News Trading

News trading uses analysis of economic reports and events to predict market prices. Using the news for trading is a versatile strategy that can be applied to all market types, though specific events to look out for will vary between assets.

Whether you’re considering news trading forex, stocks or oil, read our guide to find out how you can benefit from today’s wealth of news sources to predict prices. We’ll walk through an example news trading strategy, as well as explaining how you can use algorithmic bots to capitalise on the release of economic data.

Trading Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the News Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the News Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the News Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the News Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the News Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the News Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

What Is News Trading?

Trading on the news is based on analysis of economic news and events, unlike technical analysis which uses charts and indicators to predict patterns. However, technical analysis can be used in combination with news-driven trading to confirm any predicted trends. News trading involves reacting to events that are both scheduled and unscheduled.

Scheduled news trading uses reports from recurring or one-off events with predictable timings, such as company announcements or general elections. Day traders take advantage of the volatility that often surrounds stocks just before and after an announcement, unlike longer-term investors who will be interested in whether the overall trend is likely to reverse. Speculation can be just as important, if not more important, than the reported figures themselves. The most successful scheduled trading will come from traders who have carried out in-depth research of the company, asset or market they are trading.

Unscheduled events are ‘one-off’ occurrences. These are the unpredictable events such as the 2008 financial crisis or Covid-19 pandemic, that a trader will likely be unprepared for. However, the potentially significant impact of these events means there can be high profits to be made.

News Trading Markets

News affects everything and can therefore be applied to all markets including forex, stocks cryptos, oil, futures, gold and binary options, though certain news events will have a stronger effect on specific market directions.

Forex

When trading news on forex now, central bank announcements and political news can have large influences on price. UK news traders should consider the effect of a general election or Bank of England online announcements on the FTSE100 and USD/GBP when developing indices and forex news trading strategies. The EU referendum result in 2016 saw a strong breakout of EUR/GBP, for example.

2016 Brexit referendum impact on EUR GBP

Stocks

Company share price is likely to be impacted by periodic company announcements and annual reports. Stock news trading strategies can be developed based on patterns seen around these news releases.

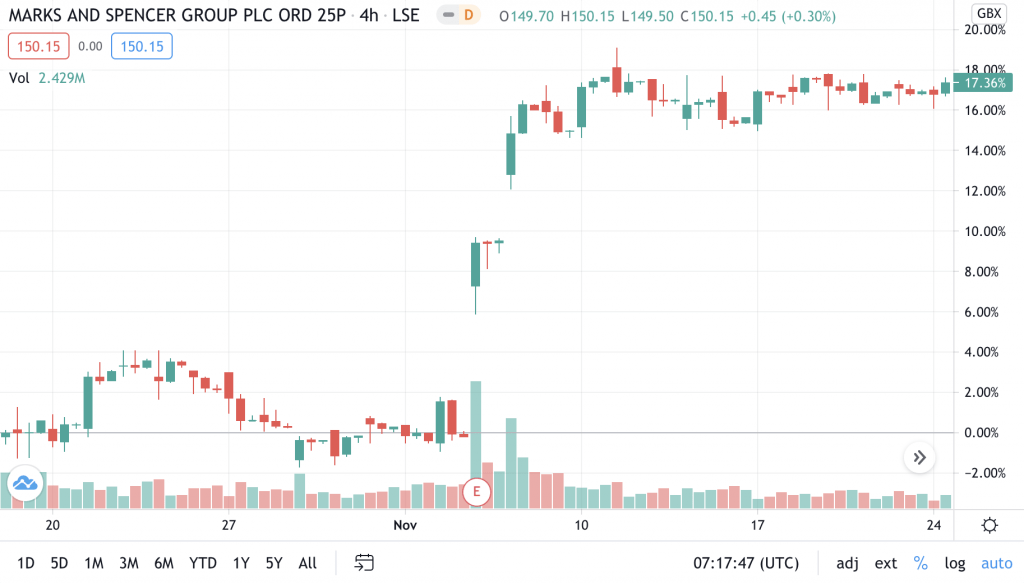

M&S trading news effect on trading volume and share price

Cryptos

Cryptos are primarily affected by supply and demand and are not influenced by monetary policy. News reports about trading regulation and competing altcoins are significant when news trading cryptocurrency.

Commodities

Gold news traders should keep on top of updates regarding inflation, deflation and supply and demand. Supply and demand are also extremely influential on the price of oil and gas, along with any news relating to OPEC (Organisation of the Petroleum Exporting Countries).

How To Trade On The News

Trading on the news involves three key steps: find a suitable broker, conduct research and establish a trading strategy.

Choosing A Broker

First, you’ll need to decide on a broker to execute your trades. Basic checks include whether they offer access to the market you are interested in, the associated spreads and fees, and if they are regulated. The FCA is a reputable regulator in the UK, which ensures protection of funds up to £85,000 through the FSCS.

The tools offered by the broker should also be a deciding factor. In particular, review their trading platform, which might be proprietary or a popular third-party platform such as MetaTrader. Either way, an easily accessible economic news calendar and the ability to place pending orders to lock profit and minimise losses is crucial. Check if the broker has an app so you can keep up-to-date with news and execute trades on the go.

Many brokers offer demo accounts which allow traders to practice using virtual funds first. Practising with yesterday’s trending news is a great way to get familiar with news trading.

Though Trading 212 is an FCA regulated broker, its mobile app ratings are poor. Pepperstone is a great FCA regulated broker which excels in its platform choices, offering 11 types including MetaTrader and cTrader. OctaFX, which is regulated by CySEC, is also a good option for news traders looking to use the MetaTrader platforms.

Research Markets

Taking the time to conduct in-depth research is essential for news-based trading. Books provide the framework for news trading strategies, while subscribing to a trading newspaper, newsletter or podcast will keep you up to date with today’s trading news around the world.

The top websites for news trading include Bloomberg (which also has a radio channel) and Reuters, covering events that impact various markets from brent crude oil to gold. They are also great sources of international news, including US NFP reports and stock exchange information about Nasdaq, ASX, DAX and NSE. The TradingView news feed provides a great free source of events and analysis today, while Telegram has a host of trading channels to pick up tips.

For forex specific trading news releases and updates this week, check out websites such as IG. YouTube is a rich source of information for the best forex secrets and insider tips, which also provides live demos of news trading.

Crude Oil News Trading Strategy Example

The latest crude oil price crash of 2014 was a combination of multiple factors that could have been predicted using news trading. Here, we discuss the specific events to look out for when oil news trading, in addition to how technical analysis can be used to confirm price predictions.

A range of economic news sources provided indications of the oil price decline in 2014:

- GDP reports – Countries such as China, which had pushed up oil prices due to increasing demand in the lead up to the financial crisis of 2008, had weakening economies. This could be observed in their GDP reporting from 2008 onwards.

- Forex analysis – The US Dollar is also important when news trading oil, due to its correlation with oil commodities which are generally traded in USD. Forex analysis shows the US dollar was strong in 2013, encouraging oil production.

- Supply and demand reports – An extended period of high oil prices resulted in overproduction, as captured in the International Oil Agency report which details oil supply and demand.

- OPEC news – The overproduction led the price of oil to drop, subsequently raising the question about whether OPEC would cut production in response. By following OPEC news, traders would have been made aware of the announcement in November that Saudi Arabia were to maintain their oil production levels, leading to a further decline in oil price.

These news reports are backed up by technical analysis including Moving Average (MA) indicators and the Relative Strength Index (RSI). A longer-term MA with a 200 day period can be used in combination with a shorter-term MA with a 20 day period. The shorter-term MA (blue line) crossing below the longer-term MA (green line) is an indication that the trend is moving downwards and is therefore a sell signal. The RSI (purple graph) indicates whether an asset is oversold or overbought, using a scale of 0 to 100. A reading above 80 is considered to be overbought, further confirming the sell signal.

2014 Brent crude oil crash

Algorithmic News Trading

Robots can be used to automate news trading, enabling quicker trading reactions based on vast sources of information. However, training the bot to distinguish which news is relevant can be difficult and may require more complex artificial intelligence methods. Reacting to news announcements such as interest rates at high speed is one example of a simple way to get value from using software algorithms for news trading.

Example news trading robots include Expert Advisors (EAs) and indicators which are available on MetaTrader platforms such as MT4. Many are available for free download from the MetaTrader code library, while traders can also develop bespoke news trading bots using the MQL programming language. News based trading algorithms can be designed to simply set alerts, apply pending orders or carry out more specific trades based on signals. Developers of bespoke bots can use APIs to connect their algorithms to a broker platform, enabling tracking of real-time prices.

Final Word On News Trading

News trading is a popular strategy based on the research of economic events to predict asset prices, across all markets. With traders able to access more news sources than ever, in-depth research of relevant reporting is key. Algorithmic bots can provide the trader with an advantage over manual trading methods, by enabling analysis of vast amounts of economic news data and reacting to events extremely quickly.

FAQ

What Is News Trading Vs Technical Trading?

News trading decisions are based on economic news and events, unlike technical analysis which uses charts and indicators to predict patterns. Technical analysis can be used in combination with news driven trading to confirm predicted trends.

What Is News Based Day Trading?

Day traders can take advantage of the short-term volatility surrounding markets just before and after economic events, such as central bank reports and company announcements.

Which UK Broker Is The Best For News Trading?

Pepperstone is one of the best UK broker choices for news trading. As well as being FCA regulated, it offers a huge range of platform options including MetaTrader and cTrader.

Where Can I Find Trading News Now?

The top news trading websites include Bloomberg and Reuters, covering events that impact various markets including forex. A series of other websites, such as Zerodha, have breaking news pages for traders looking to find information on assets such as gold and oil right now.

What Is a News Trading Forex Strategy?

News trading forex strategies should prepare for the impact of events such as central bank announcements and political news, including general elections. In the UK, these are likely to have the largest impact on USD/GBP and EUR/GBP forex pairs.