Crypto Exchanges

Crypto exchanges act as a link between buyers and sellers of digital currencies like Bitcoin. However, they do carry some fundamental security risks. This 2026 guide to comparing crypto exchanges lists the best platforms with the largest volumes and lowest fees in the UK. Our team also explain how crypto exchanges make money and why safety concerns are leading retail investors to crypto brokers.

Top Crypto Exchanges UK

-

PrimeXBT is a multi-asset platform providing leveraged trading across forex, indices, commodities, and cryptocurrencies. Established in 2018, it now boasts over 1 million users from upwards of 150 countries. Offering copy trading, low commissions, and no minimum deposit, this broker is a favoured choice for those new to crypto trading.

Instruments Regulator Platforms CFDs, Cryptos, Forex, Indices, Commodities, Futures Own Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:1000 -

Founded in 2017, OKX is a reputable cryptocurrency company, providing a comprehensive range of offerings, including trading and NFTs. It enables traders to access more than 400 crypto tokens through OTC trading and derivatives. Its excellent web platform, developer tools, and interactive charts make OKX a preferred option among technical traders.

Instruments Regulator Platforms Spot, futures, perpetual swaps, options VARA AlgoTrader, Quantower Min. Deposit Min. Trade Leverage 10 USDT Variable -

Nexo, a centralised cryptocurrency exchange established in Bulgaria in 2018, now operates from Switzerland in approximately 200 regions. Its offerings include spot and futures trading, peer-to-peer lending, cold wallet storage, and fiat on-ramps for purchasing crypto tokens. Nexo is registered with respected financial bodies like the ASIC. Additionally, it provides unique services, such as a credit card.

Instruments Regulator Platforms Cryptos Nexo Pro Min. Deposit Min. Trade Leverage $10 $30 -

Crypto.com ranks among the top cryptocurrency exchanges, created to speed up the shift to DeFi technologies. It provides token lending, pre-paid cards, and NFTs. Founded in Germany in 2016, its excellence is affirmed by 150 million users.

Instruments Regulator Platforms Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU Own Min. Deposit Min. Trade Leverage Varies by payment method $1 -

Founded in 2012, Bitfinex, headquartered in Hong Kong, is a significant force in the cryptocurrency market. It offers a robust proprietary platform with access to 180 cryptocurrencies and over 430 market pairs for spot and perpetual swaps trading. With recent additions such as new payment options, reduced entry barriers, and innovative products like crypto futures, Bitfinex is drawing an even broader spectrum of active traders.

Instruments Regulator Platforms Cryptocurrencies Web Platform, Quantower Min. Deposit Min. Trade Leverage $0 $10 -

Gemini, established in 2014 by the Winklevoss brothers, is a prominent cryptocurrency exchange. It ranks among the top 20 globally, recognised for the founders' early ties to Facebook. Traders on Gemini have access to over 110 cryptocurrencies for trading and staking. In certain areas, derivatives trading is also available. The platform offers advanced proprietary tools and features, including an NFT marketplace.

Instruments Regulator Platforms Cryptos NYDFS, MAS, FCA ActiveTrader, AlgoTrader, TradingView Min. Deposit Min. Trade Leverage $0 0.00001 BTC -

Kraken is a top cryptocurrency exchange featuring a specialised trading platform and over 220 cryptocurrency tokens. Traders can access up to 1:5 leverage for spot trading with consistent rollover fees, and up to 1:50 for futures trading. The platform additionally offers crypto staking and hosts an engaging NFT marketplace.

Instruments Regulator Platforms Cryptos FCA, FinCEN, FINTRAC, AUSTRAC, FSA AlgoTrader, Quantower Min. Deposit Min. Trade Leverage $10 Variable

Safety Comparison

Compare how safe the Crypto Exchanges are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| Nexo | ✘ | ✘ | ✘ | ✘ | |

| Crypto.com | ✔ | ✘ | ✘ | ✔ | |

| Bitfinex | ✘ | ✘ | ✘ | ✘ | |

| Gemini | ✔ | ✘ | ✘ | ✔ | |

| Kraken | ✔ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Crypto Exchanges support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| Nexo | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Crypto.com | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Bitfinex | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Gemini | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ |

| Kraken | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Crypto Exchanges at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| PrimeXBT | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| Nexo | iOS & Android | ✘ | ||

| Crypto.com | iOS & Android | ✘ | ||

| Bitfinex | iOS & Android | ✘ | ||

| Gemini | iOS & Android | ✘ | ||

| Kraken | ✔ | ✘ |

Beginners Comparison

Are the Crypto Exchanges good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| Nexo | ✘ | $10 | $30 | ||

| Crypto.com | ✔ | Varies by payment method | $1 | ||

| Bitfinex | ✔ | $0 | $10 | ||

| Gemini | ✘ | $0 | 0.00001 BTC | ||

| Kraken | ✔ | $10 | Variable |

Advanced Trading Comparison

Do the Crypto Exchanges offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Nexo | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Crypto.com | DCA Auto-Staking | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Bitfinex | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Gemini | - | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Kraken | Kraken Futures is integrated in other platforms which have bots: Bookmap, Caspian, FMZ Quant, Gunbot, HaasOnline, Hyndor, Margin | ✘ | - | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Crypto Exchanges.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| PrimeXBT | |||||||||

| OKX | |||||||||

| Nexo | |||||||||

| Crypto.com | |||||||||

| Bitfinex | |||||||||

| Gemini | |||||||||

| Kraken |

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- Trading fees for crypto futures contracts are quite competitive, with maker fees at 0.01% and taker fees at 0.02%.

- Round-the-clock customer support, accessible through live chat, demonstrated outstanding performance during testing. Additionally, the comprehensive help centre offers ideal self-assistance resources.

- In 2025, PrimeXBT significantly expanded its Crypto Futures offerings with over 100 tokens, including AI, NFTs, Metaverse, and Layer 1 & 2 assets.

Cons

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- Active traders benefit from competitive rates, with maker fees starting at 0.02% and taker fees at 0.05%.

- In 2025, OKX obtained a MiFID II licence, allowing it to offer regulated derivatives across Europe, ensuring peace of mind for traders.

- A vast array of blockchain products is available, featuring DeFi services, NFTs, and games, along with over 400 established and emerging cryptocurrencies.

Cons

- The broker's platform and features might feel intricate for beginners.

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- Testing revealed that customer support quality varied.

Our Take On Nexo

"Nexo offers traders a platform to trade, invest, lend, and borrow digital assets efficiently, excelling in credit functions with substantial yields for lenders. Nevertheless, fees are steep, and some traders may opt for a more regulated broker."

Pros

- Traders receive bonuses and incentives, such as complimentary trading funds given to lenders and cashback through the exchange's native Nexo token.

- A well-regarded crypto exchange, established in 2018, has initiated steps towards regulatory compliance.

- Nexo's platform facilitates cryptocurrency lending and borrowing through its staking and credit features, offering traders some of the most competitive yields in the market.

Cons

- Limited educational resources diminish its attraction for newcomers, who may discover more valuable materials with leading platforms such as eToro.

- The selection of tokens is broad relative to many crypto brokers, yet it remains limited when compared to similar crypto exchanges such as Kraken.

- High deposit and withdrawal fees for cards and e-wallets may deter many traders from using these convenient payment methods.

Our Take On Crypto.com

"Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app."

Pros

- In certain regions, Crypto.com now offers more than 5,000 stocks and ETFs, allowing traders to diversify their portfolios and explore various sectors.

- Crypto.com employs cold wallets with multi-signature and geographic distribution for enhanced security. This strategy provides strong protection and securely stores user assets offline.

- Crypto.com Exchange features advanced bots like Dollar Cost Averaging, Time-Weighted Average Price, and Grid Trading. These tools enable traders to automate strategies, including leveraged perpetual trades, reducing manual input and slippage.

Cons

- The app's large bid-ask spreads on numerous coins can prove expensive for traders executing market orders. Greater spreads mean buying costs are significantly higher than selling returns, eroding profits, particularly in low-volume trades.

- Customer support mainly uses chatbots and email, with limited reliable phone assistance. This can delay urgent resolutions like account access or transaction issues, frustrating crypto traders who require swift help.

- Withdrawal fees are charged for both crypto and fiat transfers, impacting active traders making smaller movements. High minimum withdrawal limits further restrict flexibility, complicating management of smaller portfolios or quick liquidity needs.

Our Take On Bitfinex

"With its growing token selection, advanced charting tools and zero-fee model, Bitfinex is a compelling choice for frequent crypto traders. However, testing reveals a daunting platform for newer traders, hit-and-miss education and regulatory fines that raise safety concerns."

Pros

- While initially challenging, the Bitfinex platform excels for experienced traders. It offers an extensive charting suite with 12 timeframes, along with margin trading and a range of order types.

- Bitfinex has moved to a zero trading fee model on spot, margin, derivatives, securities and OTC, appealing to traders looking for a straightforward pricing model.

- Following an expansion of its offerings, Bitfinex now provides access to more than 180 cryptocurrencies. This includes major coins like Bitcoin and Ethereum, as well as volatile altcoins that might attract traders.

Cons

- Testing indicates insufficient support, particularly for active traders. Email response times are sluggish, taking up to 12 hours. The user experience is also disappointing due to the lack of integrated live chat within the trading platform.

- Bitfinex, similar to numerous crypto exchanges, functions within a regulatory grey area, potentially increasing risks for traders. This contrasts with more reputable trading platforms such as eToro.

- For traders and investors seeking a straightforward approach, platforms such as eToro, Gemini, and Kraken offer excellent choices.

Our Take On Gemini

"Gemini’s ActiveTrader platform, combined with TradingView, is ideal for serious crypto traders wanting robust charting tools. However, unnecessary fees and past security incidents are drawbacks."

Pros

- The TradingView integration offers excellent tools, such as backtesting and algorithmic trading features.

- Crypto perpetual futures can be accessed in numerous regions, offering leverage of up to 1:100.

- The exchange mandates two-factor authentication for all crypto investors, ensuring robust security measures.

Cons

- The exchange's history includes troubling incidents, such as the failure of its Earn programme and a phishing attack.

- There is no practice or demo account available for prospective traders.

- Certain funding methods incur substantial fees, such as a 3.49% charge for card transactions.

Our Take On Kraken

"Kraken is ideal for traders seeking a wide range of cryptocurrencies, including Bitcoin, along with an excellent security reputation."

Pros

- NFT marketplace and crypto staking offered for traders.

- 50x leverage on futures trading

- Crypto staking

Cons

- Slow processing times

- Minimal leverage in spot trading.

- Limited support for newer altcoins.

What Is A Crypto Exchange?

Crypto exchanges are generally split into centralised vs decentralised exchanges. Centralised exchanges operate similarly to a stock exchange; they act as an intermediary between buyers and sellers. These platforms essentially work as a marketplace where buyers for crypto tokens are matched with sellers. Examples of some of the oldest and most popular centralised exchanges include Gemini and Coinbase.

While each exchange decides which coins can be traded, it is the market that decides the value of those crypto assets. Each cryptocurrency is valued against other altcoins and stablecoins, much like the forex market.

Centralised exchanges are often a better choice for beginners than decentralised platforms as many also allow users to exchange their fiat currency for crypto (an ‘onramp’ service). These onramp services mean that clients do not need to go elsewhere to purchase their first cryptos, often requiring additional know-your-customer (KYC) checks and lead times.

On the other hand, decentralised crypto exchanges allow peer-to-peer (P2P) transactions. There is no intermediary in these transactions and no business or third-party controls it. Instead, operations are controlled by smart contracts, which are programmed to perform particular functions within the blockchain. Decentralised exchanges are not usually legally registered in a particular country and are managed by their own (native) crypto token market.

That being said, the basic principles are the same – they both allow users to trade cryptocurrencies and other decentralised crypto assets. PancakeSwap and Kyber are popular examples of decentralised crypto exchanges with substantial market share. Decentralised platforms are usually designed for more experienced investors.

How Do Crypto Exchanges Make Money?

In return for being the intermediary between DeFi buyers and sellers, crypto exchanges charge transaction fees. These are usually a fixed fee per trade but the percentage can vary depending on the volume and token in question.

Exchange platforms may also impose spreads (the difference between the bid and ask prices). Generally, the less liquid the market, the higher the spread.

Another way that some crypto exchanges make money is through deposits and withdrawals. Although onramp and offramp services are convenient features for those who like to switch between crypto and fiat currency, many exchanges will charge a fee for this service.

Some exchanges also pass network fees (sometimes referred to as gas fees) on to users but they generally do not make money from this. The money from these fees goes to miners (if a proof-of-work blockchain, which some consider fairly old and outdated now) or those staking crypto (if a proof-of-stake blockchain) to incentivise them to validate transactions. These fees can vary significantly depending on the size of the transaction and the level of supply and demand on the blockchain at the time.

Crypto Exchanges Vs Crypto Brokers

Although many use the terms interchangeably, there are fundamental differences between crypto exchanges and crypto brokers. An exchange is an intermediary between one trader and another. A crypto brokerage, on the other hand, connects an investor with the market and may buy and sell cryptos on behalf of its clients.

Brokerages also generally offer other instruments in addition to cryptos, like forex, stocks and commodities. Leading firms also provide derivatives like CFDs, so traders can go long or short on Bitcoin and other digital assets without taking ownership of the tokens.

Security and safety is a key consideration when choosing between exchanges and brokerages. Crypto brokers are generally more reputable and trustworthy. The top platforms have a track record in traditional financial products alongside oversight from a trusted regulator, such as the FCA.

There has also been an increasing number of scams, fraudulent players, and cyber attacks amongst crypto exchanges. FTX is the latest high-profile exchange that failed, collapsing before returning the billions it owed to customers.

Exchanges usually have a wider range of cryptos on offer because that is what they specialise in.

Another difference is that the top crypto exchanges will usually accept both fiat and crypto deposits. Aside from a few online brokerages that accept crypto deposits, most will only accept deposits in fiat currency with debit/credit cards, PayPal, or another method like a bank transfer.

Overall, crypto brokers are usually more secure with established backgrounds in retail investing, robust financial controls and typically operate with oversight from trustworthy regulators (though not always on crypto products).

How To Choose Crypto Exchanges

Coins & Tokens

Although most crypto exchanges will support users with the buying and selling of the main cryptocurrencies like Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), some offer more tokens than others. Bitfinex supports over 170 cryptocurrencies and Kraken supports more than 185 tokens for spot trading.

However, bear in mind that, although more cryptos may seem like a good thing, obscure tokens can be extremely volatile and illiquid, adding substantial risk to your portfolio.

Vehicles

Crypto exchanges usually allow direct investment in the actual cryptocurrencies and blockchains themselves. This means that, when you invest in Bitcoin, you actually own some Bitcoin. However, with some exchanges, clients can speculate using derivatives products, such as futures.

Derivatives involve speculating on the price movement of a crypto or stablecoin without owning the underlying asset. Other types of derivatives include CFDs and options, usually being traded with leverage, which means borrowing capital to invest more. That being said, margin investing can lead to increased losses, as well as magnified profits.

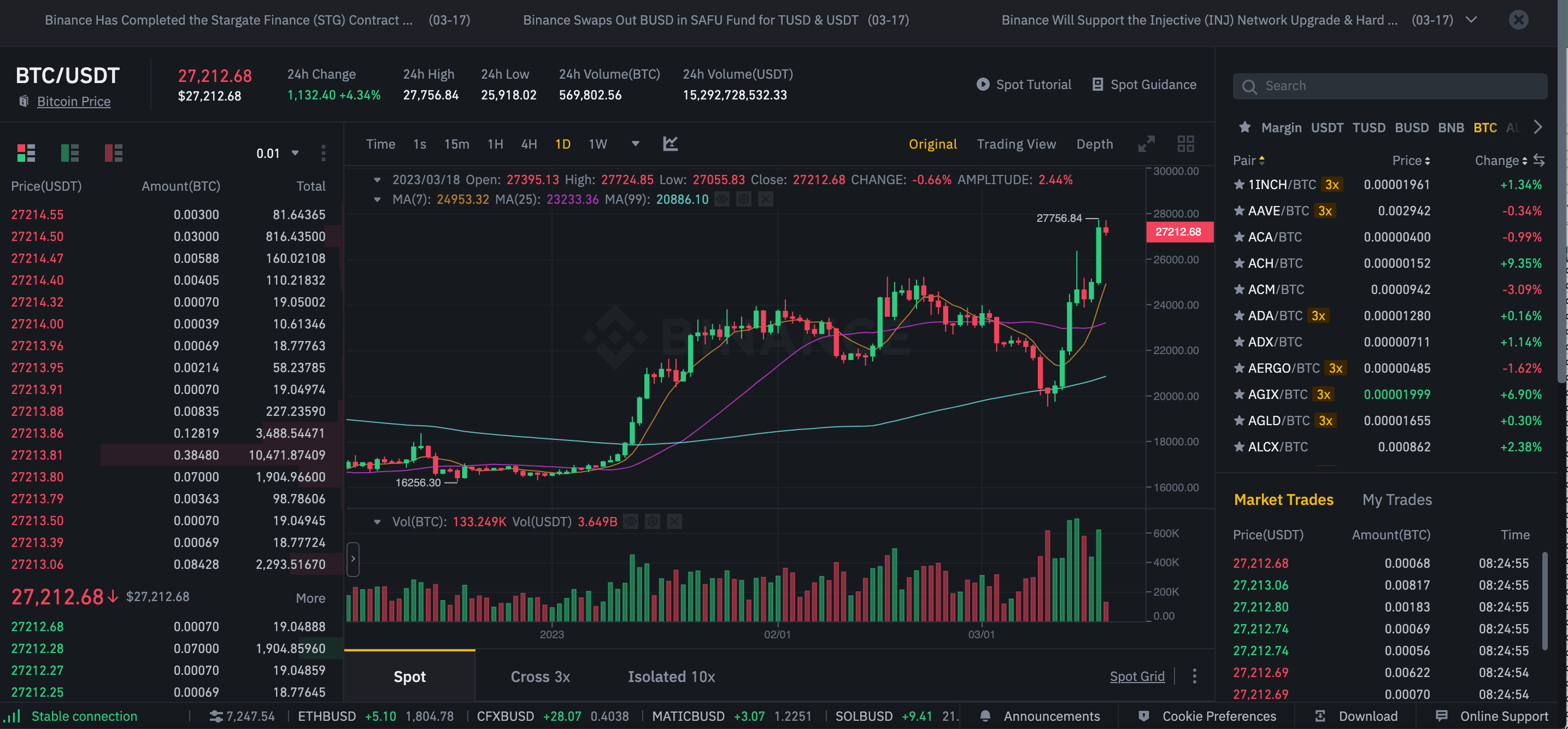

Binance Platform

Fees

Investors will struggle to find an exchange with zero commission and no other fees. Transaction fees are the most common charge imposed by crypto exchanges and most have rates between 0% and 1.5% per transaction.

For example, Coinbase charges a 1% flat fee for crypto transactions. In comparison, Kraken has incentives by volume; the higher your 30-day trading volume, the lower your transaction fees are. Traders with high volume, including institutional investors and high-net-worth individuals, will therefore find some of the lowest fees in the market here.

Some crypto exchanges vary their fees depending on whether the user is a market maker or a market taker. Makers are those that create buy or sell orders that are not carried out immediately, thereby adding liquidity to the market. Takers, on the other hand, create instant buy or sell orders, removing liquidity from the market. Where there is a discrepancy, maker fees are usually the lower of the two.

Our experts found that deposit and withdrawal fees are also common, even if the transaction is purely crypto and does not involve fiat-to-crypto or crypto-to-fiat. Kraken has a withdrawal fee for Bitcoin of 0.00001 BTC.

Fees also apply on decentralised exchanges. For example, Uniswap has a 0.3% fee for swapping tokens.

Other fees include:

- Gas/network fees to incentivise the validation of transactions on the blockchain (exchanges may pass these on to users)

- Spreads to allow the exchange to lock in the price for a certain period and cover themselves if the market moves in that time

- Staking fees (Coinbase does not charge a fee to stake but does charge commission on any rewards from staking)

Safety & Security

There is always a risk when investing with crypto exchanges and storing coins in its wallets or your own. In recent years, there have been multiple incidents of global exchanges being hacked and customer funds being lost. The quarterly trading volume of Coinbase is a whopping $145B and this makes it and other exchanges prime targets for international criminals. There have also been several instances of exchanges that have collapsed.

Unlike decentralised exchanges, where users typically use their own wallets to hold their crypto (not to say decentralised platforms are without security risks), centralised exchanges generally act as custodians for their customers’ deposits. Although the biggest companies will usually hold the majority of client funds in cold storage to mitigate the risk of hacks, a smaller portion will usually be held in an online hot wallet to ensure customers have easy access to their funds.

Even though there is always an underlying risk when investing with crypto exchanges, some have taken measures to reduce their own and their clients’ exposure. In exchange for a subscription fee, Coinbase has an indemnification option of up to $1m. Its funds are also insured up to a certain limit for theft from the exchange, although this does not cover losses that have resulted from unauthorised access to your personal account.

Always make sure to check the history of the exchange in the news and whether there have been any hacks or funds lost in the past, even for the largest and seemingly most reputable cryptocurrency exchanges, as well as the small ones.

Regulation

The crypto industry in the UK is generally unregulated, which means there is little or no insurance or consumer protection (such as access to an ombudsman). That said, crypto exchanges based within the UK’s jurisdiction must be FCA-registered for anti-money laundering (AML).

The regulator has also been known to take robust action in the DeFi industry; in 2021, Binance was banned from operating in the UK as a result of multiple concerns, some of which related to its business structure and how consumers purchased its products.

Therefore, when comparing exchanges, it will be difficult to find an FCA-regulated and approved crypto-trade exchange. However, users should check whether the FCA or any other regulator has taken action against the exchange in the past.

Promotions

As crypto exchanges are typically unregulated in the UK, they have the freedom to offer bonuses that attract new traders. Coinbase has a promotion to earn up to £25 in crypto, in the hope that this will enable people to get into the crypto market.

Always check the terms and conditions of any promotions you intend to use. While using some exchanges, we have found some stringent “wagering requirements” that make rewards difficult to withdraw. These often take the form of a total trading volume, active days or profit levels.

Decentralised exchanges like PancakeSwap may also have promotions, such as token airdrops and exclusive NFTs.

Other Crypto Products

The best and most highly rated crypto exchanges in the UK go much further than the simple buying and selling of crypto. Many will also give access to staking, where users can invest cryptocurrency in a staking pool and earn a reward in the form of additional tokens if a transaction is successfully validated on the blockchain.

Although miners can earn rewards on a proof-of-work blockchain like Bitcoin, this requires sophisticated hardware and is energy-intensive, making it unsuitable for most amateur investors. On the other hand, proof-of-stake systems simply require users to partition some funds to be used within the blockchain system.

Other services to look out for on crypto exchanges are:

- Lending – a form of DeFi service, lending out funds to other traders can earn sizeable interest, although it does carry risk

- NFTs – some exchanges allow the swapping of and investing in NFTs, which are crypto assets that prove the authenticity of artwork or other artefacts

- Fan Tokens – some institutions like sporting clubs issue fan tokens that allow investors to engage more in the affairs of the club or company

- Borrowing – those looking to invest more in a particular coin may want to put a different crypto up as collateral and borrow the additional funds (interest will usually be charged for this)

Customer Support

The crypto market is a 24/7 world – its unregulated and decentralised nature means it never sleeps. The top-rated crypto exchanges, therefore, offer 24/7 customer support, so there is always someone on hand should you encounter an issue.

Bitfinex has such customer service in the form of online contact forms. Kraken, on the other hand, has a more extensive range of support options, including 24/7 live chat and phone support, as well as email.

Trust

Significant controversy has surrounded the industry and, although some crypto exchanges appear legitimate, their business model may be fundamentally flawed leading to bankruptcies. That being said, there are some basic checks that investors can undertake before depositing any money to identify the most trusted firms.

First, try and identify a physical address for the exchange. Those that do not have a public address displayed on their website and are essentially anonymous entities may be fake or could require more scrutiny. Also consider exchanges that publishes their proof of reserves.

Another useful tip is to search for a list of user reviews online. Although most major crypto exchanges will likely have some negative reviews, investors should look to see whether a pattern has developed of poor customer service or a sub-par investing experience.

Moreover, take a look at the registration process. If the registration process is too quick, there are little to no security questions or it goes without KYC requirements, this may indicate that the exchange is not secure for traders. When we have used popular crypto exchanges, our experts found that a more robust registration process may suggest that the platform is taking its responsibilities seriously. This goes the other way for those that do not require stringent checks or are a non-KYC exchange.

User Experience

The intuitiveness and simplicity of the platform are other important benefits. Some crypto exchanges are ranking higher in terms of how user-friendly they are compared to others. For example, Coinbase is known for its simple design and accessibility, making it a better choice for beginners.

Deposits and withdrawals should be easy to make, charts should be simple to read and searches for cryptocurrencies should be carried out with ease. Some exchanges also allow the use of APIs, so users can invest using bots and cryptocurrency algorithms.

Bottom Line On Crypto Exchanges

Now that cryptocurrency exchanges have been explained, it should be clear that they carry significant risks that investors must be aware of – their unregulated status and the volume of deposits they hold make them a prime target for cybercriminals, which alongside mismanagement, can lead to filings for bankruptcy and collapse. That being said, the majority of investing does take place through these crypto exchanges and some may feel able to accept that risk for the benefit of investing in cryptocurrencies with ease.

However, those more cautious may want to check out crypto brokers, which combine the legitimate and trustworthy nature of traditional online brokerages with access to popular digital assets.

FAQ

Are Crypto Exchanges Safe?

There are risks attached to investing with crypto exchanges. The large volume of digital funds they hold makes them a prime target for cybercriminals, and alongside poor financial controls, there have been many cases of exchanges losing funds and even failing entirely. As a result, some aspiring investors trade through crypto brokers.

What Are The Safest Crypto Exchanges?

There are no 100% safe crypto exchanges. However, some have more robust security measures in place and more stringent KYC requirements. The best crypto exchanges may also store the majority of client funds in offline cold wallets, reducing their attractiveness as a hacking target.

How Many Crypto Exchanges Are There?

There are hundreds of crypto exchanges across the world, although not all of these may be available to UK traders. Our list of top-rated crypto exchanges ranks the platforms available to British investors.

Are Crypto Exchanges Regulated In The UK?

Crypto exchanges operating in the UK are only required to register with the FCA for money laundering prevention. Other activities, including online investing, are typically unregulated. As a result, only risk what you can afford to lose.

What Are The Top 10 Best Crypto Exchanges?

Crypto exchanges each have benefits and drawbacks. We recommend checking user reviews, seeing whether there is any history of lost funds and choosing an exchange that has robust account security. Fees and digital assets are also important considerations. See our table of the best cryptocurrency exchanges ranked to find a suitable provider.

What Is The Difference Between Hot Wallets Vs Cold Wallets On Crypto Exchanges?

Hot wallets are connected to the internet and are more susceptible to cyberattacks against exchanges. Cold wallets are offline and, therefore, more secure but less accessible in short notice. The pros and cons of the two types of wallets are explained in more detail in our full overview and guide to choosing and comparing cryptocurrency exchanges.