Best Trading Signal Providers In The UK 2026

Trading signals serve as strategic prompts that assist investors in identifying optimal moments to enter or exit trades. For UK-based investors, these signals are accessible across various markets, including forex, equities, commodities, and cryptocurrencies.

For seasoned traders or beginners starting out, we’ve run tests to pinpoint the best UK brokers with trading signals. Find out how these tools operate and what sets different offerings apart.

Best Brokers With Trading Signals

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

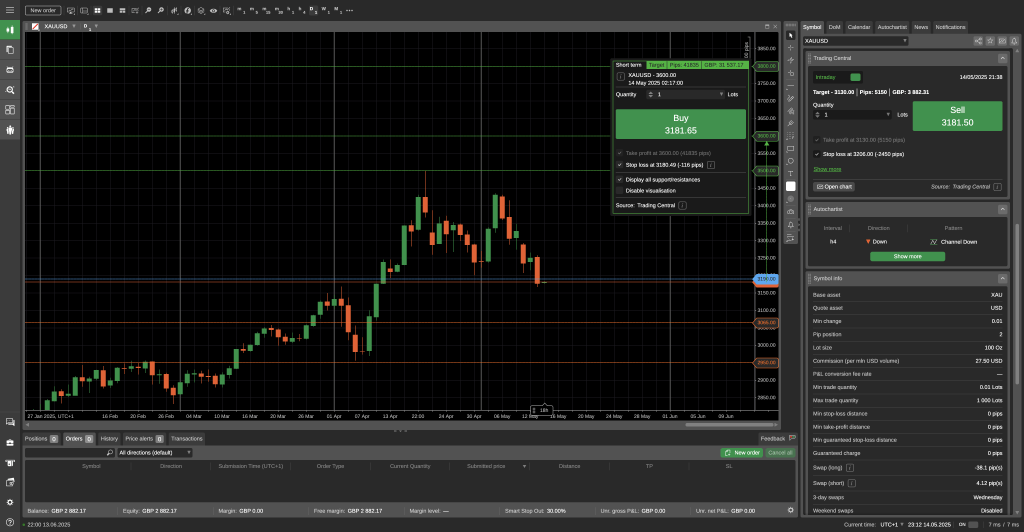

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Spreadex, regulated by the FCA, provides spread betting across 10,000+ CFD instruments, including 60 forex pairs. Traders have the option to engage in short-term positions on sporting events as well. With a history exceeding 20 years, the company has earned numerous accolades.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30

Safety Comparison

Compare how safe the Best Trading Signal Providers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading Signal Providers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Trading Signal Providers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| Spreadex | iOS & Android | ✘ |

Beginners Comparison

Are the Best Trading Signal Providers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| Spreadex | ✘ | £0 | £0.01 |

Advanced Trading Comparison

Do the Best Trading Signal Providers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading Signal Providers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| Spreadex |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- There are appealing new account promotions, such as double the odds and matched betting offers.

- A unique broker offering access to low market cap stocks on the AIM.

- Traders can place wagers on sporting events directly through their brokerage accounts.

Cons

- Limited customer support may lead to delays in resolving issues.

- There is no support for expert advisors or trading bots.

- Third-party e-wallets are not permitted.

We’ve also evaluated and identified the best independent providers of trading signals, operating via specialised software, platforms and apps:

Top Third-Party Signal Providers

What Are Trading Signals?

Trading signals are real-time notifications highlighting potential trading opportunities across financial markets.

These alerts typically include key trade parameters—such as suggested entry points, stop-loss levels, and profit targets—enabling you to make more informed decisions. Rather than offering guarantees, signals act as a decision-support tool that you can choose to follow or ignore based on your strategies.

You can access trading signals for various markets, including forex pairs involving the British pound, stocks listed on the FTSE 100, commodities like gold, and even cryptocurrencies like Ethereum.

Signals are also available for more speculative products, such as binary options, though the FCA has permanently banned the sale of binary options to retail consumers in the UK.

Signal generation can come from two primary sources:

- Automated algorithms that scan market data for patterns, or

- Human analysts using a mix of technical indicators and macroeconomic insights.

Depending on the provider, we’ve found alerts may be delivered through channels that suit different trading styles and preferences, from email and SMS to popular platforms like Telegram, WhatsApp, and Discord.

However, you need to approach signal services with discernment. Every signal is based on human or machine—generated interpretation, which means outcomes are never guaranteed.

For instance, while one provider might anticipate a bullish trend in Bitcoin based on a breakout pattern, another might see insufficient confirmation. This variability highlights the need to assess each signal source’s track record and methodology.

Our testing shows not all providers offer the same level of accuracy or transparency, so conducting due diligence is especially important for UK investors operating under the FCA’s regulatory framework.

I’ve discovered that trading signals are like traffic lights on the financial motorway—they can guide your timing and help you avoid obvious hazards, but they’re not a substitute for driving with skill and awareness.Relying on them blindly can lead you off course. The real edge comes from combining high-quality signals with your judgment, experience, and understanding of the road ahead.

How Do Trading Signals Work?

Trading signals often draw from technical and fundamental analysis, offering a blended perspective on market direction.

On the technical side, signals may be generated using tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), chart patterns, or support and resistance levels—each aiming to pinpoint potential trend shifts or breakouts.

Experienced analysts and automated systems frequently use these indicators to scan markets for price action setups.

Remember, no signal is foolproof, and even a well-structured trade can be undermined by unexpected events or shifts in investor sentiment.

In contrast, signals based on fundamental analysis rely on macroeconomic or corporate developments. This could mean updates tied to Bank of England interest rate decisions, government fiscal policies, or company-specific events like earnings releases and dividend announcements.

These signals attempt to capture movements sparked by real-world news rather than chart patterns alone.

A well-crafted trading signal typically outlines key trade components to help structure a position.

An example trading signal will typically look like this:

Asset: Gold

Order Type: Buy Stop

Current Price: £2,527

Entry Point: £2,530

Take Profit: £2,542

Stop Loss: £2,525

In this scenario, the signal suggests a potential bullish move in gold. You’d set a buy stop order at £2,530, which would only trigger if the price climbs above the current level, confirming upward momentum.

Once in the trade, you’d either exit at the take profit level for a gain or at the stop loss level to cap potential losses. Alternatively, you could manually close the position based on evolving market conditions.

Signals like these can help manage risk and improve timing, especially in volatile markets. However, it is essential to interpret them in the context of broader market sentiment and personal risk appetite.

Pros Of Trading With Signals

- An extensive choice of signal providers is available to UK investors

- You can access opportunities across a wide range of markets

- You stay in control—follow the signal or apply your judgment

- Option to automate trades using copy trading or signal integration tools

- Seamless integration with trusted platforms like MT4, MT5, cTrader and TradingView

- The best signal providers that we’ve tested explain the logic behind each signal

Cons Of Trading With Signals

- You need to be wary of unregulated and fraudulent signal providers – we’ve come across many

- Costs and subscription fees can reduce your overall returns

- Signal effectiveness relies on the provider’s trustworthiness and track record

- Historical success does not guarantee future performance

- Overreliance on signals can hinder your personal skill development

How To Compare Trading Signal Providers

After years following the market and testing many trading signals, we’ve pinpointed the key factors to prioritize when choosing a provider:

Fees

Trading signal services can have different pricing models—some charge a monthly subscription, others a one-time fee. Depending on the provider and service quality, subscription costs typically range from around £10 to £150 per month.

However, certain FCA-regulated brokers like IG and CMC Markets offer free signals from market-leading third parties like Autochartist, Trading Central, and Signal Centre as part of their platform features.

You need to weigh these fees against how often signals are issued. For example, if you’re paying £40 a month and only receive a few signals weekly, those trades must deliver consistent profits to break even, before factoring in other costs.

In addition to the signal fee itself, don’t overlook standard trading costs such as bid-ask spreads, commission charges, deposit or withdrawal fees, and potential inactivity penalties. These expenses can significantly affect your profitability.

Being aware of the full cost structure ensures that you choose a signal service that fits your budget and trading volume.

Top pick for fees: Using IG‘s free trading signals during testing has been a smooth and practical experience, especially when I want quick, data-backed trade ideas. I can access signals from providers like Autochartist and PIA First directly within the platform, which saves me time and keeps everything in one place. What I find especially useful is how the signals are displayed alongside the charts—I get suggested entry and exit points, visual indicators like chart patterns, and timeframe analysis.

Frequency

The number of trading signals you receive often depends on the scope of markets or instruments a provider covers.

For example, a service that monitors the entire FTSE 100 will likely generate more frequent alerts than one focused solely on a specific forex pair like GBP/USD.

Selecting a signal provider—whether broker-based or independent—is essential to match your trading style.

You’ll likely benefit from high-frequency signals across liquid markets if you are day trading. On the other hand, if you prefer long-term trading, you may want fewer, more carefully selected signals based on broader trends or fundamental analysis.

Choosing a provider that aligns with your preferred assets, time horizon, and risk tolerance can help maximise the usefulness of trading signals while avoiding information overload.

Autochartist provides trading signals across multiple timeframes

Notification Method

Trading signal providers deliver alerts through multiple channels, allowing you to stay informed wherever you are. The standard delivery methods we typically see include SMS, email, and push notifications via mobile trading apps, offering real-time updates during market hours.

In addition, many providers share signals through online trading communities or social platforms. Popular apps such as Telegram, Discord, WhatsApp, X, and Reddit are frequently used to distribute signals, particularly for fast-moving markets like forex, cryptocurrencies, and equities.

Autochartist’s email services highlight potential trading opportunities

Platform Integration

Certain trading signal providers integrate their services directly into your trading platform through APIs, streamlining the process of viewing and acting on signals.

Popular platforms like MT4 and MT5 give you access to over 3,200 signal providers, making it easy to compare and select the best options for your strategy.

MetaQuotes, the developer of MT4 and MT5, even offers tools to review provider details, including growth, win percentages, subscriber counts, and costs, helping you make informed decisions.

For those using the popular cTrader platform, market-leading providers like Trading Central and Autochartist have also integrated their services, offering advanced charting tools, pattern recognition, and technical analysis directly within the platform.

These features allow you to act more efficiently and precisely on high-quality signals.

Trading Central signals in cTrader can be copied with a single click

Mobile compatibility is another increasingly important consideration. Many of the top brokers with trading signals that we’ve used provide apps for iOS and Android devices, allowing you to receive and act on signals even when away from your computer. This ensures you don’t miss trading opportunities, regardless of your location.

Top pick for platform integration: When I use IC Markets through cTrader, I appreciate how Autochartist and Trading Central trading signals are built into the platform. I don’t have to jump between websites or apps—the signals pop up directly within my chart view. For example, if Autochartist identifies a potential breakout on the GBP/USD pair, I can instantly see the pattern, suggested direction, and key levels like entry and stop-loss. Moreover, I can act on the signal with a few clicks, making it easy to respond quickly to market moves without overthinking. It’s a big plus for keeping my workflow fast and focused.

Research & Education

Top-quality signal providers often go beyond sending alerts by offering valuable research and educational resources to help you develop your skills.

These providers typically include in-depth market analysis, technical and fundamental analysis tutorials, and detailed breakdowns of the strategies used to generate signals.

For example, they might explain how specific indicators like the RSI or MACD are interpreted, or why specific chart patterns trigger particular signals.

This educational support can help you understand the rationale behind the signals and empower you to make informed decisions on your own.

Autochartist’s pattern descriptions teach traders the logic behind each setup

Bottom Line

Trading signals can offer helpful insights when navigating the forex, commodities, and broader financial markets, particularly for newcomers seeking assistance with trade timing and market entry points.

A wide range of trusted providers supply signals across multiple platforms and asset classes, allowing you to match signal services with your trading approach, whether short-term scalping, medium-term swing trading, or a longer-term investment strategy.

That said, trading signals should be used to support, not replace, your market analysis. Overdependence on signals may prevent you from building critical trading skills or adapting to new market conditions.

UK investors should also be cautious, as the digital landscape includes regulated providers and unlicensed operators. To stay secure, consider working with trusted trading signal providers.

Careful research is essential to avoid unreliable services and potential financial loss.

FAQ

Are Trading Signals Legit?

Trading signals can be legitimate, especially when offered by reputable providers or FCA-regulated brokers. Many use proven strategies based on technical or fundamental analysis.

However, the market also includes scams and low-quality services, so you should carefully review performance data, user feedback, and regulatory status before relying on any signal provider.

Are Trading Signals Worth It?

Trading signals can be worth it to save time, learn from expert analysis, or identify opportunities across various markets. They’re especially useful for beginners or those with limited time for research.

However, their value depends on the provider’s accuracy, transparency, and how well the signals align with your trading goals, so careful selection is key.

Do Trading Signals Work?

Trading signals can work, but their effectiveness depends on the provider’s strategy, market conditions, and how you use them.

High-quality signals based on solid analysis can help identify good trade setups, but they’re not foolproof. You should treat them as tools to support decision-making, not guaranteed paths to profit.