Best Trading Software In The UK 2026

Whether investing in stocks on the FTSE 100, dabbling in crypto, or speculating on GBP forex pairs, the right trading software can make all the difference. This beginner’s guide explains how trading platforms work and lists the best trading software in the UK.

List of Top Trading Software

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Trading Software In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading Software In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Trading Software In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Trading Software In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Trading Software In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading Software In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Beginners benefit from a modest initial deposit.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

How Did Investing.co.uk Choose The Best Trading Software?

Our evaluation began by confirming that each platform in our growing database is available to UK traders and supports live trading accounts.

We then used our proprietary scoring system to assess more than 200 data points across eight key areas, including FCA regulation, software performance, platform features, mobile compatibility, ease of use, and overall reliability.

This comprehensive approach ensures that our recommendations are based on the specific needs and priorities of UK investors using trading platforms today.

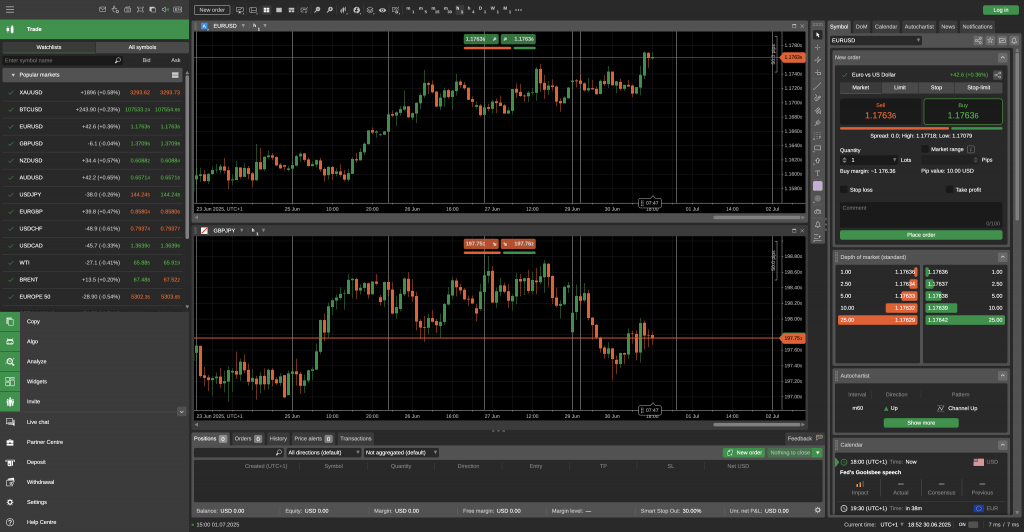

What Is Trading Software?

Trading software refers to digital platforms that allow you to access financial markets, place trades, and manage your portfolios in real time.

Whether you’re dealing in stocks on the London Stock Exchange, forex pairs like GBP/USD, or crypto assets like Bitcoin, trading software provides the tools to execute trades quickly and efficiently from your desktop, web browser, or mobile device.

Modern trading platforms offer much more than basic order placement. They offer advanced charting tools, technical indicators, price alerts, news updates, and economic calendars.

Many UK-regulated brokers also integrate risk management features, such as negative balance protection and stop-loss and take-profit orders, to help you limit exposure.

Importantly, the best trading software is user-friendly and tailored to specific strategies – whether you’re a casual investor, a day trader, or a long-term portfolio builder.

Some platforms also offer Expert Advisors (EAs), allowing you to run trading bots or set up rules-based trading without manual input.

Ultimately, in my years of trading I’ve learned that trading software acts as the control centre – combining data, analysis, execution, and account management into a single interface to give you a competitive edge.

cTrader Web delivers fast, intuitive trading right in your browser

How To Pick Trading Software In The UK

Choosing the best trading software for a UK trader or investor comes down to a few key factors: regulation, usability, cost, and the tools that match your trading style.

First and foremost, ensure the platform is authorised and regulated by the Financial Conduct Authority (FCA) – this ensures your funds are protected and the broker operates under UK financial standards.

You’ll also want to think about what and how you trade. If you’re focused on UK stocks, forex pairs like EUR/USD, or indices such as the FTSE 100, choose a platform that offers fast execution, low trading costs, and access to the markets you care about.

Always check the platform’s execution speed and reliability during peak UK market hours. Fast, stable order execution is critical to avoid slippage and missed opportunities, especially when trading volatile instruments like commodities or GBP currency pairs.

Active traders might prioritise advanced charting, technical indicators, and automation tools, while long-term investors may value research features and portfolio tracking. Mobile access and ease of use are also essential, especially if you trade on the go.

Let’s examine what you need to know to make an informed choice and find the software that fits your strategy and helps you trade with confidence.

How Trading Software Works

Understanding the core components of trading software is essential. Whether you’re running algorithmic strategies or manually analysing the FTSE 100, trading platforms typically have four specialised functions: market data, charting, execution, and platform integration.

Market Data Feeds

Reliable, low-latency data is the backbone of any trading setup. For equities and derivatives traded on UK exchanges like the LSE, data is often tiered – Level 1 shows top-of-book prices and Level 2 reveals full market depth.

Institutional and high-frequency traders in the UK usually pay for direct market access (DMA) to reduce slippage and improve execution precision.

In contrast, forex data is fragmented due to its decentralised structure, so you’ll have to rely on liquidity providers (LPs) and electronic communication network (ECN) feeds.

Check how frequently the data updates (tick-by-tick versus snapshot), as it can significantly affect scalping and intraday strategies.

Advanced Charting & Technical Tools

While many brokers offer basic charting, serious traders, myself included, often opt for specialist platforms like MetaTrader, TradingView, cTrader, MultiCharts, or ProRealTime. These tools provide tick-level charting, custom scripting, and robust backtesting environments.

The ability to layer multiple timeframes, run Monte Carlo simulations, and test strategies against historical tick data is essential when developing robust trading systems or validating setups before committing capital.

Integrating custom indicators and automated alerts also provides a significant advantage.

Order Execution Systems

The execution layer is where analysis becomes action. While retail traders may use web-based platforms like IG‘s or eToro‘s interface, more advanced users often require platforms with API support (e.g., FIX protocol, REST, or WebSocket) to implement automated strategies.

Key features include bracket orders, one-click trading, partial close functionality, and built-in risk management settings.

I’ve used tools like the MetaTrader software with custom EAs and low-latency VPS hosting to reduce execution delay, especially when trading fast-moving markets like GBP/USD around UK economic releases.

Broker vs Third-Party Trading Software

Broker-native platforms (like CMC Markets’ Web Platform or Saxo’s SaxoTraderGO) are typically plug-and-play, but our testing shows they can be restrictive if you need advanced customisation or multi-broker access.

Independent trading platforms, such as Quantower or NinjaTrader, offer broader functionality, including order flow visualisation, depth-of-market tools, and the ability to connect to multiple brokers or data feeds via a unified interface.

Third-party platforms are ideal for multi-asset trading, combining analysis and execution in one interface for greater efficiency across brokers and markets.

Free vs Subscription Trading Software

There’s no universal trading software – your choice depends on your strategy and markets.

Simple approaches like moving average tracking on UK shares need basic tools, while complex strategies or real-time forex trading require advanced platforms with automation and fast data feeds.

Use demo accounts offered by FCA-regulated brokers to ensure the software matches your needs before committing.

While cost matters, the cheapest option isn’t always the best (trust me). Some platforms come free with brokerage accounts, but premium software often charges fees for features like deep market data and advanced analytics.

Platforms like Bookmap may be pricier, but they offer powerful tools that justify the investment.

From my experience, adding features down the line often costs more than choosing a fully equipped platform from the start.That’s why it’s crucial to check if your broker includes the software or if it comes with additional fees before you commit.

Mobile Trading Software

For many traders, accessing markets anytime, anywhere, is increasingly important. However, not all leading trading platforms offer fully functional mobile trading apps, which can limit your ability to respond quickly to market movements when you’re away from your desktop.

If you often trade during your commute, between meetings, or outside the traditional home office setup, choosing trading software with a robust, user-friendly mobile app is essential.

The best mobile trading platforms provide seamless access to real-time market data, advanced charting tools, order execution, and risk management features – allowing you to monitor positions and place trades confidently anywhere.

Prioritising mobile compatibility ensures you won’t miss out on crucial trading opportunities simply because you’re away from your computer.

TradingView’s mobile app offers powerful charting and real-time market data

Bottom Line

When choosing the best trading software in the UK, remember that the broker you select often limits the tools you can access.

Free platforms might be tempting, especially for new traders. Still, they can lack advanced features like fast data feeds, technical indicators, or automation in our experience – tools that can improve trading decisions and results.

It’s also important to remember that software designed for forex may not be ideal for stocks or cryptocurrencies.

Always research platforms based on the markets you trade and use demo accounts to try trading software before committing fully.