Expert Advisors

Brokers with expert advisors (EAs) offer a powerful automation feature available on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. With algorithmic investing becoming ever more accessible, more traders are looking to learn how to use EAs. In this guide for UK traders, we will cover what expert advisors are, how they work and how to enable them in MT4. Our team have also produced a list of the best expert advisor brokers in 2026:

Top UK Brokers With Expert Advisors

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Expert Advisors are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Expert Advisors support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Expert Advisors at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| FXPro | iOS & Android | ✘ |

Beginners Comparison

Are the Expert Advisors good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Expert Advisors offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Expert Advisors.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Trade Nation | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| FXPro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

- The trading firm provides narrow spreads and a clear pricing structure.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

Cons

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

What Are Expert Advisors?

Expert advisors are programs coded to perform automated, hands-free trading on the MetaTrader 4 and MetaTrader 5 platforms. EAs can be designed, programmed and compiled individually from within the dedicated MQL MetaEditor or purchased from the MetaTrader Market.

Many traders publish their EAs on the MQL stores, either allowing public use for free or requiring a fee to be paid. MT4 and MT5 EAs come in all shapes and sizes, from simple SMA crossover strategies to complex, multi-asset hedging and netting systems that combine fundamental and technical analysis approaches. Outside of the MetaQuotes platforms, expert advisors are referred to as trading bots, robots or investing algorithms.

Expert advisors are a great way to remove limiting factors from hands-on trading strategies. Namely, human emotion, speed (or lack thereof), availability limits and cognitive holdbacks. By building a repeatable strategy that (hopefully) works consistently and setting it to run automatically, you remove the emotional component of decision-making, ensuring that trades are based solely on evidence and patterns.

In addition, an EA will often react more quickly to market events, take advantage of profitable opportunities while you are away from the computer, and not be distracted by irrelevant information.

How Do EAs Work?

Expert advisors are programmes in the MetaTrader terminals that perform automated trading tasks.

They can be programmed in the MetaEditor to perform technical analysis of price data and manage trading activities based on the signals they receive. This allows them to efficiently perform analysis and automatically open or close trades on behalf of the trader.

What Platforms Offer Expert Advisors?

Expert advisors are primarily available on the MetaTrader 4 and 5 trading platforms. These platforms are designed to seamlessly integrate with EAs, interfacing with MetaQuotes’ proprietary programming languages (MQL4 & MQL5).

Note, some other third-party platforms, such as cTrader, also offer a form of expert advisor trading.

How To Make An Expert Advisor

Creating an expert advisor does not require proficiency in MQL4 and MQL5, you can do it without programming experience. While those with a greater understanding of programming will find it easier to build and optimise complex EAs, those new to algorithmic investing can take advantage of the MQL5 Wizard. This tool uses a graphical interface to help generate an automated trading bot within MT5, making the process much simpler. A step-by-step guide to using the wizard is given below.

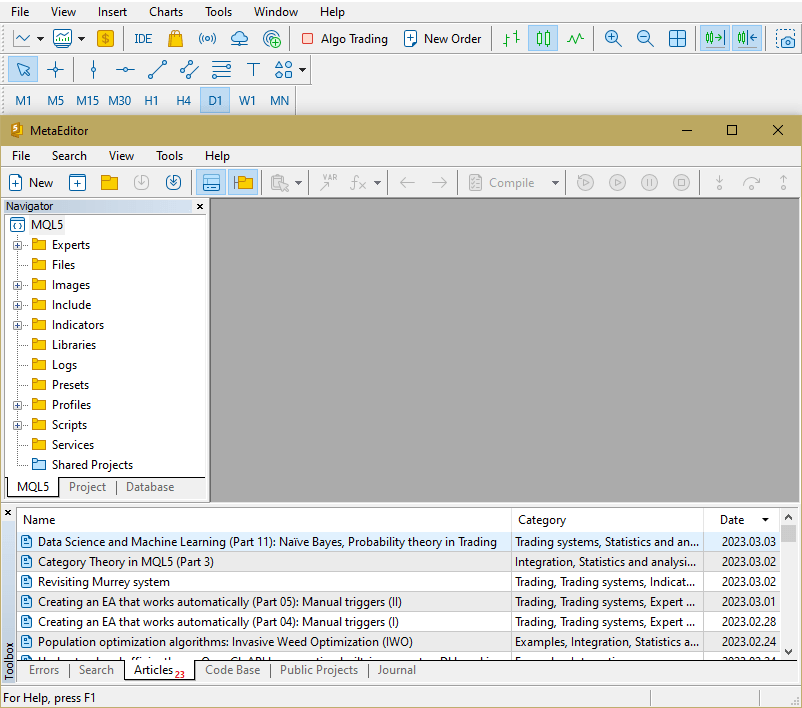

MetaEditor is the built-in scripting window within MetaTrader 4 and MetaTrader 5 that allows users to produce scripts and generate their EAs with MQL4 and MQL5. Note that MQL5 allows users to produce expert advisors that can work up to 20 times faster than their equivalents in MQL4.

While using expert advisors, our experts found that it is key to test any EA you plan to use before giving it the chance to play with your money. This can be done in real-time markets within the MT4 or MT5 demo account environment, a mock account with simulated funds and live pricing data.

Alternatively, you can use MT5’s strategy backtesting feature, which lets you test EAs on an extensive history of asset values. However, there is no guarantee that an EA that is profitable in one period will perform the same in another. Longer periods of testing can mitigate this phenomenon, though the further you go, the more the market characteristics will have changed.

Beginner’s Guide To Creating MT5 Expert Advisors

- Open the MetaEditor from within the MetaTrader 5 platform. This can be done by clicking the IDE button in the toolbar or pressing F4.

MT5 MetaEditor

- Click the New button in the MetaEditor toolbar to access the MQL5 Wizard. This will produce a menu from which you can generate an EA, create a custom indicator, implement scripts, create a new class and more. Click on the Expert Advisor (Generate) button.

- Next, type in the name of your EA. The author and link can also be changed here. Click Next to continue onto the parameters.

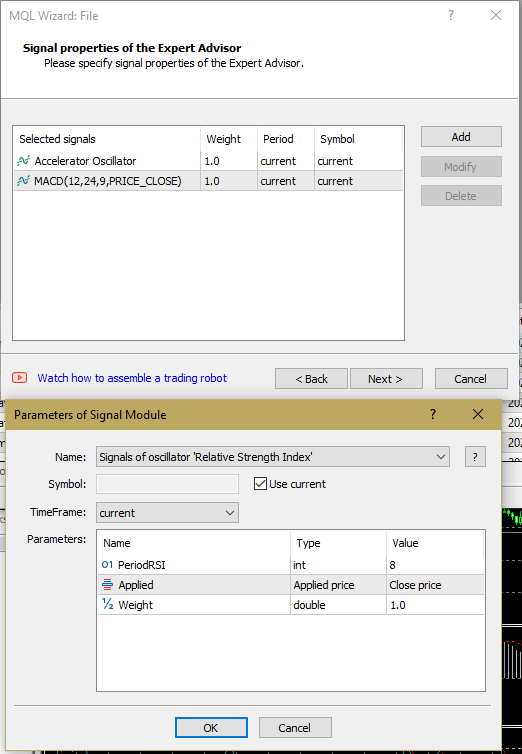

- This is the point to add the signal properties of the expert advisor. Click the Add button to open a window that allows you to set the parameters of a signal module. If you want, you can layer several signal modules on top of each other.

Expert Advisors Signal Properties Page

- Once the signal parameters are set up, you can define the trailing properties of the algorithm. These work just like trailing stops and take profits when investing manually.

- Expert advisors also need to know how much capital to invest in each position. The money management section here includes parameters for volume fixing, risk management, margin and more. Once you have finalised these parameters, click Finish to generate the EA.

- Once the expert advisor is in place, its code needs to be compiled before it can be implemented. This is done by clicking the Compile button in the MetaEditor hotbar.

- Once expert advisors have been compiled, they can be implemented as part of a trading strategy. To do so, ensure that algorithmic trading is enabled by pressing the Algo Trading button in the hotbar. Next, open the Insert menu and navigate to Experts. Here, you should find your named EA and clicking on it will begin implementing it on your chosen asset.

MQL Market

MetaTrader’s MQL5 Forex Market is the largest available collection of free and paid expert advisors. Here, traders can browse the online database of EAs and indicators for sale created by other users and provided to the public. There are many filters here that can be used to narrow the resulting range of EAs that appears.

The market conveniently offers demos of the EAs, renting options and a buy option. Expert advisor prices can range from being completely free to £25,000.

It is key to remember that not every algorithm will work for every situation and good expert advisors for MT4 and MT5 may be difficult to find. Most are designed for specific assets over specific timeframes.

Pros & Cons Of Expert Advisors

Pros

- Automation – Using brokers that support expert advisors lets you perform trades with limited manual effort. The positions will automatically open and close according to the parameters of the EA, giving you more time to focus on other investing activities.

- Speed – As expert advisors are electronic programmes, they can automatically perform trades with reactions much quicker than humans. This means that the EA robots can react to volatility and market conditions much more quickly than humans, so more of each profitable opportunity can be taken advantage of.

- Accessibility – Creating expert advisors has never been easier than with the MQL5 wizard. Programming knowledge is not required to build simpler EAs, so newer traders can jump into algorithmic trading.

Cons

- Programming – To create more complex, specialised expert advisors, specific programming knowledge is required. The most suitable is the bespoke MQL4/5 languages, which users will likely need to learn.

- Risk – Although leaving your investing to a robot with expert advisors brokers can make it easier and potentially more profitable, there is also the risk that market conditions could change unexpectedly. This could cause the bot to no longer be as efficient at profit-making or even switch to loss-making. The programme will continue to do as it is programmed, so users should need to keep a watchful eye.

- Price – Our experts found that, while there are many free or cheap EAs, there are also many priced very highly (up to £25,000). There is no guarantee that expert advisors will be a good return on investment, so caution should be used when buying an EA off of the market.

Comparing Expert Advisors Brokers

If you want to trade using expert advisors then you will need to choose a broker that offers the MetaTrader 4 or 5 platforms. However, these are two of the most popular platforms used by online traders, so there is a huge range of suitable brokers. As such, choosing the right one can be daunting. Below, we have outlined some of the key things UK traders should consider when choosing from expert advisors brokers.

Instruments

The instruments available for investing will differ between brokers for expert advisors. Many UK firms will offer the major UK exchanges, like the London Stock Exchange, as well as the New York Stock Exchange.

However, if you are looking to trade more exotic products like cryptocurrency then you will need to make sure the broker offers those assets before opening an account.

Base Currency

UK traders will likely want to invest with brokers that support GBP as a base currency. When GBP is not available, depositing in and withdrawing to GBP may incur foreign exchange (forex) fees, meaning you will be charged an extra fee on top of any others incurred while investing.

Regulation

To ensure brokers with expert advisors practise financial fair play, traders are advised to sign up with regulated brokers.

Top UK expert advisors brokers, such as Pepperstone, are regulated by the Financial Conduct Authority (FCA), the golden standard of financial regulators, ensuring the highest level of safety of clients’ funds.

Fee Structures

Brokers with expert advisors may operate different fee structures. Some have deposit and withdrawal fees, while others may charge commissions on trades. Additional fees include swap fees, subscription and freemium models, inactivity fees and loose spreads.

Finding brokers with a fee structure that minimises your costs will be key in maximising your profit-making potential with expert advisors.

Bottom Line On Brokers With Expert Advisors

The MetaTrader 4 and 5 platforms offer a unique, customised algorithmic trading experience through their expert advisors feature. Signing up for brokers that support expert advisors allow users to automate their investing workflow, improving reaction times, removing human emotion and increasing their profit potential. Moreover, with MQL5’s streamlined EA generation wizard, automated trading has become ever more accessible and is something that any investor using MetaTrader can give a go.

FAQ

What Are Expert Advisors?

Expert advisors are automated, algorithmic trading programmes primarily available on the MT4 and MT5 investment platforms. They are programmable and customisable scripts written in the MQL4 or MQL5 languages for seamless integration with the platforms. EAs automatically perform technical analysis and place trades based on statistical and graphical signals they perceive.

Do UK Brokers Offer Expert Advisors?

There are many UK brokers that support expert advisors, such as Pepperstone. This broker is regulated by the FCA and offers both the MetaTrader platforms with access to EAs. Alternatively, see our full list of brokers with expert advisor trading.

How Do You Make An Expert Advisor?

Expert advisors can be programmed using the MQL4 or MQL5 languages for MT4 and MT5, respectively. Alternatively, the MQL5 MetaEditor EA builder gives users the tools to generate bots without any programming knowledge. Follow our step-by-step tutorial to learn how.

How Do You Enable Expert Advisors In MetaTrader?

To enable the use of EAs in MetaTrader, click the Algo Trading button in the hotbar of the platform. A message should then appear in the comment section below indicating that expert advisors have been enabled.

Can You Buy Expert Advisors?

The MetaTrader MQL Market allows you to browse, buy, rent and demo expert advisors created by other users. Here you will find a huge range of EAs, some costing nothing while others can cost up to £25,000. There are many forex trading robots available but many detail that they are designed for specific pairs traded over certain timeframes.