts.

- Swing trading: FX Trades that last days or weeks. This fits part-time traders who can’t sit in front of a screen all day.

The right service is the one that matches your lifestyle. There’s no point in paying for scalping signals if you can’t react fast enough.

I’ve used all types of forex signals. Scalping felt rushed, and day trading was hard to follow while working. Swing signals suited me best—they gave time to plan without being glued to the screen. Matching the style to my schedule mattered more than the win rate.

Costs & Value

Forex signal services charge in different ways:

- Monthly or yearly subscriptions.

- One-time payments.

- Free trials or demo groups.

Cost alone should not be the sole guide for your choice. Cheap signals that lose money will cost you far more than the subscription fee. On the other hand, a high price does not guarantee better signals.

Always weigh the cost against proven results and how well the signals align with your trading needs.

Support & Community

Some providers only send signals. Others add extras:

- Live chat support.

- Q&A channels.

- Communities where traders share ideas.

This isn’t essential, but it can help. If you’re new to forex, a supportive community can make it easier to understand how to apply the signals.

Regulation & Trust

In the UK, brokers are regulated by the FCA. But most signal providers are not. That means you need to rely on trust and transparency.

Things to check:

- Is the provider clear about who they are?

- Do they give real contact details?

- Are they upfront about risks?

Avoid anyone who promises ‘guaranteed profits.’ No one can guarantee results in the forex market. If it sounds too good to be true, it is.

Trial Periods & Testing

Before paying, see if you can test the service. Many providers offer free trials, demo accounts, or sample signals. This helps you check:

- If the signals are clear and easy to follow.

- If they arrive at the right time for your schedule.

- If they match your trading style.

Don’t jump into live trading with real money right away—test for a few weeks first, ideally on a demo account.

Independent Reviews & Feedback

Check what other traders say, but be cautious. Online reviews can be misleading. Some are fake, written to boost a service.

Others are counterfeit negatives, written by competitors. Look for balanced reviews that point out both strengths and weaknesses.

Your Own Role

It’s tempting to think a signal service will do the work for you. But that’s not how it works. You still need to:

- Decide how much money to risk per trade.

- Follow your own rules.

- Stay disciplined.

A signal is just a tool. It won’t save you from poor money management or overtrading.

Bottom Line

The best forex signal service in the UK is not the one with the flashiest website or boldest promises. It’s the one that fits your trading style, shows honest results, and provides signals you can act on in time.

Take the time to test, review the history, and determine if the service aligns with your own habits. A good signal service can help, but it won’t replace discipline, patience, and risk management.