Swing Trading

Swing trading is a common strategy in the UK that takes advantage of short to medium-term market fluctuations. This guide will cover the basics of swing trading and include some helpful strategies as well as our tips on what markets to swing trade for beginners.

Top Swing Trading Brokers

See All Top Swing Trading Brokers

What Is Swing Trading?

Swing trading is a short- to medium-term strategy aimed at capturing price movements over several days or weeks, longer than scalping or day trading, which closes positions within minutes or hours.

While scalpers focus on tiny, rapid moves and day traders react to intraday volatility, swing traders hold positions long enough to benefit from broader market swings without the constant screen time.

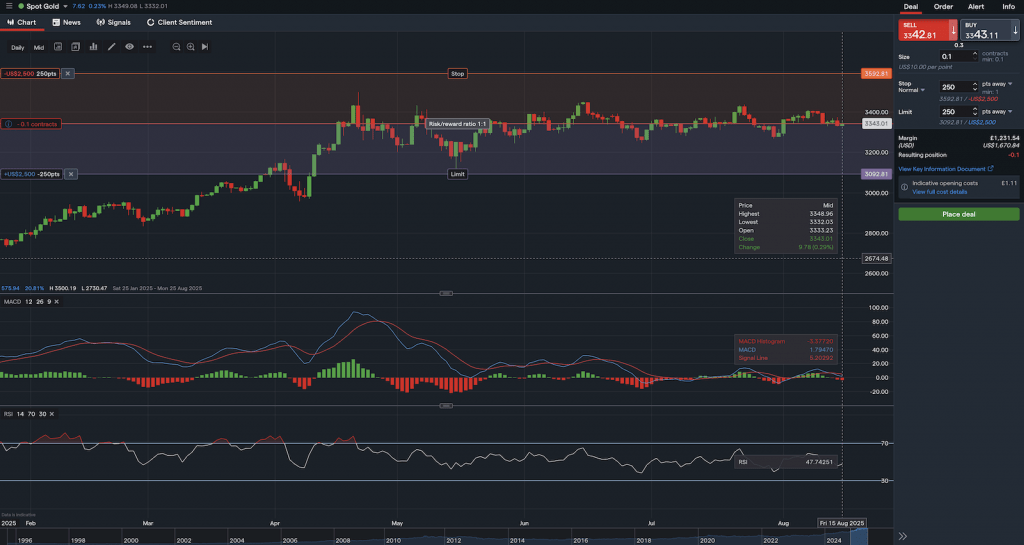

Like shorter-term traders, swing traders rely heavily on technical analysis, using tools such as moving averages, Fibonacci retracements, and oscillators to identify precise entry and exit points.

Understanding market structure is crucial, including tracking support and resistance levels on key indices and stocks, as well as using volume analysis, trendlines, and candlestick patterns to gauge the strength of a move.

Unlike scalpers and many day traders, swing traders must also account for overnight and weekend exposure, meaning macro events—such as Bank of England rate decisions, inflation data releases, or corporate earnings—can create both risks and opportunities.

Successful swing trading blends the technical precision often associated with day trading with the patience and broader perspective of position trading, enabling you to ride momentum while managing risk effectively.

IG gives UK swing traders broad market access, strong charting tools, and FCA regulation

Pros Of Swing Trading

- Capitalises on medium-term momentum: Swing trading allows you to exploit price trends over several days or weeks, rather than reacting to minute-by-minute fluctuations like day traders. By using technical tools such as moving averages, RSI, and MACD crossovers, you can identify high-probability entry points and ride market momentum. For UK investors, this can mean taking advantage of FTSE 100 or AIM stock swings triggered by sector rotation, earnings releases, or macroeconomic announcements—without being glued to the screen all day.

- Improved risk-reward management: Swing trading naturally allows for tighter risk control compared to long-term investing. You can set precise stop-loss levels based on support and resistance zones, Fibonacci retracements, or volatility measures like Average True Range (ATR). This structured approach helps protect capital while allowing for targeted gains, giving you a practical framework to balance risk and reward even in volatile market conditions.

- Flexibility without overexposure: Unlike day trading, swing trading does not require constant monitoring, which reduces emotional stress and operational fatigue. Positions are held over multiple sessions, giving you the ability to analyse charts overnight, assess macro events like Bank of England policy moves, and plan trades more strategically. This balance of active participation with calculated patience makes swing trading both manageable and scalable.

Cons Of Swing Trading

- Exposure to overnight & weekend risk: Because swing trades are held for several days or weeks, positions are exposed to overnight and weekend gaps caused by unexpected news, geopolitical events, or economic announcements. This can include sudden FTSE 100 moves after the US market closes or Bank of England policy surprises, which may trigger stop-losses before you have a chance to react. This risk is inherently higher than day trading, where positions are closed daily.

- Requires discipline & consistent technical analysis: Swing trading relies heavily on accurate chart reading, trend identification, and risk management. Mistimed entries or exits—due to misinterpreted RSI divergences, false breakouts, or overextended candlestick patterns—can quickly erode profits. You must maintain vigilance over both local market conditions and macroeconomic indicators, meaning that a lack of disciplined analysis can lead to repeated losses.

- Limited opportunity during low volatility: Swing trading depends on clear price swings and market momentum. During periods of low volatility, such as quiet summer months or post-announcement consolidation in stocks, potential gains can be muted and trading signals may generate false positives. You may experience multiple whipsaws or small losses, highlighting that swing trading is less effective when markets lack pronounced directional moves.

In my swing trading, the best wins have come from sitting on my hands until the setup was perfect—patience has paid me far more than chasing half-baked trades ever did.

Swing Trading Strategies

There are no winning secrets of swing trading or strategies that work 100% of the time, you must be patient, do your research and show dedication. The main difference between swing trading and traditional long-term investing is the reliance on technical, rather than fundamental, analysis. Mastering the maths required will take diligence.

With stock trading, fundamental analysts look at factors like the company’s earnings, interest rates and the economic environment to calculate a valuation for the stock. Technical analysts presume all these factors are already present in the current value of the stock and rely instead on patterns in the price movements. Swing traders mostly focus on using hourly, daily or weekly charts.

As a rule of thumb, it is best to keep your swing trading portfolio at five securities, or fewer. This way you can get to know each one inside out and better spot patterns and price swings. Some traders use scanners or screeners to analyse the performance of numerous stocks and highlight the ones that are likely to be profitable. They will also use watchlists to identify those that are approaching a profitable position. These stock picks can sometimes be successful but you should always ensure you are comfortable with your trades and the reasoning behind them.

No matter what you are trading with, make sure you adapt your strategy to the particular assets or markets – the strategies for swing trading forex might be different from those focusing on crypto derivatives.

Here are some useful tools for beginners, plus a few tips to get you started:

Exponential Moving Average (EMA)

Exponentially weighted moving averages, also known as EMAs, are similar to simple moving averages (SMA), except that they are calculated using more recent data and a slightly different weighting equation. Swing traders generally use 9, 13 or 50 period EMA time frames.

If an asset’s price goes above the EMA, this indicates a long entry. If it falls below, this indicates a long exit or a short entry.

Effective use of the EMA crossover is one of the core principles of swing trading. When used correctly, it can help define optimum entry and exit strategies and identify trends and patterns, as knowing when to buy and sell is key for your profits.

Support And Resistance

Understanding support and resistance levels is a key part of swing trading. Technical analysts use these levels with price action as indicators of a price reversal. Flipping position sides according to support and resistance levels is a popular strategy.

Software

Finding the right platform is key to successful swing trading and will depend on the market you’re trading in. If you are considering cryptos, you might prefer a platform like Coinbase, while forex swing traders might prefer something like the FxPro Platform. Some brokers will offer their own proprietary software as well as commercial platforms like MT4 and MT5. You may want access to a range of signals and indicators that are easily customisable.

Automated trading options like NMA swing trading algorithms, Gann technique EA systems and oil futures bots can also be helpful when swing trading as they can alleviate some of the time commitment. You may also want to find an intuitive, user-friendly setup that will provide a comfortable experience. You should use demo accounts to get an idea of what each platform offers before investing any real capital and to practice your swing trading skills.

Candlestick Charts

Candlesticks are a swing trader’s best friend. They provide a clear graphical indication of any potential swing patterns. Getting to grips with using candlesticks and chart patterns like moving average crossovers, head and shoulders patterns and cup-and-handle patterns may give you the edge when swing trading.

Heikin-Ashi, also spelt Heiken-Ashi, is a Japanese phrase that means “average bar”. Similar to EMAs, this chart can help traders spot price reversals and patterns. Heikin-Ashi charts can make candlesticks easier to use and more readable.

Pivot Points

In swing trading, pivot points are a change in price direction. Once you learn to identify minor and major pivot points, also called swing low and swing high points, you can increase your profits and manage your risk by using stop losses to exit a trade after a major pivot point. Using stop losses is a common way to mitigate the risk of breakouts by exiting a position at a preset level even if you are not present. Entry signals, which will open a position under certain conditions, are also a clever way to automate swing trading.

Dividends

If you own stocks at the time when they produce dividends, these will get paid to you. There are some swing trading strategies that profit from market movements around the dividend collection date.

What Markets To Swing Trade

You will want to find a market that swings regularly from high to low. The best markets for this are those with high liquidity and volatility. These markets will see regular swings with more dramatic highs and lows that you can take advantage of. Some of the most liquid and volatile markets include crypto, forex and the stock market. You can also swing trade using all sorts of securities and derivatives, including options, futures and CFDs. Weekly options and other short-term derivatives are common among swing traders.

Swing Trading For A Living

It is possible to make a living swing trading, both full-time and part-time, but it takes a lot of dedication. If you want to become a millionaire swing trader, you will need a combination of luck and skill. Swing trading is an active profession and requires a lot of time commitment, it cannot easily be a casual side gig. Any trader used to long term “buy and hold” positions will need to let go of their fundamentals and embrace technical analysis before they can make their millions with this strategy. Masters will know that the psychology is centred around shorter time periods and traders must ensure they don’t get distracted by the long-term prospects of an asset.

If you are considering swing trading alongside a full-time job, you will need a lot of discipline. You may find time for both if you consider end of day investing. If you have refined your techniques, then it is possible to make a living from swing trading in both bullish and bearish markets.

Swing Trading Vs Scalping

Scalping is different from swing trading in that scalpers generally close their positions as soon as a profit has been made. The goal with scalping is to have an extremely high turnover of small profit trades that mount up to greater overall results. Scalping is often reliant on algorithms, where swing traders tend to be more interested in longer-term price fluctuations and will hold positions until they identify a price reversal.

Swing Trading Vs Position Trading

Position trading is different from swing trading as it revolves around longer-term investments. Where swing traders will use technical analysis to capitalise on short-term price movements, position traders use fundamentals to choose a security to invest in over a long period.

Swing Trading Education

There are many ways to learn more about swing trading. Numerous websites with training courses, helpful videos and online classes exist that are run by reputable trading experts and gurus. Aside from this, there are plenty of books, audiobooks, online PDFs, podcasts, blogs and forums with ideas, methods and success stories to get you inspired.

Educational websites and training course providers like BabyPips can provide helpful examples of how to utilise news events, lessons on profit percentage calculators made easy, daily stock alerts, journal building mistakes and even realistic explanations of the dangers of swing trading when it does not work. They can also offer Gann swing trading techniques, links to live Discord discussions and calls, personality requirements advice and reviews of how much money you could make on sites like GDAX and DailyFX.

All it takes is a quick search online and you will have a wealth of information at your disposal. However, be sure to sift through this and find genuinely valuable content. While a lot of this will be available free of charge, some of the better resources will come at a cost.

Swing Trading Taxes

Any profits made swing trading in the UK will be taxed according to standard British tax laws, meaning any profits made over the basic tax exemption of £12,500 may be classed as capital gains. The rules also say that these profits are added onto any other income you may earn so be careful you are reporting your earnings accurately. You may want to consult a local tax advisor before investing in the UK.

Final Word

The swing trading game can be an exciting one for those looking for medium-term investments. Accumulated holding fees are a danger to investors but can be avoided with careful technical analysis and a solid strategy. Make sure to time your entry and exit points correctly and use indicators and other tools available to optimise your swing trading experience.