Saxo Review 2026

Established in 1992, Saxo is a Danish-headquartered broker with 1+ million clients and £15+ billion in daily trading volumes. In this Saxo review, we investigate whether UK investors should register for an account, drawing on our own experience with the platforms and comparisons with the best brokers.

Our Take

- Saxo is authorised by multiple tier-one regulators, including the FCA, ensuring strong safeguards for British investors.

- Saxo stands out with 72,000+ instruments, surpassing category leaders like Blackbull (26,000+), and catering to short- and long-term traders.

- Despite reducing UK stock commissions from £8 to £3, Saxo remains more expensive than leading brokers like Interactive Brokers.

- The absence of social and copy trading tools makes Saxo less attractive to novice and passive traders, especially compared to eToro.

- Overall, Saxo best suits experienced investors seeking a powerful platform and extensive market access, notably global stocks, though it charges a percentage on trades rather than a flat fee, affecting those with larger portfolios.

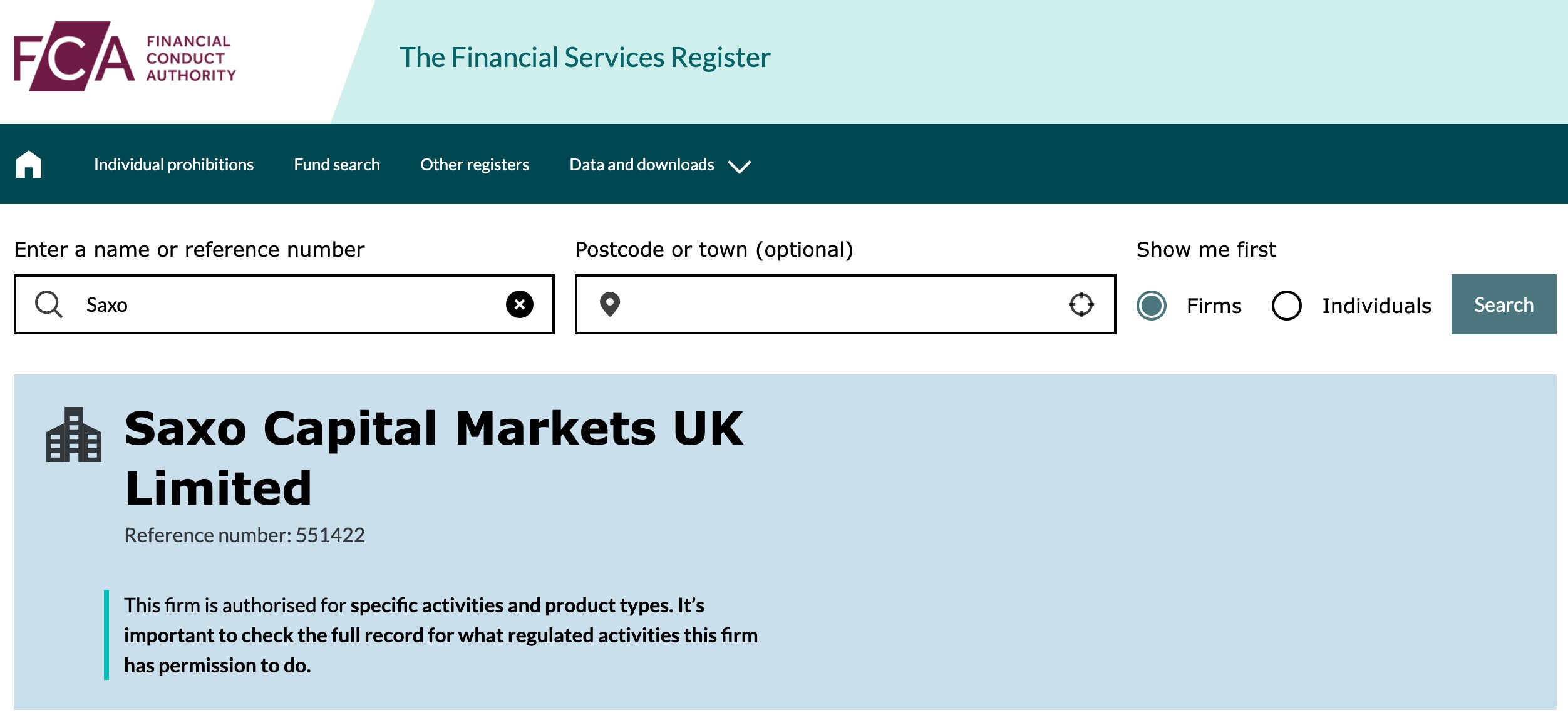

Is Saxo Regulated In The UK?

Saxo operates under regulation in 15 jurisdictions, ensuring compliance with a wide range of regulatory standards. It’s also an authorised bank, underscoring its legitimacy.

In the UK, services are regulated by the Financial Conduct Authority (FCA), known for its high regard in the financial markets.

Through FCA licensing, British clients enjoy the security of segregated funds held in top-tier banks, along with negative balance protection and Financial Services Compensation Scheme (FSCS) protection up to £85,000.

Additionally, the broker adheres to the FX Global Code of Conduct, aligning its activities with industry best practices.

Accounts

Live Accounts

Saxo offers three primary account types: Classic, Platinum, and VIP, each tailored to different funding requirements.

For the Classic account, there is no minimum funding. Platinum accounts require a minimum of £200,000, while VIP accounts necessitate a substantial minimum of £1,000,000.

With Platinum and VIP accounts, traders enjoy advanced customer service, IP address-linked logins for added security, and improved pricing.

Saxo also offers Individual Savings Accounts (ISAs), Self-Invested Personal Pensions (SIPPs) and Trust accounts, plus professional accounts for qualifying traders with increased leverage in return for fewer safeguards, notably no negative balance protection.

Opening an account involves filling out a simple online registration form and submitting identity documents and proof of address. Regardless of the chosen account, you gain access to all asset classes, 24/5 technical support, and both trading platforms.

Demo Account

Saxo offers a demo account, which provides access to £100,000 in virtual funds. I’ve found it an excellent way to familiarise myself with the platform features and experiment with different strategies without any risk.

Registering for the demo account is also quick and easy – within minutes I was trading with the virtual funds.

What’s particularly beneficial is that there’s no time limit for the demo account, allowing ample opportunity to test out strategies, including more long-term approaches. It’s also an advantage over UK brokers like AvaTrade, where the demo expires after 60 days.

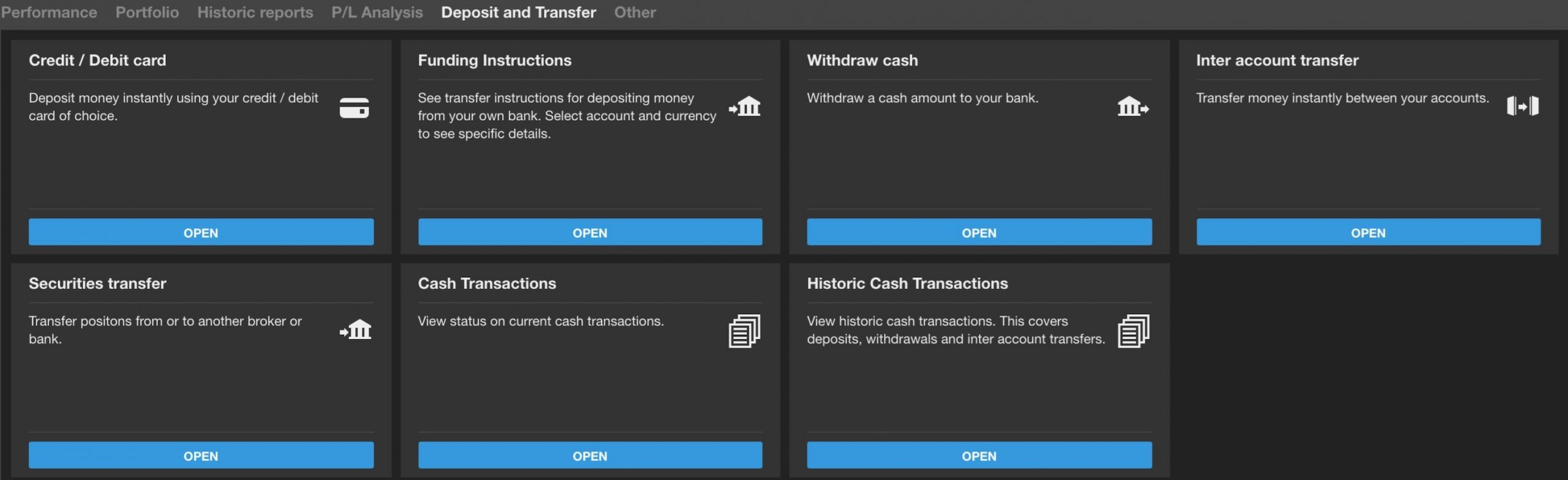

Funding Options

Deposits

Saxo requires a minimum deposit of £500, which is significantly higher compared to platforms like XTB with its £0 requirement, reducing its appeal to budget traders.

Initial deposits must be verified via bank transfer. Bank transfers may take several business days to process, while payments with credit/debit cards are instantaneous.

Note that funds can only be deposited from accounts registered in your name.

To test the deposit process at Saxo, I transferred money from my Revolut account, and it arrived almost instantly.

Bank wire transfers are also fee-free, but can take up to 3 working days to process. In the UK, clients can link a maximum of three cards to one account, with transaction limits of £100,000 and £160,000 over a 30-day period.

Additionally, Saxo allows the opening of multiple sub-accounts in various currencies, which is convenient for trading assets in different currencies.

This feature is not available with competitors like Interactive Brokers. However, one drawback is the inability to fund your account using digital wallets such as PayPal.

Withdrawals

There are no withdrawal fees for traders with accounts at Saxo. Withdrawal requests made before 1 pm GMT can usually be processed the following day.

To initiate a withdrawal, I simply logged in to my UK trading account and selected the withdrawal option. I transferred the funds to my registered bank account.

Based on my experience, withdrawn funds typically take about 2 working days to reach your account.

Market Access

Saxo excels with its increasing suite of investments with 72,000+ assets, beating out the likes of Blackbull with its commendable 26,000+ instruments.

Importantly, Saxo caters to both short-term traders with its derivative products and long-term traders with its investment products.

Notably, Saxo provides access to a vast selection of 23,500 stocks across 50 global exchanges, making it the most extensive range of equities among the long row of UK brokers I’ve used. Extended hours trading is also supported.

What I find particularly impressive is the inclusion of indices from exchanges like Tokyo and Hong Kong, which are not commonly offered by UK brokers.

Furthermore, Saxo offers access to ETFs and bonds, allowing for comprehensive diversification in investment portfolios.

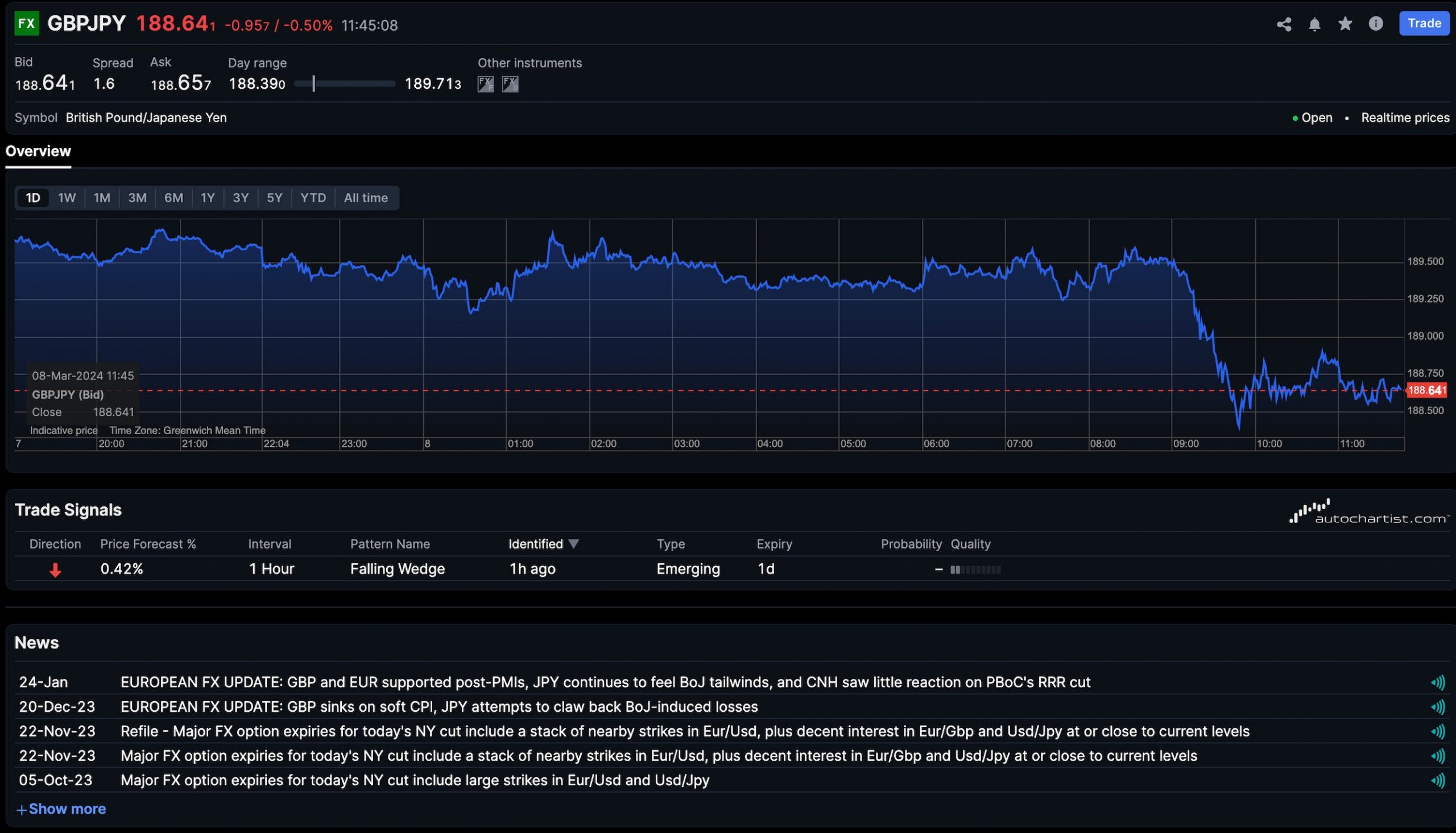

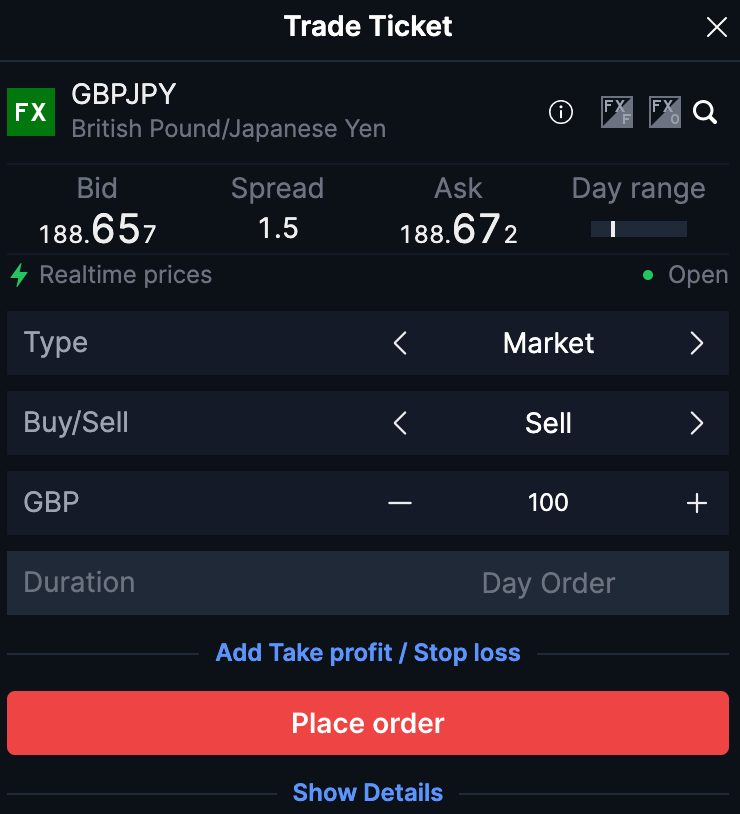

Leveraged Products

- Forex: 185 pairs including majors, minors, and exotics like GBP/USD and EUR/GBP

- CFDs: 8,800+ instruments on single stocks, indices, forex, and more, including the FTSE

- Futures: 250+ from 23 global exchanges including equities, indices, energies, metals, and more

- Commodities: Trade as CFDs, futures, options, spot pairs, or exchange-traded

- Forex options: 45 vanilla options across major pairs with maturities from 1 day to 12 months

- Options: 1,200+ listed options from 20 global exchanges

Investment Products

- Stocks: 23,500 stocks on 50 global exchanges including the LSE

- Bonds: 5,900+ digital government and corporate bonds including UK gilts

- ETFs: 7,000 exchange-traded funds from 30+ exchanges worldwide

- Managed portfolios: A mix of mutual funds and a robo-advisory service

- Funds: 6,000+ funds with zero commissions

Certain strategies, such as short selling, may not be available for all instruments due to local regulations. Moreover, in adherence to FCA regulations, Saxo Bank does not offer cryptocurrency trading.

It was disappointing to find out that there’s no option for crypto investing either, especially considering that it’s offered by other brokers like eToro.

Leverage

Saxo provides leverage that varies depending on the asset class, with UK retail investors subject to rates compliant with ESMA regulations.

For instance, leverage for equities like UK shares can reach up to 1:5, while indices like the FTSE can go up to 1:20. Commodities offer leverage of up to 1:10, and for forex trading, it can range up to 1:30 for major currency pairs such as the GBP/USD and up to 1:20 for non-majors like the EUR/GBP.

It’s important to note that Saxo enforces a margin close-out rule for UK accounts, with standardised minimum margin requirements of at least 50% to close out open CFDs.

Pricing

Saxo has historically been associated with high fees, especially for trading futures, options, and bonds in smaller volumes. While still not market-leading, it’s a step in the right direction that the broker revamped its pricing structure in 2024 to offer lower trading fees.

For example, the minimum commission for US stocks has been slashed from $10 to just $1, while for UK stocks, it has dropped from £8 to £3. Additionally, the commission for US options has seen a reduction from $0.85 to $0.75 per contract.

Furthermore, the currency conversion fee, which applies to various transactions like automated conversions and FX options transactions, has been decreased from 1% to a mere 0.25%.

In terms of futures contracts, the costs have been adjusted to $3 for contracts with Classic accounts, $2 for Platinum accounts, and $1 for VIP accounts. Saxo also shines when it comes to its competitive forex and metal spreads, starting from as low as 0.4 pips.

Other notable enhancements include the removal of inactivity fees, which previously penalised less active investors, and a reduction in custody fees.

It’s still important to note that Saxo Market’s spreads and commissions may vary based on the type of account and asset class. Accounts holding stocks, ETFs, or bond positions are subject to a maximum custody fee of 0.25% per annum, with a minimum monthly charge of £5.

- CFDs: Spreads start from 0.4 on the S&P 500

- FX options: Spreads begin from 3.0

- Stocks: US stocks from $1 commission and UK stocks from £3

- Options: Rates can be as low as £0.75

- Futures: Commissions start from £1

- Commodities: Commissions begin from $0.09

- ETFs: Commissions start from £3 on UK ETFs

- Bonds: Commissions start from 0.05% on government bonds

- Forex: Spreads start from 0.4 pips, with EUR/USD offered at 0.7 pips on the Classic account and 0.5 pips on the VIP account.

The broker applies overnight swap rates on positions held overnight.

Saxo also offers interest on uninvested cash, allowing you to earn while identifying opportunities. That said, the rate up to 3.91% is lower than XTB, which offers up to 4.9% on GBP balances.

Trading Platforms

Saxo Market offers access to all asset classes through two trading platforms: SaxoTraderGO and SaxoTraderPRO. I’ve found both platforms to be exceptionally sleek and comprehensive and I’ve spent years trading real money at a variety of leading brokers in the UK.

The SaxoTrader suite is compatible with various devices and operating systems, including desktops running Windows or Mac OS. Additionally, the mobile suite, known as SaxoTraderGO, is available on both iOS and Android.

The SaxoTraderGO platform offers various filters for stocks, allowing you to refine your search based on factors like market capitalisation, dividend yield, and recent popularity.

However, I find customising charts to be somewhat challenging. Unlike other platforms where I can adjust chart layouts for each stock individually, I have to access charting tools through the platform settings.

Nonetheless, the platform provides extensive customisation options, boasting 64 indicators and 20 drawing tools. Other highlights include the options chain, performance analysis, enhanced trade tickets, comprehensive account overviews, fundamental analysis tools, plus news and research including SaxoStrats analysis and price data.

SaxoTraderPRO is suitable for high-volume, active traders. The main difference is that it offers advanced trading features for professional or large-scale traders, such as support for six monitors (SaxoTraderGO supports two).

It also sports several tools that enhance the trading experience, notably depth trader, algorithmic orders, portfolio summary, advanced trade ticket, an extensive list of sophisticated technical indicators, and market movement insights with real-time order executions.

Additionally, what sets Saxo apart is its compatibility with third-party platforms like TradingView and MultiCharts, which significantly enhances the overall flexibility of the broker’s offerings.

Extra Tools

Saxo offers a range of online trading features, including daily analysis and an insights forum. Their website provides access to live news bulletins, market research guides from Saxo’s strategy team, and a financial quarterly outlook.

I particularly find the ‘Your Week Ahead’ videos helpful in keeping track of economic announcements for the upcoming week.

The platform also offers educational resources such as videos, webinars, and online courses covering various topics like order placement, forex leverage utilisation, and rollover rates. Additionally, there’s a trading strategy-focused podcast with multiple weekly episodes available.

However, I think the platform could enhance the learning experience by providing more structured courses tailored to individual investing backgrounds. That would bring in it on a par with resources like the Academy from IG.

Moreover, the absence of copy trading is a notable drawback, especially for beginners seeking to emulate the strategies of experienced investors. eToro is a better option here.

Overall though, if you’re interested in staying updated with financial news and understanding how broader economic developments impact the stock market, Saxo is an excellent source of information.

Customer Service

Saxo offers comprehensive customer support options, including phone support (+44 207 151 2100), email support (londonreception@saxobank.com), and live chat (within trading platforms).

In my interactions with the phone support service, I’ve found relatively short wait times and knowledgeable agents, resulting in a positive overall experience.

For less urgent inquiries, the email support system has proven to be excellent, with prompt responses typically received within the same day.

The live chat feature, a crucial component of any support system, connects to an agent in less than a minute, and most of my inquiries have been efficiently resolved in just a few messages.

However, it’s important to note that live chat support is only available during normal office hours, Monday to Friday, which is less convenient compared to platforms like Pepperstone with their 24/7 assistance.

Should You Invest With Saxo?

Saxo is a comprehensive trading platform designed for investors with significant trading expertise. It stands out by offering access to stocks and assets worldwide, a feature not commonly found in general UK investment platforms that typically focus on Europe and North America.

However, investors with larger portfolios should be cautious of the trading charges, which are calculated based on a percentage of the trade rather than a flat fee.

While Saxo doesn’t require a minimum deposit to open an account, its complexity could pose challenges for new traders. For beginners, there are more suitable options among UK brokers, notably XTB and eToro.

FAQs

Is Saxo Good For UK Investors?

Yes. With a diverse range of trading instruments and account types, you can access various markets and tailor your accounts to your needs. Saxo is also highly trusted and regulated by the FCA.

However, you should review Saxo’s fee structure, trading platforms, and customer support services to ensure they align with your investment objectives and preferences before making a decision.

Can You Invest In GBP With Saxo?

As a regulated brokerage offering services to UK investors, Saxo allows you to deposit, trade, and withdraw funds in GBP.

Is Saxo Safe?

Saxo is a secure and trustworthy broker. With a track record of over 25 years in award-winning trading services and favourable customer service ratings, the company demonstrates transparency, financial stability, and innovation. Backed by FCA regulation, Saxo offers added reassurance to UK traders.

Can You Invest In Cryptocurrencies With Saxo In The UK?

Saxo Markets does not offer cryptocurrency trading services to retail investors in the UK, only professional traders.

If you’re specifically interested in cryptocurrency trading, explore alternative platforms that specialise in digital asset trading, such as top-rated eToro.

Article Sources

Saxo Capital Markets UK Limited FCA License

Top 3 Saxo Alternatives

These brokers are the most similar to Saxo:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

Saxo Feature Comparison

| Saxo | IG | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| Rating | 4 | 4.5 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | £500 | $0 | $0 | $1,000 |

| Minimum Trade | Vary by asset | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | - | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 | 1:30 |

| Visit | 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Saxo Review |

IG Review |

Interactive Brokers Review |

Swissquote Review |

Trading Instruments Comparison

| Saxo | IG | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | Yes | Yes | Yes | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

Saxo vs Other Brokers

Compare Saxo with any other broker by selecting the other broker below.

Popular Saxo comparisons:

|

|

Saxo is #53 in our rankings of CFD brokers. |

| Top 3 alternatives to Saxo |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Demo Account | Yes |

| Minimum Deposit | £500 |

| Minimum Trade | Vary by asset |

| Regulated By | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Leverage | 1:30 |

| Mobile Apps | SaxoTraderGo (iOS, Android, Windows) |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Mastercard, PayNow, Visa, Wire Transfer |

| Copy Trading | No |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Copper, Corn, Gold, Natural Gas, Oil, Silver |

| CFD FTSE Spread | 1.2 pts (Variable) |

| CFD GBPUSD Spread | 0.7 (var) |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | 0.10% (subject to min commission) |

| GBPUSD Spread | 0.7 (varies by region) |

| EURUSD Spread | 0.2 (varies by region) |

| GBPEUR Spread | 0.6 (varies by region) |

| Assets | 40+ |