Best VPS Brokers in the UK 2026

Brokers with a Virtual Private Server (VPS) allow users to implement trading strategies continuously. An isolated server, operated by a cloud-based hosting provider, ensures trading systems can run without technical interruptions, delays or outages.

Dig into our selection of the best VPS brokers following the hands-on tests of our UK experts.

Top UK Brokers With VPS

-

Pepperstone provides an attractive VPS package for dedicated traders. Clients enjoy a 25% discount on ForexVPS, which includes MT4 integration, 1ms ultra-low latency, a 100% uptime guarantee, Expert Advisor installation, and around-the-clock support. Additionally, the broker collaborates with New York City Servers to deliver a customised low latency service, also discounted by 25% for clients.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Eightcap provides a high-performance ForexVPS, pre-installed with MT4, enabling traders to begin immediately. ForexVPS ensures ultra-fast execution speeds without any downtime. Traders who qualify by depositing $1000 and trading 5 lots monthly can access this service. Registration is quick and can be completed in seconds on the broker's website.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

IG clients gain access to the broker's comprehensive market offerings via the dependable MT4 VPS, provided by the renowned Beeks. This service features up to 30 GB of disk space and 2.5 GB of RAM, ensuring ultra-low latency for traders. Clients with a balance of at least $2000 can use the service for free, while others incur a $50 monthly charge.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

FOREX.com offers an excellent VPS service in collaboration with Liquidity Connect. Traders maintaining a minimum balance of $5,000 and executing at least 10 round-trip mini-lots monthly can effortlessly run algorithmic strategies 24/7 with optimal uptime. The registration and connection process is straightforward.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

Vantage collaborates with NYC Servers, a reputable provider, to offer an optimal VPS solution for MT4/MT5 traders with deposits of $1,000. Traders reaching $1 million in notional volume will have their monthly subscription fees refunded up to $50. Clients can swiftly connect and begin trading in just five minutes.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

The FxPro VPS enables traders to automate strategies around the clock with constant trading, minimised latency, and zero downtime. It boasts reliable infrastructure from BeeksFX, co-located with top-tier liquidity providers at Equinix LD4 London. The service costs $30 per month but is complimentary for Premium account holders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Axi provides exceptional VPS services with attractive offers. Enjoy an additional 256MB memory and a 30% discount on your first month's BeeksFX subscription. Additionally, Axi offers a monthly credit of up to $36 for ForexVPS and CNS VPS subscriptions, ideal for traders handling 20 lots or more monthly.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best VPS Brokers in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best VPS Brokers in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best VPS Brokers in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ |

Beginners Comparison

Are the Best VPS Brokers in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Axi | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best VPS Brokers in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best VPS Brokers in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| FXPro | |||||||||

| Axi |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

Cons

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

How Investing.co.uk Chose The Top Brokers With Free VPS

We ran targeted tests to evaluate each broker’s VPS offering, focusing on key factors such as uptime/downtime, technical requirements, stability, and ease of setup.

Alongside this, we assessed broader broker features, from trading costs and platforms to regulation and support, and then ranked UK providers by their overall ratings.

How To Pick Brokers That Offer A VPS

The number of VPS brokers in the UK is growing, but here’s what to focus on to find the right provider for your needs:

Fees

When you trade with a VPS you’ll need to consider the broker’s spread and any commission fees as usual, but you should also factor in any additional cost for using the VPS service.

The price can vary significantly depending on the specs of the VPS – higher RAM, storage space and faster bandwidth costing more – and range from around £5 per month to £50 or more.

While we’ve found that this service pays for itself in the hands of a skilful trader, some of the best VPS brokers offer a free service if the minimum deposit and/or trading volume requirements are met.

- IG‘s VPS service, which is usually valued at £50 per month, is available for free to traders who maintain an account balance over £5,000. That’s a great benefit for active traders to add to IG’s fantastic list of features, including a suite of excellent research tools like Autochartist.

VPS Location

Each VPS is located in a data centre where the servers and all other technical components are housed. FP Markets, for example, uses VPS infrastructure from the Equinix New York data centre.

The physical distance between the server and your trading platform will impact the processing time of orders due to the reliance on the fastest connection speeds and low latency.

The best brokers with VPS trading will publish the location of their data centres, so you may want to look for a UK-based server if you’re trading forex, for example, or one based in New York if you focus on US stocks.

- FxPro provides low-latency trading and 24/7 connectivity through VPS provider BeeksFX, running their servers in London in close connection with the brand’s liquidity providers – a huge boost for traders who rely on ultra-fast connections. The service is available for free to Premium account holders and for a fee to others.

Performance Quality

The top trading brokers with a VPS provide at least 1 CPU, 1GB RAM, and circa 25GB HHD in our experience. The higher the specifications (RAM/CPU) and the faster the host’s internet speed, the faster the order execution.

Also consider reliability and software uptime. Leading VPS brokers we tested offer a 99.9% uptime.

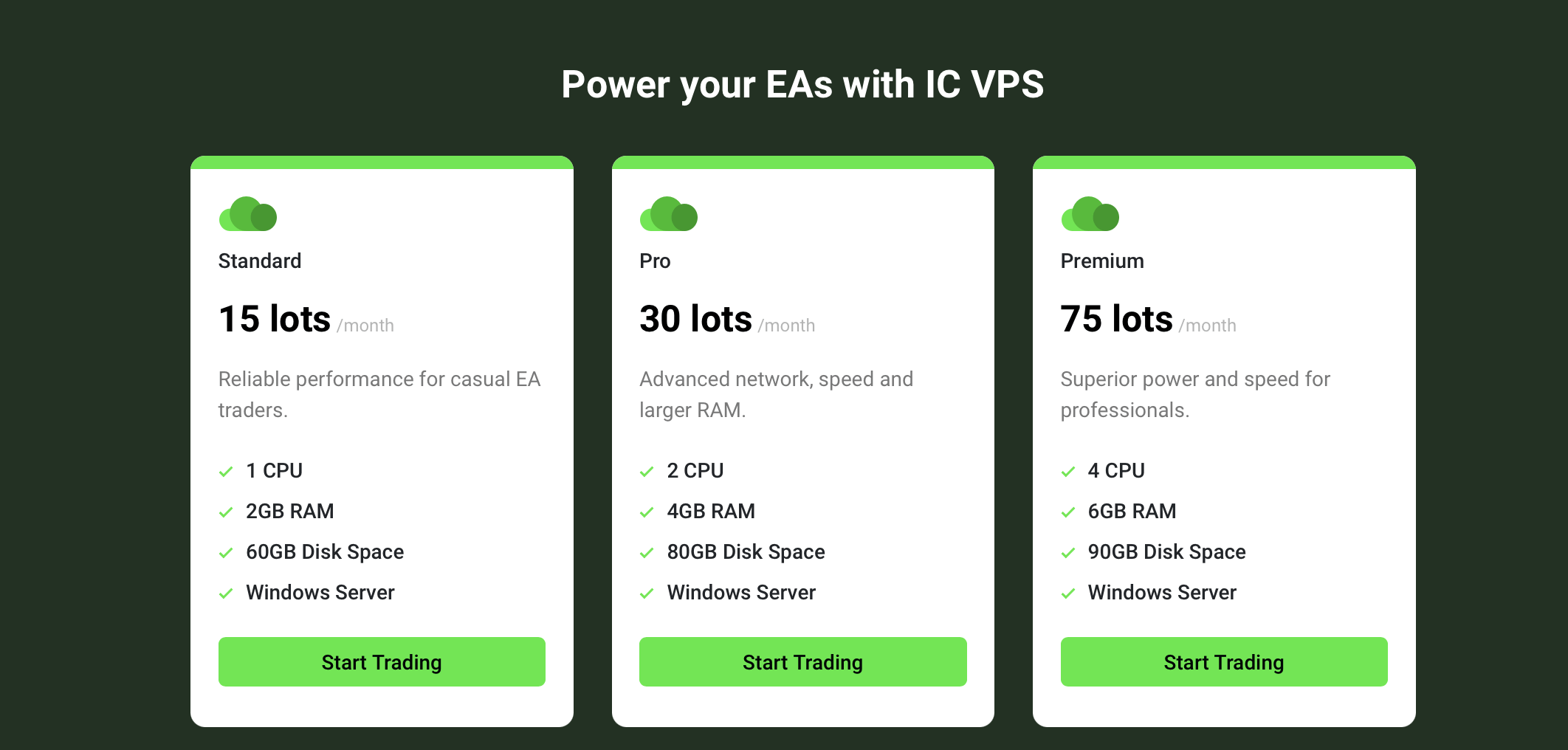

- IC Markets offers free VPS access to clients who trade at least 15 lots per month, and even the lowest tier of VPS service is strong with 2GB RAM and 60GB SSD storage available for more casual traders. Higher-volume traders gain significant boosts to the RAM and storage level, and all VPS servers allow trading on all 200+ of IC Markets’ CFDs.

Minimum Trading Criteria

Most forex VPS brokers don’t provide access to their software free of charge. Traders will usually need to maintain a minimum account balance or execute a certain volume of trades.

IC Trading’s tier VPS system

- IC Trading offers one of the most flexible complimentary VPS hosting packages available, as higher-volume traders can access higher-spec servers. This means traders with lower volumes of around 15 lots per month can still access the service, while those who trade 30 or 75 lots get a valuable boost in line with their increased volumes.

Customer Support

A reliable customer service team is important when setting up and trading through a VPS. You may need support with technology integration or connection lags – especially important as virtual private servers operate around the clock, so to get the most from this service you’ll need to be able to reach your broker easily if you hit any snag.

Even if you’ve got a VPS running with 24/7 connectivity, you could still find yourself delayed by a separate issue.Some of my most frustrating trading experiences involved problems funding my account while setting up positions before an important news event, and I was only able to resolve these in time by contacting customer support.

- Pepperstone provides 24/7 toll-free phone support to UK traders, meaning you can cut downtime to the lowest possible when you’re using their powerful VPS hosting service, which is available for free to Pro account holders.

What Is A Virtual Private Server (VPS)?

A virtual private server is essentially a remote computer located in a secure data centre. It basically splits one powerful server into multiple virtual servers. Each server runs separately from the others, meaning the systems are more secure, and each has independent performance benefits.

VPS brokers use the technology to facilitate 24-hour automated trading, with the top firms guaranteeing a 99.9% uptime. The VPS ensures that, regardless of external influences such as power failure or internet lags, your trades will operate without interruption.

Traders are also normally given control over the amount of network space and RAM to be used.

Note, that trading through a VPS is best suited to serious short-term traders. Beginners or those that do not open and close positions frequently may get limited benefits from them.

The Pepperstone forex VPS, for example, provides users with access to ultra-low latency of approximately 1 millisecond, and a 100% uptime guarantee. It offers 2.5GB of RAM and 80GB of disk space on SSD technology. The VPS is preinstalled on the Pepperstone MT4 terminal and the firm has experts on-hand to support the setup and fix any issues.

How To Set Up VPS For Forex Trading

Although the technology behind VPS systems may feel complex, they are relatively easy to access and use. To get started:

- Sign up with an online broker that offers VPS access

- Seek approval from the brand to join the virtual network and request login credentials

- Connect to the VPS via a remote desktop app with the registered IP address

- Navigate to the virtual desktop environment

- Log in to the investing platform and complete forex trading activities as usual

Pros Of Using A Brokers’ VPS

- Reduced Slippage – A VPS can execute trades much quicker than most setups on personal computers, meaning fewer delays and less slippage.

- Trade Anywhere – Brokers with VPS hosting ensure there is no need to be confined to a home PC or office setup. You can conveniently access the server from a mobile, laptop, or shared device.

- 24/7 Uptime – VPS trading provides a 24-hour connection to the financial markets even if you are away from a computer, experience internet issues, or have a power outage. Additionally, when you are unable to log in, the server will continue trading activities on your behalf.

- Secure – The best VPS brokers provide a high level of safety and security. Servers are scanned regularly to ensure the tools are fully functioning and that antivirus and malware features will protect against online hacking. Top-ranked brokers with a VPS also offer responsive customer service to help with the software set-up and ongoing usage.

Cons Of Using A Brokers’ VPS

- Availability – Not all brokers offer VPS services, so you might find that you have limited choice when it comes to brokers and those available don’t offer all the features you want.

- Cost – Using a VPS can be more expensive than basic online trading. Access to the server may require a monthly or annual fee if minimum thresholds are not met. Improved connectivity speeds and increased RAM can also come at an additional cost.

- Technicalities – You will need some technical understanding to link the software to your trading platform and maintain the optimum server conditions.

Popular Virtual Private Servers

MetaTrader VPS

The MetaTrader virtual hosting software offers 24-hour operation of the client platform. The server can be accessed directly from the MetaTrader 4 or MetaTrader 5 terminal and takes just a few minutes to transfer EAs, scripts, signals, and indicators.

You can register for the VPS within the MT4 platform by right-clicking on your account settings in the ‘Navigator’ panel.

The fees for MetaTrader VPS services are usually applied by the supporting broker, and generally start from under £15 per month if not covered by the broker.

Forex VPS

Forex VPS has numerous data centres across the world including in London, New York and Sydney with lightning-fast order speeds as quick as one millisecond. The server can be integrated with partnered brokers’ trading platforms. Technical support is available 24/7.

The basic subscription plan starts at less than £30 per month, and the fee includes trading analytics and other extras. Users can choose from higher-spec plans with increased levels of RAM, storage space and CPUs or create their own custom plan.

VPSServer.com

VPSServer.com offers flexible memory subscriptions and CPU-optimised plans. It integrates with major trading platforms, including MetaTrader 4 and MetaTrader 5.

The firm offers a 99.99% uptime guarantee with high-performance servers maintaining minimal downtimes from 15+ data centres across the globe, including in London.

VPSServer.com comes with pre-built templates as part of the basic service, meaning you can get up and running quickly. Traders can also access resilient firewalls and DDoS technology while live data backups are used.

VPSserver.com offers a seven-day free trial. Live packages are highly customisable to the customer’s needs, with options to increase RAM, number of CPUs, SSD storage, operating system and more. The cheapest plan clocks in below £10 per month.

FXVM

FXVM offers an easy-to-use solution that integrates with many leading platforms, including MT4, TradeStation, and NinjaTrader.

The brand has nine data centres across the globe including in London, with established infrastructure providers such as Global Switch, Equinox, Internap, and Level3. The servers are secure and maintain full data privacy, alongside 24/7 access to customer support.

The firm offers new clients a seven-day trial for £0.99. Live packages start below £20 per month, with options for premium options with increased RAM and SSD storage available at higher cost for advanced and high-frequency traders. All plans come with a 100% uptime guarantee.

Bottom Line

Brokers with VPS access offer several benefits to active traders, such as fast execution speeds, stable connectivity and top-tier security.

There are multiple third-party brands and integration solutions, so consider performance quality, location, usage requirements, and monthly fees. To get started, see our list of the best VPS brokers in the UK.