ActivTrades Review 2026

ActivTrades is a UK online CFD and spread betting brokerage that specialises in the forex, commodities, indices, shares and cryptocurrency markets. The firm offers a competitive range of trading platforms and financial instruments for beginners and professionals alike. Check out this ActivTrades broker review to explore the company’s trading fees, leverage rates, payment methods and customer support.

History & Overview

ActivTrades Corp is regulated by the UK’s FCA (based in London) and is a subsidiary of ActivTrades PLC. Our experts found the firm to have an established history and few complaints. It is an award-winning global company with customers in more than 140 countries. The company’s number of employees stands at more than 200 and its revenue sits around £23m.

ActivTrades was founded in 2001 by Alex Pusco, its current Chairman. It is a UK-based company, with the address of its HQ office situated in London, and it has won the award for ‘Best Forex Broker UK’ (Le Fonti IAIR Awards), among other accolades. The broker also has offices elsewhere in Europe and the Bahamas. Customers can be reassured that this broker is regulated by multiple reputable bodies, including the UK’s FCA. In 2015, ActivTrades launched its own prepaid Mastercard.

Trading Platforms

The broker offers a choice of three investing platforms: ActivTrader, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). ActivTrader is the in-house platform and provides a good starting point for beginners to get to grips with the markets. We recommend that more experienced speculators use the widely-recognised MT4 or MT5 platforms, which you can download and connect to the broker via an API. There are no requotes with any of these options, so investors may wish to use a VPS to reduce slippage. Further details on the ActivTrades range can be found below:

ActivTrader

- Hedging options

- Over 14 chart types

- Market sentiment analysis

- Modifiable trailing stop orders

- More than 1,000 CFDs across multiple markets

- Desktop version reduces reliance on WiFi strength

- Available as a mobile/tablet app on iOS and Android

- Range of indicators, including moving averages and stochastic oscillators

ActivTrader

MT4

- 6 order types

- Nine timeframes

- One-click trading

- 50 technical indicators

- Historical data for strategy backtesting

- Mobile, desktop and WebTrader variants

- Forex, metals, indices, fixed income assets and commodities

- Industry-leading platform offered by brokers across the globe

- Additional SmartTools (including SmartOrder 2) can be integrated with MT4

MT5

- 8 order types

- 21 timeframes

- One-click trading

- 60+ technical indicators

- Advanced strategy tester

- Economic news headlines

- Mobile, desktop and WebTrader variants

- Over 500 CFDs in forex, metals, indices, fixed income assets, commodities, stocks and ETFs

Markets

ActivTrades offers investors a range of markets and assets, enabling decent portfolio diversification and risk management. There are over 1,000 CFD and spread betting instruments, broken down as follows:

- 5 bonds (including EUBBL and EUSTZ)

- 18 commodities (metals, energies, grains and softs)

- 48 currency pairs (majors, minors and exotics)

- 14 cash and 18 forward indices (including the UK100 and GER40)

- 16 cryptocurrencies (including Bitcoin and Ethereum pegged to the USD)

- More than 1,000 company shares and ETFs from the London, New York and Frankfurt markets

Fees

With most assets, the cost of trading is factored into the variable spread (the difference between the bid and ask price) or flat commission. For forex, index and commodity products, ActivTrades imposes a markup on the spread rather than a commission. Spread fluctuation can depend on the time of day and overall market liquidity and volatility, so be aware that real-time spreads are often higher than the target spreads.

Spread betting instruments are charged a variable spread markup from 0.5 pips, depending on conditions and underlying assets.

Our experts found the following to be the broker’s target spreads for major UK investment CFD and spread betting products:

- Gold: 0.25 points

- GBP/USD: 0.8 pips

- EUR/GBP: 0.8 pips

- FTSE 100: 0.45 points

- Brent Crude Oil: 0.03 points

Share CFDs are fee-free for unleveraged positions, though investors trading on margin will incur a 0.1% commission (£1 minimum) for assets listed on London exchanges. American equities cost $0.02 per share, with a minimum $1 charge and European stock CFDs cost from 0.01% per unit, with a minimum of €1. Moreover, access to European and New York market data will cost €1 per month.

Details of overnight swap rates can be found in real-time within the ActivTrades investment platforms. These charges are not applied to index and commodity instruments. An inactivity fee of £10 per month will kick in for any accounts with a remaining balance not used for over a year.

ActivTrades Leverage

Margins, requirements and leverage ratios on ActivTrades vary with the market and position size. ActivTrades’ FCA regulation means that UK clients are limited to pre-set leverage rates. These are outlined below:

- 1:30 – major forex pairs

- 1:20 – minor & exotic forex pairs, major indices & gold

- 1:10 – minor indices & other commodities

- 1:5 – stocks & other assets

The stop out level for any margin position is 50%.

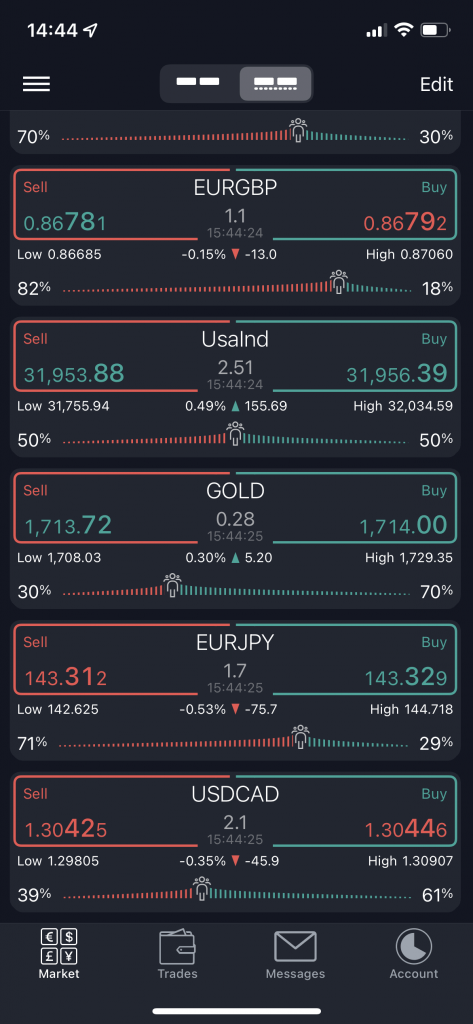

Mobile Trading

Mobile and tablet applications have been created for each of the three trading platforms linked to ActivTrades, helping investors manage their positions on the go. These apps are available for download on both Apple (iOS) and Android (APK) devices. Our experts found the ActivTrader mobile app to be intuitive and easy to navigate. Positions can be opened and closed in seconds and there is a decent level of account management and analysis supported.

ActivTrader Mobile

Payment Methods

Deposits

The following deposit methods are available:

- Skrill

- PayPal

- Neteller

- SOFORT

- Bank Transfer

- Credit/Debit Card

Other than credit and debit card payments, for which the fees are 1.5% (except the first deposit, which is free), the deposit options are free. However, in exceptional circumstances where the trading volume is disproportionately low compared to the third-party trading fees, charges may be incurred.

ActivTrades’ processing times are 30 minutes for all deposit methods, apart from a bank transfer, which may take longer, though it is still processed on the same working day. Note that these are the broker’s processing times and that banks and payment providers may have separate delays. We were disappointed to see that the minimum deposit at ActivTrades is $500. This is high when compared to many of its competitors.

Withdrawals

While using ActivTrades, we found UK investors must withdraw account funds via the same method used for their deposits, although Sofort and credit cards are not valid withdrawal methods. Withdrawals are generally free, though bank wire transfers incur a £9 flat fee.

We recommend withdrawing only when absolutely necessary if using bank transfers to minimise costs. Withdrawals are processed by ActivTrades on the same working day, providing the request is made before 12:30 GMT/BST.

ActivTrades Demo Account

ActivTrades provides a free demo account, which can be funded with up to £10k of virtual funds. Impressively, traders get to choose from ActivTrader, MT4 and MT5 for their demo accounts. This means that, if there is a particular investing platform that you are unfamiliar with, there is demo support to get comfortable with all its features and functionality. Investors should note that there is a 15-minute delay for market data on share CFDs in demo accounts. Other than this, your demo account experience should be completely representative.

Bonuses & Promos

Although there is no deposit bonus or rewards scheme, ActivTrades does have a cashback programme, through which investors can receive a 20% reduction in spreads, commission and swap rates. However, through scouring the terms and conditions, we discovered that most traders will not qualify as you need to trade over $50m in notional value.

Regulation

This broker is authorised and regulated by the UK’s Financial Conduct Authority (not ESMA or CySEC), which means investors are protected more than if they opted for an offshore and unregulated company. The FCA dictates that brokers like ActivTrades must treat their customers fairly and this includes having a formal complaints procedure. The Financial Services Compensation Scheme will compensate eligible clients up to £85,000 for an investment firm that has failed.

Account Types

ActivTrades only has one live account, although Islamic variants are also available. These do not impose interest charges on contracts open overnight. The broker’s live account can be funded using multiple currencies: GBP, EUR, USD and CHF. Investors can also trade in mini and micro-lots, which increases affordability and makes the firm more accessible to beginners.

The ActivTrades live account is linked to all three trading platforms. Professional accounts are available but certain criteria must be met, such as carrying out large transactions or having substantial experience working in the financial sector.

How To Get Started With ActivTrades

1. Test The Platform Using A Demo Account

Beginners or those unfamiliar with the ActivTrader, MT4 or MT5 platforms should register for a free demo account to learn the features and how to place trades. Paper trading accounts can also be a useful way to test an investment strategy, explore a new market or trial a new instrument type. It is quick and easy to register for a demo account with ActivTrades.

2. Sign-Up For A Live Account

The next step is to sign-up for a live account (or an Islamic account). The registration process is slightly longer for a live account than a demo account as more information is required, such as your National Insurance Number and any previous experience. It is common for brokers to ask about investing experience so they can tailor their products to you appropriately. Other required documents include ID and proof of address. Once signed up and approved, you will be able to login through the platform.

3. Choose A Product To Trade

Selecting an instrument will depend on several factors. First, always choose a market you are familiar with and have a decent knowledge of. Investors must understand what causes prices in particular markets to shift if they want to build a successful strategy. Also, there are different fees on ActivTrades for each market. For example, cryptocurrencies are not charged commission but leveraged shares are.

4. Open Your Position

Positions can be opened in just a few clicks on each of the trading platforms. Investors will usually need to enter the number of lots they wish to trade, as well as set any advanced order types such as take profit or stop loss.

5. Monitor Your Position

Day traders and swing traders may choose to focus more on technical analysis, which would involve using various graphical indicators such as moving averages and Bollinger Bands. Medium to long-term investors will likely need to incorporate some fundamental analysis into their strategy.

The broker has a market blog and data to enable investors to analyse the financial state of the economy. Economic calendars are another useful tool to identify upcoming market events that could cause a shift in the price of an asset. ActivTrades’ calendar includes details of trading holidays.

6. Close Your Position

Positions are just as easy to close as they are to open and can be done in a couple of clicks on the ActivTrader platform. Your open positions will be listed at the bottom of your screen under the chart (powered by TradingView) and the ActivTrades server time – it is here that you can click on a particular order to close it.

Benefits Of ActivTrades

When we used ActivTrades we found several advantages of opening a live account:

- No requotes

- NDD broker

- Low spreads

- Crypto trading

- Islamic accounts

- Free demo trading

- MT4 & MT5 access

- Regulated by the FCA

- Spread betting & CFDs

- Great education section

- Negative balance protection

Drawbacks Of ActivTrades

- One account type

- Wire transfer fees

- High minimum deposit

Additional Features

ActivTrades has a comprehensive education section, which includes the option of one-to-one training, as well as webinars. Content is often free and covers topics like trading with candlesticks and an introduction to risk management. If you miss a particular webinar in the schedule, there is an archive section where you can easily catch up.

Educational videos on how to navigate the MetaTrader platforms are also on offer, as are manuals for those that prefer learning by reading. The Glossary section contains a long list of investing-related terms – something that is particularly useful for beginners not used to broker jargon.

Trading Hours

Trading hours on ActivTrades depend on the market in question. For example, the forex market is open 24/5 from 21:00 GMT on Sunday to 20:00 GMT on Friday. Opening hours for shares will depend on the hours of the exchange they trade on. For example, the active hours of the London Stock Exchange (LSE) or the New York Stock Exchange (NYSE).

Customer Support

ActivTrades has excellent customer support should investors have any technical issues, such as withdrawal problems or a platform connectivity error. The firm can be contacted via the live chat window on its website, an email request form or directly via phone or email as below.

- Email: englishdesk@activtrades.bs

- Phone/Hotline Number: +1 242 603 5200

Support is available 24/5 in 14 languages. The average email response time is a speedy 27 minutes. Additionally, all account representatives are trained and encouraged to take an exam. While a UK phone number is not available, there is an English support desk. Our experts were unable to find an FAQs page.

Safety & Security

Client funds are held in separate accounts from ActivTrades’ company funds. This helps protect investors should the company become insolvent. The broker has also purchased its own insurance to cover client funds up to $1m, although the excess is $10,000, so only funds between $10,000 and $1m are covered in such an event. The firm is also a member of the Financial Services Compensation Scheme.

The company also operates under the Basel II framework (consisting of Pillars 1, 2 and 3), which helps ensure financial soundness among investment firms.

ActivTrades Verdict

ActivTrades is a reputable and trustworthy broker with a good range of CFD and spread betting markets on offer. Low spreads, good customer support and a wealth of educational content make this an excellent broker for beginners and veterans alike.

FAQs

Do I Need To Download The ActivTrader Trading Platform?

No. Web versions are available for the MetaTrader and ActivTrader platforms, which can be run through a browser. However, MetaTrader also has platforms that can be downloaded.

Where Can I Keep Up-To-Date With The ActivTrades Markets?

ActivTrades provides an economic calendar, which lists the key upcoming financial events and announcements. The company also publishes articles providing analysis of current market news.

Are My ActivTrades Funds Insured Should The Firm Become Insolvent?

Funds are insured up to $1m, although there is a $10,000 excess. Customers may also be eligible for separate insurance under the Financial Services Compensation Scheme.

I Do Not Speak English: Can I Still Access ActivTrades Customer Support?

Yes. ActivTrades provides support in 14 languages to assist people from across the globe.

Can My ActivTrades Account Balance Become Negative If I Trade On Margin?

No. ActivTrades has negative balance protection. This means that, should the funds in your account fail to meet the margin requirements, your positions will be automatically closed.

Top 3 ActivTrades Alternatives

These brokers are the most similar to ActivTrades:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

ActivTrades Feature Comparison

| ActivTrades | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 4 | 4.5 | 4 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CMVM, CSSF, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (UK and EU), 1:400 (Global & Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

||

| Review | ActivTrades Review |

IG Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| ActivTrades | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

ActivTrades vs Other Brokers

Compare ActivTrades with any other broker by selecting the other broker below.

Popular ActivTrades comparisons:

|

|

ActivTrades is #47 in our rankings of CFD brokers. |

| Top 3 alternatives to ActivTrades |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, CMVM, CSSF, SCB |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 (UK and EU), 1:400 (Global & Pro) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | AstroPay, Credit Card, Debit Card, Mastercard, Neteller, PayPal, Skrill, Sofort, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Yes (APIs), Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Corn, Gold, Natural Gas, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | 0.6 |

| CFD GBPUSD Spread | 0.8 |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 0.8 |

| Assets | 50+ |

| Currency Indices | USD |

| Crypto Coins | ADA, AVAX, BCH, BNB, BTC, DOGE, DOT, EOS, ETH, LINK, LTC, NEO, SOL, XLM, XMR, XRP |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |