Best Brokers For Trading Ethereum 2026

Ethereum exploded onto the scene in 2015 to become one of the most prominent cryptocurrencies and a main rival to Bitcoin. Today, it is one of the few crypto assets that’s gained mainstream recognition, and investors in the UK can choose from many different brokers to buy, sell and trade ETH.

Dive in to our list of the best Ethereum brokers – reviewed and rated by our team of experienced traders, that includes investors who have held ETH on various platforms for many years.

Top Ethereum Brokers

-

IG provides more than 55 crypto CFDs and digital assets for trade and storage. It uniquely features a crypto index tracking the top 10 digital currencies by market cap, allowing broad speculation on the crypto market’s value. In the UK, its crypto services strengthened post-acquisition of an FCA digital asset licence, enabling regulated trading and investment in leading cryptocurrencies.

Crypto Coins- BTC

- ETH

- SOL

- XRP

- BCH

- ADA

- TIA

- LINK

- EOS

- HBAR

- ICP

- LTC

- NEAR

- NEO

- ONDO

- PEPE

- DOT

- POL

- SHIB

- XLM

- SUI

- TRX

- TON

- UNI

- DOGE

- AAVE

- APT

- ARB

- AVAX

- CRYPTO10

Crypto Spread Crypto Lending Platforms Variable No Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Crypto Staking Minimum Deposit Regulator No $0 FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA -

XTB provides a robust array of over 50 cryptocurrencies, featuring competitive spreads beginning at 0.22% on Bitcoin and leverage up to 1:5. The xStation platform facilitates trading with pairs like ETH/BTC and DSH/BTC. Traders can operate round-the-clock in a secure and transparent cryptocurrency trading environment.

Crypto Coins- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

Crypto Spread Crypto Lending Platforms 0.22% No xStation Crypto Staking Minimum Deposit Regulator No $0 FCA, CySEC, KNF, DFSA, FSC -

IBKR offers access to Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at attractive commission rates without the need for a crypto wallet. Furthermore, traders can explore a variety of assets, including crypto indices like the NYSE Bitcoin Index, and futures contracts such as BAKKT Bitcoin Futures.

Crypto Coins- BTC

- LTC

- ETH

- XRP

Crypto Spread Crypto Lending Platforms 0.12%-0.18% No Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Crypto Staking Minimum Deposit Regulator No $0 FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM -

Kraken is a dedicated crypto exchange offering over 220 cryptocurrencies, including major tokens like Bitcoin and various altcoins. Traders can engage in spot markets with leverage of up to 5:1, or in futures markets with leverage up to 50:1. The platform provides low fees and is highly user-friendly.

Crypto Coins- AAVE

- ALGO

- ANT

- REP

- REPV2

- BAT

- BAL

- XBT

- BCH

- ADA

- LINK

- COMP

- ATOM

- CRV

- DAI

- DASH

- MANA

- XDG

- EWT

- EOS

- ETH

- ETC

- FIL

- FLOW

- GNO

- ICX

- KAVA

- KEEP

- KSM

- KNC

Crypto Spread Crypto Lending Platforms 0-0.26% average No AlgoTrader, Quantower Crypto Staking Minimum Deposit Regulator Yes $10 FCA, FinCEN, FINTRAC, AUSTRAC, FSA -

The broker’s Bahamas entity facilitates access to cryptocurrencies. Traders can utilise a vast array of indicators to customise their strategies, with transparent pricing and no hidden fees.

Crypto Coins- BTC

- ETH

- LTC

Crypto Spread Crypto Lending Platforms Fixed No TN Trader, MT4 Crypto Staking Minimum Deposit Regulator No $0 FCA, ASIC, FSCA, SCB, FSA -

Trade over 15 popular cryptocurrencies such as Bitcoin and Ethereum. Engage in trading these digital assets 24/7, with transparent fees. Access up to 1:10 leverage on leading tokens like BTC.

Crypto Coins- BTC

- ETH

- LTC

- BCH

- DOT

- EOS

- LINK

- XLM

- NEO

- ADA

- SOL

- XRP

- BNB

- XMR

- AVAX

- DOGE

Crypto Spread Crypto Lending Platforms Variable No ActivTrades, MT4, MT5, TradingView Crypto Staking Minimum Deposit Regulator No $0 FCA, CMVM, CSSF, SCB -

FXOpen provides more than 40 cryptocurrency CFDs, featuring both crypto-only pairs and those paired with traditional currencies like GBP, USD, and JPY. Traders can leverage their crypto CFD trades at a ratio of 1:2. There are three types of orders available: market, limit, and stop, and scripts are on hand for automated trading.

Crypto Coins- BTC

- BCH

- ETH

- LTC

- ETC

- EOS

- DSH

- XRP

- IOT

- XMR

- NEO

Crypto Spread Crypto Lending Platforms 9.0 (BTC) No TickTrader, MT4, MT5, TradingView Crypto Staking Minimum Deposit Regulator No $100 FCA, CySEC, FC

Safety Comparison

Compare how safe the Best Brokers For Trading Ethereum 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Kraken | ✔ | ✘ | ✘ | ✘ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| ActivTrades | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Trading Ethereum 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Kraken | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| ActivTrades | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Trading Ethereum 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Kraken | ✔ | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| ActivTrades | iOS & Android | ✘ | ||

| FXOpen | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers For Trading Ethereum 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Kraken | ✔ | $10 | Variable | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| ActivTrades | ✔ | $0 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers For Trading Ethereum 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Kraken | Kraken Futures is integrated in other platforms which have bots: Bookmap, Caspian, FMZ Quant, Gunbot, HaasOnline, Hyndor, Margin | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| ActivTrades | Yes (APIs), Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (UK and EU), 1:400 (Global & Pro) | ✘ | ✘ | ✔ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Trading Ethereum 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Kraken | |||||||||

| Trade Nation | |||||||||

| ActivTrades | |||||||||

| FXOpen |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Kraken

"Kraken is ideal for traders seeking a wide range of cryptocurrencies, including Bitcoin, along with an excellent security reputation."

Pros

- An impressive selection of over 220 well-established cryptocurrencies.

- Has maintained an excellent security history with no breaches over the past ten years since inception.

- Mobile investing

Cons

- Slow processing times

- Limited support for newer altcoins.

- Delayed verification for Pro accounts.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- The trading firm provides narrow spreads and a clear pricing structure.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On ActivTrades

"ActivTrades stands out for traders at every level, offering nearly unparalleled execution speeds of 4ms. Choose from top-tier trading software like MT4, MT5, TradingView, or the user-friendly ActivTrader, perfect for budding traders."

Pros

- ActivTrades is a reputable firm with over 20 years in the financial sector. It holds authorizations from three top-tier regulatory bodies, according to DayTrading.com's Regulation & Trust Rating. For UK traders, it offers enhanced protection with £1 million in investor compensation, surpassing the £85,000 provided by the FSCS, should the firm face insolvency.

- Based on our tests, ActivTrades offers swift and reliable support via live chat, email, and phone in multiple languages. This makes it an excellent choice for both traders and newcomers seeking quality assistance.

- While cTrader isn't supported, MT4, MT5, TradingView, and the broker's ActivTrader platform accommodate various trading requirements. The firm's web-based platform has proven user-friendly and visually appealing for novices during testing.

Cons

- Its research tools are decent, although somewhat lacking. The expanding 'Analysis' hub is useful, but the absence of Trading Central or Autochartist means advanced technical insights are missing. This limitation may hinder traders seeking to spot opportunities in volatile markets.

- The platform lacks features for copy or social trading, which is a disadvantage for traders interested in passive investing or replicating the trades of seasoned traders. This is particularly evident when compared to eToro and Vantage.

- ActivTrades needs improvement in educational resources to compete with firms like XTB and CMC Markets. While it offers well-presented and informative webinars, the selection of courses and quizzes remains limited, hindering a more comprehensive and engaging learning experience for traders.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

Cons

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

How to Choose an Ethereum Broker

We’ve found that the best ETH brokers consistently perform well in these areas:

Trust

A broker’s reliability and regulatory status are the first things we evaluate in each review – if we’re not convinced that a broker or exchange is secure enough to invest our money, then none of the fees or other criteria matter.

For ETH brokers, the first step in determining a reliable broker is simple – we check whether it’s regulated by the Financial Conduct Authority (FCA). Any broker with an FCA license must live up to stringent standards to obtain it, and they must prove their continued compliance hang onto their license.

However, in some cases Ethereum investors choose a crypto exchange or offshore broker that doesn’t have an FCA license.

We’ve found that these, too, can provide reliable service to traders, though you need to do your due diligence and choose carefully.

The reliable ETH exchanges and offshore brokers have years in the industry serving large numbers of clients without reports of dishonest practices. Many also implement similar protections to those mandated by the FCA, such as segregating clients’ funds and undergoing regular third-party audits.

IG Index offers spot trading of ETH and other cryptocurrencies.

- IG has often led the field of UK-based ETH brokers for years, thanks to its FCA license, top-rate reputation among traders, and huge list of features and services. These include spot trading of Ethereum and other crypto tokens, plus some of the best education and research tools around to help you polish your skills and plan trades.

Charting Platform

Choose an ETH broker with a strong trading platform that allows you to efficiently analyse price movements and execute trades with a strong range of in-built tools and indicators.

We’ve found that online brokers often support tried-and-tested third-party platforms like MetaTrader 4 and MetaTrader 5, as well as popular contemporary platforms like TradingView.

Crypto exchanges are more likely to use proprietary platforms, which can take some getting used to if you’ve regularly used a more conventional trading platform.

- IC Markets consistently tops our charts for its trading platform options, which include four of the most popular and feature-rich out there: MT4, MT5, cTrader and TradingView.

Pricing

You should looks for a broker that offers low average fees when trading Ethereum – especially if you plan to make frequent trades, as fees will add up and cut into your profits.

Also look out for non-trading fees, such as on deposits and withdrawals or for accounts that remain inactive – the latter can be an issue if you plan to buy and hold ETH for long periods, as they will add up over months.

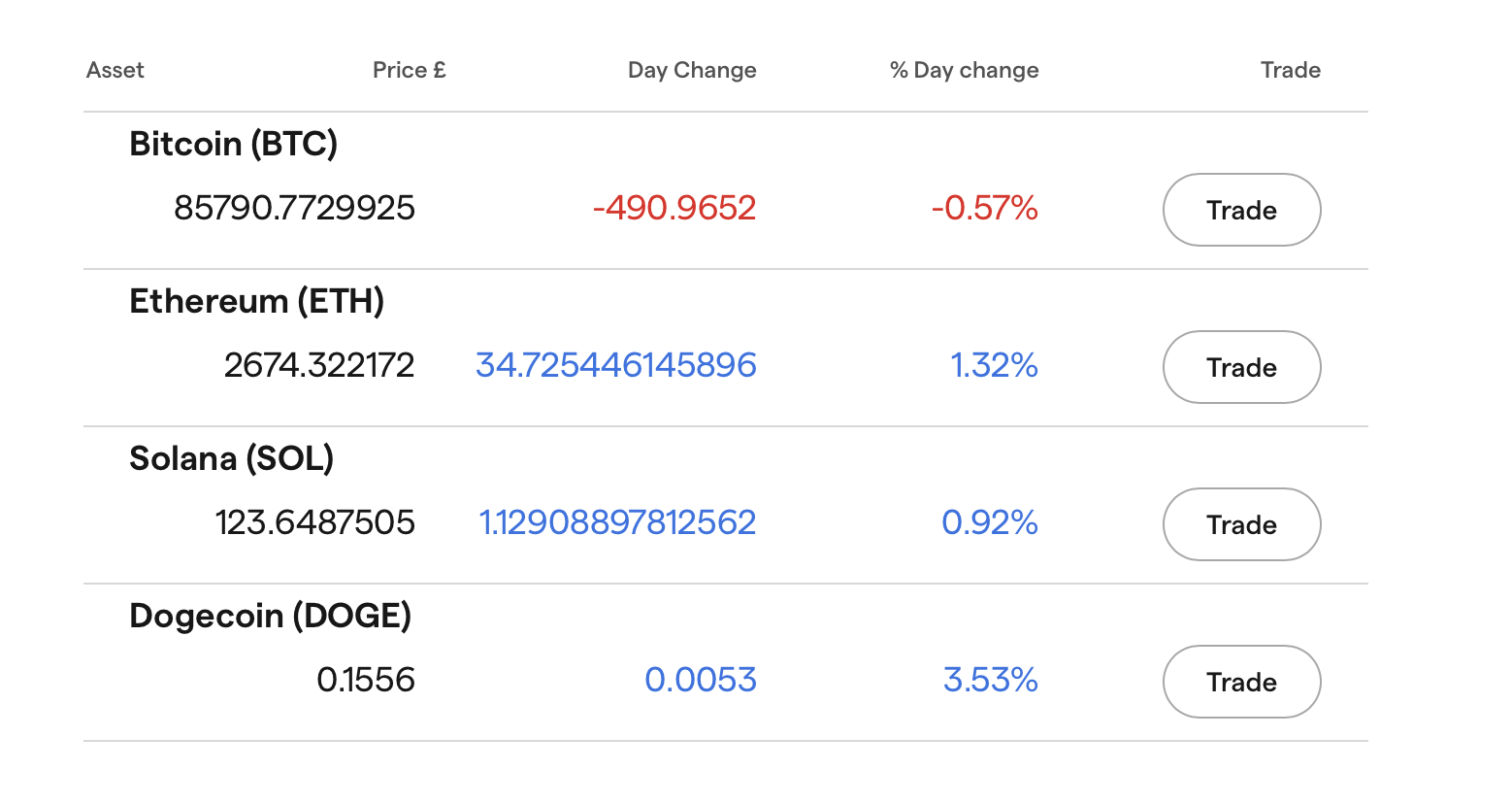

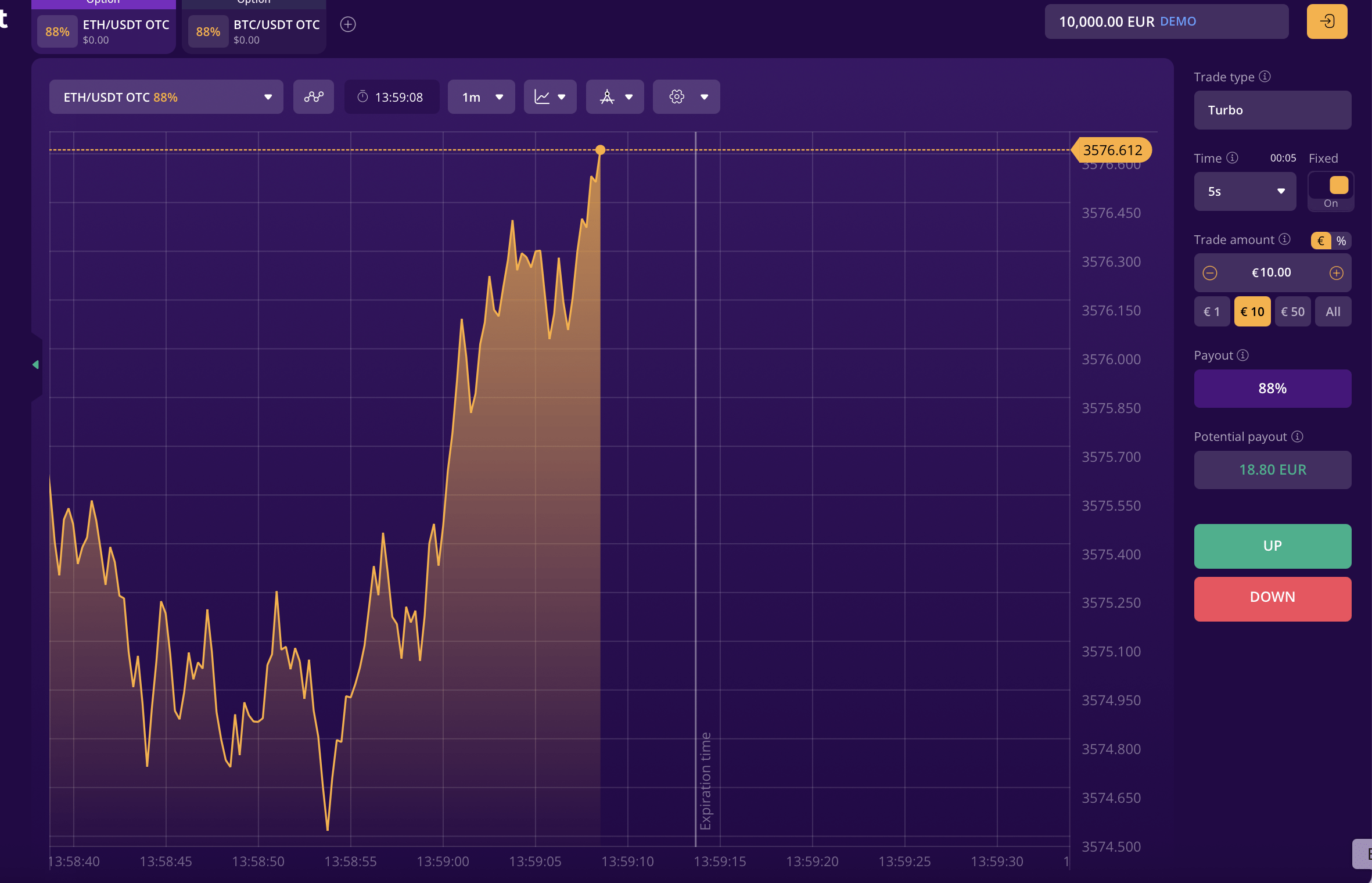

Trading ETH on IQCent’s proprietary platform

- IQCent remains our top-choice ETH binary broker thanks to its high payout of 88% on ETH/USDT. Traders with higher-tier accounts have the chance to boost this to 91% – higher than almost any ETH binary broker out there.

Account Options

You should make sure the ETH broker’s account options suit you before signing up, and avoid any that require larger minimum deposits than you’re comfortable with.

Over years trading ETH, we’ve found that most brokers accept new clients for an initial deposit of between £50 and £250, though some will go as low as £5 or even £0.

Other account options to look out for include perks like interest payments on your uninvested account balance, or the opportunity to stake your ETH tokens in return for a yield.

- Kraken has proven itself over the years as a reliable crypto exchange, and its low US$10 minimum deposit and high-interest ETH staking make it one of the most accessible and versatile accounts that ETH traders can open.

Leverage

Not all ETH investors need leverage, but if your trading style requires it you’ll need to look for an exchange or higher-risk offshore broker, since the FCA doesn’t allow this trading style for the retail market.

We’ve found that the leverage available on crypto products like ETH usually doesn’t exceed 1:100. This is already a very large amount of leverage for a volatile instrument, so we suggest sticking to far lower levels.

When trading with leverage, you’re using borrowed funds that you’ll need to pay back if the trade turns against you. If you’re trading with leverage of 1:100, then for every pound you lose, you’ll need to add another 100 to your losses. Since cryptocurrencies like ETH are prone to very large price movements, this makes for very risky trading so I personally steer clear of highly leveraged ETH trades.

- BlackBull Markets continues to impress our experts as an ETH broker with excellent execution quality, a clear reputation and flexible leverage up to 1:100 on ETH/USD CFDs.

Chart

How to Trade Ethereum

Trading Vehicles

In the UK, crypto investors have a few options to choose from if they want to trade ETH tokens:

- Spot trading – Most commonly, UK investors buy and sell ETH tokens on the spot market. This is the only way to directly trade ETH and other cryptocurrencies with an FCA-regulated broker.

- CFDs – Many crypto traders use contracts for difference to bet on ETH price movements, often using leverage and in pairs with fiat currencies such as ETH/USD or other crypto tokens like ETH/BTC. While this is a popular way to trade Ethereum, it’s not permitted by the FCA, so UK investors must use a riskier offshore broker to do so.

- Other derivatives – Besides CFDs, there are other popular crypto derivatives used to trade ETH such as futures and perpetual swaps. There are usually found on dedicated crypto exchanges, which are not generally licensed by the FCA.

- Indirect ETH trading – A few stocks correlate with Ethereum to some degree, such as crypto mining companies like Hive Digital Technologies (TSVX: HIVE). Some of these are available on FCA-regulated brokers, allowing UK traders to make leveraged plays on assets that reflect ETH price movements. There are also several ETH ETFs, though these are not available to UK retail traders.

Broker Vs Exchange

Crypto exchanges are the most common destinations for trading Ethereum and other cryptocurrencies, and they have some advantages such as tight spreads, large ranges of crypto tokens and the opportunity to trade ETH derivatives with leverage.

The drawback is that these exchanges are not typically licensed by the FCA in the same way as some online crypto brokers, so they don’t have the same protections. Traders who sign up with FCA-regulated brokers can be assured their firm:

- Regularly submits financial reports to ensure continued compliance with the FCA’s stringent standards

- Holds client funds in segregated accounts so they don’t mix with business funds

- Implements negative balance protection to prevent traders’ losses from exceeding their account balance

- Participates in the Financial Services Compensation Scheme (FSCS), ensuring that up to £85,000 of each client’s funds are insured in case of business failure.

Head to the FCA’s website and search for a broker’s company name or license number on the Financial Services Register to check that it is currently licensed.

Investing or Trading?

Ethereum investors usually hold assets for the medium- to long-term, while traders will often buy and sell an asset more quickly to try to profit from shorter-term price movements.

Since they’re seeking gains from much smaller time frames, and often from small price movements, traders will look for the tightest spreads – the difference between the buy and sell price – and low or no commission fees. Exchanges often have an advantage when it comes to this pricing, especially those that discount frequent traders.

Exchanges also often support leveraged trading via ETH derivatives. These can also be found in some offshore brokers in the form of Ethereum CFDs.

However, the spread and leverage become less important when you’re holding your ETH tokens for the long term, and especially if you plan to invest a large amount in Ethereum and hold it for the long term, we see stringent regulation as far more important.

Over years of trading and investing in Ethereum, I’ve seen the risks of trading with unlicensed brokers and exchanges play out time and again as massive players like FTX collapse and their clients face millions in losses.If you’re just looking for a place to invest in ETH tokens, an FCA-regulated broker will be the most secure place to do so.