Autochartist Review 2026

Autochartist is an automated technical analysis tool that provides free trading signals and alerts. The plugin is essentially designed to save time and support trading decisions. The software is offered by a growing list of forex and CFD brokers.

This review ranks the best Autochartist brokers in 2026 alongside subscription prices and demo trading. Our tutorial also unpacks the key features of Autochartist and explains how to download and get the most out of the software.

UK Brokers With Autochartist

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IC Trading belongs to the reputable IC Markets group. Designed for dedicated traders, it offers highly competitive spreads, dependable order execution, and sophisticated trading tools. However, it operates from Mauritius, an offshore financial centre, allowing high leverage but within a less regulated environment.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

BlackBull, a New Zealand-based CFD broker, offers a wide range of trading options across more than 26,000 instruments. Following a 2023 rebrand, it boasts a contemporary design and provides advanced trading tools along with ultra-fast execution speeds, averaging 20ms.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Spreadex, regulated by the FCA, provides spread betting across 10,000+ CFD instruments, including 60 forex pairs. Traders have the option to engage in short-term positions on sporting events as well. With a history exceeding 20 years, the company has earned numerous accolades.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Autochartist are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Autochartist support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Autochartist at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| FXPro | iOS & Android | ✘ | ||

| Spreadex | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ |

Beginners Comparison

Are the Autochartist good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Spreadex | ✘ | £0 | £0.01 | ||

| Axi | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Autochartist offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Autochartist.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IC Trading | |||||||||

| BlackBull Markets | |||||||||

| IG | |||||||||

| FXPro | |||||||||

| Spreadex | |||||||||

| Axi |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

Cons

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull provides three ECN-powered accounts—Standard, Prime, and Institutional—to cater to traders of all experience levels, from novices to seasoned professionals. The variety of account types allows for flexible options tailored to individual trading needs and available capital.

- BlackBull provides everything a trader needs: execution speeds under 100ms, leverage as high as 1:500, and competitive spreads starting at 0.0 pips.

- After collaborating with ZuluTrade and Myfxbook, upgrading its CopyTrader, and activating cTrader Copy, BlackBull provides an exceptionally thorough trading experience.

Cons

- Despite enhancements such as webinars and tutorials in the Education Hub, our review indicates that the courses still require greater emphasis on elucidating broader economic factors affecting prices.

- Unlike many leading brokers, BlackBull imposes a bothersome $5 fee for withdrawals. This charge can reduce the overall cost-effectiveness, particularly for traders who regularly transfer funds.

- Despite an expanding range of over 26,000 assets, including new additions to Asia Pacific indices, their offerings are primarily equities. The selection of currency pairs and indices remains average.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG obtained a crypto asset license from the FCA, allowing it to re-enter the UK market to provide buying, selling and storing opportunities on 55+ digital tokens with fees from 1.49%, and all within an FCA-licensed environment.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- Spreadex offers UK traders the chance to earn tax-free profits via spread betting.

- Spreadex has added trading signals to its desktop platform, using Autochartist to deliver real-time, pattern-based insights. These insights assist traders in spotting potential opportunities.

- There is a superb selection of instruments and trading vehicles for short-term traders.

Cons

- The absence of a demo account may dishearten potential clients wishing to evaluate Spreadex's offerings.

- There is no support for expert advisors or trading bots.

- Third-party e-wallets are not permitted.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

Cons

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

What Is Autochartist?

Autochartist Limited (Ltd) is a financial data company that provides automated market analysis to aid trading decisions. The firm was established in 2004 by founder and CEO, Ilan Azbel and operates from headquarters in Nicosia, Cyprus.

Forex.com was the first online broker to offer Autochartist to its traders in 2006. Today, Autochartist is a widely available market scanning and analytical solution that offers insights into forex, stocks, indices, commodities, and cryptocurrencies. Its services support millions of traders in 100+ countries, including the UK.

The tool is mainly provided through a web interface and is available on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as a custom plugin.

Autochartist is compliant with regulatory rules set out by major financial agencies, including the UK’s Financial Conduct Authority (FCA).

How Does It Work?

Autochartist automatically analyses financial information relevant to your watchlist. Results are then published directly within a linked trading platform.

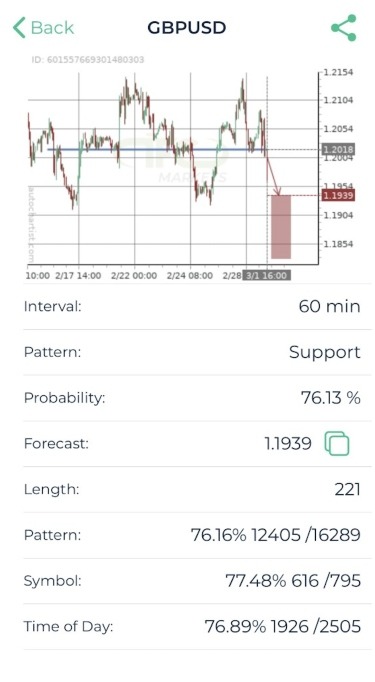

The software monitors the markets 24 hours a day, alerting users to trading opportunities in real time. It has been developed to identify openings based on support and resistance levels, breakouts, wedges, and triangles.

Key Features

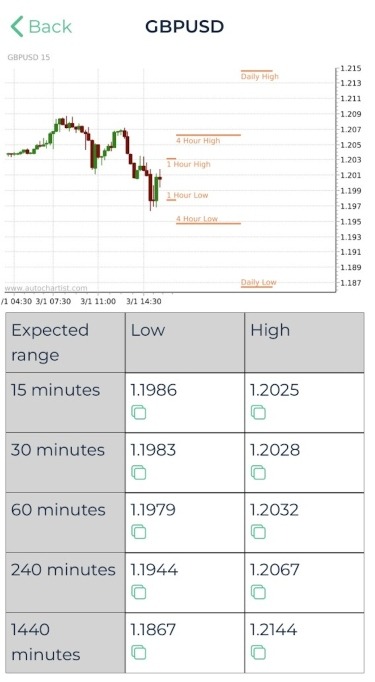

- Volatility Analysis – Detailed volatility evaluation on hourly, daily, and weekly timeframes. The software provides the statistical measure of the dispersion of data around an average over a pre-defined period. Data patterns can be used to set exit levels based on price deviation.

- Risk Calculator – Manage your risk and establish suitable position sizes to help maintain stable trading conditions. The calculator also gives suggested trade volumes to stay within a set risk tolerance.

- Social Sentiment – Community response metrics on major assets every minute. This includes Twitter volumes and conversation dispersion with proprietary Natural Language Processing (NLP). Data can be used as context for trade timing, new investment ideas, and market intelligence.

- Trade Setup Identifier – Chart analysis delivers direct results based on selected instruments. This includes macroeconomic forecasts, consecutive candles, Fibonacci patterns, support & resistance levels, and extreme movements.

- Economic Events – Major announcements and upcoming news can be assessed. The plugin provides an indication of potential price movements based on historic data alongside volatility warnings to protect against significant losses.

- PowerStats – Supports traders in setting stop loss and take profit levels with statistical information on the assets being traded. It can be helpful when creating new trading plans or refining existing strategies.

Installation Guide

Autochartist can be used as a desktop application, web terminal, or via a plugin for third-party platforms like MT4, MT5, and cTrader.

To download the software for a PC/Mac:

- Download or open the web version of your trading platform

- Log in to your trading account using your registered credentials

- Open the Autochartist installation file from your broker and select the setup language

- Review the welcome and disclaimer information and select Next

- Tick the box next to each file path to install the Autochartist plugin

- Click Install and then Finish

- Open your trading platform and drag the Autochartist plugin onto a chart

- Enter your email address to sign up for daily market forecasts and click Save

Once Autochartist has been successfully installed, you can restart your trading platform.

How To Use Autochartist On MetaTrader

To open the Autochartist tool, locate the brand name in the Navigation window under Expert Advisor (EA). Select an instrument from the Market Watch window, such as the EUR/GBP, and then drag the tool onto a chart. The programme will then load the relevant data and display it in an advanced chart.

The navigation menu will be visible in the bottom left of the chart with several features including a pattern probability display, filters, and timeframes. The view icon on the left of the features will automatically update the relevant chart. Select the tick box labelled Display all symbols if you want to view data based on the instruments listed in the Market Watch widget.

Historical price patterns will be available on the graph in a grey colour tone. This provides a visual representation of the direction that the instrument has taken in the past.

Once the close button of the main menu is selected, the programme will remove itself completely from the chart.

Mobile App

Autochartist offers a mobile-compatible app, available for free download on iOS and Android (APK) devices. Autochartist brokers including Pepperstone provide a QR code for the mobile application from their client dashboard area.

Autochartist offers a mobile-compatible app, available for free download on iOS and Android (APK) devices. Autochartist brokers including Pepperstone provide a QR code for the mobile application from their client dashboard area.

Unfortunately the mobile app is fairly basic, with limited customization options. Having said that, the search function enables users to filter by asset type and probability statistics. It is also useful for receiving push notifications whilst on the go.

To get started:

- Download the Autochartist mobile app from Google Play or the Apple App Store

- Log in to your broker’s client area and launch Autochartist

- Scan the QR code on your mobile device

- Search for an instrument in the bottom navigation bar or filter using the funnel symbol

Contact your broker directly for any download help or information as to why the app is not working.

Pricing

Brokers pay Autochartist a licensing fee, so there is not normally a fee for traders. With that said, some brokers may require traders to hold a minimum account balance or meet trading volume criteria. Membership levels also vary between Autochartist brokers, meaning the number of tools and content available may change.

If your broker does not provide access to any version of the tool, consider a subscription-based indicator download that can be integrated into your platform. ChartViper, for example, provides access to Autochartist for £29 per month or £145 for six months.

Pros Of Autochartist

- Alerts – Autochartist can provide email or dashboard alerts every 15 minutes. The tool creates audio and visual alerts for emerging opportunities as they happen in real-time. For example, a highly volatile instrument due to a macroeconomic announcement.

- Customisation – Users can filter search criteria based on specific instruments. This means unrequired data is left out, and information only relevant to your strategy is published. The advanced search filter uses either predefined or selected criteria to find trading opportunities.

- Time-Saving – The tool is a time saver, doing all the market analysis that could otherwise take hours to study manually. Autochartist can scan all instruments within the Market Watch window on MetaTrader, searching for actionable opportunities.

- Integration – Traders can easily drag and drop the Autochartist web application directly onto existing trading platforms. Information can be viewed within one interface, with no switching between screens or additional login required.

Cons Of Autochartist

- Profits Are Not Guaranteed – Returns are not guaranteed even when following trade suggestions. Your trading performance and success rates will still require insights and input. Spend time learning how to use the programme with the best settings, alongside learning the basics of investing.

- No Automated Trading – Although Autochartist is a popular automated market analysis tool, it cannot open and close positions on your behalf. It simply scans the markets for signals and sends alerts and trade suggestions. It is your responsibility to decide how to review and use the signals.

- Inadequate Education – Autochartist takes away from the traditional ‘learning by doing’ aspect of trading. For beginners, it is important to learn how to read market information and interpret financial data.

How To Compare Brokers With Autochartist

As well as checking the quality of the Autochartist package, also consider:

- Demo accounts – Brokers that offer Autochartist typically allow customers to test the programme. A practice account is ideal to get comfortable with the features including how to use the risk calculator download plus chart patterns and indicators. The tool is also available as a free 14-day trial before registration with a broker. Note, all demo accounts will be subject to information delays.

- Trading Platforms – The best Autochartist brokers offer industry-recognised platforms such as MetaTrader 4 and MetaTrader 5 with simple download integration. A stable terminal interface will ensure the Autochartist tool can operate effectively and provide appropriate signals for trading decisions. You should also consider access to mobile trading, which means you can keep up with investments whilst on the go.

- Customer Support – Autochartist does not offer support to retail traders directly. For any issues including MT4 download and integration, how to uninstall Autochartist, or the latest programme updates, you will need to contact your brokerage. It is important to find a broker with responsive customer service during trading hours. This may include via live chat, telephone, or email. IG for example provides 24-hour support, 5 days a week.

- Fees – Although Autochartist brokers do not typically pass costs on to retail investors, it is important to assess trading fees. Commission charges and spreads can eat away at profits. Non-trading fees to consider include inactivity charges, rollover fees, and payments to deposit or withdraw to live trading accounts.

Should You Use Autochartist?

Autochartist is a popular automated market analysis tool. It provides a wealth of trade setup ideas, alerts, and insights to aid decision-making. The software can also be easily integrated into brokers’ trading platforms, often with no fees. However, profits are not guaranteed and the tool will still need oversight and input to get the most out of it. To get started, use our list of the best Autochartist brokers.

FAQs

Is Autochartist Good?

Autochartist is an intuitive automated analysis tool that can be integrated into brokers’ platforms. It provides 24/7 market scanning which can save hours of manual analysis. The software also provides free trading signals, alerts every 15 minutes, and a risk calculator. It is usually available for free when you sign up with partnered brokers.

Does Autochartist Work With MT4?

Yes, Autochartist works with the MetaTrader 4 (MT4) desktop and mobile terminal. It can be downloaded as a free plugin and integrated into the platform interface. Our installation guide provides a step-by-step tutorial on how to get started with Autochartist brokers.

Does Autochartist Work?

Autochartist provides visual price analysis and trade setup suggestions. It considers a wealth of historical data and macroeconomic factors, though what you do with this information is up to you. Some suggest the success rate of Autochartist trade ideas is between 70-80%, but profits are never guaranteed.

What Are Best The Alternatives To Autochartist?

Autochartist provides similar services to Trading Central. Both link with partner brokers and are typically available free of charge. TradingView is also a good alternative that is widely available and offers automated trading bots.

Is Autochartist Suitable For Beginners?

Yes, Autochartist is a good option for beginners. Investors can simply wait for trading alerts from the dashboard. However, it is important to remember success is not guaranteed. Some market knowledge and understanding will help you assess the credibility of trade suggestions.