NinjaTrader Review 2026

NinjaTrader is a well-known brokerage brand in the investing world due to its popular standalone trading platforms and futures brokering services. This 2026 review will focus on the NinjaTrader trading account and cover key aspects of its features, such as broker fees and commissions, available markets, minimum deposit amounts and funding details. So, whether you are just getting started or simply looking for a new edge, find out here if NinjaTrader can help.

NinjaTrader Headlines

NinjaTrader was created in 2003 to provide traders with a range of financial services. The company is based in the USA, with offices in Denver and Chicago. Through its brokerage accounts and several iterations of trading platforms, the firm has served over 500,000 clients in its almost 20-year history.

The broker has won several awards for its trading platforms and services. It holds a full licence with the National Futures Association (NFA) to provide clients with access to futures markets.

Trading Platforms

NinjaTrader is perhaps best known for its eponymous trading platform, so it comes as no surprise that it is the only platform option for brokerage clients. However, many will be disappointed to learn that the platform is only available as a Windows PC download, with no official NinjaTrader support for Mac, Linux, browser-based web trading or a mobile app.

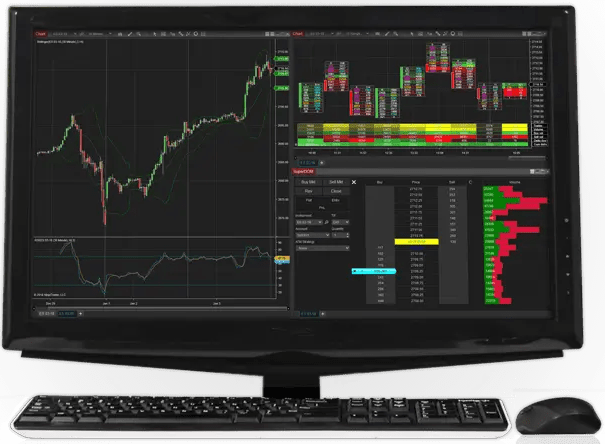

NinjaTrader Platform

Platform Features

A top tier trading platform needs to feature a substantial range of indicators, advanced charting tools and strategy builder and testing options.

To this end, NinjaTrader provides a comprehensive indicators list that users can apply to live trading charts or market replay data for backtesting purposes. These include the average daily range, swing, trend lines, divergence, value area, Elliott wave, gap, news and volatility indicator types.

Investors can choose between a tick or time chart for viewing data. Heiken Ashi candles are also available. Drawing tools like the Fibonacci retracement and volume oscillator can also be utilised for technical analysis.

The trading software also supports strategy backtesting through its simulate feature. With this, you can manually review historical data tick by tick to analyse the markets and develop scanner facilities and automated trading strategies. Developer users can even create artificial market events through the simulator to review how scripts would react.

Platform Variants

While the firm provides a free version of its platform exclusively to brokerage clients, you can pay to unlock additional features by purchasing a platform lease or perpetual licence.

There are three versions of the NinjaTrader platform:

- The free option provides advanced charting, market analysis and trading simulation at no extra cost to users. Prospective clients can trial this software for free as a demo platform download before committing to a full account.

- The lease version of the trading software enables several premium features, including order entry hotkeys, advanced order types such as automatic prospective stop-loss, OCO and stop-limit orders and the advanced alerts system. Leasing is available from a quarterly to an annual basis and will allow traders to seamlessly update to NinjaTrader 9 upon its release.

- For clients that purchase a lifetime licence, the Order Flow + package provides the highest level of features available. These include the volume profile indicator, a volumetric bars style chart, volume-weighted average price indicator and the market depth map view. While users will have to pay again if they wish to upgrade to a newer platform, the perpetual licence is far cheaper than leasing over extended periods.

As well as extra features, the higher tier platforms offer a discount on trading commissions.

Add-Ons

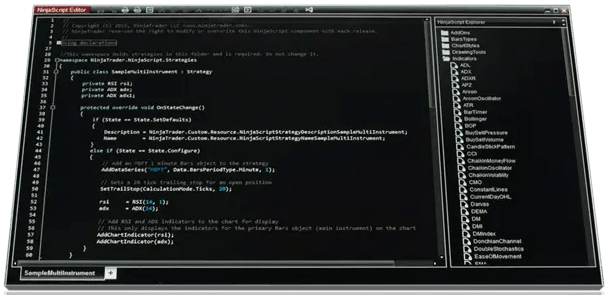

In addition to the free indicators included in the platform, there are thousands of third-party add-ons for users to choose from to enhance their trading. Experienced programmers can even create custom indicators in the C# programming language.

As well as indicator programming, traders can utilise NinjaScript coding to execute automated trading strategies. As with custom indicators, users can create personalised programs or download third-party applications.

NinjaTrader Developer Platform

In addition to viewing replay forex data on NinjaTrader, the download and import of up to three months’ worth of historical tick data are facilitated to refine trading scripts through techniques such as machine learning, which requires a large feed of training data.

NinjaTrader 8 System Requirements

The NinjaTrader trading software minimum system requirements are a 1 GHz or faster processor, 2 GB of RAM and a screen resolution of 1024 x 768.

For optimal performance, hardware requirements are a 2 GHz or faster quad-core processor and 8 GB of RAM, with a DirectX 10 compatible graphics card recommended.

A Windows 8.1 or later operating system is also required.

Markets & Assets

Licensing restrictions limit the broker from offering the popular CFDs. However, futures contracts covering forex, indices and even cryptocurrencies are supported as investment products.

NinjaTrader supports futures from many major global exchanges, including the CME, CBOT, COMEX, NYMEX, EUREX and ICE. E-mini and micro e-mini provide low-cost options in some of the largest markets, such as the S&P 500 index, UK FTSE 100 index and crude oil futures.

While the firm does not support individual stocks, the platform offers a competitive range of equities indices, crypto, forex, agricultural and commodity assets. Users can even speculate on future interest rates in several global currencies. Indeed, the broker is one of the best for cryptocurrency futures, with markets for Bitcoin futures, micro Bitcoin futures and Ethereum futures.

Account Types

NinjaTrader supports several account types to cater for a wide range of clients. While most traders will be satisfied with either an individual or joint account, alternative account formats are Corporate, LLC, Trust, Partnership and Retirement (IRA). These specialised accounts often have additional requirements and, as such, IRA accounts are not open to UK clients.

To open an account, you must submit verification documents and personal information. This usually takes between 24 and 48 hours to process, though account creation may take longer for more complex account types. The minimum capital is $400 for all variants. Login is straightforward and secure for all types, with clients able to access their account area via the broker’s website.

Leverage

Leverage rates for the brokerage depend on the asset in question, with margins on full futures contracts, e-mini and micro e-mini trades varying immensely. All instruments require initial and intraday margin minimums, with leverage for intraday hours positions significantly higher than that needed for overnight swaps.

When trading on a live account, it is good to hold futures margin over the minimum levels, as adverse price movements can lead to positions being forcibly margin called. In addition, clients should ensure that either their positions are closed out or initial margin levels are met at least 15 minutes before market close. NinjaTrader penalises clients with $25 in exchange fees for margin calls for a first offence and $50 thereafter.

Trading Costs

The most substantial costs come from platform fees for the lease and lifetime licence platforms. While some clients may find the features of the free platform adequate, many will require the advanced elements included in the Trader + and Order Flow + data feed subscription packages.

- Lease – $720 if paid annually, $425 semi-annual charge or $225 quarterly.

- Lifetime Licence – One-off cost of $1,099 or four payments of $329.

There is also a monthly inactivity charge of $25 for live account holders that review the markets using the platform but do not place any round trades.

NinjaTrader Commissions

The additional platform fees may be offset for high-frequency traders by the discount in trading commissions for the paid platforms. Commission levels are as follows:

- Free – From $0.35 per micro contract.

- Lease – From $0.25 per micro contract.

- Lifetime Licence – From $0.09 per micro contract.

Exchange, order routing and NFA fees also apply to trades, irrespective of the chosen trading platform.

Payment Methods

NinjaTrader supports several deposit and withdrawal methods. These include ACH bank transfer, wire transfer and physical cheque. There is no support for payment cards, e-wallets or crypto transfers. Transactions must be made in USD, GBP or EUR, with other currencies subject to a 1% conversion fee.

While deposits are always free, withdrawals can be subject to brokerage charges. Clients are entitled to two free ACH withdrawals per month, though extra transactions are charged a flat $15 fee. Cheque requests cost $7, while domestic wire withdrawals are subject to $30 charges and international ones a $/£/€50 fee.

While the broker has an initial account minimum of $400, there is no information on limits for subsequent deposits and withdrawals.

Safety & Regulation

When trading with any broker, the safety of user funds and information is vital. Regulation is often a key indicator of overall reputability and, to this end, NinjaTrader is registered with the National Futures Association. Furthermore, client funds and assets on the platform are held securely with tier-one regulated external brokerages. The website client login portal and platform are protected by high-level encryption and withdrawals are secured via two-factor authentication (2FA).

Customer Service

Whether you are struggling with how to use the platform, unsure of how to make a withdrawal or have general technical questions, there are several options to contact NinjaTrader support.

One of NinjaTrader’s greatest assets is its active and comprehensive support forums. In these, other users or staff can help answer general or specific queries, with many complex questions already comprehensively answered and available to view. The scope of this support forum far exceeds the minimal FAQ offering on the broker’s website.

The company’s help desk is available via a US phone number, a range of email addresses and a live chat service for more personal support. Unfortunately, the support hours correspond to US office hours, with no facility for 24/7 help.

- Phone: 312 262 1289

- Email: brokeragesupport@ninjatrader.com

Education

In terms of education and training content, the firm provides a comprehensive video library with beginner guides, charting basics, strategy examples and tutorials and ATM how-tos. Through these, clients can easily learn how to install plugins and add-ons to their platform and how to place a stop loss on positions.

Moreover, NinjaTrader runs a blog that features upcoming events in the economic calendar, new indicators and educational content on specific assets. The company also runs frequent webinars in which the major movements of the trading day are recapped.

Advantages

- Advanced, reliable platform

- Competitive commissions

- E-minis & micro e-minis

- Futures instrument list

- Several account types

- Good margin levels

- Crypto trading

- Regulated

Disadvantages

- Limited free withdrawals

- Costly advanced features

- Windows support only

- Inactivity charges

- Futures only

Trading Hours

The broker’s trading hours are the same as the global futures markets, with its emergency trade desk operating 24-hours a day. Even when the futures markets are closed, clients can access their accounts at any time.

NinjaTrader Verdict

NinjaTrader is a solid option for those looking to trade futures on a competitive range of global assets, markets and currencies. The popular NinjaTrader platform forms the backbone of their service, while the availability of e-mini and micro e-mini contracts enhances market accessibility. However, the lack of alternative instruments and the high cost of advanced trading features may dissuade some from opening an account with the broker.

FAQs

Does The NinjaTrader Platform Have A User Guide?

While there is no specific NinjaTrader user guide, the company provides several training videos to equip investors with comprehensive platform knowledge.

Is There A NinjaTrader iPhone App?

Unfortunately, NinjaTrader does not currently have an iPhone (iOS) or Android (APK) app, with its platform available exclusively on Windows PCs.

Can I Use NinjaTrader To Trade Stocks?

NinjaTrader brokerage accounts are limited to futures contracts on forex, indices and cryptos, with no stock trading support. However, the platform does support CFDs on stocks with other brokers.

How Does NinjaTrader Compare For Cryptocurrency Trading?

NinjaTrader offers three crypto instruments: Bitcoin futures, micro Bitcoin futures and Ethereum futures.

Does NinjaTrader Support Custom Indicators?

Yes, the lease and full licence versions of NinjaTrader allow clients to seamlessly integrate add-ons for automated trading and custom indicators.

Top 3 NinjaTrader Alternatives

These brokers are the most similar to NinjaTrader:

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

NinjaTrader Feature Comparison

| NinjaTrader | Interactive Brokers | IG | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.5 | 4.3 | 4.5 | 4.8 |

| Markets | Forex, Stocks, Options, Commodities, Futures, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | NFA, CFTC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | - | MT4 | MT4, MT5, cTrader |

| Leverage | 1:50 | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

||

| Review | NinjaTrader Review |

Interactive Brokers Review |

IG Review |

Pepperstone Review |

Trading Instruments Comparison

| NinjaTrader | Interactive Brokers | IG | Pepperstone | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | No | Yes | Yes |

NinjaTrader vs Other Brokers

Compare NinjaTrader with any other broker by selecting the other broker below.

Popular NinjaTrader comparisons:

|

|

NinjaTrader is #27 in our rankings of UK brokers. |

| Top 3 alternatives to NinjaTrader |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | NFA, CFTC |

| Leverage | 1:50 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ACH Transfer, Cheque, Debit Card, Wire Transfer |

| Copy Trading | No |

| Auto Trading | NinjaScript or via Automated Trading Interface |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities | Copper, Gold, Oil, Silver |

| GBPUSD Spread | 1.6 |

| EURUSD Spread | 1.3 |

| GBPEUR Spread | 1.6 |

| Assets | 50+ |

| Crypto Coins | BTC |

| Crypto Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |