Best ECN Brokers In The UK 2026

ECN (Electronic Communication Network) brokers offer direct market access, tighter spreads, and faster execution—crucial advantages for investors aiming to maximise profits and minimise costs.

We cut through the noise to highlight the top UK ECN brokers that deliver transparency, reliability, and competitive trading conditions.

Top ECN Brokers

-

Upon assessment of VT Markets’ ECN Raw account, execution speeds averaged 35–40ms with minimal slippage. Spreads on key pairs such as EUR/USD frequently reached 0.0 pips, with a $6 round-trip commission. Liquidity proved dependable across sessions, making it an excellent choice for trading and automated systems.

Instruments Regulator Platforms CFDs, Forex, Commodities, Stocks, Indices ASIC, FSCA, FSC VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral Min. Deposit Min. Trade Leverage 50 - 500 USD 0.01 Lots 1:500 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Errante, a regulated forex and CFD broker based in Cyprus, provides trading on a variety of assets with leveraged options. It offers tiered accounts, including one with zero spreads, and supports copy trading. Under its CySEC regulation, leverage is available up to 1:30, while its offshore branch offers leverage up to 1:500. Traders can utilise MetaTrader 4 and MetaTrader 5 platforms. Although Errante's asset selection is somewhat limited, the company is known for its fast execution, low latency, and reliability.

Instruments Regulator Platforms CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos CySEC, FSA MT4, MT5 Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:500 -

TMGM, an ASIC-regulated broker, offers a broad selection of tradeable assets, including forex, stocks, indices, cryptocurrencies, and commodities. Traders can choose between account options that feature either no commission or zero spreads, ensuring competitive pricing throughout.

Instruments Regulator Platforms CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex ASIC, FMA, VFSC MT4, MT5, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:500 -

Anzo Capital is an offshore broker providing leveraged CFDs on over 100 instruments, such as forex, stocks, indices, and metals. It supports the MetaTrader 4 and MetaTrader 5 platforms. Traders can opt for an STP account with spreads from 1.4 pips and no commission or an ECN account with spreads from zero and a $4 round-turn commission. A variety of payment methods, including cryptocurrency deposits, are accepted.

Instruments Regulator Platforms CFDs, Forex, Precious Metals, Stocks FSC, SVGFSA, FCA MT4, MT5 Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Pacific Union Prime, regulated by the FSCA and offshore authorities, is a multi-asset broker providing competitive fees and direct market access. It offers trading in forex, commodities, stocks, bonds, and indices. Traders can utilise the widely-used MetaTrader 4 and MetaTrader 5, as well as a bespoke mobile app. Fees differ by account type: the Standard account has no commission, with spreads starting from 1.9 pips, while the Prime account charges $7 commission per lot with spreads from 0.4 pips.

Instruments Regulator Platforms Forex, Commodities, Cryptocurrencies, Stocks, Indices ASIC (Australian Securities and Investments Commission), FSA (Financial Services Authority of Seychelles), FSCA (Financial Sector Conduct Authority), SVGFSA (Financial Services Authority St Vincent & The Grenadines) MT4, MT5 Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:500 -

AdroFx, an offshore ECN/STP brokerage, has been providing CFD trading services since 2018. It offers over 100 assets for trading on the widely-used MetaTrader 4 platform and also on the Allpips web trader. There are eight live account options available, with no limitations on trading strategies.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Metals, Cryptos VFSC, FSA, BSSLA Allpips, MT4 Min. Deposit Min. Trade Leverage $25 0.0001 Lots 1:500

Safety Comparison

Compare how safe the Best ECN Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| VT Markets | ✘ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| Errante | ✘ | ✔ | ✘ | ✔ | |

| TMGM | ✘ | ✔ | ✘ | ✔ | |

| Anzo Capital | ✔ | ✘ | ✘ | ✔ | |

| PU Prime | ✘ | ✘ | ✘ | ✔ | |

| AdroFX | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best ECN Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| VT Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| Errante | ✘ | ✔ | ✔ | ✔ | ✔ | ✘ |

| TMGM | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Anzo Capital | ✘ | ✔ | ✔ | ✔ | ✔ | ✘ |

| PU Prime | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| AdroFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best ECN Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| VT Markets | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| Errante | iOS & Android | ✘ | ||

| TMGM | iOS & Android | ✘ | ||

| Anzo Capital | iOS & Android | ✘ | ||

| PU Prime | iOS & Android | ✘ | ||

| AdroFX | iOS &; Android | ✘ |

Beginners Comparison

Are the Best ECN Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| VT Markets | ✔ | 50 - 500 USD | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| Errante | ✔ | $50 | 0.01 Lots | ||

| TMGM | ✔ | $100 | 0.01 Lots | ||

| Anzo Capital | ✔ | $100 | 0.01 Lots | ||

| PU Prime | ✔ | $50 | 0.01 Lots | ||

| AdroFX | ✔ | $25 | 0.0001 Lots |

Advanced Trading Comparison

Do the Best ECN Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| VT Markets | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| Errante | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✘ | ✘ |

| TMGM | ✔ | ✘ | 1:500 | ✔ | ✘ | ✘ | ✘ |

| Anzo Capital | Myfxbook AutoTrade plus Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✔ | ✘ | ✘ | ✘ |

| PU Prime | - | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| AdroFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best ECN Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| VT Markets | |||||||||

| Tickmill | |||||||||

| Errante | |||||||||

| TMGM | |||||||||

| Anzo Capital | |||||||||

| PU Prime | |||||||||

| AdroFX |

Our Take On VT Markets

"VT Markets is an excellent option for traders seeking tight spreads and robust charting tools. The broker excels in share CFDs, offering hundreds of commission-free assets across various global markets."

Pros

- Traders have access to various analytical tools from trusted sources, such as the Market Buzz AI by Trading Central and a personalised economic calendar.

- The top-tier MetaTrader 4 and 5 platforms are available, providing sophisticated charting tools and access to Expert Advisors (EAs).

- VTrade offers a proprietary trading service accessible on two platforms, connecting you with over 100 providers.

Cons

- Unlike peers such as Fusion Markets, VT Markets lacks cryptocurrency trading options.

- The broker's bonus programmes have strict conditions, including limits on minimum deposits and acceptable payment methods.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

Cons

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

Our Take On Errante

"Errante is ideal for those interested in multi-asset trading on MT4 and MT5. Its copy trading feature and simple registration are perfect for novice traders."

Pros

- Excellent range of educational resources and effective trading instruments.

- Copy trading accessible for traders.

- Respected and reliable broker dealing in multiple assets.

Cons

- Substantial deposits are required to access premium account levels, offering more advantageous trading conditions.

- Limited range of stocks

- Accessing advanced educational content often incurs significant costs.

Our Take On TMGM

"TMGM excels as a versatile option due to its extensive asset range, varied account types, multiple platforms, and competitive pricing."

Pros

- Robust platform integration with MetaTrader 4, MetaTrader 5, and IRESS.

- Vast array of assets, featuring 10,000 international stocks.

- A variety of rewards and bonuses available through a points-based loyalty programme.

Cons

- Shares can be traded exclusively through the IRESS account. They are not accessible via MT4 or MT5 platforms.

- A £30 monthly fee is charged on accounts inactive for six months or with balances under £500.

Our Take On Anzo Capital

"Anzo Capital is ideal for traders seeking high-leverage CFDs, offering flexibility in choosing between STP and ECN accounts."

Pros

- Forex, oil, and silver trading with spreads starting from zero pips.

- Top-tier liquidity providers, such as Goldman Sachs and HSBC

- Supported in multiple languages.

Cons

- Restricted selection of assets

- Unavailable in the United States

- Week regulatory oversight

Our Take On PU Prime

"PU Prime attracts traders with high leverage and low fees in a direct market setting."

Pros

- Multilingual customer service

- A strong selection of nearly 1,000 instruments spans six asset classes.

- Swap-free Islamic account

Cons

- For withdrawals below $100, there's a relatively steep minimum charge of $40 including a handling fee.

- No primary regulatory supervision.

- Standard account spreads are average.

Our Take On AdroFX

"AdroFx attracts traders seeking an efficient and cost-effective method for high-leverage currency speculation through two reliable platforms, such as MetaTrader 4. Nonetheless, testing indicates it lags behind top trading brokers in areas like regulation and investment offerings."

Pros

- With over 60 currency pairs available, this extensive range surpasses many competitors, offering ample opportunities for forex traders.

- MetaTrader 4 is accessible, designed for experienced traders, offering a comprehensive charting suite.

- Pro account holders receive complimentary VPS access to enhance automated trading on MT4, while other traders can obtain it starting at an affordable rate of £10.

Cons

- The research tools provided are quite basic and offer limited insights into future events that could assist new traders in spotting opportunities. This is particularly evident when compared to more robust platforms such as eToro.

- Most payment methods incur hefty withdrawal fees, such as a 1.9% charge on card transactions. However, this cost is typically avoidable with leading trading brokers.

- With just over 100 instruments, the selection is limited, especially in stocks and cryptocurrencies. This narrow range restricts diversification, making the platform less appealing to seasoned traders.

How We Selected The Top ECN Account Brokers

Our UK-based team carried out in-depth testing on a long list of providers, focusing on brokers offering true ECN trading accounts to UK clients.

Each broker was rated based on performance across critical areas: execution speed, slippage, raw spreads, commission structure, and liquidity.

Our final rankings combine hands-on testing with data to highlight the most reliable, low-latency ECN brokers for active traders in the UK.

How To Choose An ECN Broker

- Market coverage determines what assets you can trade. A strong ECN broker should offer deep liquidity across a wide range of markets, including major forex pairs such as GBP/USD, UK indices like the FTSE 100, and even UK-listed stocks or gilts. Broader access to tradable instruments means you can diversify strategies, hedge positions, and take advantage of local market events—all within the same high-speed, low-latency ECN environment. Limited asset access can restrict your ability to respond effectively to UK-specific news and economic shifts.

- Trading platforms directly affect how efficiently and accurately you place trades. Advanced platforms like MT4, MT5 or cTrader offer features such as one-click trading, custom indicators, and access to Level 2 market depth—crucial for analysing liquidity on assets like GBP crosses or FTSE 100 futures. A reliable execution tool ensures minimal lag, accurate pricing, and the ability to automate trades—especially important during fast-moving UK market sessions or key economic releases, such as BoE rate decisions. The wrong platform can limit your speed and strategy execution.

- Order execution performance determines how quickly and accurately your trades are filled at the expected price. In fast-moving UK markets—such as during BoE rate announcements or FTSE 100 earnings seasons—even a fraction of a second delay can lead to slippage, where trades are filled at worse prices than intended. A high-performance ECN broker routes orders directly to liquidity providers with minimal latency, ensuring you capture real market prices, especially on volatile instruments like GBP/USD or UK government bonds. Poor execution can eat into profits or turn winning trades into losses.

- Fees and costs directly impact your bottom line. ECN brokers typically charge tight raw spreads plus a fixed commission per trade, which can add up quickly—especially if you’re trading actively. Unlike brokers who build costs into wider spreads, ECN brokers separate these fees, so you need to calculate your total trading cost precisely. Understanding how commissions affect your returns is crucial, particularly when trading during volatile sessions where volume—and expenses—can spike.

- Analytical features enhance your ability to interpret the market and manage trades in real-time. Quality platforms should offer tools such as economic calendars, depth-of-market views, and automated strategy support. These features enable you to respond to events such as BoE updates or GDP releases. Without robust analytical features, your ability to make timely, informed decisions is limited—no matter how fast your execution is.

- Leverage allows you to control larger positions with a smaller amount of capital, thereby amplifying both potential profits and risks. FCA-regulated brokers typically cap leverage at 1:30 for major forex pairs, such as GBP/USD, and lower for more volatile assets, including UK equities or indices. While leverage can enhance returns during strong market moves, it also increases your exposure to losses. The right broker should offer flexible leverage options with proper risk management tools.

- Trading accounts determine your access to spreads, commission rates, minimum deposits, and execution conditions. Some brokers offer raw spread accounts with lower spreads and fixed commissions, ideal for active trading, while others provide commission-free accounts with slightly wider spreads, better suited for beginners. It’s also important to look for accounts that support GBP as a base currency, which avoids conversion fees.

- Capital thresholds and payment methods affect how easily you can start trading and manage your funds. Some ECN brokers require higher initial deposits—often £200 or more—due to the professional-grade execution and access to deep liquidity pools needed for trading assets like GBP/USD or FTSE 100 CFDs. Additionally, flexible funding options that include UK-friendly methods, such as Faster Payments, PayPal, or debit cards, help ensure smooth and fast transactions without unnecessary currency conversion fees or delays, enabling you to react quickly to market opportunities.

- Reliable support helps you resolve execution problems, platform glitches, or funding concerns quickly—minimising costly downtime or missed opportunities. Brokers offering 24/5 UK-based support and multiple contact channels (live chat, phone, email) provide peace of mind, ensuring you’re never left stranded when precision and timing are critical.

- A regulated broker ensures that your funds and personal data are protected under strict rules set by authorities such as the FCA in the UK. Regulation ensures transparent pricing and fair execution. Additionally, licensed brokers must hold client funds in segregated accounts and participate in compensation schemes, giving you extra security against broker insolvency or malpractice.

Using an ECN broker is like stepping onto the trading floor—when I trade I can see real liquidity, feel the momentum, and trust that every price comes straight from the market, not a middleman.

What Is An ECN Broker?

An ECN broker acts as a direct bridge, connecting traders to the global financial markets by linking them with multiple liquidity providers, including banks, hedge funds, and other traders.

Unlike traditional brokers, ECN brokers like IC Markets and Fusion Markets don’t take the other side of your trade. Instead, they route your orders directly into the market. This means you’re trading ‘in the raw’ with access to real-time prices, tighter spreads, and greater transparency.

How does this work in practice? When you place a trade through an ECN broker, your order enters a digital network where it’s matched with the orders of other market participants.

This system fosters a competitive environment where prices fluctuate based on actual supply and demand, often leading to more favourable pricing and faster execution.

When evaluating an ECN broker, check if they offer access to Level 2 pricing, which displays the full order book depth and allows you to see the available liquidity at each price level. It’s a powerful tool that reveals market sentiment and can help you time entries and exits more effectively, especially in fast-moving UK markets.

ECN brokers typically charge a small commission per trade, rather than generating revenue from widening spreads, which aligns their interests more closely with those of traders.

ECN brokers differ from other types, such as STP (Straight Through Processing) brokers and market maker brokers.

STP brokers also send your orders directly to liquidity providers, but typically mark up spreads slightly to cover their costs, striking a balance between transparency and ease of use.

Market Makers, on the other hand, act as the counterparty to your trades—they ‘make the market’ by setting their bid and ask prices, which can lead to wider spreads and potential conflicts of interest.

If you prioritise transparency, speed, and actual market pricing, ECN brokers generally offer the most direct and fair trading environment.

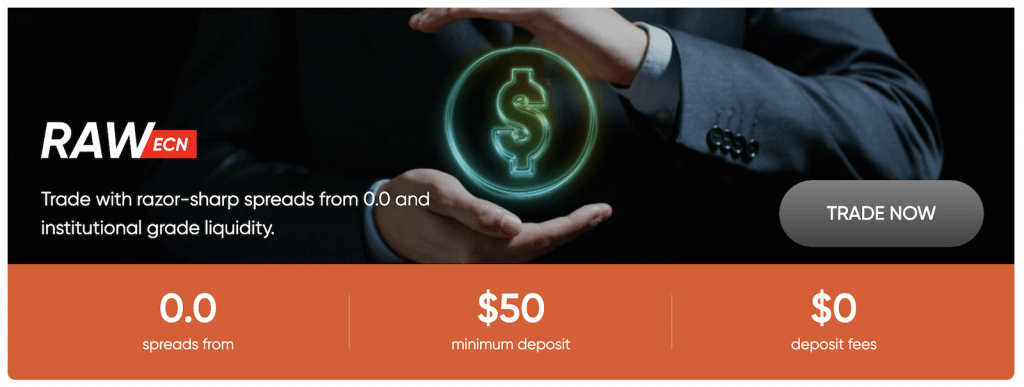

Vantage’s RAW ECN account offers you greater control over your trades

Pros Of ECN Accounts

- Tighter spreads from deep liquidity pools: ECN brokers aggregate quotes from multiple liquidity providers—such as tier-one banks and institutional traders—resulting in ultra-competitive, variable spreads. During high-liquidity periods, spreads can drop close to zero (e.g., 0.1 or 0.2 pips on major GBP forex pairs), which significantly reduces trading costs, especially for high-frequency or scalping strategies. Since ECN brokers don’t manipulate spreads for profit, you benefit from actual market conditions without artificial widening.

- No dealing desk intervention: Unlike market makers, ECN brokers don’t operate a dealing desk, meaning they never take the opposite side of your trade. Instead, orders are matched anonymously within the ECN, ensuring non-conflicted execution. This eliminates issues like price manipulation, requotes, or intentional slippage. Moreover, ECN brokers typically support advanced order types (e.g., limit orders inside the spread) and partial fills, which are crucial for algorithmic or institutional-style trading.

- Transparent trading environment: One of the standout features of ECN brokers is complete pricing transparency. You can often see the full depth of the market (Level 2 data), which displays all bid/ask quotes and order volumes in real-time. This visibility provides an edge in analysing order flow, gauging market sentiment, and timing entries with precision. For technically minded traders, this transparency supports more informed decisions and aligns well with data-driven strategies.

Cons Of ECN Accounts

- Commission-based fee structure can add up: While ECN brokers offer razor-thin spreads, they typically charge a fixed commission per trade, often per lot (e.g., £4–£7 round-trip per standard lot). For high-frequency traders or those placing many small trades, these commissions can quickly erode profits—especially in low-volatility markets where price movement is minimal. Unlike with STP brokers, where costs are built into wider spreads, you must manage cost-per-trade more carefully to maintain profitability.

- High sensitivity to market volatility & slippage: ECN brokers provide true market access, which means you’re directly exposed to natural market conditions, including price spikes, gaps, and slippage—particularly during major news events or low-liquidity periods. Unlike Market Makers, who may buffer execution during high volatility, ECN platforms do not guarantee fills at your requested price. Orders are filled based on real-time liquidity, so even with faster execution, partial fills or execution at worse-than-expected prices can occur, especially with large order sizes.

- Higher minimum deposits & more complex platforms: Because ECN brokers cater to more experienced traders and institutions, they often require higher minimum deposits (e.g., £500–£1,000+) and offer advanced trading platforms, such as cTrader and MT5. These platforms provide tools like Level 2 data, one-click trading, and complex order types—but can overwhelm beginners unfamiliar with depth of market (DOM) views or fast-paced execution settings. The steeper learning curve may deter casual traders.

Trading through an ECN broker taught me the value of raw pricing—when I’m no longer second-guessing spreads or hidden markups, my focus shifts entirely to strategy and execution.

Bottom Line

Choosing the best ECN broker requires a careful balance of factors tailored to your trading style and goals. Look for brokers that offer direct market connectivity with competitive costs, fast and transparent order execution, and robust platforms equipped with advanced analytical tools.

Ensure the FCA fully licenses them to provide security and trust, and consider the range of tradable UK assets and account options available.

By prioritising these elements, you can find a broker that effectively supports both your trading ambitions and risk management needs.

To get started, dig into our choice of the top ECN account brokers.