Scalping Trading Strategy

A scalping trading strategy involves executing fast-paced trades with extreme accuracy. The aim is to get in and out of a trade quickly, making just a few pips on each position. Over time the pips accumulate, creating larger profits. In this article, we dive into the best 5 scalping strategies that work across multiple assets, including forex, stocks, gold, futures and options.

Top Scalping Trading Brokers

How To Use A Scalping Trading Strategy

A scalping trading strategy works by holding positions over a very short time frame, typically around 1 – 5 minutes. The system is a type of day trading strategy as no position is ever held overnight. Traders aim to close a position once they are in profit, making only a few pips each time. These short, sharp trades are made frequently enough so that one or two pips can turn into 50+ pips per day.

Manual Or Automated

Scalping can be executed manually or using an automated trading robot. Robots, or Expert Advisors (EAs) as they are known, are often preferred because they can open and close a position much quicker than a manual trader can.

Speed of execution is vital in scalping as the profits per trade are relatively low. Just as profits can rack up quickly, losses can too – so accuracy is crucial. EAs are based on an algorithm written in a coding language such as C+ or Python. They look at data points and are programmed to execute a trade based on logic, rather than human emotion or feeling – another key factor in the success of a scalping trading strategy.

Liquidity Of The Asset

A scalping trading strategy can be used with any tradable asset, such as cryptos, stocks or commodities like gold. But it is most popular in forex. This is due to the liquidity of the FX market. Scalpers usually trade only the most liquid currency pairs, such as the USD/EUR or JPY/USD.

They’ll also be aware of the best time frame for each asset. For example, the EUR/USD is generally traded between 7 am and 8 pm GMT Monday to Friday, but it is most liquid between 1 pm and 4 pm GMT when volumes pick up dramatically, making this the ideal time of day to scalp.

Tight Spreads

Scalping is profitable for those who can hold their nerve and execute positions quickly. But it also relies on brokers having the tightest spreads. There are some scalping trading strategies that will not work with spreads above 2 pips as this leaves limited room for profit. As a result, traders should shop around for the best rates.

Best Scalping Trading Strategies

When considering how to create your own scalping day trading strategy, it’s important to consider your options. We’ve listed 5 of the best strategies below to help you find one that works for you.

Relative Strength Index (RSI)

The RSI is an oscillating indicator often used in scalping trading strategies. It tells a trader when the market is overbought or oversold. When the RSI value is over 70, this suggests the market is overbought. This means the price is higher than it should be and traders may want to sell before it drops back down to its expected value. When the RSI value is under 30, this suggests the market is oversold and the price is lower than it should be. Some analysts choose to operate on more extreme RSI values of 80 or 20.

RSI

The RSI Index has been known to extend way beyond the 70/30 limits, and so it is advised that traders supplement this indicator with other momentum or trend indicators to avoid errors. Traders should also set a stop loss to cover against positions that could wipe out profits from previous scalping trades. For example, an SL of -6 pips is a good place to start but should be regularly reassessed and increased or reduced as necessary.

Volume & Price Action

Price action trading and scalping go hand in hand due to the short, sharp decision making required. A volume indicator can tell you which way the market is heading and so volume and price action can be paired together to form a scalping trading strategy.

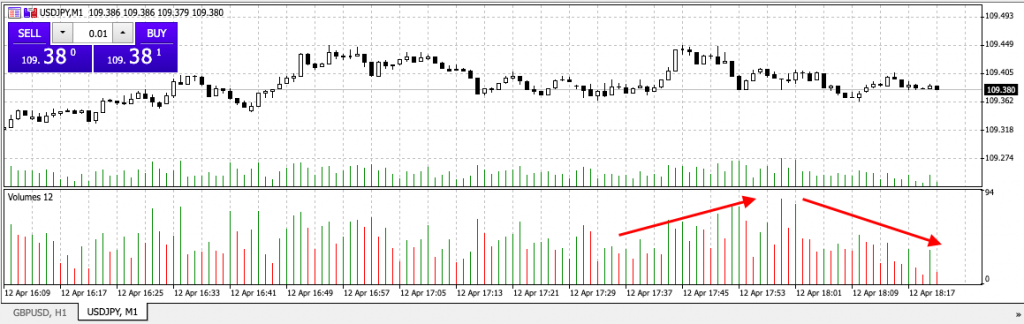

Volume

If the volume traded in an asset is reducing, the market is slowing. This could indicate an imminent trend reversal, or it could mean a short break before it continues to move again. Price action involves reading the market for these changes, making a prediction based on the movements and trading accordingly.

Moving Averages

A moving averages (MA) scalping trading strategy is another good option. Add the MA indicator to a short timeframe chart. Compare the moving average for a shorter and a longer time period (EMA-5 and EMA-20 will work). Once the EMA-5 crosses the EMA-20, you have an idea of which direction the trend will move in and can take a position in this direction.

Moving averages

Be sure to close your position within the 20 minute time frame and have stop losses set up in case the trend doesn’t emerge.

Stochastic Oscillator

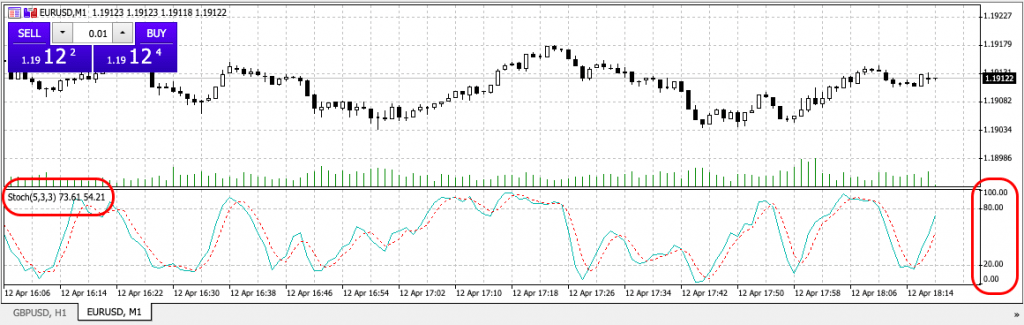

The stochastic oscillator is a type of momentum indicator that assesses the random probability distribution. This means it looks at the current price in relation to its range over a period of time. Just like the RSI indicator above, it will give a number between 0 and 100 which will indicate the likelihood that an asset is overbought or oversold.

Stochastic Oscillator

ZigZag Strategy

The ZigZag indicator helps traders to identify trends. When the forex price moves more than a certain percentage from your pre-chosen amount, the indicator will plot points and create a straight line on the chart. These lines indicate a swing high or low greater than 5%.

ZigZag

In this way, it removes minor price movements to make trends more easily visible. It is usually combined with another indicator, like the Elliot Wave, as it helps traders identify where each wave is positioned within the overall cycle. The ZigZag indicator is not provided by default on MT4 and so it will need to be downloaded from the MetaTrader Market.

Tips For Implementing A Scalping Trading Strategy

Check Your Broker Is Suitable

Brokers that are prone to slippage are not suitable for scalping trading strategies. Slippage is when a trade is executed a few pips away from the intended buy or sell price. For a scalping trader operating at such minute profits, this could be the difference between a trade concluding in the red or black. Look for brokers that can guarantee execution prices. Also note that some brokers do not allow scalping trading systems on their platforms.

The Right Environment

It’s vital that your trading operation is suitable for a scalping trading strategy. This means having the basics in place, such as a fast internet connection and no interruptions. It may seem overly simple, but there’s no room for error when scalping trading.

The Correct Charting Time Frame

Scalping trading strategies involve very small time frames. Some traders prefer to use tick charts, but one and two-minute charts are also popular. For beginners, it’s recommended that you start with a 5-minute chart until you’ve built enough practice to progress to shorter time frames.

Final Word On Scalping Trading Strategies

The best scalping system will minimise the likelihood of error by ensuring their broker and operations are capable of fast-paced execution. It will utilise indicators where appropriate, ideally using one of the 5 simple scalping trading strategies above. Also, it will leave emotional or knee-jerk reactions at the door.

Now you’re armed with the basics, you can start to build your own forex or stock trading strategy for scalping. Plus, if you’re interested in learning more, there are plenty of scalping trading strategy books and pdf guides available for download which will help you curate more advanced techniques. They’ll take you beyond the top 5 listed above to help you find a scalping trading strategy option that works for you.

FAQ

Is Scalping A Day Trading Strategy?

Yes, all scalping is day trading as it involves opening and closing a position within a very small time frame – usually a matter of minutes. Trades are short and sharp, just like a scalpel, with the aim of generating a few pips profit per position. However, not all day trading is scalping, there are many other day trading strategies out there and scalping is just one of them.

What Is The Best Scalping Trading Strategy?

This depends on your experience, risk appetite and market conditions. Not all scalping strategies work for every trader so there is no ‘best’ strategy. Practice on a demo account and find out which works for you. Once you’re happy that you’re making a profit, you can have a go with real funds.

Is Scalping A Good Trading Strategy?

Scalping can be a hugely successful trading strategy for the right trader in the right conditions. Those undertaking a scalping trading strategy should maintain a laser focus on accuracy and limit exposure where possible. They should choose a broker with guaranteed execution prices and an asset with sufficient liquidity. Implementing these will increase the likelihood of a successful scalping trading strategy.

Is Scalping Suitable For Beginners?

Yes, scalping is a great strategy for beginners because its main premise involves limiting exposure to loss. Trades are only open for a few minutes, so the likelihood of large losses is very low. This means beginners can practice creating profitable trades, while steadily building both profits and expertise.

How Does Scalping Trading Work?

The scalping trading strategy uses short, sharp and frequent trades to generate a couple of pips with each position. Traders use indicators to identify trends in an asset’s price movement and buy/sell based on this. Over time, the pips can accumulate, resulting in large scale profits.