Risk Management

Effective trading risk management is fundamental to long-term investing success. Traders must evaluate the risk of their trade against the probability of hitting their goals. In doing so, traders can curb losses and maximise returns. There are many simple, yet effective trading risk management systems and rules which can help traders manage risk. This article will outline a number of key strategies and tools, including the one percent system and stop-loss orders.

What Is Trading Risk Management?

Trading risk management strategies are used to limit losses and protect profits. Risk factors are widely recognised but often overlooked, despite being applicable to all markets and products, from forex, energy, stocks, oil, natural gas, and cryptocurrencies such as Bitcoin to CFDs, futures and options trading.

Using the wealth of software, technologies and resources available, trading risk management systems can be implemented quickly and effectively.

Why Is Trading Risk Management Important?

Risk management based trading should be fundamental when pulling together a strategy. It will ensure you don’t blow all your trading capital on one wrong options trade, for example. It can also protect you from market peculiarities and trader errors. Put simply, trading risk management will help you stay in the investing game for as long as possible.

There are tools and techniques that can be applied to all forms of investing, including model algorithmic trading, quantitative, rogue, swing and manual trend investing.

Trading Risk Management Strategies

While there is no magic formula, there are several key strategies and rules which help traders keep a handle on risk and increase the probability of long-term active investing.

Risk & Reward Ratios

A risk/reward ratio is the sum of money you plan to risk compared to the sum of money you stand to gain. The aim of the trader is to place trades where the potential reward outweighs the potential risk. These trades are considered to have a good risk/ reward ratio.

For example, if a trade may result in either a £500 profit or £100 loss, the trade would have a risk/reward ration of 5:1, making it favourable. Ratios lower than 3:1 are generally considered to be unfavourable. Finding trades with high risk/reward ratios may help you maintain higher than average profits and mitigate losses, making your trading strategy more sustainable.

One Percent Rule

This trading risk management strategy stipulates that no more than one percent of your account capital can be dedicated to any given trade. This is done to ensure that any loss suffered is kept to a minimum and does not affect the overall portfolio. It is a form of diversification and helps to ensure long-term investing success by limiting losses.

Stop Loss & Take Profit

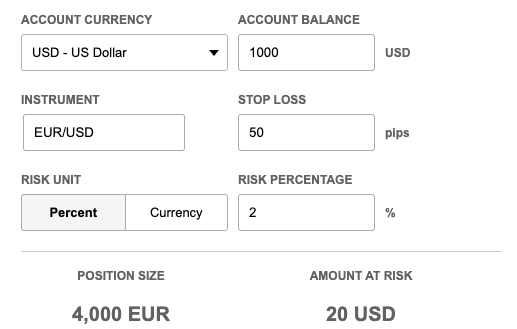

Using stop-losses and take-profit levels, you can calculate how to apply the one percent rule in advance.

Successful traders know what price they are willing to buy and sell at. They can then evaluate the probability of the stock, for example, hitting these targets, and the size of the loss they’re willing to accept if it doesn’t. Trend analysis is used to set these points:

- A stop-loss point is the price at which a trader will sell a stock and take a loss on the trade. This may happen when a trade does not head in the direction a trader planned. The stop-loss point is a damage limitation strategy, designed to limit escalating losses.

- A take-profit point is the price at which a trader will sell a stock and make a profit on the trade. This may occur when any additional profit should be limited due to increasing risk.

Note, due to execution slippage, orders will not always fill at exactly the price desired.

Diversifying & Hedging

Never put all your eggs in one basket. Investing everything in one stock or instrument is potentially setting yourself up for a big loss. Investments should be diversified across both industry and sector. This not only mitigates losses but offers more opportunities for profits.

Trading Risk Management Tools

Brokers offer a number of forex, energy and commodity trading risk management tools, software and systems to help traders manage risk. In addition to push notifications, pending order types and risk calculators, a demo account offers a great way to test new strategies, or old strategies on new markets and instruments, without risking real money.

There is also a multitude of resources applicable to forex, energy or commodity trading amongst others, including articles, psychology pages for beginners and more experienced investors, plus ultimate electronic PDF guides available for download. In addition to software trials, there are some of the best day trading risk management books, practices, trading courses and training online.

Leverage

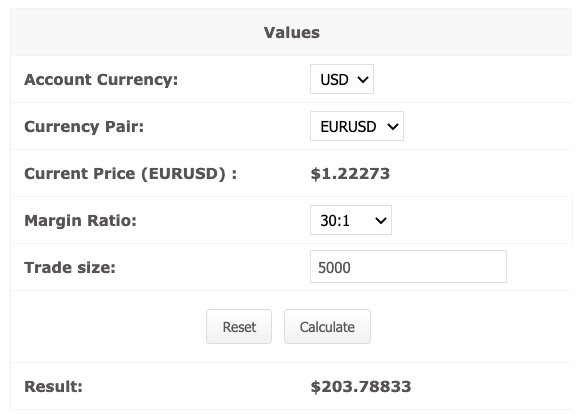

Utilising leverage allows greater investment in trades by effectively borrowing from the broker. It can improve your margins and facilitate greater returns but also much larger losses. If your trade is unsuccessful, all losses made on the trade will need to be covered, including the money borrowed from the broker, increasing the size of the overall loss.

Applying leverage to trades greatly increases risk and should be utilised only by those with the necessary experience. The UK’s FCA limits retail leverage rates to 1:30 to protect traders.

Many top brokers offer a straightforward margin calculator so you can understand how much capital you’ll need to put down.

Unregulated Brokers In The UK

Even when brokers offer a tempting sign-up bonus, it’s sensible to stay clear. Trading with an unregulated broker is an increased risk as you may encounter withdrawal issues. Always trade with regulated brokers and markets where possible. FCA-regulated brokers have to follow strict regulatory standards, including segregating client funds from company capital.

See our list of top brokers for UK-regulated providers.

Benefits Of Trading Risk Management

The advantage of effective trading risk management strategies is to enable longer-term investing by limiting losses. This is the overarching principle that underpins all risk management strategies. This principle can be broken down further into a number of individual benefits, such as increased consistency and greater trading confidence.

Those with clear-cut trading risk management strategies are more likely to consistently make better investing decisions. Also, by having clear aims, you reduce frustrations around not knowing exactly what you want or what you should expect from the financial markets.

Final Word On Trading Risk Management

There are a number of trading risk management strategies available. All help to limit losses and maximise profit. Effective risk management is crucial to long-term trading success and should be a fundamental consideration in every trade decision. Whether you are day trading on forex, natural gas or global derivatives, risk management should be at the forefront of your strategy.